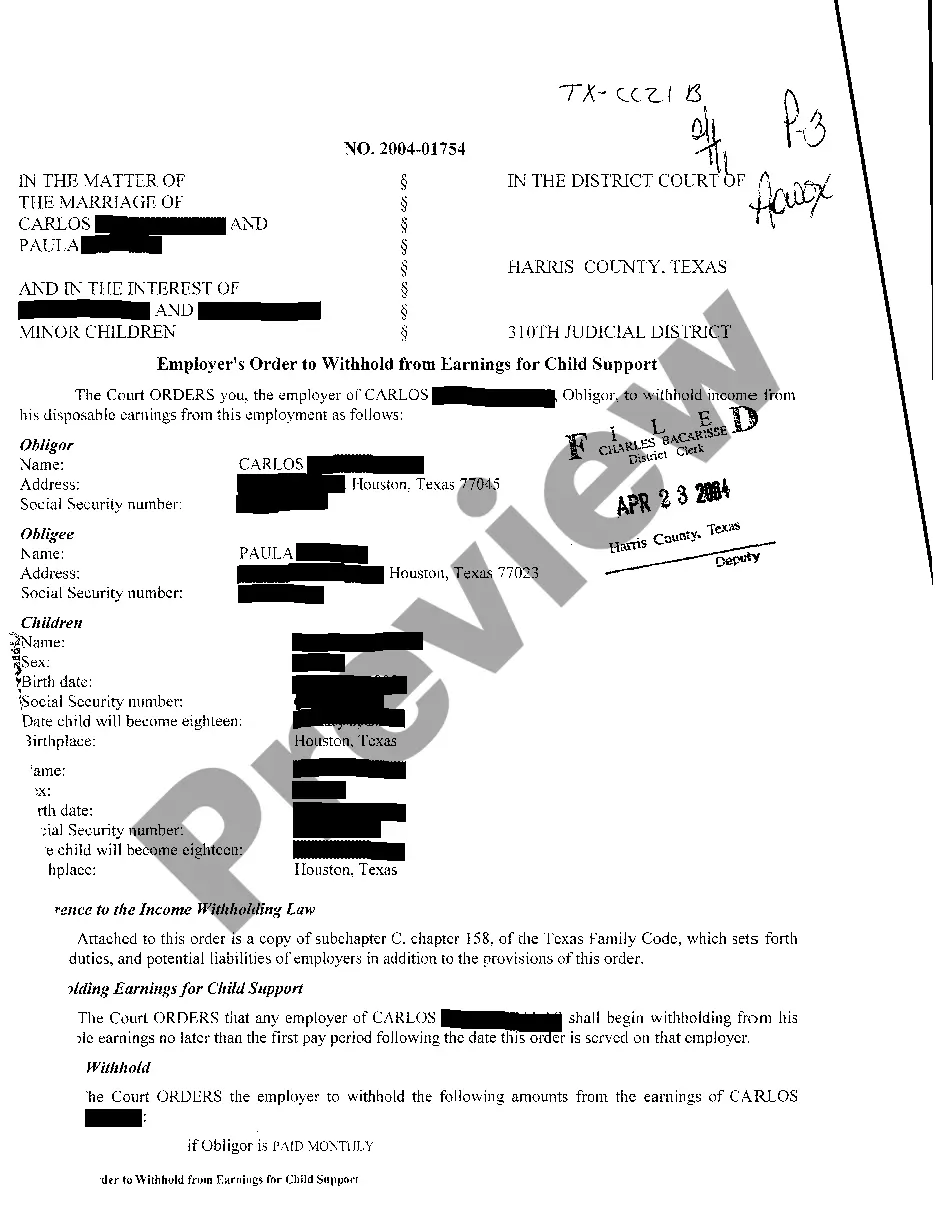

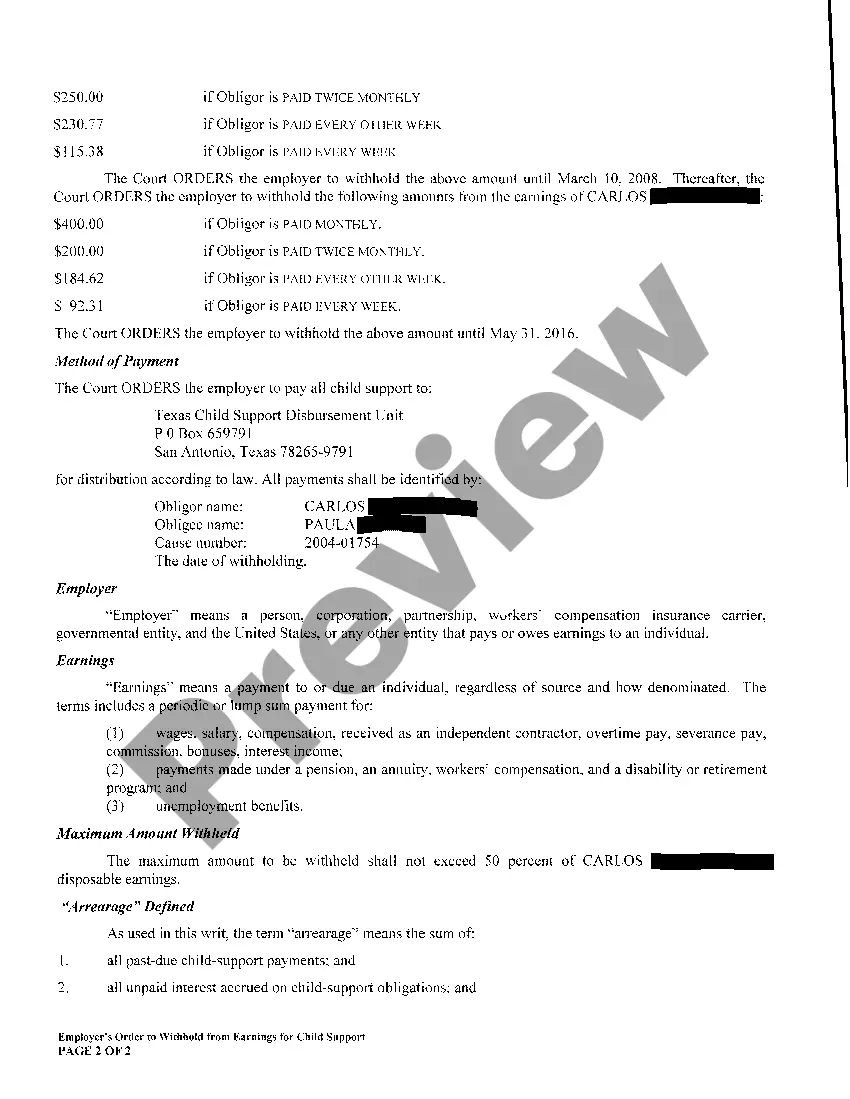

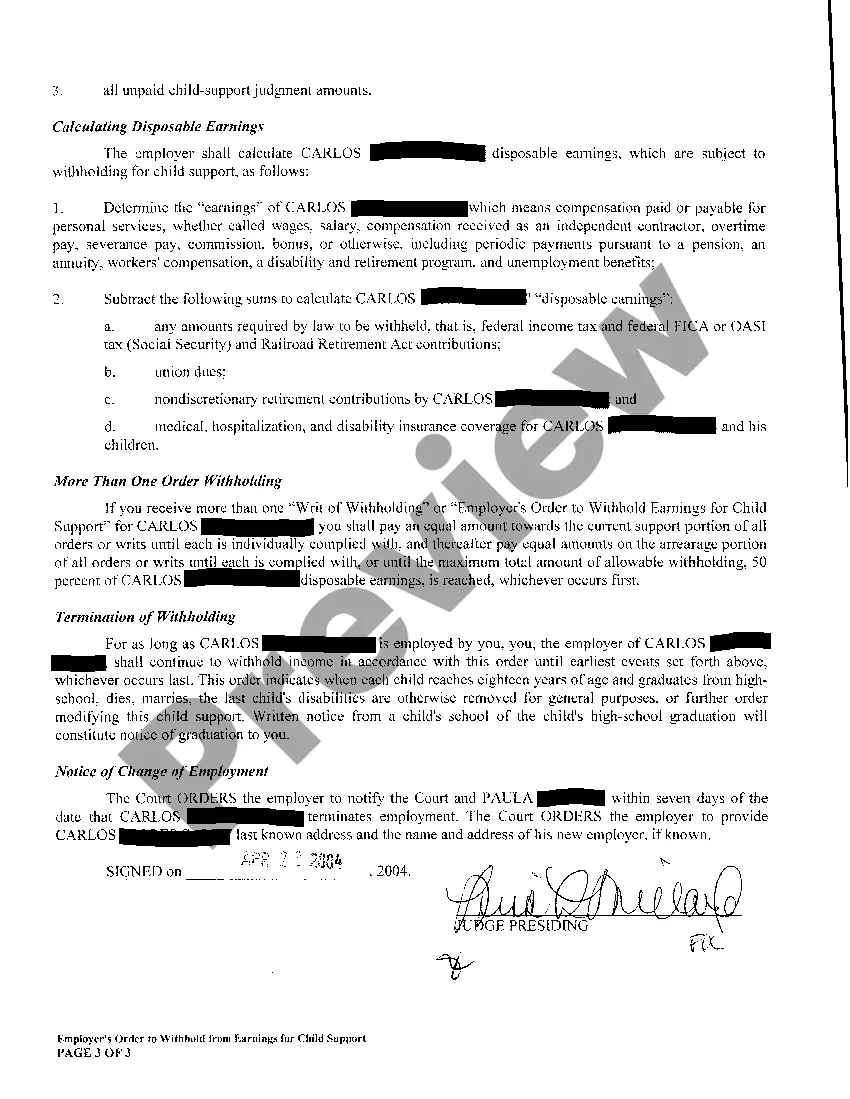

Wichita Falls Texas Employers Order Withholding From Earnings (WOE) is a legal process through which employers are required to deduct a portion of an employee's wages to meet certain financial obligations or legal obligations. This is commonly known as wage garnishment and is typically ordered by the courts or other applicable government agencies. There are several types of Wichita Falls Texas Employers Order Withholding From Earnings, each serving a specific purpose. Below, we discuss some key types of wage garnishment: 1. Child Support Orders: When an individual fails to meet their child support obligations, the court may issue an Employers Order Withholding From Earnings. This ensures that a portion of the employee's wages is withheld to fulfill their child support responsibilities. 2. Tax Levies: The Internal Revenue Service (IRS) can issue an Employers Order Withholding From Earnings to recover unpaid federal taxes. In such cases, a specific amount or percentage of the employee's wages will be deducted until the tax debt is cleared. 3. Creditor Garnishments: In situations where an employee has unpaid debts, such as credit card bills or unpaid loans, the creditor can seek a court judgment to obtain an Employers Order Withholding From Earnings. This requires the employer to withhold a portion of the employee's wages until the debt is satisfied. 4. Student Loan Garnishments: If an individual defaults on their federal student loans, the U.S. Department of Education or loan services can issue an Employers Order Withholding From Earnings. This allows them to garnish a specific amount from the employee's wages to repay the outstanding loan balance. It is important to note that an Employers Order Withholding From Earnings in Wichita Falls Texas must adhere to state and federal laws, which determine the maximum amount that can be withheld from an employee's earnings. These laws aim to protect employees from excessive wage garnishments, ensuring that they have enough income to meet their basic living expenses. If an employer fails to comply with an Employers Order Withholding From Earnings, they may face legal consequences such as fines or penalties. Therefore, it is crucial for employers to understand and adhere to their obligations when handling wage garnishments. In conclusion, Wichita Falls Texas Employers Order Withholding From Earnings encompasses various types of wage garnishments, including child support orders, tax levies, creditor garnishments, and student loan garnishments. These orders aim to ensure individuals fulfill their financial obligations by deducting a portion of their wages. Employers must follow legal regulations to properly execute and remain compliant with these orders.

Wichita Falls Texas Employers Order To Withhold From Earnings

State:

Texas

City:

Wichita Falls

Control #:

TX-CC-21-04

Format:

PDF

Instant download

This form is available by subscription

Description

A04 Employers Order To Withhold From Earnings

Wichita Falls Texas Employers Order Withholding From Earnings (WOE) is a legal process through which employers are required to deduct a portion of an employee's wages to meet certain financial obligations or legal obligations. This is commonly known as wage garnishment and is typically ordered by the courts or other applicable government agencies. There are several types of Wichita Falls Texas Employers Order Withholding From Earnings, each serving a specific purpose. Below, we discuss some key types of wage garnishment: 1. Child Support Orders: When an individual fails to meet their child support obligations, the court may issue an Employers Order Withholding From Earnings. This ensures that a portion of the employee's wages is withheld to fulfill their child support responsibilities. 2. Tax Levies: The Internal Revenue Service (IRS) can issue an Employers Order Withholding From Earnings to recover unpaid federal taxes. In such cases, a specific amount or percentage of the employee's wages will be deducted until the tax debt is cleared. 3. Creditor Garnishments: In situations where an employee has unpaid debts, such as credit card bills or unpaid loans, the creditor can seek a court judgment to obtain an Employers Order Withholding From Earnings. This requires the employer to withhold a portion of the employee's wages until the debt is satisfied. 4. Student Loan Garnishments: If an individual defaults on their federal student loans, the U.S. Department of Education or loan services can issue an Employers Order Withholding From Earnings. This allows them to garnish a specific amount from the employee's wages to repay the outstanding loan balance. It is important to note that an Employers Order Withholding From Earnings in Wichita Falls Texas must adhere to state and federal laws, which determine the maximum amount that can be withheld from an employee's earnings. These laws aim to protect employees from excessive wage garnishments, ensuring that they have enough income to meet their basic living expenses. If an employer fails to comply with an Employers Order Withholding From Earnings, they may face legal consequences such as fines or penalties. Therefore, it is crucial for employers to understand and adhere to their obligations when handling wage garnishments. In conclusion, Wichita Falls Texas Employers Order Withholding From Earnings encompasses various types of wage garnishments, including child support orders, tax levies, creditor garnishments, and student loan garnishments. These orders aim to ensure individuals fulfill their financial obligations by deducting a portion of their wages. Employers must follow legal regulations to properly execute and remain compliant with these orders.

Free preview

How to fill out Wichita Falls Texas Employers Order To Withhold From Earnings?

If you’ve already utilized our service before, log in to your account and save the Wichita Falls Texas Employers Order To Withhold From Earnings on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Make certain you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Wichita Falls Texas Employers Order To Withhold From Earnings. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!