The Austin Texas Truth in Lending Disclosures refer to a set of legal requirements designed to ensure transparency and provide accurate information to consumers regarding credit transactions in Austin, Texas. These disclosures are governed by federal and state laws, aimed at protecting borrowers from potential predatory lending practices and deceptive practices by lenders. The Truth in Lending Act (TILL) is a federal law that mandates lenders to provide key information to borrowers, allowing them to make informed decisions about credit transactions. It covers various types of credit, including mortgages, car loans, personal loans, and credit cards. TILL requires lenders to disclose certain terms and conditions of the loan agreement, such as the annual percentage rate (APR), finance charges, total amount financed, payment schedule, and any penalties or fees associated with early repayment. In addition to the federal requirements, the Texas Finance Code has specific provisions regarding Truth in Lending Disclosures in the state. These provisions work in conjunction with TILL to further protect consumers and provide them with additional information. While there are no specific types of Austin Texas Truth in Lending Disclosures, the overall purpose remains the same. Lenders are required to provide borrowers with a written disclosure statement before the consummation of the credit transaction. This document must contain information regarding the loan terms, costs, and repayment obligations, presented in a clear and understandable manner. It is important to note that Austin Texas Truth in Lending Disclosures may vary depending on the type of credit being obtained. For example, mortgage loans may require additional disclosures such as the Total Interest Percentage (TIP), which illustrates the total amount of interest the borrower will pay over the life of the loan. Overall, the Austin Texas Truth in Lending Disclosures play a crucial role in ensuring transparency and fairness in credit transactions. By providing borrowers with accurate and comprehensive information, they empower individuals to make informed decisions about their financial well-being.

Austin Texas Truth In Lending Disclosures

State:

Texas

City:

Austin

Control #:

TX-CC-24-03

Format:

PDF

Instant download

This form is available by subscription

Description

A03 Truth In Lending Disclosures

The Austin Texas Truth in Lending Disclosures refer to a set of legal requirements designed to ensure transparency and provide accurate information to consumers regarding credit transactions in Austin, Texas. These disclosures are governed by federal and state laws, aimed at protecting borrowers from potential predatory lending practices and deceptive practices by lenders. The Truth in Lending Act (TILL) is a federal law that mandates lenders to provide key information to borrowers, allowing them to make informed decisions about credit transactions. It covers various types of credit, including mortgages, car loans, personal loans, and credit cards. TILL requires lenders to disclose certain terms and conditions of the loan agreement, such as the annual percentage rate (APR), finance charges, total amount financed, payment schedule, and any penalties or fees associated with early repayment. In addition to the federal requirements, the Texas Finance Code has specific provisions regarding Truth in Lending Disclosures in the state. These provisions work in conjunction with TILL to further protect consumers and provide them with additional information. While there are no specific types of Austin Texas Truth in Lending Disclosures, the overall purpose remains the same. Lenders are required to provide borrowers with a written disclosure statement before the consummation of the credit transaction. This document must contain information regarding the loan terms, costs, and repayment obligations, presented in a clear and understandable manner. It is important to note that Austin Texas Truth in Lending Disclosures may vary depending on the type of credit being obtained. For example, mortgage loans may require additional disclosures such as the Total Interest Percentage (TIP), which illustrates the total amount of interest the borrower will pay over the life of the loan. Overall, the Austin Texas Truth in Lending Disclosures play a crucial role in ensuring transparency and fairness in credit transactions. By providing borrowers with accurate and comprehensive information, they empower individuals to make informed decisions about their financial well-being.

Free preview

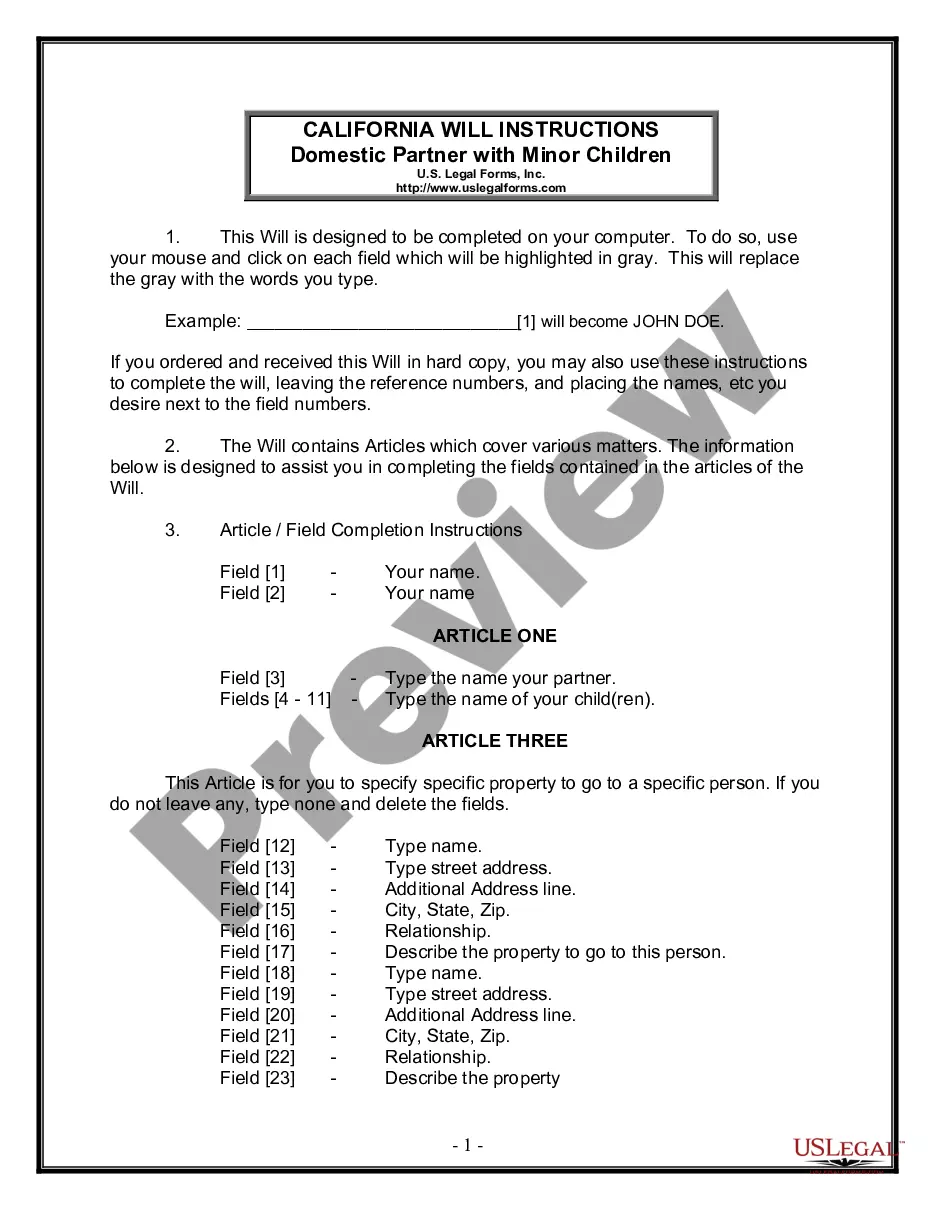

How to fill out Austin Texas Truth In Lending Disclosures?

If you’ve already utilized our service before, log in to your account and save the Austin Texas Truth In Lending Disclosures on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Make certain you’ve located the right document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Austin Texas Truth In Lending Disclosures. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!