Brownsville Texas Truth In Lending Disclosures is a set of regulations that aim to protect consumers by mandating financial institutions to provide clear and accurate information about the cost of credit. These disclosures are an important tool for borrowers, as they enable them to make informed decisions and compare different loan options effectively. The Truth In Lending Act (TILL) is a federal law that requires lenders to provide specific information to borrowers about the cost of credit. The law ensures transparency in lending practices and enables borrowers to understand and compare the terms and conditions of different loans. Brownsville, Texas, adheres to TILL and ensures that lenders in the region comply with its provisions. The Truth In Lending Disclosures include various key elements, such as the Annual Percentage Rate (APR), finance charges, amount financed, total loan costs, payment schedule, and other essential loan terms. These disclosures help borrowers understand the overall cost of credit, fees, interest rates, and the total amount they will repay over the loan term. In Brownsville, Texas, lenders are required to provide specific TILL disclosures for various types of loans, including mortgage loans, car loans, personal loans, and credit cards. Each type of loan comes with its own set of disclosures to ensure that borrowers have the necessary information to compare offers and make informed decisions. For example, mortgage loan disclosures include details about the loan's interest rate, any adjustable rate features, the total amount of finance charges, and the total payments over the loan term. Car loan disclosures provide information on interest rates, total finance charges, payment amounts, and any additional fees. Personal loan and credit card disclosures also highlight interest rates, finance charges, and payment schedules. It is important for borrowers in Brownsville, Texas, to review these Truth In Lending Disclosures carefully before accepting any credit offers. By understanding the terms and costs associated with the loan, borrowers can avoid unexpected fees, high-interest rates, and other potentially negative financial consequences. The Brownsville Texas Truth In Lending Disclosures exemplify the city's commitment to consumer protection and ensuring fair lending practices. By enforcing TILL regulations, Brownsville helps borrowers make well-informed decisions and promotes transparency in the lending industry.

Brownsville Texas Truth In Lending Disclosures

Description

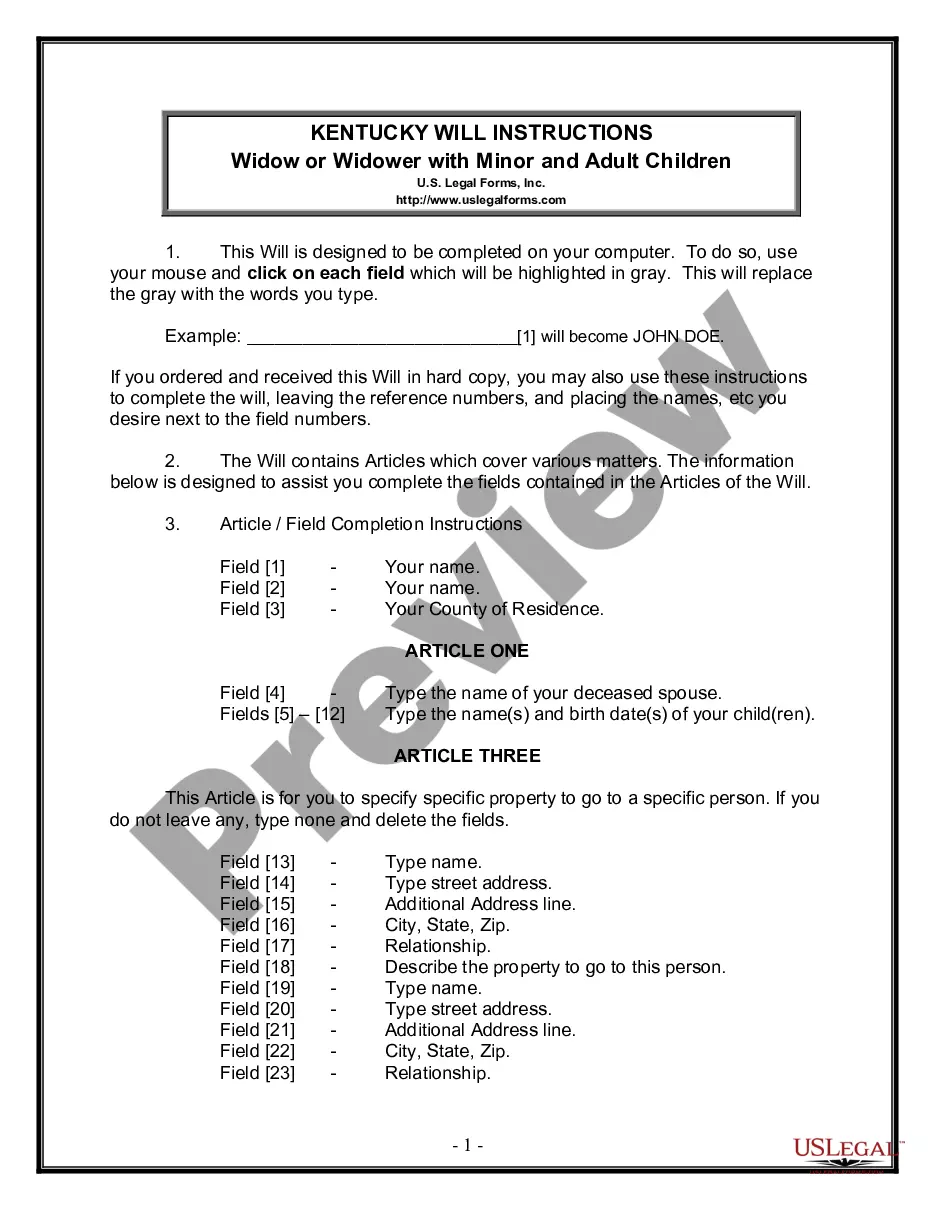

How to fill out Brownsville Texas Truth In Lending Disclosures?

No matter what social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for a person without any legal education to draft this sort of paperwork from scratch, mainly because of the convoluted jargon and legal subtleties they come with. This is where US Legal Forms comes to the rescue. Our platform offers a huge catalog with over 85,000 ready-to-use state-specific forms that work for practically any legal scenario. US Legal Forms also is a great asset for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you want the Brownsville Texas Truth In Lending Disclosures or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Brownsville Texas Truth In Lending Disclosures in minutes using our trustworthy platform. If you are already a subscriber, you can go on and log in to your account to get the needed form.

However, in case you are unfamiliar with our platform, ensure that you follow these steps prior to obtaining the Brownsville Texas Truth In Lending Disclosures:

- Ensure the template you have chosen is suitable for your area since the regulations of one state or county do not work for another state or county.

- Preview the form and go through a quick description (if provided) of scenarios the document can be used for.

- In case the one you selected doesn’t suit your needs, you can start again and search for the suitable form.

- Click Buy now and pick the subscription plan that suits you the best.

- Log in to your account credentials or create one from scratch.

- Select the payment gateway and proceed to download the Brownsville Texas Truth In Lending Disclosures once the payment is through.

You’re good to go! Now you can go on and print out the form or complete it online. Should you have any problems locating your purchased forms, you can quickly find them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.