Grand Prairie, Texas Truth in Lending Disclosures: Understanding Consumer Protection Laws In Grand Prairie, Texas, the Truth in Lending Act (TILL) is a federal law that aims to protect consumers by requiring lenders to disclose certain important information regarding the terms and costs of credit transactions. These disclosures ensure transparency and enable borrowers to make informed decisions about borrowing money. The Truth in Lending Disclosures in Grand Prairie, Texas require lenders to provide clear and understandable information regarding various aspects of the loan, including: 1. Annual Percentage Rate (APR): The APR represents the cost of credit as an annual interest rate and incorporates both the interest rate and certain fees associated with the loan. It allows borrowers to compare the cost of different loans accurately. 2. Finance Charges: This includes all costs associated with borrowing money, such as interest, loan origination fees, and certain closing costs. Lenders must disclose the total finance charge in dollar amount and as an APR. 3. Fees and Penalties: Lenders must disclose any additional fees or penalties that may be charged during the loan term. Examples may include late payment fees or prepayment penalties. 4. Total Loan Amount: Lenders must disclose the total amount being financed, including the principal amount borrowed as well as any prepaid finance charges. 5. Repayment Terms: The Truth in Lending Disclosures specify the number of payments, payment amounts, detailed payment schedule, and the total amount that will be repaid over the loan term. 6. Prepayment Options: If borrowers have the option to prepay their loan without penalty, lenders must disclose this information. 7. Security Interest: If the loan is secured by collateral, such as a house or car, the lender must disclose this information along with the consequences of failing to repay the loan (e.g., risk of foreclosure). It is essential for borrowers in Grand Prairie, Texas, to carefully review the Truth in Lending Disclosures before taking out a loan to fully understand the terms, costs, and obligations associated with the loan. Failure by lenders to provide accurate or complete disclosures may result in legal consequences. Different Types of Grand Prairie, Texas Truth in Lending Disclosures: In addition to the standard Truth in Lending Disclosures mentioned above, there are several other specific disclosures required by different lending laws that may be applicable in Grand Prairie, Texas. Some examples include: 1. Mortgage loan disclosures: Mortgage loans have additional disclosure requirements under the Real Estate Settlement Procedures Act (RESP) and the Home Mortgage Disclosure Act (HMD). These disclosures provide information regarding loan estimates, closing costs, and other specific details related to the mortgage loan process. 2. Credit card disclosures: Credit card companies must provide specific disclosures under TILL to inform consumers about interest rates, annual fees, grace periods, and other terms and conditions associated with credit card usage. 3. Auto loan disclosures: Disclosures related to auto loans may include information about the vehicle's purchase price, finance charges, repayment terms, and any additional fees or penalties. It is crucial for consumers in Grand Prairie, Texas, to be aware of these various types of Truth in Lending Disclosures to ensure they have a comprehensive understanding of their financial obligations and rights while engaging in credit transactions.

Grand Prairie Texas Truth In Lending Disclosures

Description

How to fill out Grand Prairie Texas Truth In Lending Disclosures?

Finding verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Grand Prairie Texas Truth In Lending Disclosures gets as quick and easy as ABC.

For everyone already familiar with our service and has used it before, obtaining the Grand Prairie Texas Truth In Lending Disclosures takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a few additional steps to make for new users.

Follow the guidelines below to get started with the most extensive online form library:

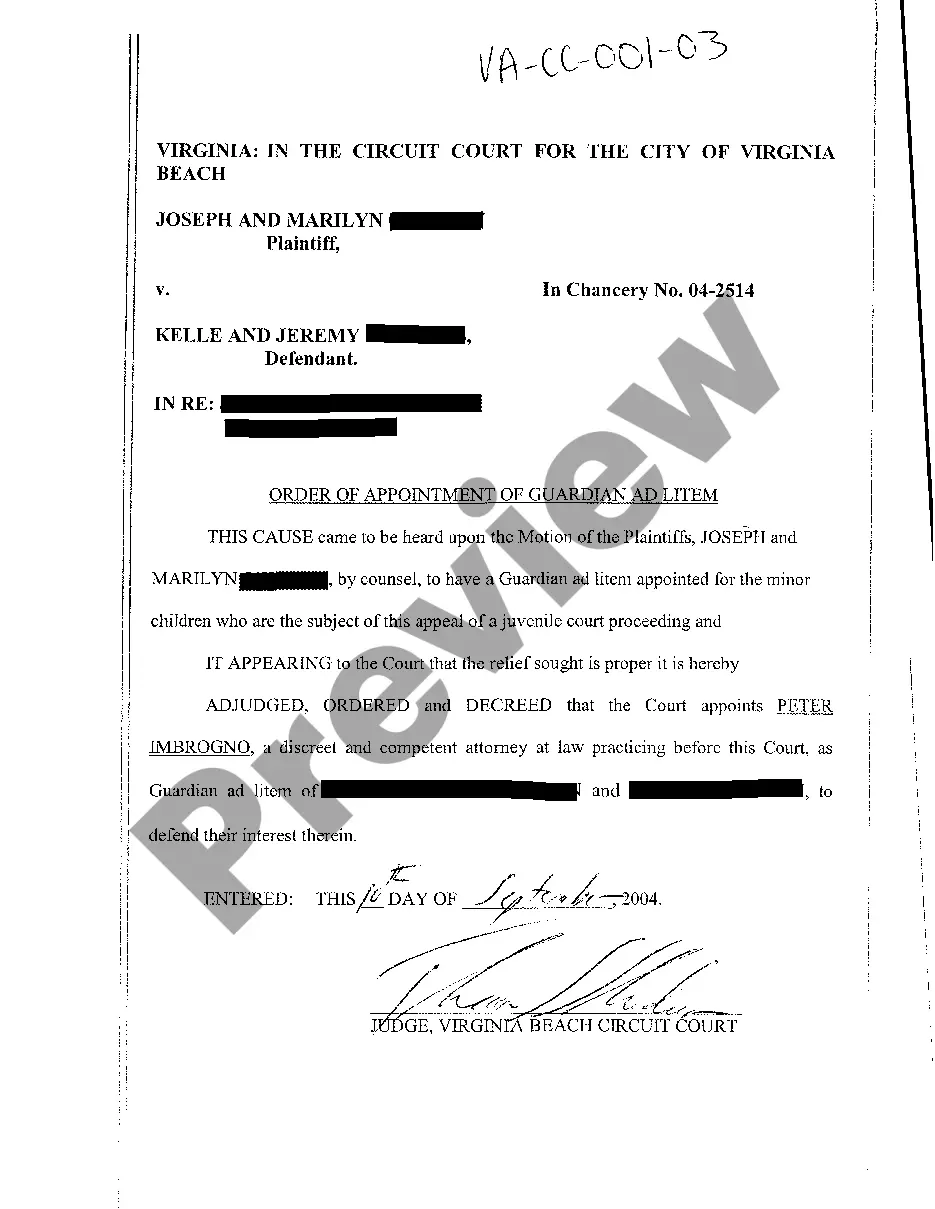

- Check the Preview mode and form description. Make certain you’ve chosen the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Grand Prairie Texas Truth In Lending Disclosures. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!