Waco Texas Truth In Lending Disclosures is a term used to describe the mandatory disclosures that lenders are required to provide to borrowers under the Truth in Lending Act (TILL). This federal law was designed to ensure transparency and protect consumers when obtaining credit. The Truth In Lending Disclosures contain important information that borrowers need to know about the terms and costs associated with their loans. These disclosures help borrowers make informed decisions and compare loan offers from different lenders. The Waco Texas Truth In Lending Disclosures adhere to the TILL standards but may have some specific aspects specific to the state of Texas. The main components of the Waco Texas Truth In Lending Disclosures include: 1. Annual Percentage Rate (APR): The APR is a crucial disclosure that reflects the total cost of borrowing. It includes both the interest rate and other fees charged by the lender. The Waco Texas Truth In Lending Disclosures require the APR to be clearly stated to help borrowers compare loan offers accurately. 2. Finance Charge: This disclosure itemizes the cost of credit and includes interest charges, certain fees, and any other charges incurred throughout the loan term. The Waco Texas Truth In Lending Disclosures ensure that all finance charges are fully disclosed, enabling borrowers to comprehend the true cost of their loans. 3. Amount Financed: This disclosure indicates the actual amount borrowed, excluding any prepaid finance charges or fees. It provides borrowers with a clear understanding of the principal amount they are borrowing. 4. Total Payments: The Waco Texas Truth In Lending Disclosures specify the total amount the borrower will repay throughout the loan term, including principal, interest, and finance charges. This helps borrowers assess the overall cost of the loan and plan their finances accordingly. 5. Payment Schedule: Lenders must provide a payment schedule that outlines the number of payments, payment due dates, and the amounts due for each payment. This ensures borrowers are aware of their future financial obligations. In addition to these general Truth In Lending Disclosures, Waco Texas may have specific requirements or additional disclosures related to certain kinds of loans, such as mortgages or auto loans. It is essential for borrowers in Waco Texas to review these loan-specific disclosures carefully. By providing these detailed and comprehensive disclosures, the Waco Texas Truth In Lending Disclosures aim to protect consumers from deceptive lending practices, empower them with the necessary information to make informed decisions, and ultimately contribute to a fair lending environment.

Waco Texas Truth In Lending Disclosures

Description

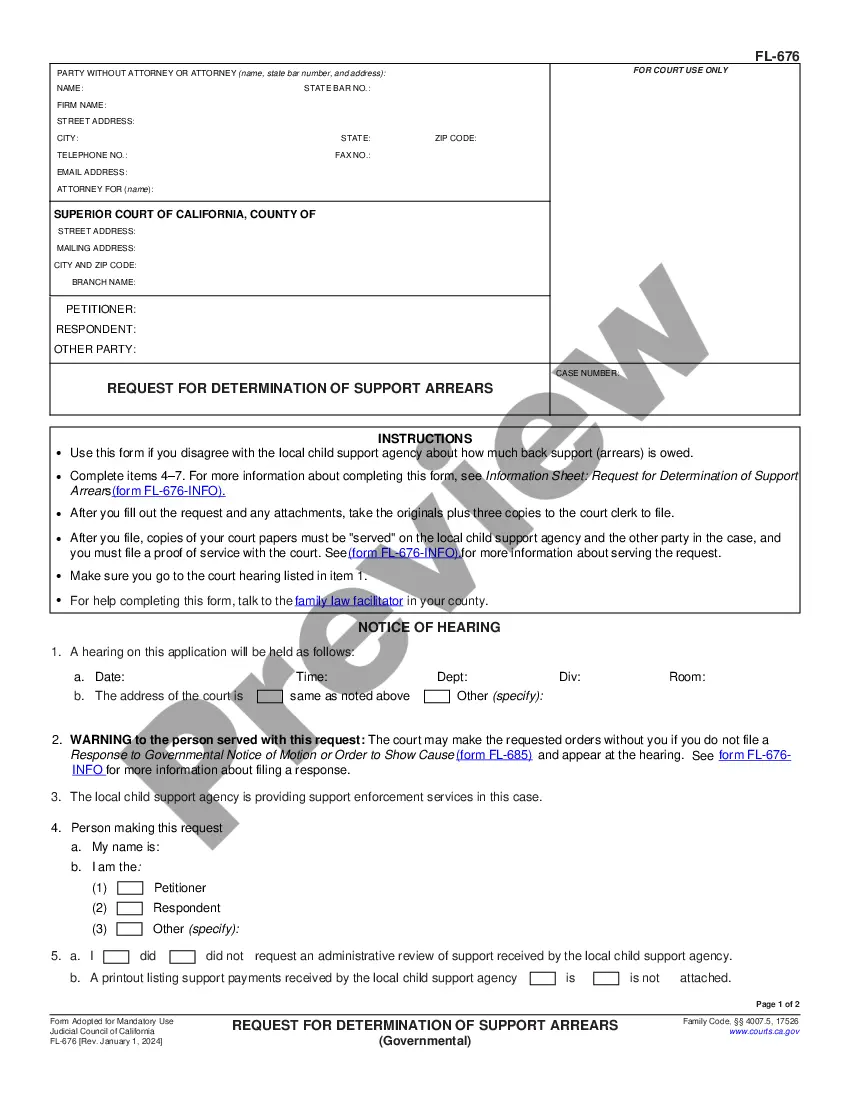

How to fill out Waco Texas Truth In Lending Disclosures?

Locating confirmed templates pertinent to your local regulations can be challenging unless you utilize the US Legal Forms library.

It’s an online collection of over 85,000 legal documents catering to both personal and business requirements as well as various real-life circumstances.

All documents are correctly categorized by usage area and jurisdiction, so finding the Waco Texas Truth In Lending Disclosures becomes as quick and simple as ABC.

Maintaining organized documentation in compliance with legal standards is of significant importance. Utilize the US Legal Forms library to consistently have vital document templates for all your requirements readily available!

- Ensure you’ve selected the correct one that aligns with your needs and fully adheres to your local jurisdiction requirements.

- Should you find any discrepancies, use the Search tab above to locate the accurate one. If it satisfies your needs, proceed to the next step.

- Click the Buy Now button and select your preferred subscription plan. It is necessary to register for an account to gain access to the library’s resources.

- Provide your credit card information or utilize your PayPal account to complete the payment for the service.

- Store the Waco Texas Truth In Lending Disclosures on your device to fill it out and ensure access to it in the My documents section of your profile whenever you need it again.

Form popularity

FAQ

The Truth in Lending Act highlights six key elements: the annual percentage rate (APR), payment terms, total finance charges, total amount financed, the schedule of payments, and the right to cancel. Each element provides vital information that assists borrowers in understanding their loans and the costs involved. Knowing these components is essential for Waco Texas Truth In Lending Disclosures. For further guidance, consider utilizing US Legal Forms to access templates and resources tailored to your needs.

Certain loans are exempt from the Truth in Lending Act, including loans made for business purposes or those with amounts above a specified threshold. Additionally, loans secured by a timeshare or commercial property may not require a truth in lending statement. Familiarizing yourself with these exceptions can shed light on your Waco Texas Truth In Lending Disclosures.

The Truth in Lending Act applies to various types of loans, particularly those intended for personal, family, or household use in Waco, Texas. This includes mortgages, personal loans, and home equity lines of credit. Each of these loans must adhere to the same disclosure requirements, ensuring that you have the information needed to make informed choices. Awareness of these regulations can help you navigate your borrowing options effectively.

The Truth in Lending Act (TILA) covers various types of loans aimed at consumers in Waco, Texas. Most consumer credit transactions, including mortgages, home equity loans, and personal loans, fall under TILA. However, some specific types of loans like business loans may not be included. Knowing the scope of TILA can help you understand your rights when borrowing.

Certain loans may be exempt from Waco Texas Truth In Lending Disclosures. These typically include loans made for business purposes, loans secured by real property, and certain government loans. It's important to check with your lender for specific exemptions. Understanding these exemptions can help clarify your rights and obligations in the lending process.

A Truth in Lending disclosure statement must include specific information to ensure borrower understanding. It requires the annual percentage rate (APR), total finance charges, total payments, and a clear repayment schedule. By ensuring that Waco Texas Truth In Lending Disclosures are complete and transparent, lenders foster a smoother borrowing experience, helping borrowers feel secure and informed.

Amount Financed: the dollar amount of credit provided to you (this is normally the amount you are borrowing); Total of Payments: the sum of all the payments that you will have made at the end of the loan (this includes repayment of the principal amount of the loan plus all of the finance charges)

The Truth in Lending Act (TILA) is intended to ensure that credit terms are disclosed in a meaningful way so consumers can compare credit terms more readily and knowledgeably.

The regulations found in the TILA apply to most kinds of consumer credit, from mortgages to credit cards. Lenders are required to clearly disclose information and certain details about their financial products and services to consumers by law.

You receive a Truth-in-Lending disclosure twice: an initial disclosure when you apply for a mortgage loan, and a final disclosure before closing. Your Truth-in-Lending form includes information about the cost of your mortgage loan, including your annual percentage rate (APR).