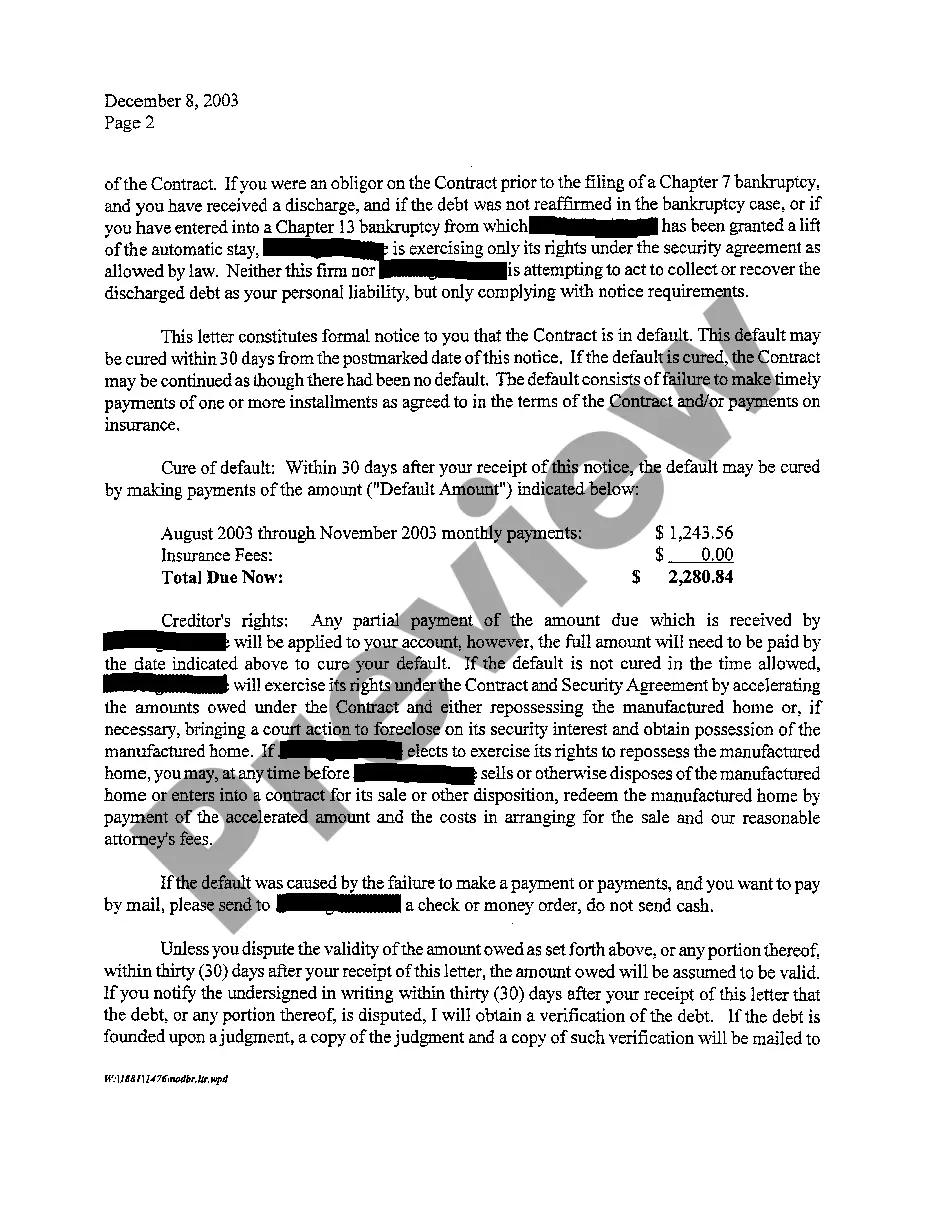

The Austin Texas Notice of Default and Right to Cure is a legal document that outlines the borrower's default on their mortgage loan payment obligations and provides them with an opportunity to rectify the default before foreclosure proceedings commence. This notice is an essential step in the foreclosure process and is regulated by both state laws and the terms of the mortgage agreement. The Notice of Default is typically issued by the lender or their authorized representative when the borrower fails to make their mortgage payments within a specified period, as outlined in the mortgage agreement. It serves as an official notification to the borrower that they are in default and that the lender intends to initiate foreclosure proceedings if the default is not cured. The Right to Cure is an important provision that accompanies the Notice of Default. It grants the borrower a specific period, usually around 20 days, to catch up with the missed payments and cure the default. During this time, the borrower can work with the lender to negotiate a repayment plan, seek loan modification, or explore other options to bring their mortgage payments up to date. In Austin, Texas, the Notice of Default and Right to Cure follows the state laws, which may vary slightly from other jurisdictions. It is important to note that there may be different types of notices and rights to cure depending on the specific circumstances and terms outlined in the mortgage agreement. Some possible variations include: 1. Pre-Foreclosure Notice: This is a preliminary notice or reminder sent by the lender to inform the borrower of their payment delinquency before the formal Notice of Default is issued. It serves as an opportunity for the borrower to rectify the situation promptly and avoid foreclosure. 2. Acceleration Notice: This type of notice is issued when the lender demands immediate payment of the loan in full. It usually accompanies the Notice of Default and may provide a shorter time frame for the borrower to cure the default. 3. Special Default Notice: In certain cases, such as when the loan is insured or guaranteed by a federal agency, there may be specific notice requirements that differ from standard procedures. These notices cater to the special circumstances associated with these types of loans. It is crucial for borrowers to carefully review the terms and conditions of their mortgage agreement to understand the specific requirements and remedies outlined in their Notice of Default and Right to Cure. Seeking legal advice or consulting with housing counseling agencies can be helpful in navigating this process and exploring potential alternatives to foreclosure.

How Can A Foreclosure Process Be Temporarily Stalled

Description

How to fill out Austin Texas Notice Of Default And Right To Cure?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Austin Texas Notice of Default and Right To Cure gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Austin Texas Notice of Default and Right To Cure takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make sure you’ve selected the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Austin Texas Notice of Default and Right To Cure. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!