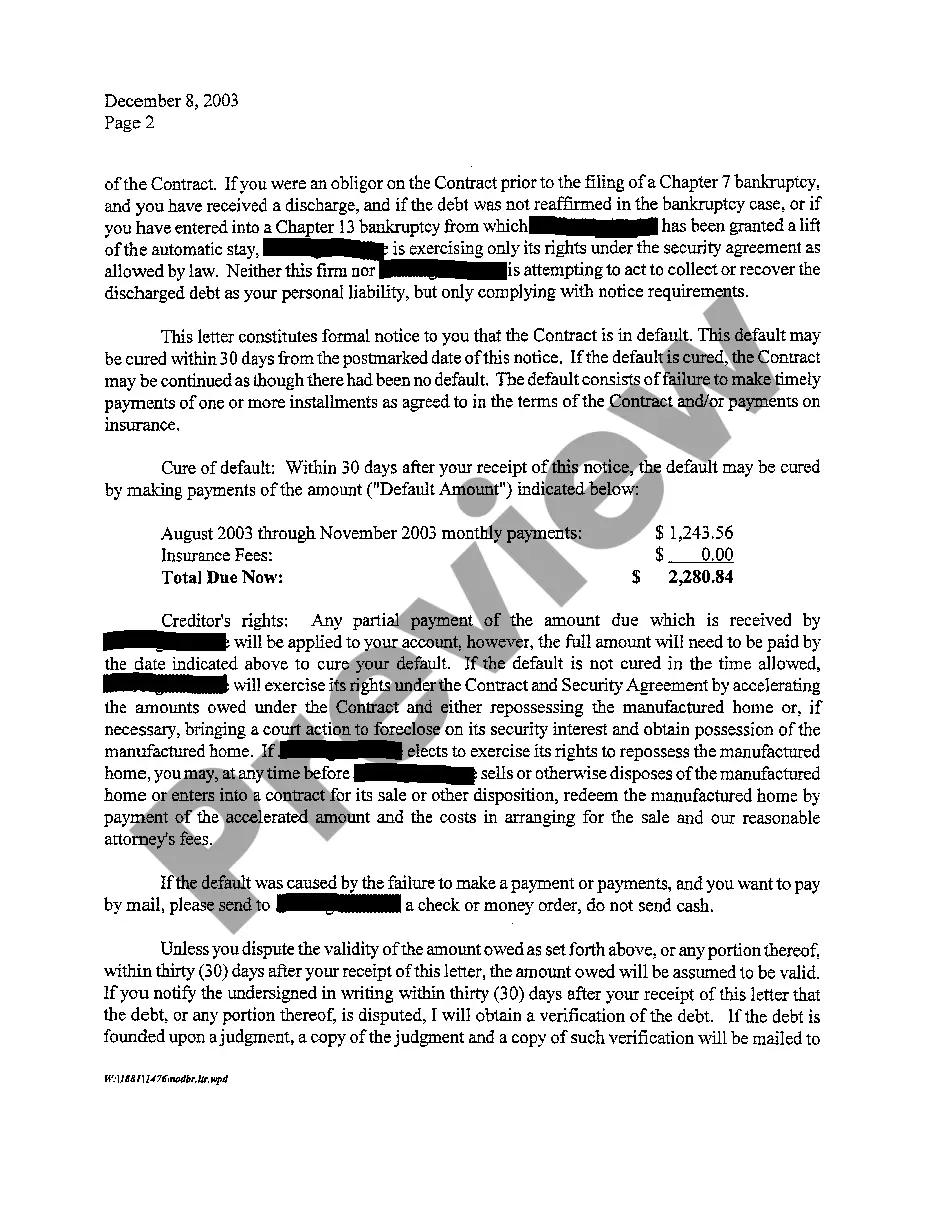

Beaumont Texas Notice of Default and Right To Cure is an important legal process that allows lenders to initiate foreclosure proceedings on a property when a borrower fails to meet their mortgage obligations. This notice is significant as it grants the borrower an opportunity to cure the default and bring their mortgage payments up to date. The Notice of Default is a formal notification sent by the lender to the borrower to inform them that they are in breach of their mortgage agreement due to non-payment or any other default specified in the contract. The notice states the specific default, the amount owed, and provides a deadline for the borrower to take corrective action. In Beaumont, Texas, there are different types of Notice of Default and Right To Cure, depending on the type of loan and the terms of the mortgage agreement. These may include: 1. Residential Mortgage: This type of Notice of Default is applicable to individuals who have borrowed money to purchase residential properties in Beaumont, Texas. It outlines the terms of the default, such as missed payments or failure to maintain insurance coverage. 2. Commercial Loan: For businesses that have obtained a loan for their commercial property, this Notice of Default serves as a warning that the borrower has failed to fulfill their financial obligations. It states the specific defaults, such as late payments or failure to pay property taxes. 3. Home Equity Loan: Borrowers who have taken out a home equity loan against their property are subject to a separate type of Notice of Default. This notice specifies the violations related to the home equity loan, such as defaulting on the loan terms or failure to maintain the property adequately. The Right To Cure allows the borrower a certain period to rectify the default and bring the mortgage payments up to date. It grants the borrower an opportunity to resolve the issue before foreclosure proceedings are initiated. The timeframe to cure the default is typically stated in the Notice of Default, giving the borrower a chance to communicate with the lender, establish a repayment plan, or seek financial advice. Understanding the Beaumont Texas Notice of Default and Right To Cure is crucial for borrowers to protect their property rights and avoid foreclosure. It is advisable for borrowers to seek legal assistance or consult with mortgage specialists to fully comprehend their options and obligations when faced with a Notice of Default. Taking prompt action and addressing the default can help borrowers retain their property and mitigate potential financial consequences.

Beaumont Texas Notice of Default and Right To Cure

State:

Texas

City:

Beaumont

Control #:

TX-CC-24-05

Format:

PDF

Instant download

This form is available by subscription

Description

A04 Notice of Default and Right To Cure

Beaumont Texas Notice of Default and Right To Cure is an important legal process that allows lenders to initiate foreclosure proceedings on a property when a borrower fails to meet their mortgage obligations. This notice is significant as it grants the borrower an opportunity to cure the default and bring their mortgage payments up to date. The Notice of Default is a formal notification sent by the lender to the borrower to inform them that they are in breach of their mortgage agreement due to non-payment or any other default specified in the contract. The notice states the specific default, the amount owed, and provides a deadline for the borrower to take corrective action. In Beaumont, Texas, there are different types of Notice of Default and Right To Cure, depending on the type of loan and the terms of the mortgage agreement. These may include: 1. Residential Mortgage: This type of Notice of Default is applicable to individuals who have borrowed money to purchase residential properties in Beaumont, Texas. It outlines the terms of the default, such as missed payments or failure to maintain insurance coverage. 2. Commercial Loan: For businesses that have obtained a loan for their commercial property, this Notice of Default serves as a warning that the borrower has failed to fulfill their financial obligations. It states the specific defaults, such as late payments or failure to pay property taxes. 3. Home Equity Loan: Borrowers who have taken out a home equity loan against their property are subject to a separate type of Notice of Default. This notice specifies the violations related to the home equity loan, such as defaulting on the loan terms or failure to maintain the property adequately. The Right To Cure allows the borrower a certain period to rectify the default and bring the mortgage payments up to date. It grants the borrower an opportunity to resolve the issue before foreclosure proceedings are initiated. The timeframe to cure the default is typically stated in the Notice of Default, giving the borrower a chance to communicate with the lender, establish a repayment plan, or seek financial advice. Understanding the Beaumont Texas Notice of Default and Right To Cure is crucial for borrowers to protect their property rights and avoid foreclosure. It is advisable for borrowers to seek legal assistance or consult with mortgage specialists to fully comprehend their options and obligations when faced with a Notice of Default. Taking prompt action and addressing the default can help borrowers retain their property and mitigate potential financial consequences.

Free preview

How to fill out Beaumont Texas Notice Of Default And Right To Cure?

If you’ve already utilized our service before, log in to your account and save the Beaumont Texas Notice of Default and Right To Cure on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Ensure you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Beaumont Texas Notice of Default and Right To Cure. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!