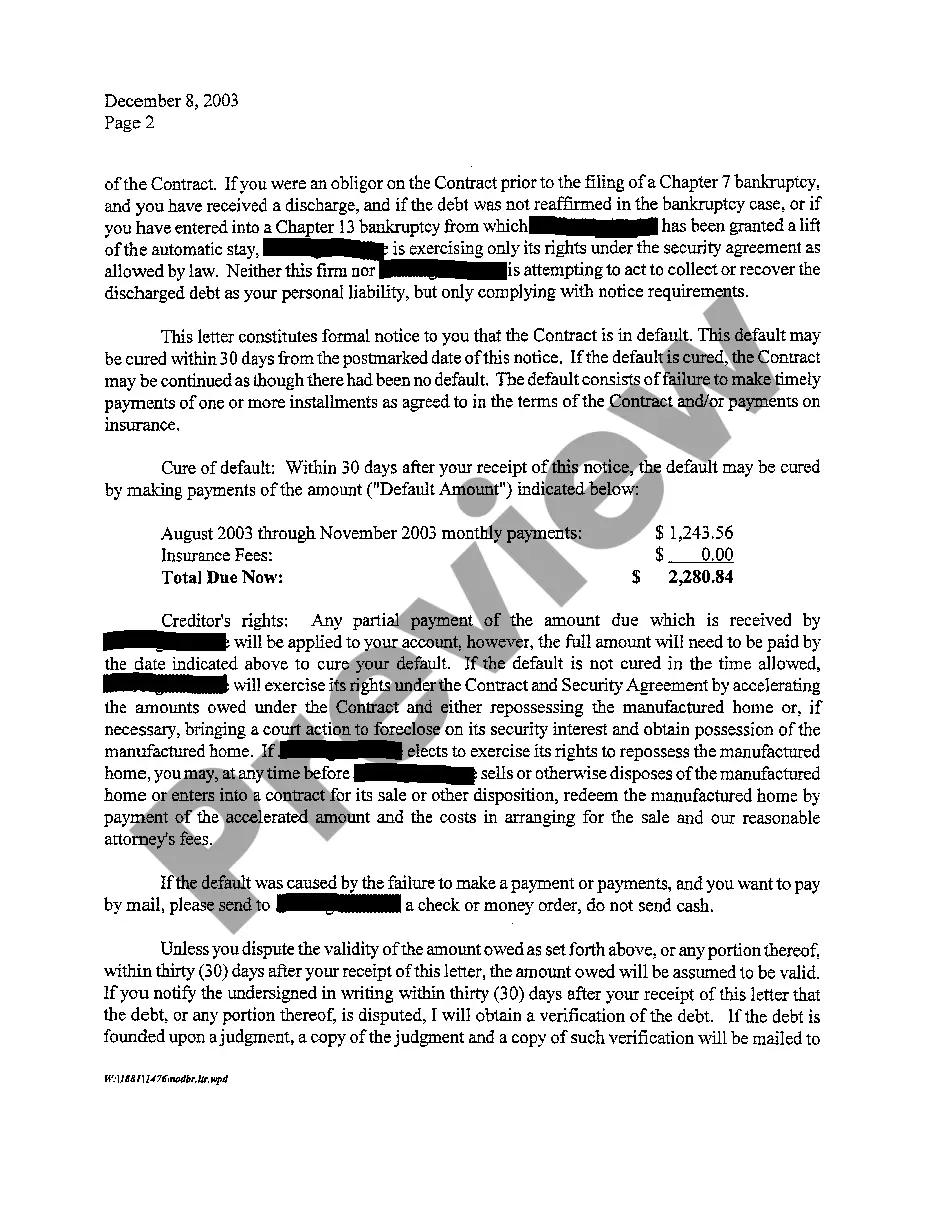

Bexar Texas Notice of Default and Right to Cure is a legal document that serves as notification to the borrower of their default on a loan or mortgage payment. This document outlines the specific terms and conditions that have been violated, giving the borrower an opportunity to rectify the situation and bring the loan current. The purpose of the Bexar Texas Notice of Default and Right to Cure is to inform the borrower of their rights under the law and give them a chance to remedy the default within a certain timeframe, usually specified in the document. It is important to note that Bexar Texas may have specific laws and regulations regarding the format and content of this notice, so it is advised to consult a legal professional familiar with local regulations. The Bexar Texas Notice of Default and Right to Cure serves as a formal warning to the borrower, stating their failure to make timely payments and potential consequences, such as foreclosure or repossession of the property securing the loan. This notice typically includes information such as the outstanding loan balance, payment due dates, interest rates, and any additional fees or charges. Different types of Bexar Texas Notice of Default and Right to Cure may exist depending on the type of loan or mortgage agreement. Some common variations include mortgage default notices, loan default notices, and promissory note default notices. These variations may differ in language and specific requirements as dictated by Bexar Texas laws. In accordance with Bexar Texas regulations, a Notice of Default and Right to Cure typically provides the borrower with a specific timeframe, referred to as the "cure period," during which they can bring their loan payments up to date and avoid further legal actions. The cure period may vary depending on the nature of the default, but it is generally a minimum of 30 days. It is crucial for borrowers to act promptly during this period to avoid any potential adverse consequences. Additionally, the Bexar Texas Notice of Default and Right to Cure may include instructions on how the borrower can contact the lender or loan service to discuss potential workout options or loan modification programs. These alternatives can provide borrowers with the opportunity to renegotiate the terms of their loan in order to make payments more manageable and resolve the default. In summary, the Bexar Texas Notice of Default and Right to Cure is a crucial legal document that notifies borrowers of their default on loan or mortgage payments. By providing clear guidelines and a remedy period, it aims to encourage borrowers to rectify their default promptly and avoid further legal actions. Compliance with local regulations is essential when drafting and issuing this notice to ensure its effectiveness.

Bexar Texas Notice of Default and Right To Cure

State:

Texas

County:

Bexar

Control #:

TX-CC-24-05

Format:

PDF

Instant download

This form is available by subscription

Description

A04 Notice of Default and Right To Cure

Bexar Texas Notice of Default and Right to Cure is a legal document that serves as notification to the borrower of their default on a loan or mortgage payment. This document outlines the specific terms and conditions that have been violated, giving the borrower an opportunity to rectify the situation and bring the loan current. The purpose of the Bexar Texas Notice of Default and Right to Cure is to inform the borrower of their rights under the law and give them a chance to remedy the default within a certain timeframe, usually specified in the document. It is important to note that Bexar Texas may have specific laws and regulations regarding the format and content of this notice, so it is advised to consult a legal professional familiar with local regulations. The Bexar Texas Notice of Default and Right to Cure serves as a formal warning to the borrower, stating their failure to make timely payments and potential consequences, such as foreclosure or repossession of the property securing the loan. This notice typically includes information such as the outstanding loan balance, payment due dates, interest rates, and any additional fees or charges. Different types of Bexar Texas Notice of Default and Right to Cure may exist depending on the type of loan or mortgage agreement. Some common variations include mortgage default notices, loan default notices, and promissory note default notices. These variations may differ in language and specific requirements as dictated by Bexar Texas laws. In accordance with Bexar Texas regulations, a Notice of Default and Right to Cure typically provides the borrower with a specific timeframe, referred to as the "cure period," during which they can bring their loan payments up to date and avoid further legal actions. The cure period may vary depending on the nature of the default, but it is generally a minimum of 30 days. It is crucial for borrowers to act promptly during this period to avoid any potential adverse consequences. Additionally, the Bexar Texas Notice of Default and Right to Cure may include instructions on how the borrower can contact the lender or loan service to discuss potential workout options or loan modification programs. These alternatives can provide borrowers with the opportunity to renegotiate the terms of their loan in order to make payments more manageable and resolve the default. In summary, the Bexar Texas Notice of Default and Right to Cure is a crucial legal document that notifies borrowers of their default on loan or mortgage payments. By providing clear guidelines and a remedy period, it aims to encourage borrowers to rectify their default promptly and avoid further legal actions. Compliance with local regulations is essential when drafting and issuing this notice to ensure its effectiveness.

Free preview

How to fill out Bexar Texas Notice Of Default And Right To Cure?

If you’ve already utilized our service before, log in to your account and download the Bexar Texas Notice of Default and Right To Cure on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Ensure you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Bexar Texas Notice of Default and Right To Cure. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!