Brownsville Texas Notice of Default and Right To Cure

Description

How to fill out Texas Notice Of Default And Right To Cure?

Locating authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms collection.

This is a digital repository of over 85,000 legal documents for both personal and business requirements, accommodating various real-life situations.

All the files are systematically organized by usage area and jurisdiction, making the search for the Brownsville Texas Notice of Default and Right To Cure as simple as 1-2-3.

Maintaining organized paperwork that complies with legal standards is crucial. Take advantage of the US Legal Forms library to always have vital document templates readily available!

- Review the Preview mode and form details.

- Ensure you’ve selected the correct one that satisfies your needs and fully aligns with your local jurisdictional criteria.

- Search for another template, if necessary.

- If you identify any discrepancies, use the Search tab above to locate the appropriate document.

- If it meets your needs, proceed to the next stage.

Form popularity

FAQ

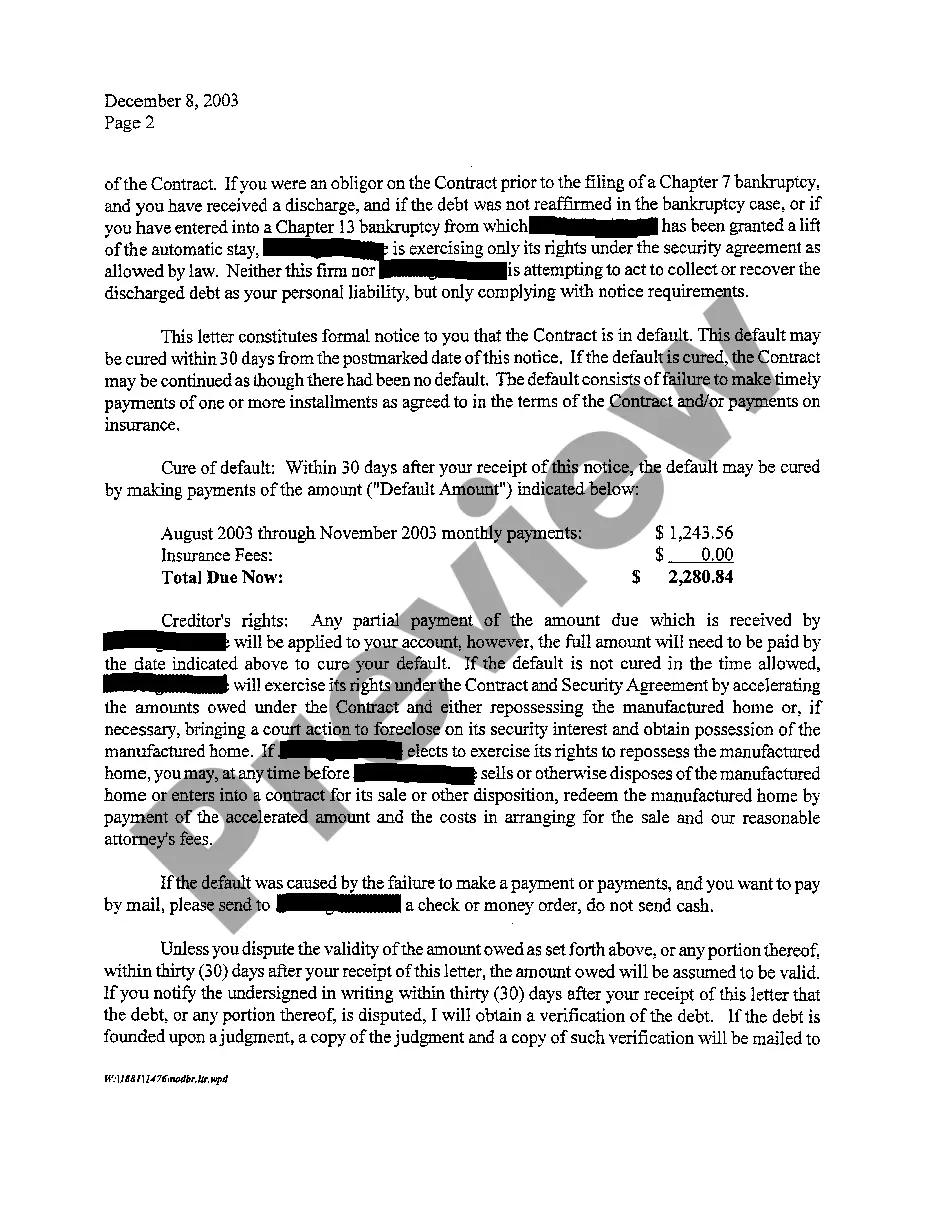

In Texas, the law mandates that a notice of a foreclosure sale must be posted at the county courthouse and filed with the county clerk at least 21 days prior to the sale. This notice should include details such as the date, time, and location of the sale. Additionally, the Brownsville Texas Notice of Default and Right To Cure must have been issued to the homeowner before the foreclosure process can legally begin. Ensuring compliance with these requirements helps protect your rights and streamlines the foreclosure process.

In Texas, the foreclosure process typically takes between 60 to 90 days, but various factors can influence this timeline. After a Brownsville Texas Notice of Default and Right To Cure is issued, property owners have a designated period to address arrears before the foreclosure can move forward. It’s essential to stay informed about each stage of the process to avoid unexpected delays or complications. Understanding your rights and options can greatly aid in navigating through foreclosure.

Yes, you can sue someone in Texas without a lawyer, but it requires a good understanding of court procedures and rules. Representing yourself can save costs, but it also comes with risks, especially when presenting a case related to the Brownsville Texas Notice of Default and Right To Cure. You may benefit from using online legal resources or templates provided by USLegalForms to ensure you follow proper protocols. Always prepare thoroughly to maximize your chances of a successful outcome.

Filing a judgment against someone in Texas involves a series of steps to ensure your claim is recognized legally. First, you need to obtain a judgment from the court, which may require proving your case based on evidence and witness testimony. Once you have this judgment, you can file it with the county clerk to make it enforceable. It is important to consider using professional resources, such as those offered by USLegalForms, to navigate the complexities of filing related to the Brownsville Texas Notice of Default and Right To Cure.

To sue someone for more than $10,000 in Texas, you need to file your lawsuit in a district court or a higher-level court. It's crucial to clearly outline your damages, providing strong evidence to support your claim. Using platforms like USLegalForms can provide guidance and templates tailored to your needs such as the Brownsville Texas Notice of Default and Right To Cure. Familiarity with the court system and proper documentation will increase your chances of a favorable ruling.

In Texas, the amount you can sue someone for generally depends on the nature of your claim. For most civil actions, you can seek damages that reflect your losses, which can range from a few hundred to several million dollars. However, when dealing with the Brownsville Texas Notice of Default and Right To Cure, ensuring your claim accurately reflects your situation is vital. Accurate documentation can strengthen your case and improve your chances of recovery.

In Texas, a notice of default foreclosure indicates that a borrower has fallen behind on their mortgage payments. This formal notice informs the borrower of the default and provides a specified time frame to remedy the situation or face foreclosure. Understanding the Brownsville Texas Notice of Default and Right To Cure is crucial, as it empowers homeowners with information on how to address their financial issues before losing their property. Taking prompt action can significantly alter the outcome of your foreclosure situation.

The foreclosure process in Texas can vary but typically lasts between 60 to 90 days once initiated. This timeframe allows for necessary notifications, such as a Brownsville Texas Notice of Default and Right To Cure, and potential responses from the borrower. Understanding this timeline helps homeowners act promptly to address their financial circumstances.

In Texas, the statute of limitations for enforcing a mortgage lien is four years from the date of default. However, the initiation of foreclosure processes must align with the lender's rights as per the mortgage terms. Homeowners should stay informed, especially regarding notices like the Brownsville Texas Notice of Default and Right To Cure to fully understand their standing.

Stopping a non-judicial foreclosure in Texas involves receiving timely notice and understanding your rights. Paying the default amount, entering into a repayment plan, or filing for bankruptcy may provide temporary relief. Utilizing services like USLegalForms can equip you with the necessary documents and strategies to respond to a Brownsville Texas Notice of Default and Right To Cure effectively.