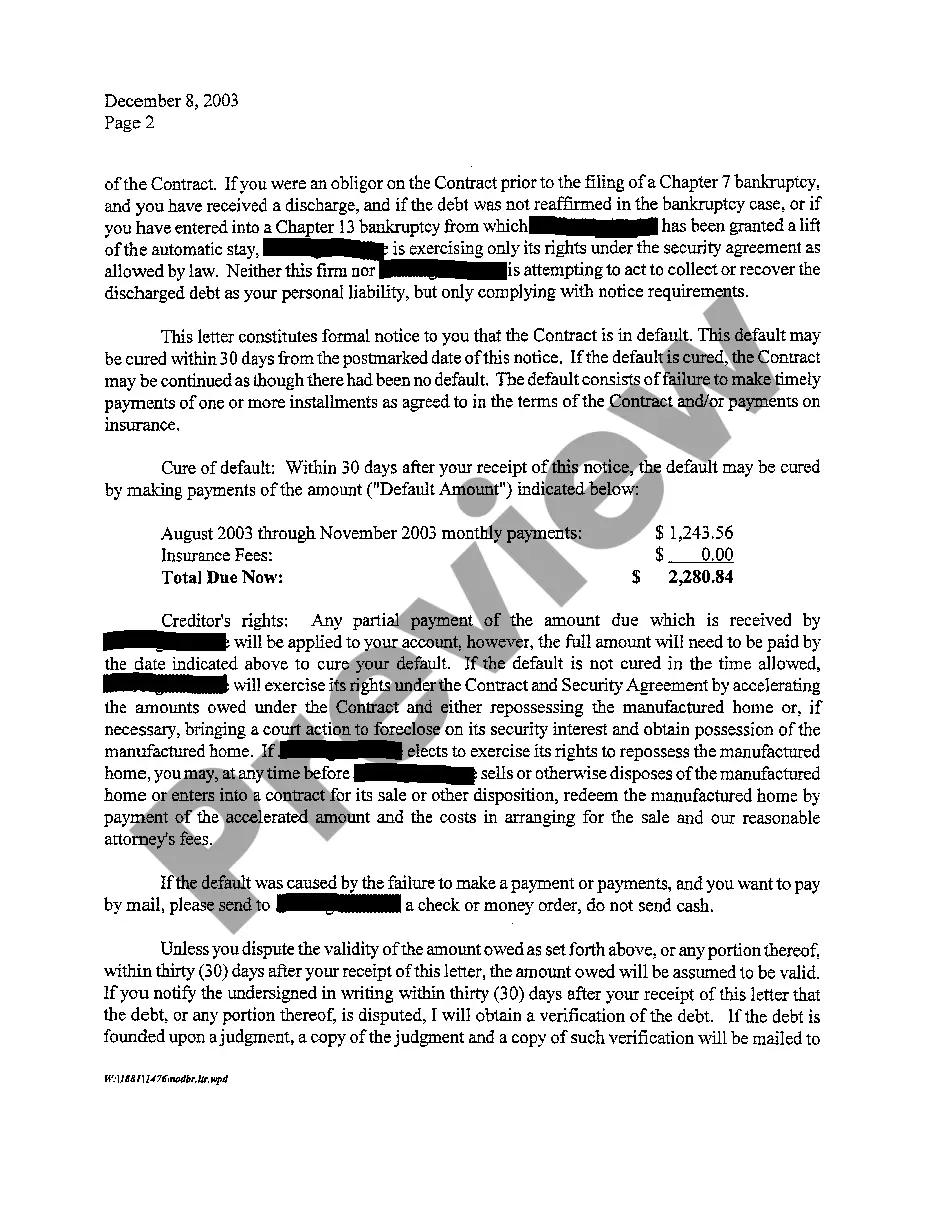

Collin Texas Notice of Default and Right to Cure is a legal process initiated by a mortgage lender or loan service when a borrower fails to make the required monthly payments on their mortgage loan. This process serves as a formal notification to the borrower about their default status and provides them with an opportunity to remedy the situation and avoid foreclosure. The Notice of Default (NOD) is the initial step in the foreclosure process and is sent to the borrower once they have missed a certain number of mortgage payments (usually three). It is a written document that informs the borrower about their default and provides details related to the outstanding payments, accrued interest, and any other applicable charges. Collin Texas also recognizes the Right to Cure, which allows the borrower a specific amount of time to bring their mortgage payments up to date and resolve the default before further legal action is taken. The Right to Cure period typically ranges from 20 to 30 days after the Notice of Default is served. During this time, the borrower has the opportunity to repay the outstanding amount or enter into a repayment plan with the lender to rectify the default. In Collin Texas, there are no specific variations or types of Notice of Default and Right to Cure. The process follows the standardized foreclosure laws of the state, ensuring consistency and transparency for borrowers. It is important for borrowers to understand that receiving a Notice of Default does not automatically mean foreclosure is imminent. It serves as a formal warning and provides an opportunity to rectify the default, either by making the necessary payments or negotiating an alternative repayment plan with the lender. Failure to respond or cure the default within the specified timeframe may lead to further legal actions, including the initiation of foreclosure proceedings, which could result in the sale of the property to recover the outstanding loan balance. In conclusion, the Collin Texas Notice of Default and Right to Cure is a critical process that aims to inform borrowers about their default status and provide them with an opportunity to make amends. It is crucial for borrowers to be aware of their rights and take immediate action to address the default and protect their home.

Collin Texas Notice of Default and Right To Cure

Description

How to fill out Collin Texas Notice Of Default And Right To Cure?

Do you need a trustworthy and inexpensive legal forms provider to get the Collin Texas Notice of Default and Right To Cure? US Legal Forms is your go-to solution.

Whether you require a basic agreement to set rules for cohabitating with your partner or a package of forms to advance your separation or divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and frameworked based on the requirements of particular state and county.

To download the form, you need to log in account, find the required form, and click the Download button next to it. Please take into account that you can download your previously purchased document templates anytime from the My Forms tab.

Are you new to our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Collin Texas Notice of Default and Right To Cure conforms to the laws of your state and local area.

- Read the form’s description (if available) to learn who and what the form is good for.

- Start the search over in case the form isn’t suitable for your legal scenario.

Now you can register your account. Then choose the subscription plan and proceed to payment. As soon as the payment is completed, download the Collin Texas Notice of Default and Right To Cure in any available format. You can return to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about wasting hours learning about legal papers online for good.