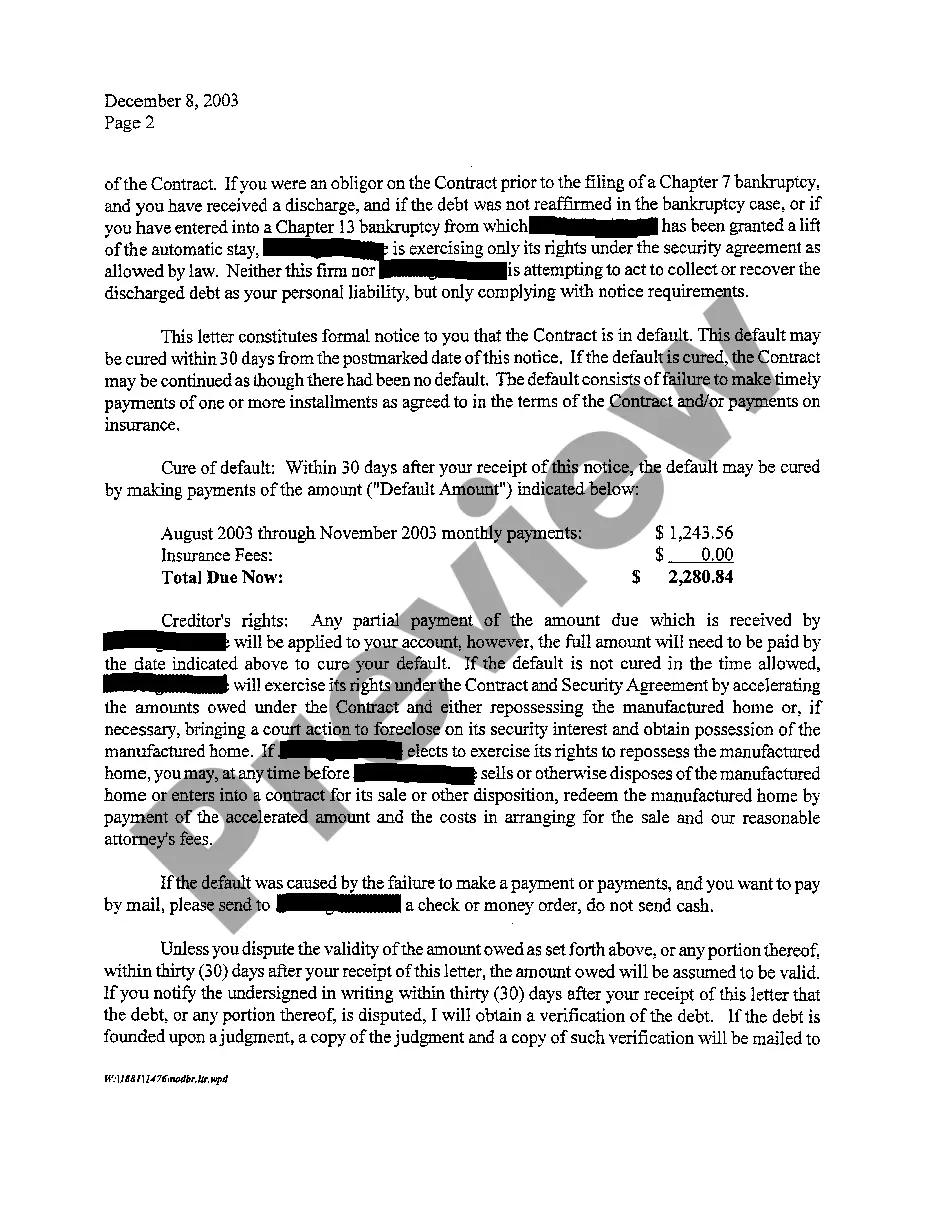

The Edinburg Texas Notice of Default and Right to Cure is an important legal document that serves as a formal communication between a lender and a borrower when a mortgage or loan payment becomes overdue or the terms of the loan agreement have been violated. This notice is a crucial step in the foreclosure process and outlines the borrower's rights and obligations, as well as the consequences of defaulting on the loan. In Edinburg, Texas, there are different types of Notices of Default and Right to Cure, including: 1. Pre-Foreclosure Notice: The Pre-Foreclosure Notice is typically sent to the borrower when they have fallen behind on their mortgage payments. It informs the borrower about the exact amount overdue, the time frame in which it must be paid, and the potential consequences if the default is not cured. 2. Notice of Intent to Accelerate: The Notice of Intent to Accelerate is issued by the lender after the borrower has failed to make payment within the specified time frame mentioned in the Pre-Foreclosure Notice. This notice informs the borrower that the lender is considering accelerating the loan, meaning the loan balance may become due immediately if the default is not cured within a designated period. 3. Notice of Default: If the borrower still fails to rectify the default after receiving the Notice of Intent to Accelerate, the lender may issue a Notice of Default. This notice officially declares that the borrower is in default and that the lender intends to initiate foreclosure proceedings if the default is not cured within a set period, usually 30 days. 4. Notice of Right to Cure: The Notice of Right to Cure provides the borrower with a final opportunity to bring their loan payments up to date and avoid foreclosure. It outlines the specific actions the borrower must take, such as paying the overdue amount plus any associated fees, to cure the default and reinstate the loan. The Edinburg Texas Notice of Default and Right to Cure is a crucial step in the foreclosure process, designed to protect both lenders and borrowers. It allows borrowers a chance to rectify their payment issues before facing the potentially severe consequences of foreclosure. It is important for borrowers to carefully review and understand the terms outlined in these notices to ensure they take appropriate action within the specified time frames to avoid further legal repercussions.

Edinburg Texas Notice of Default and Right To Cure

Description

How to fill out Edinburg Texas Notice Of Default And Right To Cure?

If you are looking for a valid form, it’s extremely hard to find a better service than the US Legal Forms site – probably the most considerable online libraries. Here you can find a large number of form samples for business and individual purposes by categories and regions, or keywords. With our high-quality search feature, finding the most up-to-date Edinburg Texas Notice of Default and Right To Cure is as elementary as 1-2-3. Furthermore, the relevance of each and every record is confirmed by a group of skilled lawyers that regularly review the templates on our website and update them based on the latest state and county demands.

If you already know about our platform and have a registered account, all you should do to receive the Edinburg Texas Notice of Default and Right To Cure is to log in to your user profile and click the Download button.

If you use US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have chosen the form you require. Read its explanation and utilize the Preview function (if available) to see its content. If it doesn’t meet your requirements, use the Search field at the top of the screen to discover the needed document.

- Confirm your decision. Select the Buy now button. Next, select your preferred pricing plan and provide credentials to register an account.

- Make the transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Receive the form. Choose the format and save it on your device.

- Make adjustments. Fill out, edit, print, and sign the received Edinburg Texas Notice of Default and Right To Cure.

Every single form you save in your user profile does not have an expiry date and is yours permanently. You always have the ability to access them using the My Forms menu, so if you want to receive an extra copy for enhancing or printing, you may come back and export it once again at any moment.

Take advantage of the US Legal Forms extensive library to gain access to the Edinburg Texas Notice of Default and Right To Cure you were seeking and a large number of other professional and state-specific templates on a single website!