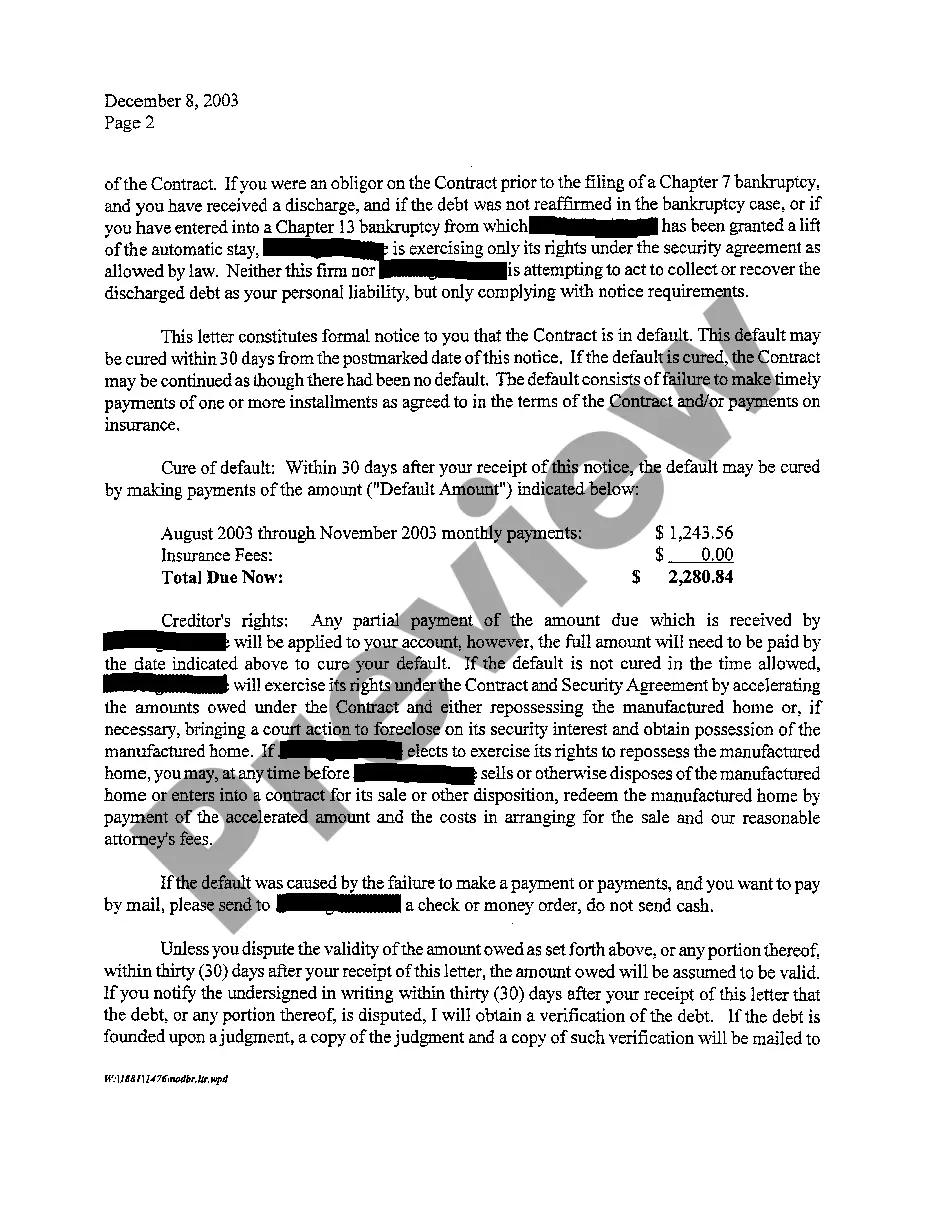

Fort Worth Texas Notice of Default and Right To Cure

Description

How to fill out Texas Notice Of Default And Right To Cure?

Are you in search of a dependable and budget-friendly provider of legal forms to purchase the Fort Worth Texas Notice of Default and Right To Cure? US Legal Forms is your ideal choice.

Whether you need a simple agreement to establish guidelines for living with your partner or a bundle of documents to progress your divorce through the court system, we have you covered. Our site boasts over 85,000 current legal document templates for both personal and business needs. All templates we provide are tailored to meet the standards of specific states and counties.

To obtain the document, you must Log In to your account, locate the desired template, and click the Download button adjacent to it. Please note that you can retrieve your previously purchased document templates at any time from the My documents section.

Is this your first visit to our site? No need to worry. You can create an account with ease, but first, ensure you do the following.

Now you can set up your account. Next, choose the subscription plan and proceed to the payment. Once the payment is processed, you can download the Fort Worth Texas Notice of Default and Right To Cure in any available format. You can return to the website at any moment and redownload the document at no additional cost.

Obtaining current legal documents has never been simpler. Try US Legal Forms today, and say goodbye to spending countless hours searching for legal papers online.

- Verify that the Fort Worth Texas Notice of Default and Right To Cure complies with the laws of your state and locality.

- Examine the form's description (if available) to determine who and what the document is suitable for.

- Start the search over if the template does not meet your particular needs.

Form popularity

FAQ

A judgment lien lasts for ten years. According to Section 52.001 of the Texas Property Code, a judgment lien cannot attach to any real property that is exempt from seizure or forced sale under Chapter 41 of the Texas Property Code.

Declare Bankruptcy To Stop Foreclosure Declaring bankruptcy in Texas is one option you have when deciding how to stop foreclosure proceedings. As soon as the petition is filed in court, an automatic stay is put in place that prevents a foreclosure from proceeding.

After the Sale Under this Act, most tenants with a lease can stay in the home until their lease expires. However, if the new owner intends to move into the home, this will not apply. In those circumstances, the new owner must give the tenant at least 90 days' notice of their intent to terminate the lease.

A judicial foreclosure requires the lienholder to file a civil lawsuit against the homeowner. They must obtain a judgment from the court before they are allowed to sell the property. This procedure is rare in Texas. See Rule 309 of the Texas Rules of Civil Procedure for the court rule governing judicial foreclosures.

Following a first-mortgage foreclosure, all junior liens (including a second mortgage and any junior judgment liens) are extinguished, and the liens are removed from the property's title. But the second-mortgage debt and creditor's judgment remain, even though they're no longer attached to the foreclosed property.

Foreclosures may be judicial (ordered by a court following a judgment in a lawsuit) or, most likely in Texas, non-judicial (?on the courthouse steps?). The effect of foreclosure is to cut off and eliminate junior liens, including mechanic's liens, except for any liens for unpaid taxes.

Texas foreclosures occur quickly. In just 60 days an uncontested foreclosure can be completed. If the lender seeks a delay or if the borrower contests the foreclosure or files for bankruptcy then it will take longer to foreclose on the property.

After the judge issues a ruling, the former homeowner has five days to vacate the property or appeal the ruling. If the former homeowner is still living on the premises after five days, the constable will post a notice on the front door giving the former homeowner 24 hours to move out.

If you are unable to collect payment on a lien after filing the affidavit, then Texas Construction Law allows you to foreclose to enforce a lien. This action forces the sale of the property to pay creditors. Unfortunately, to foreclose a lien, a lawsuit must be filed.

After the judge issues a ruling, the former homeowner has five days to vacate the property or appeal the ruling. If the former homeowner is still living on the premises after five days, the constable will post a notice on the front door giving the former homeowner 24 hours to move out.