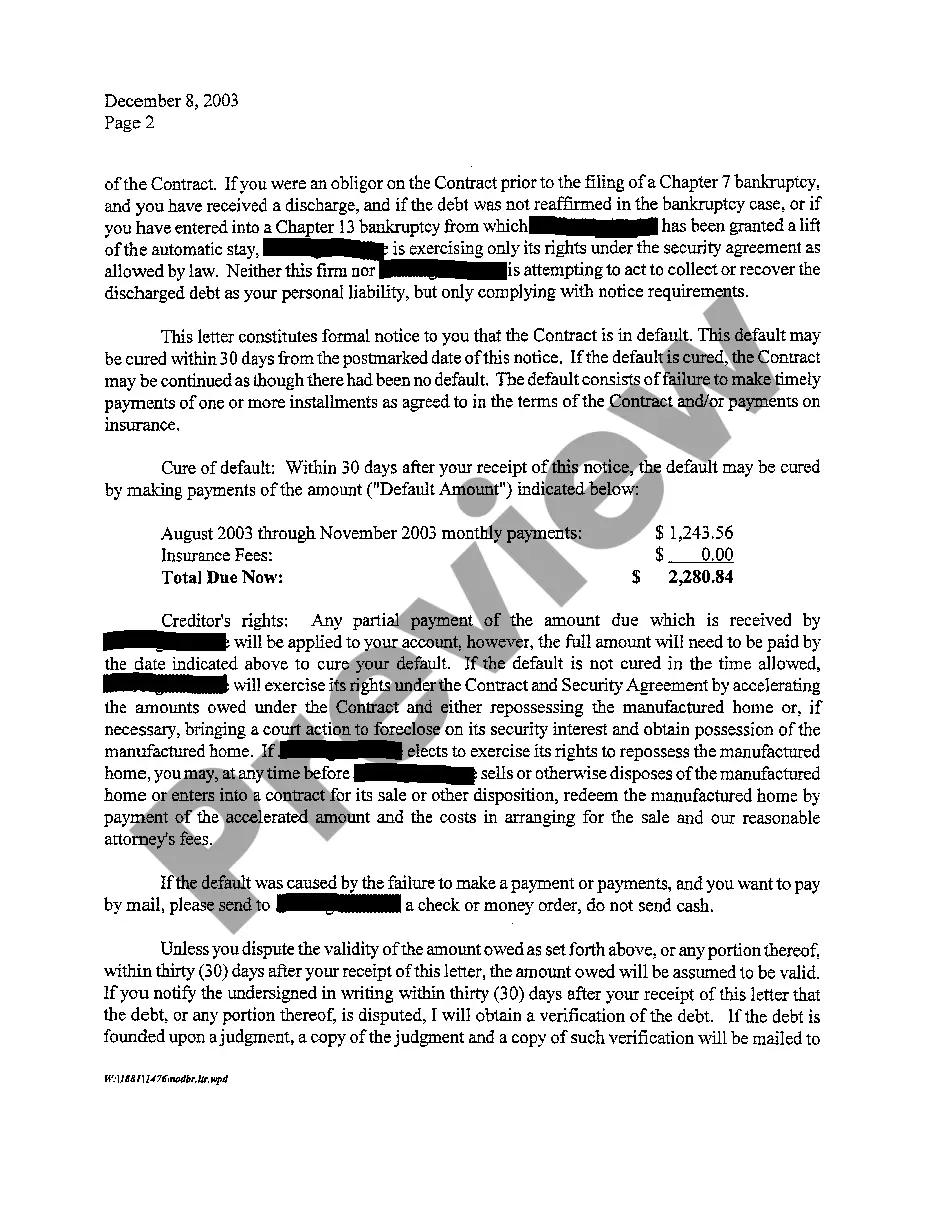

Frisco Texas Notice of Default and Right To Cure is an important legal process that homeowners and borrowers should be aware of. It refers to the formal notice issued by a lender or mortgage holder to inform a homeowner about their breach of the mortgage agreement terms, typically due to non-payment or a violation of certain contractual obligations. This notice serves as a critical step before the lender initiates foreclosure proceedings. In Frisco, Texas, there are primarily two types of Notice of Default and Right To Cure that borrowers may encounter — judicial and non-judicial. The judicial process involves filing a lawsuit against the borrower in court, while the non-judicial process typically entails following a standardized procedure outlined in the mortgage agreement. The Frisco Texas Notice of Default is typically sent by certified mail to the borrower's last known address and clearly states the amount owed, the default reason, and a specified period within which the borrower must remedy the default. This period, known as the right to cure, sets a specific timeline ranging from 20 to 30 days, depending on the mortgage terms. To protect their rights, borrowers in Frisco, Texas, must take prompt action upon receiving the Notice of Default. They should carefully review the notice, ensure its accuracy, and promptly contact the lender or mortgage holder to discuss possible remedial actions. Some common remedies to cure the default include paying the outstanding amount, entering into a repayment plan, or seeking loan modification options that can help alleviate financial distress. It's crucial for Frisco, Texas homeowners to understand their right to cure, as failing to address the default within the specified timeframe can lead to profound consequences, such as foreclosure. Foreclosure is the legal process through which a lender takes possession of the property securing the mortgage and sells it to recoup the outstanding loan amount. By staying informed about the Frisco Texas Notice of Default and Right To Cure, borrowers can proactively address any default situations, work towards resolving their outstanding debt, and potentially avoid the devastating consequences of foreclosure. Seeking legal advice or housing counseling services can provide additional guidance for homeowners facing financial difficulties and dealing with the Notice of Default process.

Frisco Texas Notice of Default and Right To Cure

Description

How to fill out Frisco Texas Notice Of Default And Right To Cure?

If you are looking for a valid form template, it’s extremely hard to choose a better platform than the US Legal Forms site – one of the most extensive online libraries. Here you can find a large number of form samples for company and individual purposes by types and regions, or keywords. With our high-quality search option, finding the latest Frisco Texas Notice of Default and Right To Cure is as elementary as 1-2-3. In addition, the relevance of every file is confirmed by a team of expert attorneys that on a regular basis check the templates on our platform and update them in accordance with the newest state and county demands.

If you already know about our platform and have an account, all you need to receive the Frisco Texas Notice of Default and Right To Cure is to log in to your account and click the Download option.

If you utilize US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have discovered the sample you want. Look at its description and use the Preview feature to see its content. If it doesn’t meet your needs, utilize the Search option at the top of the screen to discover the proper record.

- Affirm your decision. Choose the Buy now option. After that, pick the preferred subscription plan and provide credentials to sign up for an account.

- Make the purchase. Utilize your bank card or PayPal account to finish the registration procedure.

- Receive the template. Choose the file format and save it on your device.

- Make adjustments. Fill out, modify, print, and sign the obtained Frisco Texas Notice of Default and Right To Cure.

Every template you add to your account does not have an expiration date and is yours permanently. You always have the ability to access them using the My Forms menu, so if you want to receive an extra duplicate for modifying or printing, you can come back and export it again at any moment.

Take advantage of the US Legal Forms extensive collection to get access to the Frisco Texas Notice of Default and Right To Cure you were looking for and a large number of other professional and state-specific samples on one platform!