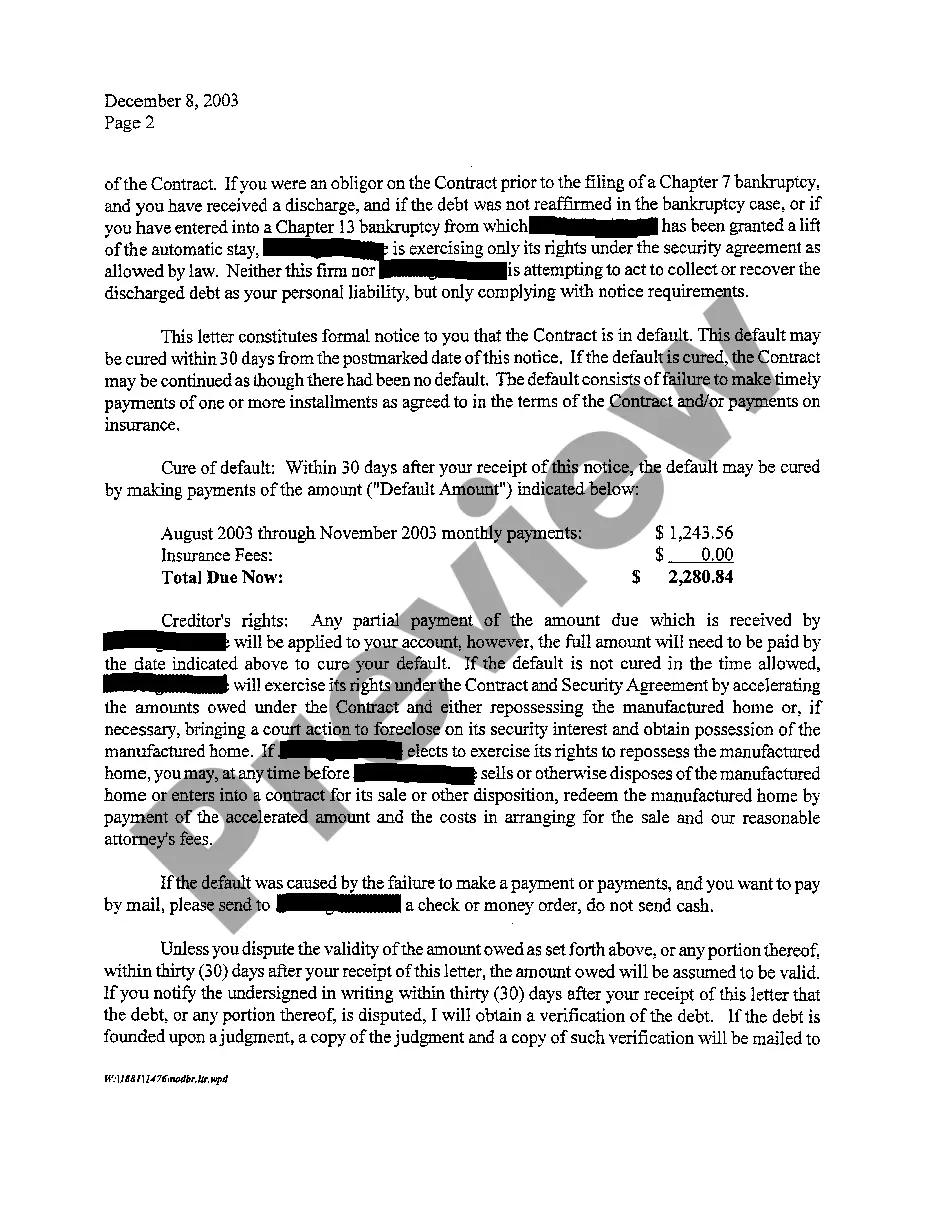

The Grand Prairie Texas Notice of Default and Right To Cure is an essential legal document that outlines the specific terms and conditions regarding mortgage payments and defaulting on a property in Grand Prairie, Texas. This document is crucial not only for homeowners but also for lenders or mortgage companies operating in the area. In the event that a borrower fails to make timely mortgage payments or violates any stipulations mentioned in the mortgage agreement, the lender may issue a Grand Prairie Texas Notice of Default. This notice serves as an official warning to the borrower that their loan is in jeopardy and immediate action is required to resolve the default. The Grand Prairie Texas Notice of Default highlights the outstanding balance, the number of missed payments, and the amount necessary to cure the default. Furthermore, it includes a detailed explanation of the borrower's right to cure, also known as the right to reinstate the loan by paying all the arrears, fees, and costs within a specific timeframe. The specific types of Grand Prairie Texas Notice of Default and Right To Cure may vary based on the circumstances of the default. Here are two common types: 1. Pre-foreclosure Notice of Default: This type of notice is typically issued by the lender as an early warning system when a borrower misses multiple mortgage payments. It states the amount due, the consequences of failing to cure the default, and provides a specific timeframe within which the borrower must cure the default. 2. Foreclosure Notice of Default: If the borrower fails to cure the default within the allotted timeframe mentioned in the pre-foreclosure notice, the lender may issue a foreclosure notice of default. This notice typically serves as a final warning before initiating foreclosure proceedings and includes information about the sale or auction of the property. It is crucial for borrowers to act promptly upon receiving a Grand Prairie Texas Notice of Default and Right To Cure to avoid foreclosure and potential loss of their property. By understanding their rights and obligations outlined in this notice, borrowers can work with their lender to find alternative solutions such as loan modifications, repayment plans, or other foreclosure prevention options. In conclusion, the Grand Prairie Texas Notice of Default and Right To Cure is an essential legal document that highlights the borrower's obligations and the steps required to cure a default. Whether it is a pre-foreclosure notice of default or a foreclosure notice of default, it is crucial for borrowers to seek professional assistance and explore all available options to protect their property and financial well-being.

Grand Prairie Texas Notice of Default and Right To Cure

Description

How to fill out Grand Prairie Texas Notice Of Default And Right To Cure?

We consistently aim to reduce or avert legal harm when engaging with intricate legal or financial matters.

To achieve this, we enlist attorney services that are typically quite expensive.

Nonetheless, not every legal issue is equally complicated. Many can be managed independently.

US Legal Forms is an online repository of updated DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

Simply Log In to your account and click the Get button next to it. If you misplace the form, you can always download it again from the My documents tab. The process remains equally simple if you’re new to the platform! You can register your account within minutes. Ensure to verify if the Grand Prairie Texas Notice of Default and Right To Cure complies with the statutes and regulations of your state and locality. Additionally, it’s crucial to examine the form’s layout (if available), and if you detect any inconsistencies with your initial expectations, look for a different form. Once you've confirmed that the Grand Prairie Texas Notice of Default and Right To Cure is suitable for you, select the subscription option and proceed to payment. You can then download the document in any format available. With over 24 years in the industry, we’ve assisted millions of individuals by providing customizable and current legal documents. Take advantage of US Legal Forms now to conserve time and resources!

- Our platform empowers you to handle your affairs autonomously without the need for an attorney's services.

- We offer access to legal document templates that are not always publicly accessible.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

- Benefit from US Legal Forms whenever you need to easily and securely find and download the Grand Prairie Texas Notice of Default and Right To Cure or any other document.

Form popularity

FAQ

Yes, in Texas, the process typically allows for 120 days from the notice to cure a default. This means if you receive a Grand Prairie Texas Notice of Default and Right To Cure, you have a specified period to address the payment issues before foreclosure actions can proceed. It's essential to act promptly and understand your options during this timeframe. Consulting with a legal expert can provide clarity on your rights and responsibilities.

Once a bank has issued a notice of default, the foreclosure process can start relatively quickly, usually within 21 days. After this, the bank may schedule a foreclosure sale, which generally happens on the first Tuesday of the month. The Grand Prairie Texas Notice of Default and Right To Cure is a critical step that communicates your options during this challenging time. Quick action is essential, so consider reaching out for guidance and potential solutions to remedy your situation.

The overall timeline for foreclosing on a house in Texas can vary, but it generally takes about 60 to 90 days from the initial default to the final foreclosure sale. The Grand Prairie Texas Notice of Default and Right To Cure can significantly impact this timeline, as it provides homeowners with an opportunity to remedy their default. Engaging with resources and services can help you navigate this difficult period and potentially avoid foreclosure altogether.

In Texas, a bank can initiate foreclosure proceedings as soon as you default on your mortgage. Typically, the foreclosure process can begin after just 20 days from receiving a Notice of Default. With the Grand Prairie Texas Notice of Default and Right To Cure, knowing this timeline is crucial for homeowners. It emphasizes the importance of seeking help early to explore alternatives to foreclosure.

Getting around a foreclosure typically involves exploring alternatives to catching up on missed payments. The Grand Prairie Texas Notice of Default and Right To Cure empowers you to address financial issues before severe actions are taken. Consulting with legal professionals and considering options like refinancing or selling your property are effective strategies.

Turning around a foreclosure situation often starts with understanding your options under the Grand Prairie Texas Notice of Default and Right To Cure. You may need to negotiate with your lender to restore your account to good standing by catching up on payments. Seeking legal or financial advice can also facilitate a smoother turnaround process.

Yes, you can stop a foreclosure in Texas through various means. You might utilize the provisions in the Grand Prairie Texas Notice of Default and Right To Cure to catch up on past payments and avoid the foreclosure process. Additionally, contacting your lender to negotiate or a legal expert for assistance can be crucial in halting foreclosure actions.

Homeowners are often the most affected by foreclosure. The emotional and financial stress can be overwhelming, as losing a home impacts personal stability and community ties. Knowing about the Grand Prairie Texas Notice of Default and Right To Cure can help homeowners understand their rights and options to mitigate losses.

The deed given at a foreclosure sale in Texas is known as a 'deed of trust' or a 'trustee's deed'. This document transfers ownership of the property to the winning bidder. Understanding this process is vital for anyone who has received a Grand Prairie Texas Notice of Default and Right To Cure, as it marks the transition of property ownership.

Foreclosure sales in Texas are typically conducted by the county sheriff or a designated auctioneer. These officials ensure the sale process is transparent and follows the legal requirements. Homeowners who receive a Grand Prairie Texas Notice of Default and Right To Cure should remain aware of the sale processes to protect their interests.