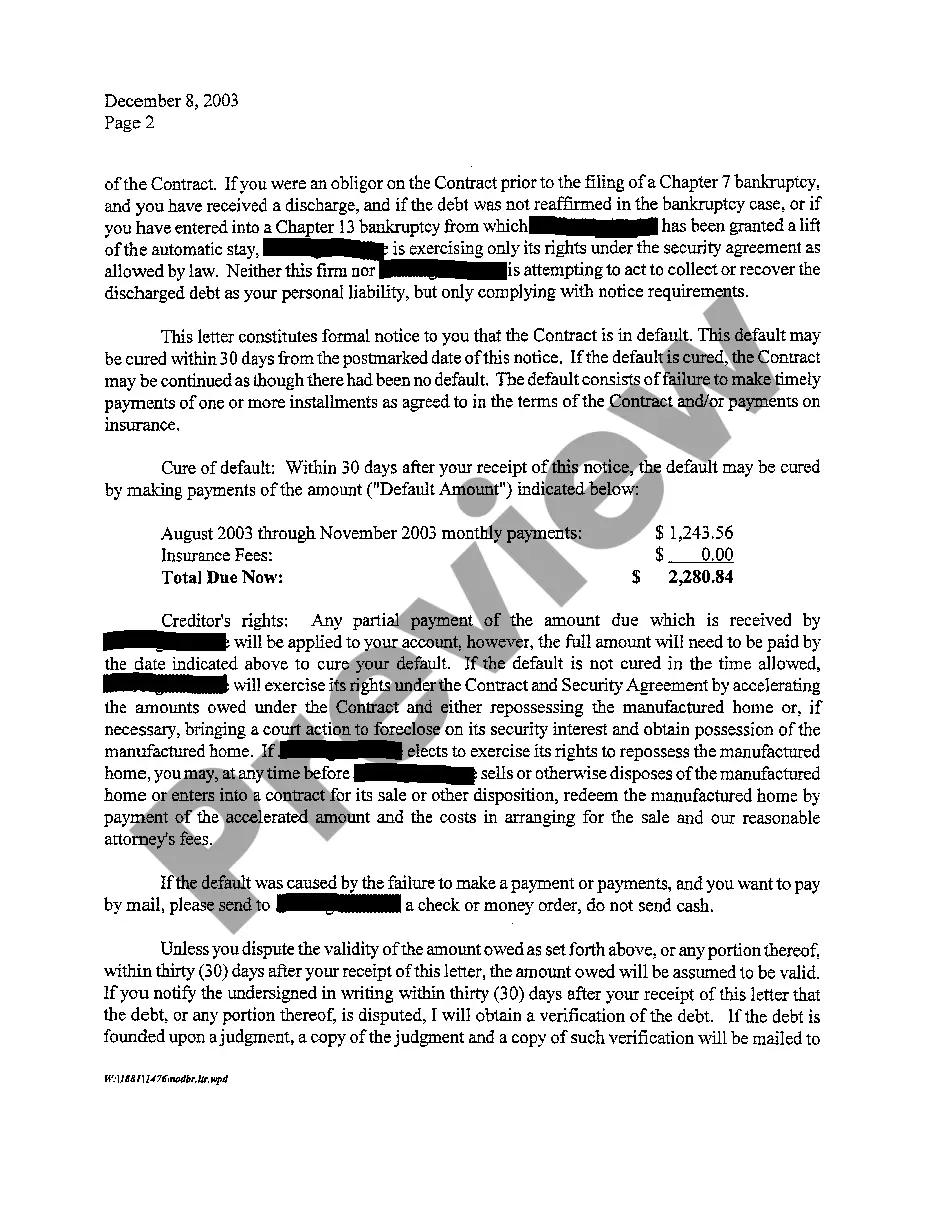

The Houston Texas Notice of Default and Right to Cure is a legal document that serves as a formal notification to a borrower or homeowner regarding their breach of a mortgage or loan agreement. It is primarily used by lenders or mortgage holders to inform the borrower about their delinquency in making timely payments or failing to meet the terms and conditions set forth in the loan agreement. This notice is an important step in the foreclosure process and provides the borrower with an opportunity to rectify the default and avoid further legal consequences. The Notice of Default typically includes specific information such as the borrower's name, property address, loan or mortgage account number, and a detailed statement outlining the specific default or breach of the loan agreement. This document also specifies the amount owed, including late fees and any associated costs, and provides a deadline by which the borrower must cure the default. In Houston, Texas, there are different types of notices of default and right to cure, depending on the specific circumstances and the type of loan agreement. Some of these may include: 1. Residential Mortgage Default: This notice is applicable when a borrower defaults on their residential mortgage, typically used for single-family homes or individual dwellings. 2. Commercial Loan Default: This notice is relevant for default situations involving commercial properties, such as office buildings, retail spaces, or industrial complexes. 3. Home Equity Loan Default: This type of notice is specific to borrowers who have defaulted on their home equity loans, which are loans that allow homeowners to borrow against the equity in their property. The right to cure is an essential component of the notice, providing the borrower with an opportunity to resolve the default by making the necessary payments, bringing their account up to date, and adhering to the terms of the loan agreement. It usually specifies the amount needed to cure the default, including any outstanding balance, late fees, and potentially any legal fees incurred by the lender. In Houston, Texas, the right to cure period is typically 20 days from the date of receiving the notice. If the borrower fails to cure the default within the specified time frame, the lender can proceed with further legal actions, which may include foreclosure or other remedies available under Texas law. It is important to note that the specifics of the Houston Texas Notice of Default and Right to Cure may vary depending on the lender, loan agreement, and the applicable state and federal laws. Borrowers should consult legal counsel or seek advice from housing counseling agencies to fully understand their rights and options when receiving such a notice.

Houston Texas Notice of Default and Right To Cure

State:

Texas

City:

Houston

Control #:

TX-CC-24-05

Format:

PDF

Instant download

This form is available by subscription

Description

A04 Notice of Default and Right To Cure

The Houston Texas Notice of Default and Right to Cure is a legal document that serves as a formal notification to a borrower or homeowner regarding their breach of a mortgage or loan agreement. It is primarily used by lenders or mortgage holders to inform the borrower about their delinquency in making timely payments or failing to meet the terms and conditions set forth in the loan agreement. This notice is an important step in the foreclosure process and provides the borrower with an opportunity to rectify the default and avoid further legal consequences. The Notice of Default typically includes specific information such as the borrower's name, property address, loan or mortgage account number, and a detailed statement outlining the specific default or breach of the loan agreement. This document also specifies the amount owed, including late fees and any associated costs, and provides a deadline by which the borrower must cure the default. In Houston, Texas, there are different types of notices of default and right to cure, depending on the specific circumstances and the type of loan agreement. Some of these may include: 1. Residential Mortgage Default: This notice is applicable when a borrower defaults on their residential mortgage, typically used for single-family homes or individual dwellings. 2. Commercial Loan Default: This notice is relevant for default situations involving commercial properties, such as office buildings, retail spaces, or industrial complexes. 3. Home Equity Loan Default: This type of notice is specific to borrowers who have defaulted on their home equity loans, which are loans that allow homeowners to borrow against the equity in their property. The right to cure is an essential component of the notice, providing the borrower with an opportunity to resolve the default by making the necessary payments, bringing their account up to date, and adhering to the terms of the loan agreement. It usually specifies the amount needed to cure the default, including any outstanding balance, late fees, and potentially any legal fees incurred by the lender. In Houston, Texas, the right to cure period is typically 20 days from the date of receiving the notice. If the borrower fails to cure the default within the specified time frame, the lender can proceed with further legal actions, which may include foreclosure or other remedies available under Texas law. It is important to note that the specifics of the Houston Texas Notice of Default and Right to Cure may vary depending on the lender, loan agreement, and the applicable state and federal laws. Borrowers should consult legal counsel or seek advice from housing counseling agencies to fully understand their rights and options when receiving such a notice.

Free preview

How to fill out Houston Texas Notice Of Default And Right To Cure?

If you’ve already utilized our service before, log in to your account and save the Houston Texas Notice of Default and Right To Cure on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Make sure you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Houston Texas Notice of Default and Right To Cure. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!