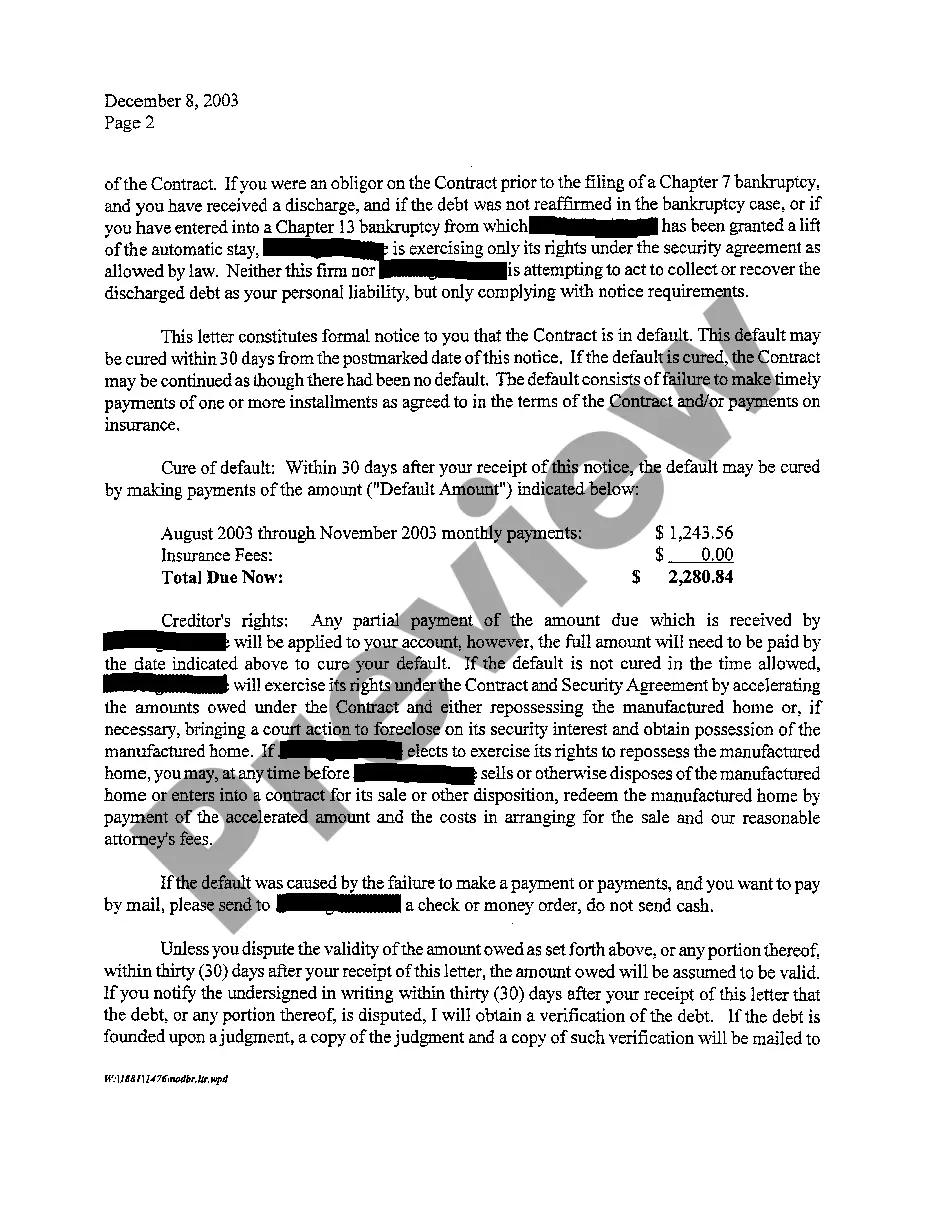

Irving, Texas Notice of Default and Right to Cure: A Detailed Description In Irving, Texas, a Notice of Default and Right to Cure is an important legal document that serves as a notification to borrowers who have fallen behind on their mortgage payments. It informs them of the impending foreclosure process and provides them with an opportunity to rectify the default before legal action is taken. The Notice of Default is typically sent by the lender or mortgage service rafter the borrower has missed a certain number of payments, usually three to four months. It serves as a formal notice that the borrower is in breach of their mortgage agreement and the lender intends to initiate foreclosure proceedings if the default is not cured within a specified timeframe. The Right to Cure, also known as the right to reinstate or redeem, is the opportunity given to the borrower to cure the default by bringing their payments up to date, including any outstanding fees, interest, or penalties. It is a crucial step to allow borrowers to avoid foreclosure and preserve their homeownership. Irving, Texas may have different types of Notices of Default and Rights to Cure, depending on the specific circumstances and loan agreements. A few notable variations include: 1. Residential Property Notice of Default and Right to Cure: This type of notice applies to homeowners who default on their residential mortgages in Irving, Texas. It outlines the borrower's obligations, details the default amount, provides the lender's contact information, and specifies the time allotted to cure the default before foreclosure proceedings commence. 2. Commercial Property Notice of Default and Right to Cure: Designed for businesses and commercial property owners, this notice is similar to the residential version but tailored to the unique nature of commercial loan agreements. It may have different timelines and procedures, as commercial loans often involve complex financing arrangements. 3. Notice of Default Due to Violations: In some cases, a Notice of Default may be issued due to violations of other terms outlined in the mortgage agreement, beyond payment defaults. This could include failure to maintain insurance coverage, property neglect, or unauthorized alterations. The Right to Cure in such instances involves rectifying the violation rather than curing the payment default. It is crucial for borrowers who receive an Irving, Texas Notice of Default to take immediate action. They should carefully review the notice, contact their lender or mortgage service, and consult with legal professionals who specialize in foreclosure defense or loan modification options. The Right to Cure offers an opportunity to remedy the default and bring the loan back into good standing, helping borrowers avoid the severe consequences of foreclosure and protect their property ownership rights.

Irving, Texas Notice of Default and Right to Cure: A Detailed Description In Irving, Texas, a Notice of Default and Right to Cure is an important legal document that serves as a notification to borrowers who have fallen behind on their mortgage payments. It informs them of the impending foreclosure process and provides them with an opportunity to rectify the default before legal action is taken. The Notice of Default is typically sent by the lender or mortgage service rafter the borrower has missed a certain number of payments, usually three to four months. It serves as a formal notice that the borrower is in breach of their mortgage agreement and the lender intends to initiate foreclosure proceedings if the default is not cured within a specified timeframe. The Right to Cure, also known as the right to reinstate or redeem, is the opportunity given to the borrower to cure the default by bringing their payments up to date, including any outstanding fees, interest, or penalties. It is a crucial step to allow borrowers to avoid foreclosure and preserve their homeownership. Irving, Texas may have different types of Notices of Default and Rights to Cure, depending on the specific circumstances and loan agreements. A few notable variations include: 1. Residential Property Notice of Default and Right to Cure: This type of notice applies to homeowners who default on their residential mortgages in Irving, Texas. It outlines the borrower's obligations, details the default amount, provides the lender's contact information, and specifies the time allotted to cure the default before foreclosure proceedings commence. 2. Commercial Property Notice of Default and Right to Cure: Designed for businesses and commercial property owners, this notice is similar to the residential version but tailored to the unique nature of commercial loan agreements. It may have different timelines and procedures, as commercial loans often involve complex financing arrangements. 3. Notice of Default Due to Violations: In some cases, a Notice of Default may be issued due to violations of other terms outlined in the mortgage agreement, beyond payment defaults. This could include failure to maintain insurance coverage, property neglect, or unauthorized alterations. The Right to Cure in such instances involves rectifying the violation rather than curing the payment default. It is crucial for borrowers who receive an Irving, Texas Notice of Default to take immediate action. They should carefully review the notice, contact their lender or mortgage service, and consult with legal professionals who specialize in foreclosure defense or loan modification options. The Right to Cure offers an opportunity to remedy the default and bring the loan back into good standing, helping borrowers avoid the severe consequences of foreclosure and protect their property ownership rights.