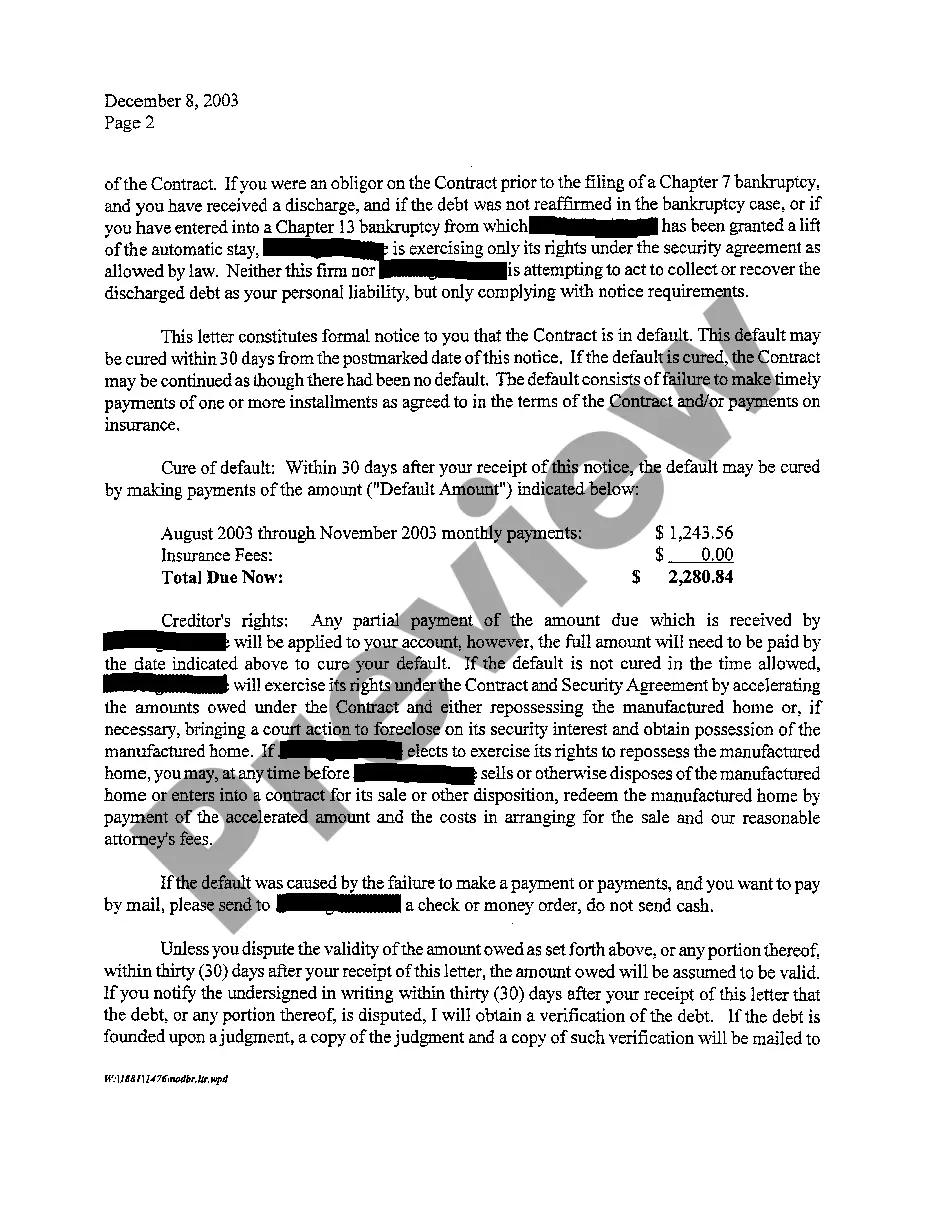

McAllen Texas Notice of Default and Right To Cure is a legal document that serves as a formal notice given to a borrower when they have defaulted on their mortgage or loan payments. This notice outlines the lender's intention to begin foreclosure proceedings and provides the borrower with an opportunity to cure or rectify the default before legal actions are taken. The Notice of Default is typically initiated by the lender or the loan service who has the legal authority to act on behalf of the lender. It informs the borrower of the specific default that has occurred, such as missed payments, failure to maintain property insurance, or violation of other loan terms. The notice includes relevant details regarding the loan, such as the outstanding balance, the nature of the default, and the actions required to cure the default. The Right To Cure, as its name suggests, grants the borrower a certain period to fix the default and bring the loan current. This period usually varies depending on the specific circumstances and the type of loan involved. In McAllen Texas, the Right To Cure period is typically 20 days for residential properties and 30 days for commercial properties. During this time, the borrower has the opportunity to repay the overdue amount, including any late fees or penalties, and reinstate the loan to good standing. It's important to note that McAllen Texas Notice of Default and Right To Cure may have different variations based on the type of loan, property, or situation. For instance, there could be separate notices for residential loans, commercial loans, and even specific notices for government-backed loans like FHA or VA loans. Each notice may have specific requirements and timelines that borrowers must adhere to in order to cure the default and avoid foreclosure. In conclusion, McAllen Texas Notice of Default and Right To Cure is a crucial legal document that protects the rights of both the lender and the borrower. It ensures that borrowers are given fair notice and an opportunity to address any default before foreclosure proceedings begin. Understanding the specific requirements and timelines associated with these notices is essential for borrowers to protect their properties and financial interests.

McAllen Texas Notice of Default and Right To Cure

Description

How to fill out McAllen Texas Notice Of Default And Right To Cure?

No matter what social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for a person without any law education to create this sort of papers cfrom the ground up, mainly because of the convoluted jargon and legal nuances they come with. This is where US Legal Forms comes to the rescue. Our platform offers a massive collection with over 85,000 ready-to-use state-specific forms that work for almost any legal situation. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

No matter if you require the McAllen Texas Notice of Default and Right To Cure or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the McAllen Texas Notice of Default and Right To Cure in minutes employing our trusted platform. If you are already an existing customer, you can proceed to log in to your account to download the appropriate form.

Nevertheless, in case you are a novice to our library, ensure that you follow these steps prior to downloading the McAllen Texas Notice of Default and Right To Cure:

- Ensure the template you have chosen is suitable for your area because the rules of one state or county do not work for another state or county.

- Preview the form and go through a quick description (if provided) of cases the paper can be used for.

- In case the one you chosen doesn’t meet your needs, you can start again and search for the necessary document.

- Click Buy now and choose the subscription option that suits you the best.

- Log in to your account credentials or register for one from scratch.

- Pick the payment method and proceed to download the McAllen Texas Notice of Default and Right To Cure as soon as the payment is done.

You’re all set! Now you can proceed to print the form or complete it online. Should you have any problems locating your purchased forms, you can easily find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.