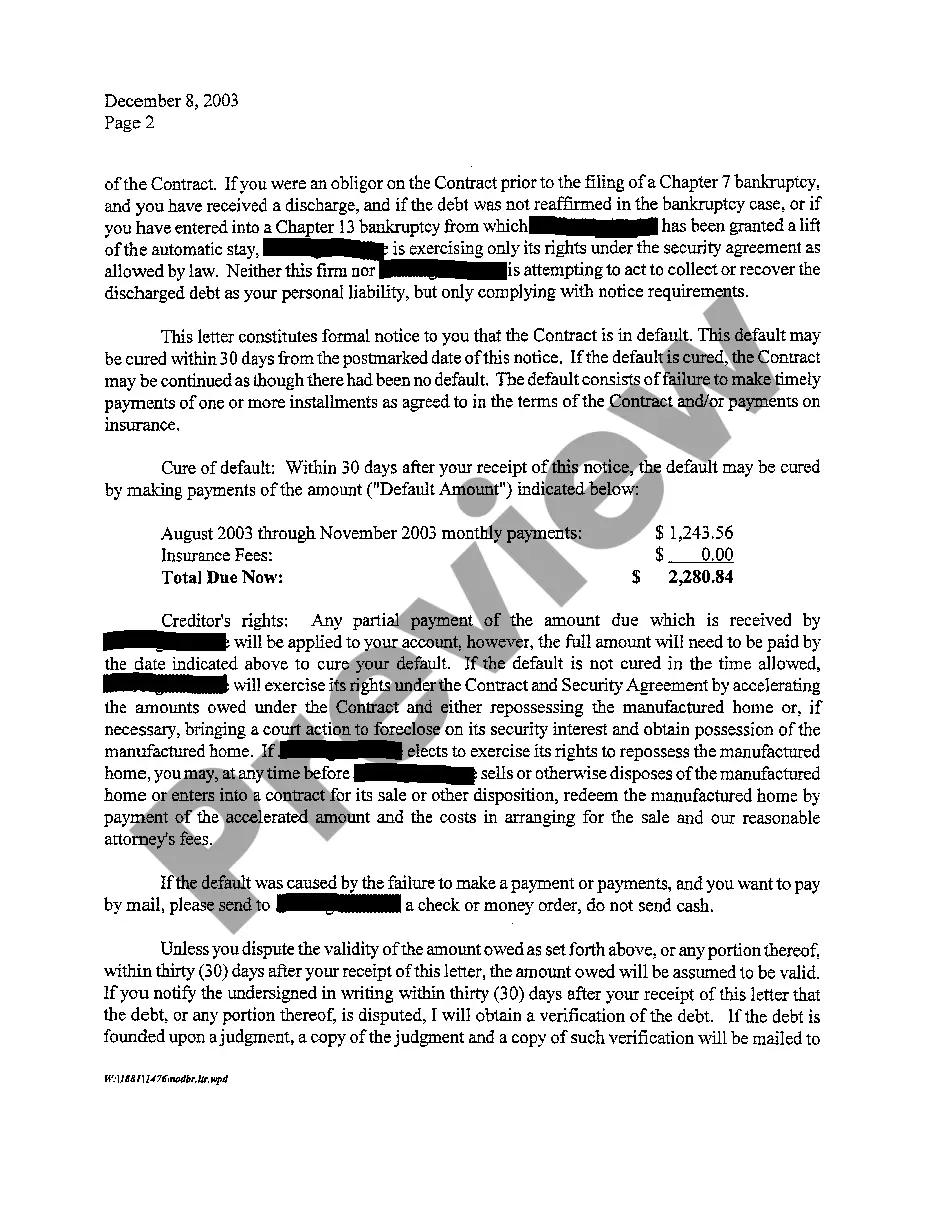

McKinney, Texas Notice of Default and Right to Cure: Understanding the Process and Types In McKinney, Texas, a Notice of Default and Right to Cure is a legal document issued to a borrower who has defaulted on their mortgage or loan payment. This notice informs the borrower that they are in breach of their contract and provides them with an opportunity to rectify the situation before further legal action is taken. The Notice of Default is a critical step in the foreclosure process, giving the borrower a chance to address the default within a specified period. The Right to Cure allows the borrower to bring their loan payments up to date by curing any outstanding defaults, including late payments, fines, or penalties. There are different types of Notice of Default and Right to Cure in McKinney, Texas, depending on the type of loan or mortgage the borrower holds: 1. Residential Mortgage Notice of Default and Right to Cure: This type of notice is specific to borrowers who have defaulted on their residential mortgage loans. It outlines the specific default conditions, such as missed payments or a breach of terms, and provides the borrower with a timeline for curing the default. 2. Commercial Loan Notice of Default and Right to Cure: For borrowers who have defaulted on commercial loans, such as loans for businesses or investment properties, this type of notice is issued. It highlights the consequences of default and includes instructions for the borrower to rectify the situation. 3. Home Equity Loan Notice of Default and Right to Cure: Homeowners who have defaulted on their home equity loans receive this type of notice. It emphasizes the importance of timely payments and offers guidance on how to cure the default, ensuring homeowners retain their equity rights. 4. Vehicle Loan Notice of Default and Right to Cure: Borrowers who have defaulted on their vehicle loans receive this specific type of notice. It specifies the number of missed payments or other default conditions and outlines the necessary steps to cure the default, preventing repossession. 5. Personal Loan Notice of Default and Right to Cure: This type of notice is given to borrowers who have defaulted on personal loans, such as loans for educational purposes or medical bills. It highlights the consequences of default and provides a solution to rectify the default condition. In McKinney, Texas, it is essential for borrowers to understand the significance of receiving a Notice of Default and Right to Cure. By carefully reviewing the notice, borrowers can take the necessary steps to remedy their default and avoid further legal actions, such as foreclosure or repossession. Seeking legal counsel or assistance from financial advisors is often recommended ensuring compliance with the notice requirements and to explore available options for resolving the default condition promptly.

McKinney Texas Notice of Default and Right To Cure

Description

How to fill out McKinney Texas Notice Of Default And Right To Cure?

Utilize the US Legal Forms and gain instant access to any document you require.

Our user-friendly site featuring a wide array of document templates simplifies the process of locating and acquiring virtually any document sample you need.

You can store, fill out, and sign the McKinney Texas Notice of Default and Right To Cure in just minutes instead of spending hours online searching for an appropriate template.

Using our library is an excellent method to enhance the security of your document submissions. Our skilled attorneys routinely examine all documents to ensure that the forms are suitable for a specific state and comply with updated laws and regulations.

US Legal Forms is likely the largest and most trustworthy template libraries online.

Our team is always happy to assist you with any legal matters, even if it is merely downloading the McKinney Texas Notice of Default and Right To Cure.

- How can you obtain the McKinney Texas Notice of Default and Right To Cure.

- If you have an account, simply Log In to your profile. The Download button will show up on every document you access. Additionally, you can find all previously saved documents in the My documents section.

- If you haven’t created an account yet, follow the steps listed below.

- Open the page with the template you need. Ensure it is the template you were seeking: verify its name and description, and use the Preview option if available. Otherwise, utilize the Search field to locate the required one.

- Begin the downloading process. Click Buy Now and choose the pricing plan that fits you best. Then, create an account and proceed to pay for your order using a credit card or PayPal.

- Download the file. Specify the format to receive the McKinney Texas Notice of Default and Right To Cure and modify and complete it, or sign it according to your specifications.

Form popularity

FAQ

To claim surplus funds after a foreclosure auction in Texas, the former homeowner must file a claim with the court that handled the foreclosure sale. Surplus funds are any proceeds from the sale exceeding the amount owed to the lender. Homeowners should be knowledgeable about the McKinney Texas Notice of Default and Right To Cure to ensure they are informed throughout the process and receive any surplus they may be entitled to.

A notice of default foreclosure in Texas is a formal communication sent to a homeowner who has missed mortgage payments. This document notifies the homeowner of their delinquency and outlines the potential consequences if they fail to act. Understanding the implications of the McKinney Texas Notice of Default and Right To Cure can give homeowners the chance to address their financial situation and avoid foreclosure.

To stop a non-judicial foreclosure in Texas, homeowners can take action upon receiving the notice of default. They may need to remedy the default with past-due payments, negotiate a repayment plan with the lender, or consider filing for bankruptcy. Utilizing resources and forms from USA Legal Forms can provide guidance on navigating the McKinney Texas Notice of Default and Right To Cure, potentially helping you preserve your home.

Foreclosure sales in Texas are typically conducted by the trustee specified in the deed of trust. This individual is responsible for carrying out the sale according to state laws and guidelines. It's important for homeowners to be aware of the McKinney Texas Notice of Default and Right To Cure, as understanding these regulations can help them navigate their options and decide how to act before the sale.

A foreclosure sale in Texas usually involves a public auction where the property is sold to the highest bidder. First, a notice of default is sent to the homeowner, outlining the reasons for the foreclosure. If the homeowner does not resolve the default, the McKinney Texas Notice of Default and Right To Cure processes will lead to a scheduled auction, providing potential buyers a chance to acquire the property.

In Texas, the deed given at a foreclosure sale is typically known as a 'deed of trust.' This legal document serves to transfer ownership of the property to the new buyer while extinguishing the borrower's previous interest. It is crucial to understand how the McKinney Texas Notice of Default and Right To Cure affects this process, as it may provide opportunities for homeowners to remedy their default before the sale occurs.

In Texas, a notice of default and intent to accelerate informs a borrower that they have missed payments and gives them the chance to cure the default before legal action occurs. This notice is a vital part of the McKinney Texas Notice of Default and Right To Cure process, offering a possible resolution to borrowers facing financial difficulties. Utilizing platforms like uslegalforms can provide the necessary documentation and guidance you need during this critical time.

A default foreclosure occurs when a homeowner fails to meet mortgage payment obligations, leading the lender to take legal action to recover the owed amount. This process typically starts with the McKinney Texas Notice of Default and Right To Cure, informing the homeowner of their delinquency. Understanding this notice is crucial for any homeowner facing financial difficulties. Knowledge of this process empowers you to take necessary steps to protect your home and finances.

Yes, a foreclosure can be reversed in Texas, but it depends on the circumstances surrounding the case. If homeowners act quickly after receiving the McKinney Texas Notice of Default and Right To Cure, they may have the chance to negotiate with their lender. Seeking legal or financial advice can also be beneficial. By understanding your rights and the foreclosure process, you may identify potential solutions.

In Texas, a homeowner typically faces foreclosure after missing two to three mortgage payments. However, the exact timeline can vary based on the lender's policies. It is essential to understand the McKinney Texas Notice of Default and Right To Cure as it provides crucial information regarding this process. Taking prompt action upon receiving this notice can help homeowners explore available options to avoid foreclosure.