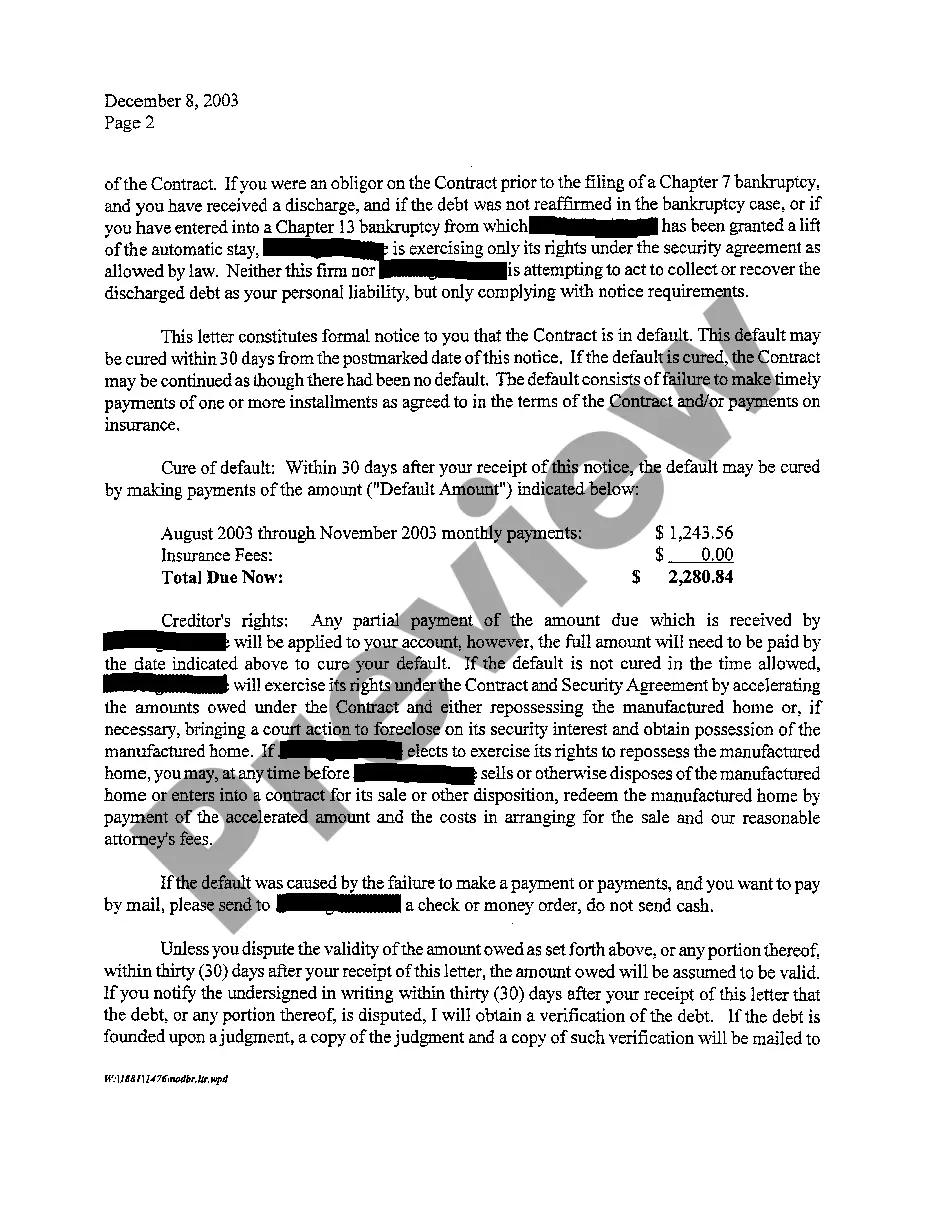

Plano Texas Notice of Default and Right to Cure is an important legal process that homeowners in Plano, Texas should be aware of. It is crucial to understand the significance of these terms if you find yourself in a situation where you may face foreclosure or are struggling with mortgage payments. A Notice of Default in Plano, Texas is a document issued by the lender or mortgage holder when a homeowner fails to make timely mortgage payments. This notice serves as the initial step in the foreclosure process, alerting the homeowner that they have defaulted on their loan and giving them a specific timeframe to take corrective actions. The Notice of Default typically includes essential details such as the homeowner's name, address, loan amount, and the specific amounts and due dates of missed payments. It also outlines the lender's intention to initiate foreclosure proceedings if the homeowner does not cure the default within a specified period. In Plano, Texas, homeowners are granted the Right to Cure, allowing them an opportunity to rectify their default and prevent foreclosure. By law, the homeowner must be given a certain period (typically 20 to 30 days) to bring their mortgage payments up to date and cure the default. During the Right to Cure period, homeowners have the option to communicate with their lender, negotiate repayment terms, or explore other alternatives such as loan modification or refinancing. It is essential to act promptly and be proactive during this time to avoid further complications and potential foreclosure. Plano, Texas also has specific laws and regulations in place to protect homeowners throughout the default and cure process. These laws ensure that lenders adhere to proper procedures and provide homeowners with the necessary information and opportunities to address their default. It is important to note that, apart from the general Notice of Default and Right to Cure, there may be additional types of notices specific to Plano, Texas. For example, there could be notices related to property tax defaults or HOA (Homeowners Association) dues nonpayment, which may trigger a separate cure process and have its own specific requirements. In conclusion, understanding the Plano Texas Notice of Default and Right to Cure is crucial for homeowners facing financial difficulties. Being informed about the process, timelines, and options available can help homeowners take appropriate actions to rectify their default, negotiate with their lender, and potentially avoid foreclosure. Seeking legal advice from professionals specializing in foreclosure law and real estate transactions can also provide further guidance in navigating this complex process effectively.

Plano Texas Notice of Default and Right To Cure

Description

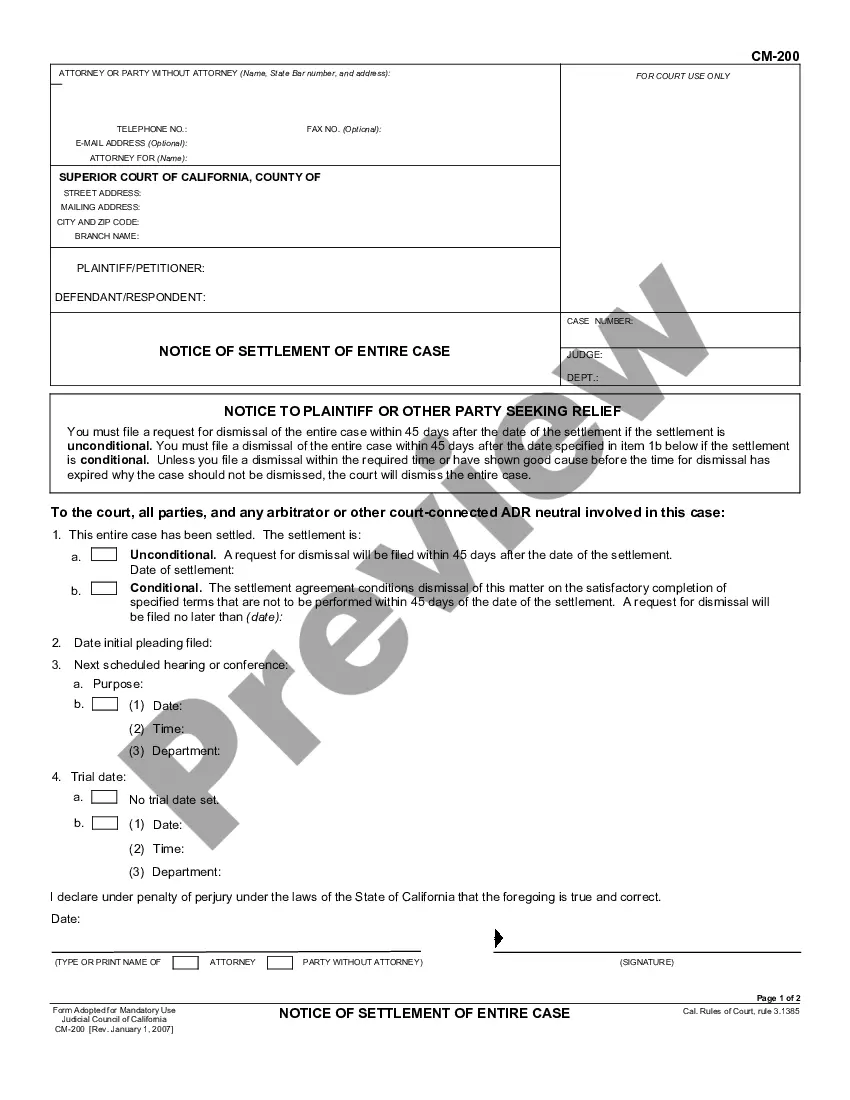

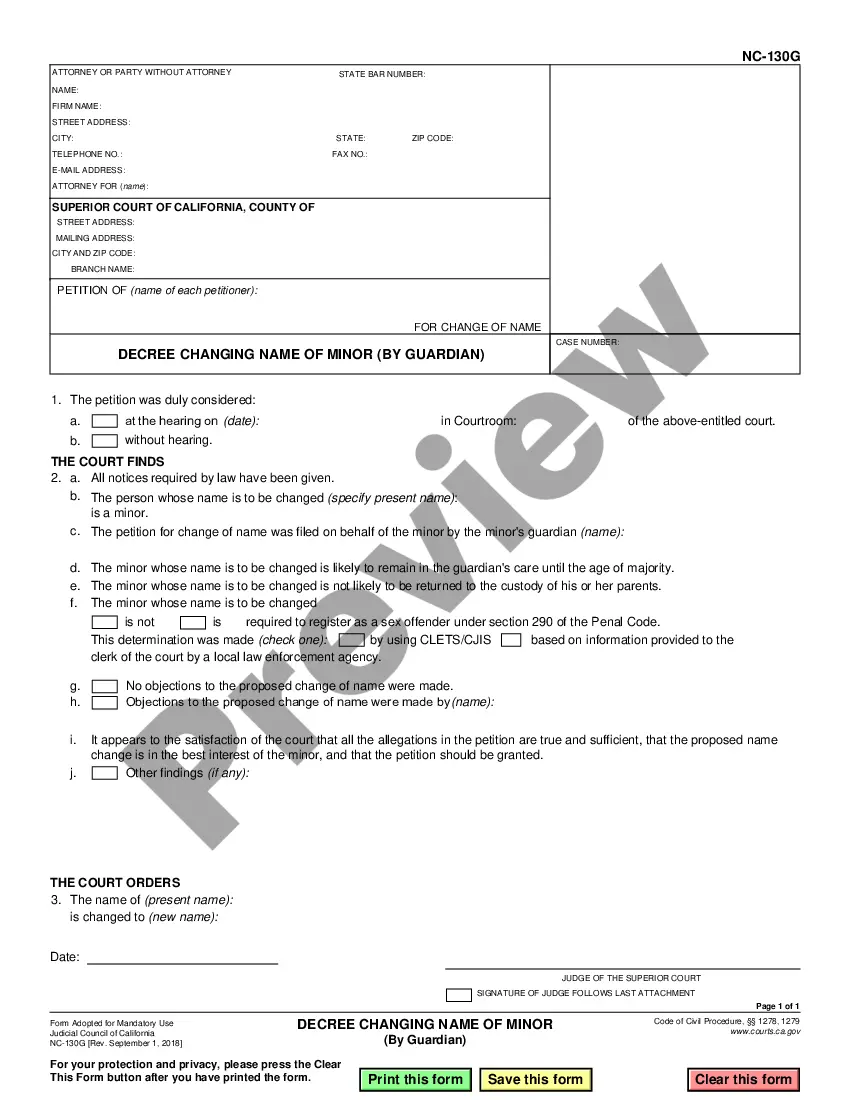

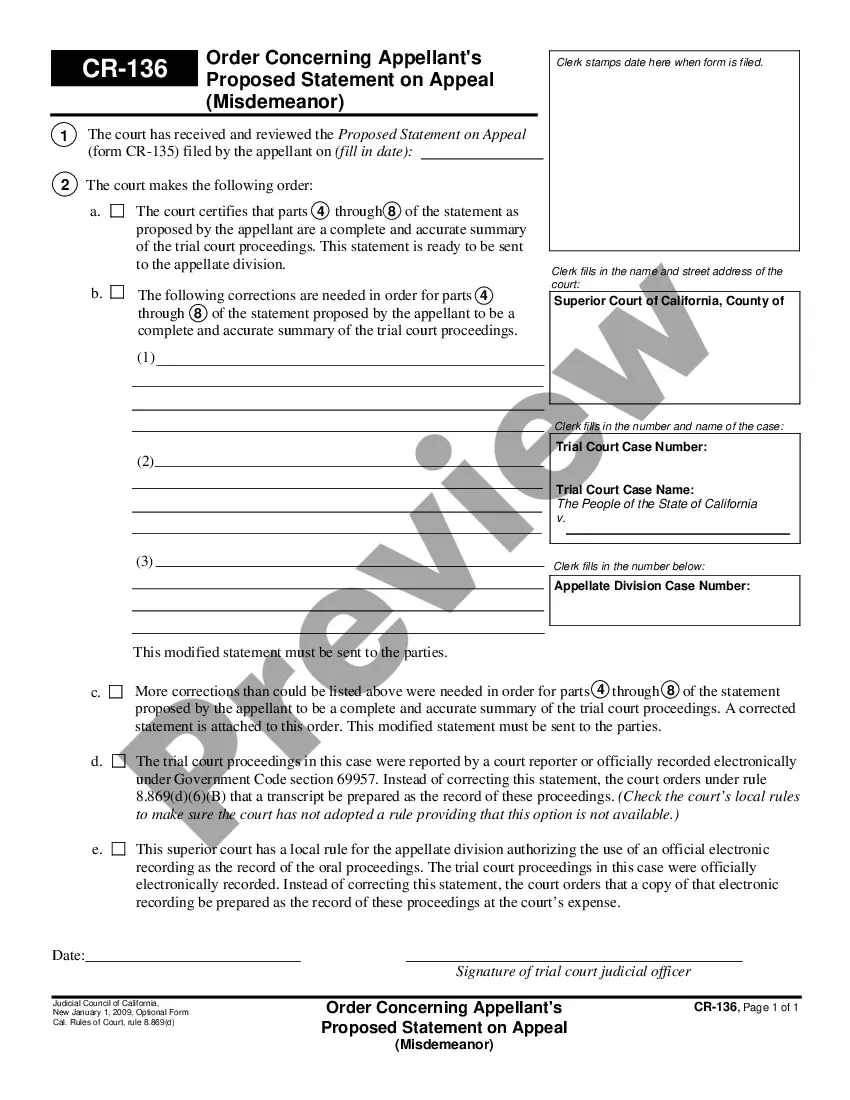

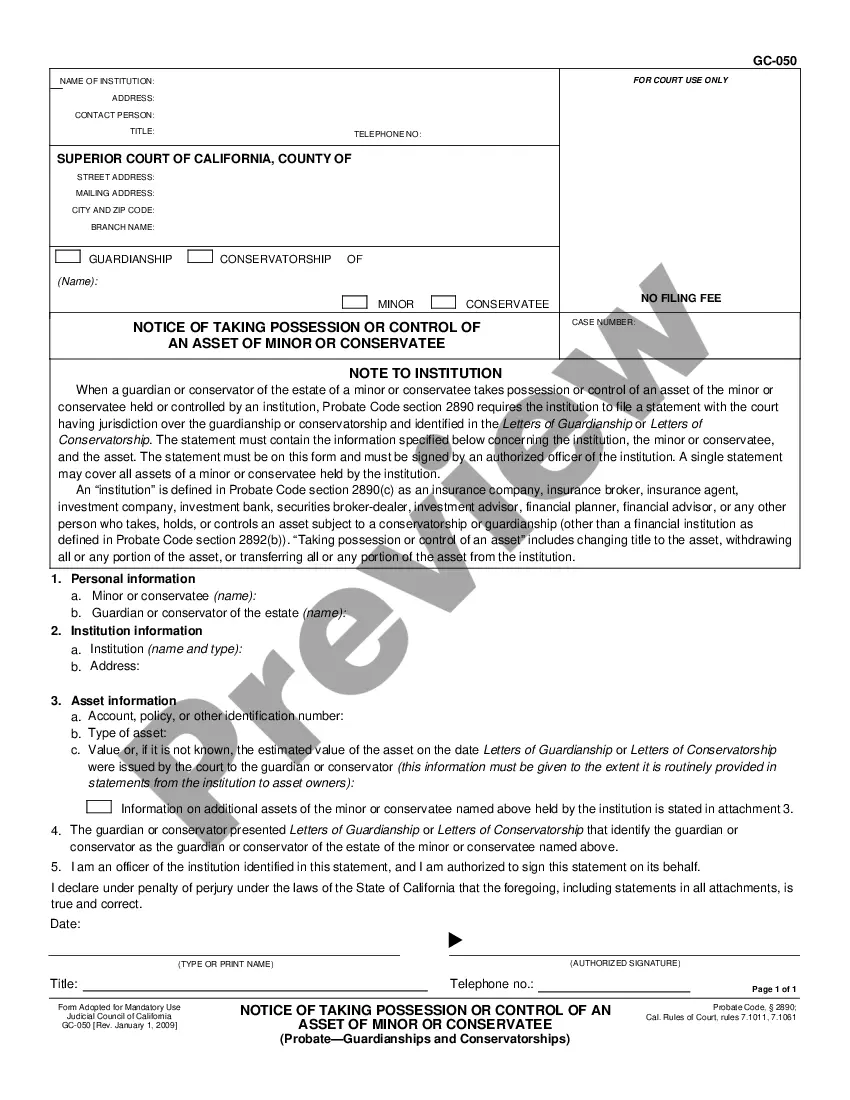

How to fill out Plano Texas Notice Of Default And Right To Cure?

Utilize the US Legal Forms and gain instant access to any document you need.

Our valuable platform with a wide array of templates simplifies the process of locating and acquiring virtually any form sample you require.

You can download, complete, and authenticate the Plano Texas Notice of Default and Right To Cure in just a few moments, rather than spending hours searching the internet for an appropriate template.

Using our collection is an excellent method to enhance the security of your document submission.

Locate the form you need. Ensure that it is the template you are looking for: check its title and description, and use the Preview feature if it is available. Alternatively, use the Search field to find the necessary document.

Initiate the saving process. Click Buy Now and select your preferred pricing plan. Then, create an account and complete your order using a credit card or PayPal.

- Our skilled legal experts routinely review all forms to confirm that the documents are pertinent for a specific state and in accordance with current laws and regulations.

- How do you retrieve the Plano Texas Notice of Default and Right To Cure.

- If you already have a subscription, simply Log In to your account. The Download option will be visible on all the samples you explore.

- Furthermore, you can access all your previously saved files in the My documents menu.

- If you haven't created a profile yet, follow the steps below.

Form popularity

FAQ

However, the borrower may also ?cure? the defaults, typically by making payments to bring the loan current. The cure generally means the borrower can avoid the consequences of default so that the loan is reinstated and the borrower can keep the property securing the loan.

If you are behind in mortgage payments you are in ?default.? If you pay the bank all the payments you missed, you can ?cure the default?. The bank must send you a notice that says you have the right to pay the money you owe.

N. if a defendant in a lawsuit fails to respond to a complaint in the time set by law (commonly 20 or 30 days), then the plaintiff (suer) can request that the default (failure) be entered into the court record by the clerk, which gives the plaintiff the right to get a default judgment.

If you miss payments or you don't pay the right amount, your creditor may send you a default notice, also known as a notice of default. If the default is applied it'll be recorded in your credit file and can affect your credit rating. An account defaults when you break the terms of the credit agreement.

The legal right to cure is a principle founded in contract law that allows one party in a contract, who has defaulted under a contract provision, to remedy their default by taking steps to ensure compliance or otherwise, cure the default.

A ?default? is a failure to comply with a provision in the lease. ?Curing? or ?remedying? the default means correcting the failure or omission. A common example is a failure to pay the rent on time.

Write to the agency making the claim. Present evidence of why the NOD was improperly issued or why you legitimately cannot make payments. Ask the agency in the letter if they will take a lower monthly payment, total settlement or a payment plan. Send a copy of your letter by certified mail.

Foreclosures may be judicial (ordered by a court following a judgment in a lawsuit) or, most likely in Texas, non-judicial (?on the courthouse steps?). The effect of foreclosure is to cut off and eliminate junior liens, including mechanic's liens, except for any liens for unpaid taxes.

A Seller's ?right to cure? does not mean that the Seller must cure any defects uncovered during a home inspection. Rather, a Seller's ?right to cure? means that the Seller simply has the option to cure a defect once the Buyer notifies the Seller that there are defects to which the Buyer objects.

You can cure a default in payments by paying the amount due, plus any allowable costs and fees, by a specific time before a foreclosure sale. The cure amount includes just overdue payments, plus fees, costs, and interest?not future payments or accelerated payments. After you cure the default, the foreclosure stops.