The Waco Texas Notice of Default and Right To Cure is an important legal document that serves as a formal notice to borrowers regarding their mortgage loan default. This notice outlines the borrower's rights and provides them with an opportunity to cure the default before foreclosure proceedings begin. Here is a detailed description of what the Waco Texas Notice of Default and Right To Cure entails, along with its different types: 1. Waco Texas Notice of Default: The Notice of Default is typically sent by the lender or mortgage service to the borrower when they have failed to make timely payments on their mortgage loan. It acts as an official notification that the borrower is in default, breaching the terms of their mortgage agreement. The document serves to inform the borrower of the consequences of continued default, including potential foreclosure proceedings. 2. Right To Cure: The Right To Cure provision in Waco Texas provides the borrower with an opportunity to rectify the default and reinstate their loan to good standing. This provision is designed to protect the borrower's interests and allow them to resolve the default before more drastic measures, such as foreclosure, are pursued. The Right To Cure period typically consists of a specific timeframe during which the borrower can make the necessary payments to bring the loan current. The Waco Texas Notice of Default and Right To Cure are essential components of the foreclosure process in the state. They are governed by Texas law and must adhere to specific requirements, including proper notice delivery methods and timeframes. Failure to comply with these legal requirements may adversely impact the lender's ability to pursue foreclosure. Different types of Waco Texas Notice of Default and Right To Cure may include variations based on the specific circumstances of the default, such as the number of missed payments, the nature of the default, or any alternative remedies available to the borrower. However, the fundamental purpose of these notices remains the same — to inform the borrower of their default and provide them with an opportunity to cure it. In summary, the Waco Texas Notice of Default and Right To Cure are crucial elements of the foreclosure process. These notices aim to ensure that borrowers have a fair chance to rectify defaults on their mortgage loans, promoting transparency and maintaining a balance between the rights of lenders and borrowers. It is essential for borrowers in Waco Texas to understand these notices, their rights, and the available options for resolving the default in order to protect their homeownership.

Waco Texas Notice of Default and Right To Cure

Description

How to fill out Waco Texas Notice Of Default And Right To Cure?

We consistently wish to reduce or evade legal complications when handling intricate law-related or financial issues.

To achieve this, we seek attorney solutions that are generally very expensive.

Nevertheless, not all legal matters present the same level of complexity.

Many of them can be managed independently.

Utilize US Legal Forms whenever you need to quickly and securely find and download the Waco Texas Notice of Default and Right To Cure or any other document. Just Log In to your account and click the Get button adjacent to it. If you happen to misplace the form, you can always download it again from the My documents tab. The procedure is just as simple if you are unfamiliar with the website! You can create your account in just a few minutes. Ensure to verify whether the Waco Texas Notice of Default and Right To Cure adheres to your state's and area's laws and regulations. Moreover, it is essential to examine the form's structure (if available), and if you find any inconsistencies with what you originally sought, look for an alternative form. Once you confirm that the Waco Texas Notice of Default and Right To Cure fits your needs, you can select a subscription plan and complete your payment. Afterward, you can download the form in any available file format. With over 24 years of market presence, we have assisted millions by providing ready-to-edit and current legal forms. Take advantage of US Legal Forms now to conserve time and resources!

- US Legal Forms is an online repository of current DIY legal templates covering everything from wills and power of attorney to incorporation articles and dissolution petitions.

- Our collection enables you to manage your legal affairs without the need for professional legal advice.

- We provide access to legal document templates that may not be readily accessible to the public.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

Form popularity

FAQ

Yes, a notice of default is considered a public record in Texas. This means that anyone can access this information, which can affect your credit and future borrowing options. Being aware of the Waco Texas Notice of Default and Right To Cure can help you take proactive steps to manage your situation and maintain your financial reputation.

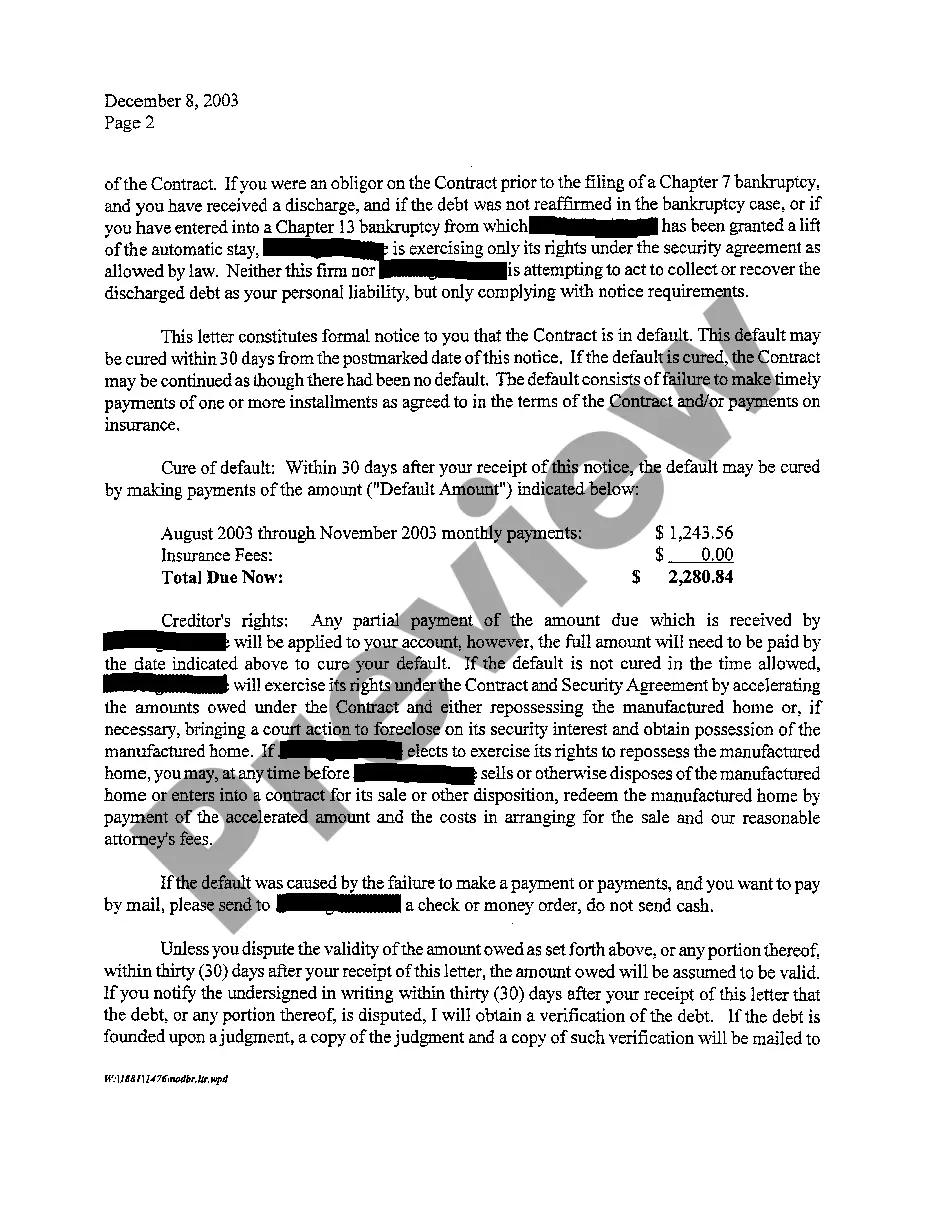

The notice of default and right to cure letter outlines the specific defaults in mortgage payments and explains how to remedy the situation. It is an essential legal document in Waco, Texas, that guides homeowners on their options to avoid foreclosure. By addressing this letter promptly, you can utilize the Waco Texas Notice of Default and Right To Cure effectively to secure your financial standing.

Receiving a notice of default means that your lender has officially recognized your delayed mortgage payments. This initiates the foreclosure process, during which you may lose your home if you do not act. Ensuring you understand the implications of the Waco Texas Notice of Default and Right To Cure is critical for taking the necessary steps to avoid foreclosure.

In Texas, a notice of default is a formal notification sent by a lender when a borrower fails to make mortgage payments. This document serves as the beginning of the foreclosure process, alerting the borrower to their delinquency and the potential for foreclosure. Understanding the Waco Texas Notice of Default and Right To Cure can help you take appropriate action to avoid losing your home.

Receiving a default notice in Waco, Texas, indicates that you have fallen behind on your mortgage payments. It's essential to treat this notice seriously, as it outlines your rights and provides options to cure the default. Engaging with resources like uslegalforms can help you understand the steps you need to take to protect your home and explore solutions available to you.

To determine if a property in Waco, Texas, is in default, you can check local public records or consult with a real estate professional. Many online platforms, including uslegalforms, offer valuable resources that can assist in checking a property's status. This step ensures you stay informed and can take appropriate action if necessary.

Yes, notices of default are considered public record in Waco, Texas. This means that anyone can access these documents through public records, allowing potential buyers and investors to be informed about the status of properties. Keeping track of these notices can be beneficial for homeowners as well, as it helps them understand their standing and options.

In Waco, Texas, specific requirements govern the notice of a foreclosure sale. The lender must provide a written notice at least 21 days before the scheduled sale date, ensuring the homeowner has adequate time to respond. This notice typically includes information regarding the property, the debt, and the details of the foreclosure auction, ensuring transparency throughout the process.

The first notice of default and right to cure in Waco, Texas, is a formal notification sent to homeowners when they fall behind on their mortgage payments. This notice serves as an alert, providing the homeowner the chance to correct their payment issues before foreclosure procedures begin. Understanding this process is crucial, as it outlines the homeowner’s rights and options to retain their property.

A homeowner in default may face foreclosure for failing to make mortgage payments as agreed. Various factors can lead to this situation, including job loss, medical expenses, or other financial challenges. The Waco Texas Notice of Default and Right To Cure allows you to address these issues, presenting a chance to avoid foreclosure by catching up on payments. Staying informed and proactive can help you maintain ownership of your home.