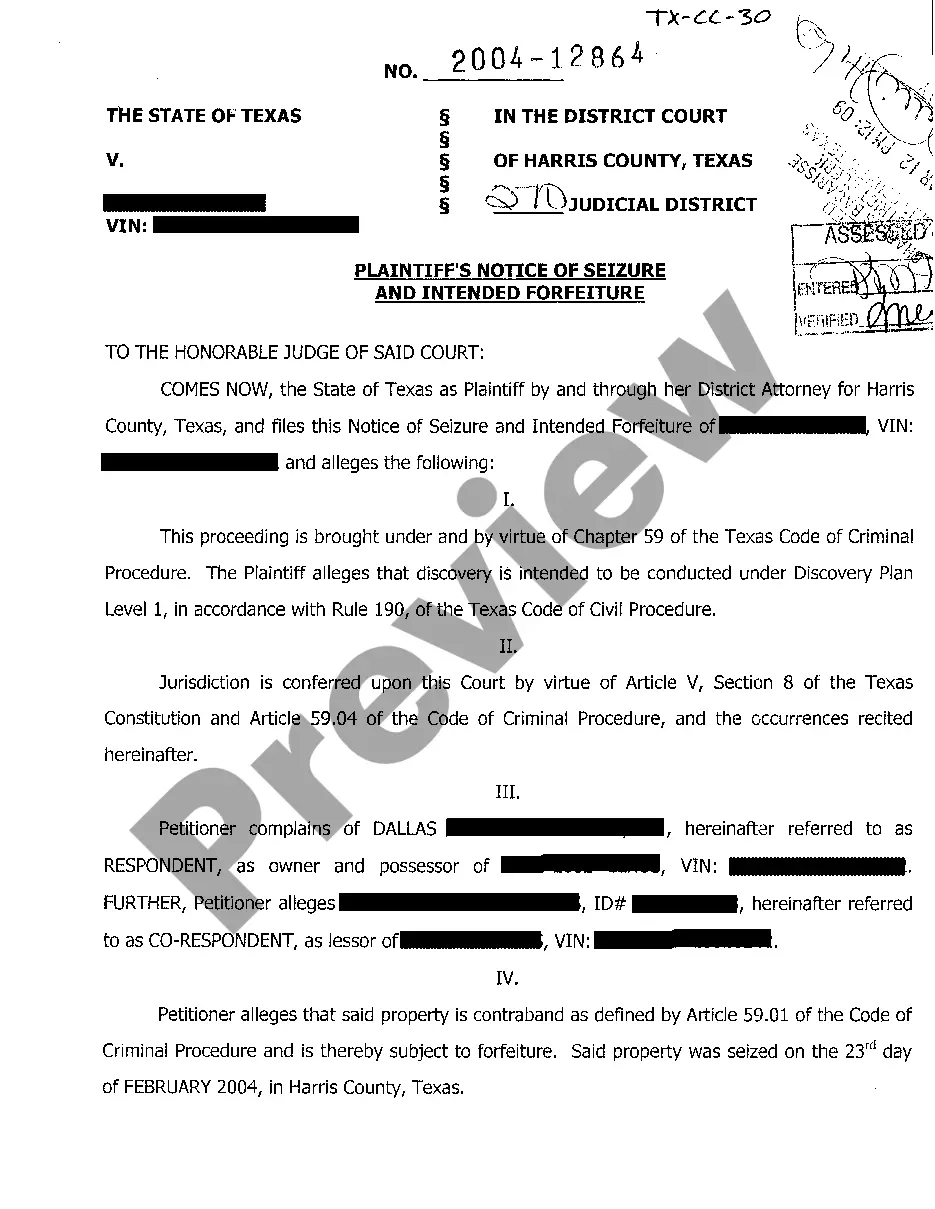

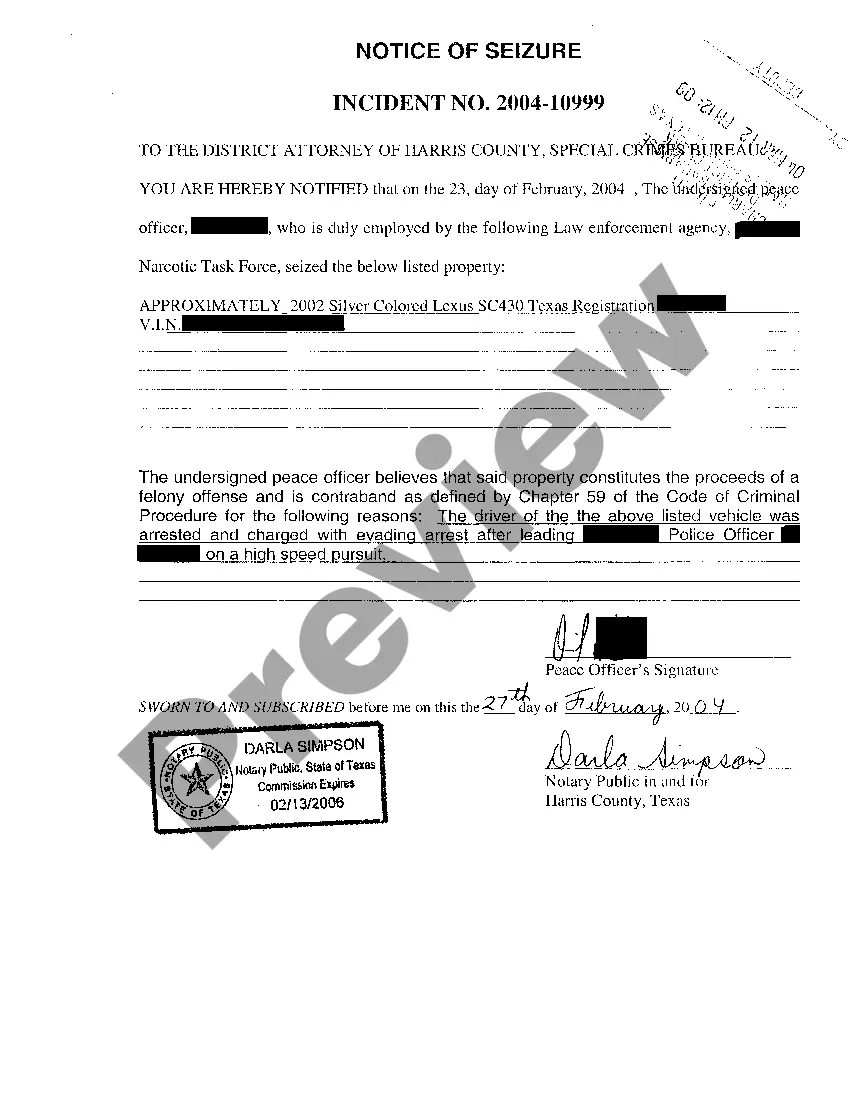

Title: Understanding Dallas Texas Plaintiffs Notice of Seizure and Intended Forfeiture: Types and Implications Introduction: The Dallas Texas Plaintiffs Notice of Seizure and Intended Forfeiture is an important legal document that outlines the actions taken by the plaintiffs in the seizure and possible forfeiture of assets and property. This detailed description dives into the types and implications of this notice, providing crucial information for those potentially affected by it. Types of Dallas Texas Plaintiffs Notice of Seizure and Intended Forfeiture: 1. Civil Asset Forfeiture: This type of notice is issued when the plaintiffs seek to seize assets linked to criminal activities, such as drug trafficking, money laundering, or fraud. They aim to permanently forfeit the assets to the state or federal government. 2. Civil Forfeiture: This notice is served for the seizure and intended forfeiture of property associated with civil offenses, like tax evasion, trademark violations, or illegal gambling. Civil forfeiture focuses on the property's involvement in illegal acts rather than its owner's criminal involvement. 3. Equitable Forfeiture: In certain cases, plaintiffs may pursue equitable forfeiture, seeking the seizure and intended forfeiture of property deemed to be associated with unlawful activities. This type typically focuses on breaching contracts, trust violations, or other improper actions that warrant forfeiture. Key Details and Components of the Notice: 1. Identification of Parties: The notice typically features the names of the plaintiffs, the government agencies involved (such as the Dallas County District Attorney's Office), and the individuals whose assets are subject to seizure. 2. Description of Seized Assets: The notice includes a comprehensive inventory of the assets under seizure, providing details such as real estate properties, vehicles, bank accounts, jewelry, or any asset of significant value implicated in the alleged criminal or civil offense. 3. Legal Justification: This section of the notice outlines the legal basis for the seizure and intended forfeiture, clearly stating the alleged criminal or civil violation committed, evidence supporting the claim, and the specific laws that authorize such action. 4. Filing Deadline: The notice specifies the timeframe within which the affected parties must respond or challenge the seizure and intended forfeiture, typically within 30 days. It also informs them about the required procedures and documentation for contesting the action. Implications and Recommendations: 1. Seek Legal Counsel: Individuals or businesses receiving this notice must immediately consult with an experienced attorney specializing in asset forfeiture to understand their rights, options for defense, and potential implications. 2. Challenges and Appeals: The affected parties have the opportunity to contest the seizure and intended forfeiture by presenting evidence that disproves the allegations, questions the legality of the seizure, or challenges the constitutionality of the forfeiture process. 3. Negotiation and Settlement: In some cases, negotiations between the plaintiffs and affected parties can lead to settlement agreements, offering alternatives to complete forfeiture, such as fines, penalties, or asset transfer agreements. 4. Public Notices: Plaintiffs may be required to publish notice of the seizure and intended forfeiture in local newspapers to inform third parties, potential claimants, or lien holders about the ongoing legal proceedings and their potential rights. Conclusion: The Dallas Texas Plaintiffs Notice of Seizure and Intended Forfeiture is a significant legal document that demands immediate attention from affected parties. Understanding the types, components, and implications of this notice is essential to navigate the forfeiture process successfully. Consulting legal professionals will ensure proper defense and the protection of assets and property rights.

Dallas Texas Plaintiffs Notice of Seizure and Intended Forfeiture

Description

How to fill out Dallas Texas Plaintiffs Notice Of Seizure And Intended Forfeiture?

We always want to reduce or prevent legal issues when dealing with nuanced legal or financial matters. To accomplish this, we apply for legal solutions that, usually, are extremely expensive. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of using services of an attorney. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Dallas Texas Plaintiffs Notice of Seizure and Intended Forfeiture or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is equally effortless if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Dallas Texas Plaintiffs Notice of Seizure and Intended Forfeiture adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Dallas Texas Plaintiffs Notice of Seizure and Intended Forfeiture would work for you, you can choose the subscription option and proceed to payment.

- Then you can download the form in any suitable file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!