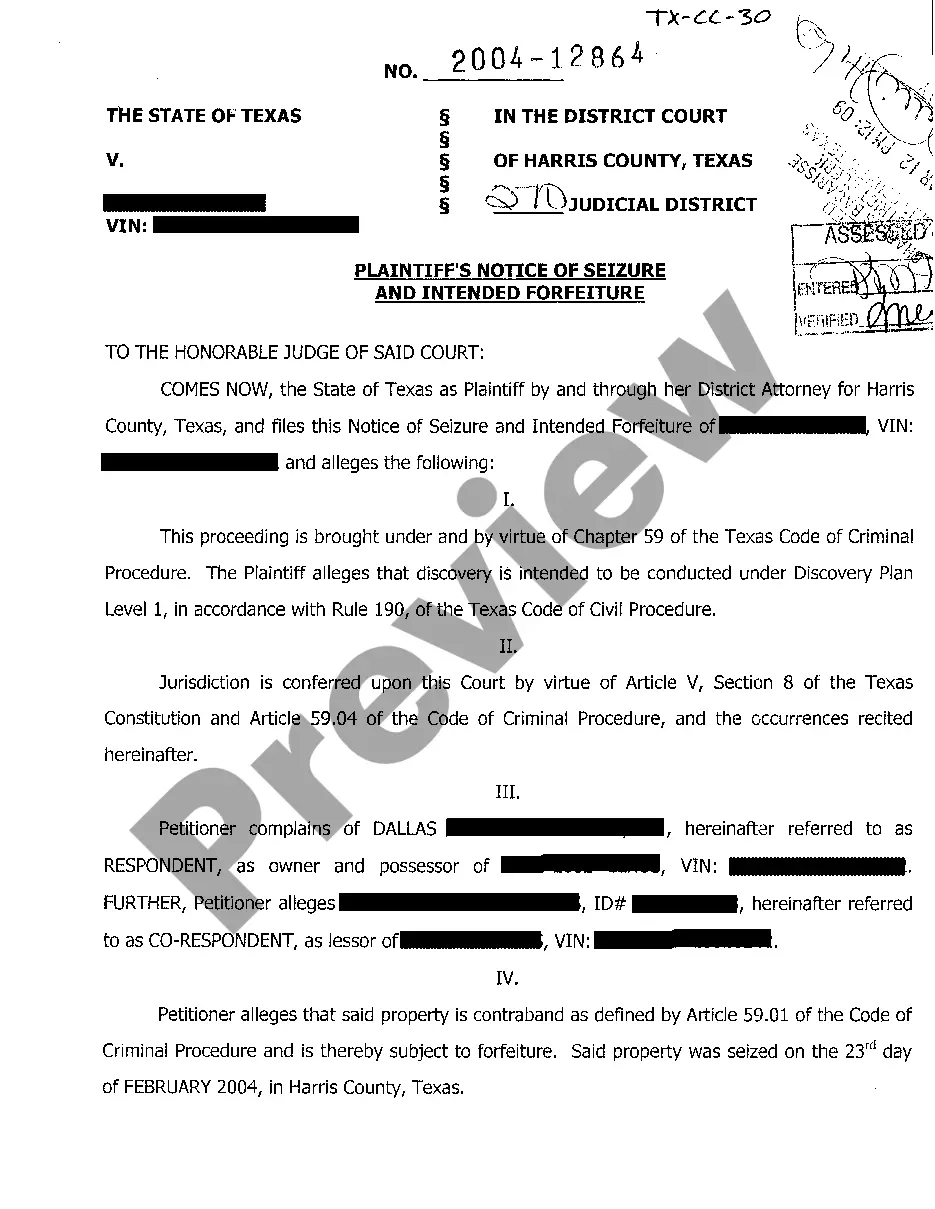

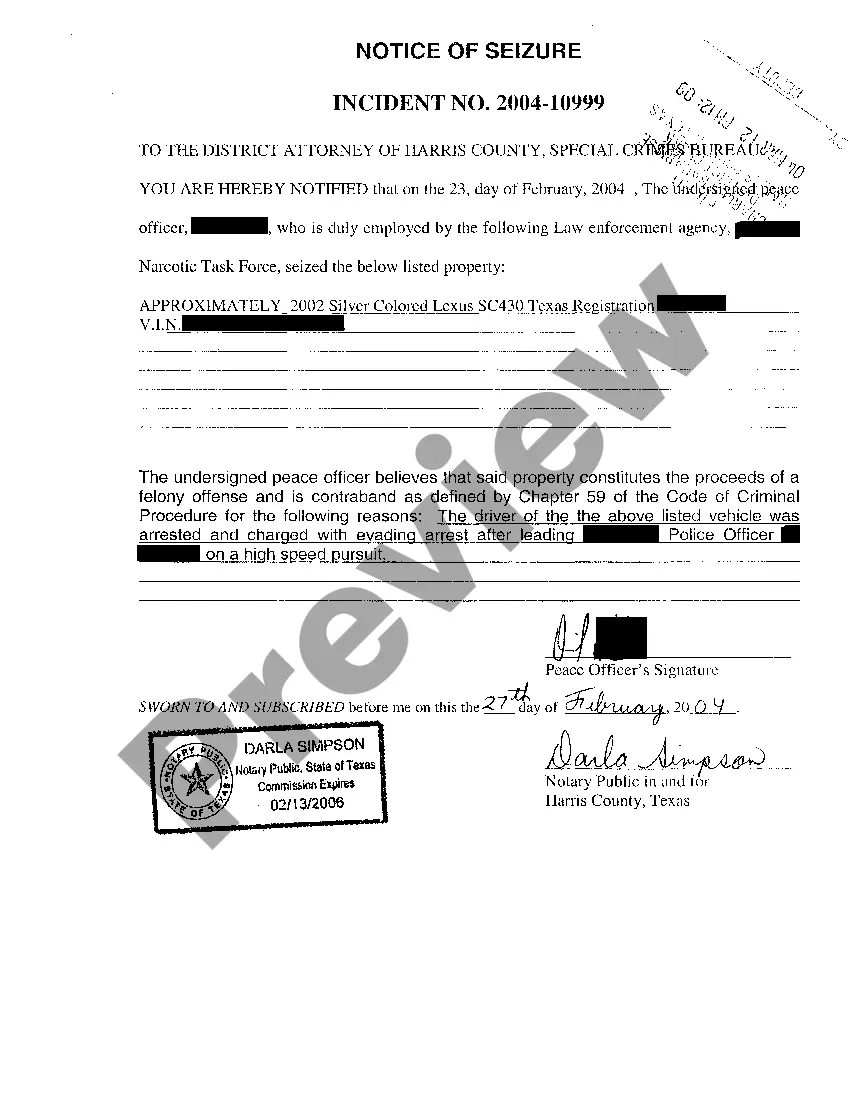

Title: Understanding Killeen Texas Plaintiffs Notice of Seizure and Intended Forfeiture: Types and Detailed Explanation Introduction: Killeen, Texas, being a city governed by the law, has a legal process in place to deal with the seizure and intended forfeiture of assets in cases related to plaintiffs. This article seeks to provide a detailed description of what the Killeen Texas Plaintiffs Notice of Seizure and Intended Forfeiture entails, along with highlighting different types that may exist within this legal framework. 1. Overview of Killeen Texas Plaintiffs Notice of Seizure and Intended Forfeiture: The Killeen Texas Plaintiffs Notice of Seizure and Intended Forfeiture serves as a legal document in cases where plaintiffs have requested the seizure and intended forfeiture of assets owned by the defendants. It is a formal notice issued by the plaintiffs to inform the defendants about the actions being taken against them, providing them with an opportunity to respond and defend their interests within a specified timeframe. 2. Types of Killeen Texas Plaintiffs Notice of Seizure and Intended Forfeiture: While there may not be distinct types of the notice itself, the underlying cases leading to a seizure and intended forfeiture can vary. Some common examples of cases where this notice might be used include: a) Civil asset forfeiture: This type of plaintiffs notice is typically employed in civil cases where assets are believed to be connected to criminal activity or used to facilitate criminal activities. Plaintiffs, often law enforcement agencies, seek to seize and potentially forfeit these assets following a legal process. b) Debt collection lawsuits: In these cases, the plaintiffs, such as creditors or debt collectors, may file a notice of seizure and intended forfeiture to recover unpaid debts. This process allows plaintiffs to target specific assets that can be seized in lieu of the owed amount. c) Fraud or white-collar crime cases: Plaintiffs, such as government agencies or private individuals, may file a notice of seizure and intended forfeiture when assets are suspected to be obtained through fraudulent or illegal means. This legal action aims to reclaim the unlawfully acquired assets. d) Personal injury claims: In certain personal injury cases, the plaintiff may choose to file a notice of seizure and intended forfeiture to secure potential compensation. This action ensures that the defendant's assets are retained, preventing them from disposing of assets before the resolution of the case. 3. Process and Legal Obligations: Upon receiving the notice of seizure and intended forfeiture, defendants have a duty to respond within a prescribed period. They may choose to contest the seizure, challenge the allegations made by the plaintiffs, or negotiate a settlement. Failure to respond or comply with the notice within the specified timeframe can result in the automatic forfeiture of assets in some cases. In compliance with legal requirements, the plaintiffs must provide a detailed inventory of the assets being seized and their estimated value. Defendants are entitled to access legal representation to defend their rights and present their case before the court. Conclusion: The Killeen Texas Plaintiffs Notice of Seizure and Intended Forfeiture is a crucial legal document that informs defendants about the seizure and potential forfeiture of their assets. Understanding the types of cases that may involve this notice allows individuals to comprehend the implications and take appropriate measures to respond effectively. It is advisable for defendants to seek legal counsel when facing such notices to ensure their rights and interests are protected throughout the legal process.

Killeen Texas Plaintiffs Notice of Seizure and Intended Forfeiture

Description

How to fill out Killeen Texas Plaintiffs Notice Of Seizure And Intended Forfeiture?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for a person with no law background to draft such paperwork cfrom the ground up, mainly due to the convoluted terminology and legal nuances they entail. This is where US Legal Forms comes in handy. Our platform provides a massive library with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal case. US Legal Forms also is an excellent resource for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you want the Killeen Texas Plaintiffs Notice of Seizure and Intended Forfeiture or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Killeen Texas Plaintiffs Notice of Seizure and Intended Forfeiture quickly using our reliable platform. In case you are presently an existing customer, you can proceed to log in to your account to get the appropriate form.

Nevertheless, if you are new to our platform, make sure to follow these steps prior to downloading the Killeen Texas Plaintiffs Notice of Seizure and Intended Forfeiture:

- Ensure the template you have found is specific to your location since the rules of one state or area do not work for another state or area.

- Review the form and read a short outline (if available) of scenarios the paper can be used for.

- In case the one you picked doesn’t meet your requirements, you can start over and search for the necessary document.

- Click Buy now and choose the subscription plan that suits you the best.

- utilizing your login information or register for one from scratch.

- Pick the payment gateway and proceed to download the Killeen Texas Plaintiffs Notice of Seizure and Intended Forfeiture once the payment is done.

You’re good to go! Now you can proceed to print out the form or fill it out online. Should you have any issues locating your purchased documents, you can easily access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.