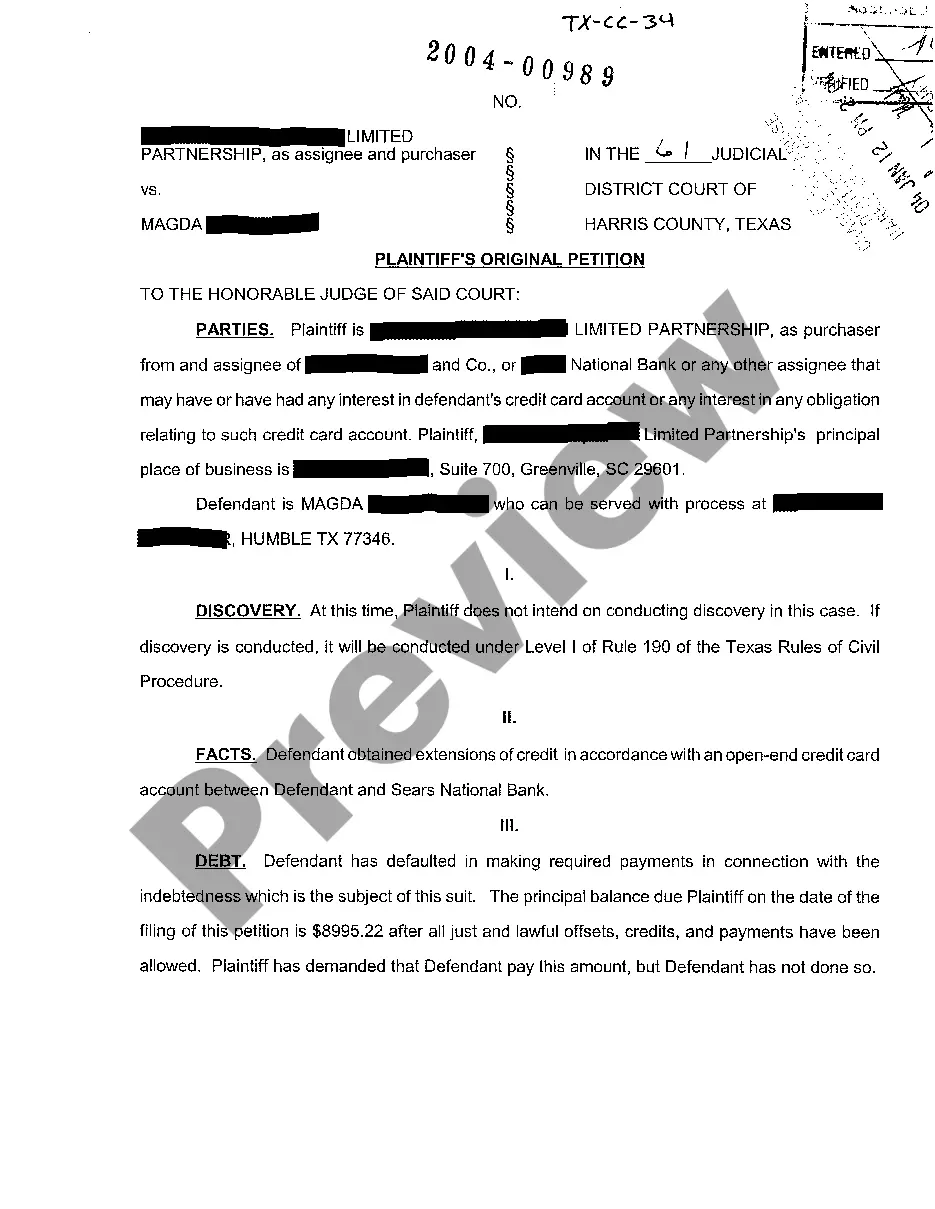

Abilene Texas Plaintiffs Original Petition for Credit Card Debt Collection is a legal document filed by the plaintiff (the creditor or collection agency) in a court of law to initiate a lawsuit against a debtor who has not paid their credit card debt. This petition outlines the details of the debt owed, including the amount owed, the creditor's information, and the history of the account. Keywords: Abilene Texas, Plaintiffs Original Petition, Credit Card Debt Collection, legal document, lawsuit, debtor, creditor, collection agency, credit card debt, amount owed, history of the account. There are various types of Abilene Texas Plaintiffs Original Petitions for Credit Card Debt Collection that may be filed based on the specific circumstances of the case. These variations may include: 1. Abilene Texas Petition for Credit Card Debt Collection — Default Judgment: This petition is filed when the debtor fails to respond to the lawsuit or appear in court within the specified timeframe. The plaintiff requests a default judgment in their favor, allowing them to pursue collection of the outstanding debt. 2. Abilene Texas Petition for Credit Card Debt Collection — Fraudulent Charges: If the plaintiff believes that the debtor made fraudulent charges on the credit card, they can file a petition specifically addressing this issue. The plaintiff may provide evidence of the fraudulent activities committed by the debtor. 3. Abilene Texas Petition for Credit Card Debt Collection — Unpaid Balance: This type of petition is filed when the debtor has simply failed to make the required payments on their credit card debt. The plaintiff will outline the history of the missed payments and request the court's intervention in collecting the outstanding balance. 4. Abilene Texas Petition for Credit Card Debt Collection — Statute of Limitations: If the debt is beyond a certain timeframe defined by the statute of limitations, the plaintiff may file a petition seeking the court's permission to collect the debt. This petition involves providing details of the debt, its age, and explaining why the plaintiff believes they should still be able to pursue collection. 5. Abilene Texas Petition for Credit Card Debt Collection — Counterclaim: In some cases, the debtor may file a counterclaim against the plaintiff, alleging unfair or illegal practices. This type of petition addresses both the original debt and the counterclaim and allows the court to consider both parties' arguments. Overall, Abilene Texas Plaintiffs Original Petition for Credit Card Debt Collection serves as the initial legal step taken by the creditor or collection agency to begin the process of collecting the outstanding credit card debt from the debtor.

Abilene Texas Plaintiffs Original Petition for Credit Care Debt Collection

State:

Texas

City:

Abilene

Control #:

TX-CC-34-01

Format:

PDF

Instant download

This form is available by subscription

Description

A01 Plaintiffs Original Petition for Credit Care Debt Collection

Abilene Texas Plaintiffs Original Petition for Credit Card Debt Collection is a legal document filed by the plaintiff (the creditor or collection agency) in a court of law to initiate a lawsuit against a debtor who has not paid their credit card debt. This petition outlines the details of the debt owed, including the amount owed, the creditor's information, and the history of the account. Keywords: Abilene Texas, Plaintiffs Original Petition, Credit Card Debt Collection, legal document, lawsuit, debtor, creditor, collection agency, credit card debt, amount owed, history of the account. There are various types of Abilene Texas Plaintiffs Original Petitions for Credit Card Debt Collection that may be filed based on the specific circumstances of the case. These variations may include: 1. Abilene Texas Petition for Credit Card Debt Collection — Default Judgment: This petition is filed when the debtor fails to respond to the lawsuit or appear in court within the specified timeframe. The plaintiff requests a default judgment in their favor, allowing them to pursue collection of the outstanding debt. 2. Abilene Texas Petition for Credit Card Debt Collection — Fraudulent Charges: If the plaintiff believes that the debtor made fraudulent charges on the credit card, they can file a petition specifically addressing this issue. The plaintiff may provide evidence of the fraudulent activities committed by the debtor. 3. Abilene Texas Petition for Credit Card Debt Collection — Unpaid Balance: This type of petition is filed when the debtor has simply failed to make the required payments on their credit card debt. The plaintiff will outline the history of the missed payments and request the court's intervention in collecting the outstanding balance. 4. Abilene Texas Petition for Credit Card Debt Collection — Statute of Limitations: If the debt is beyond a certain timeframe defined by the statute of limitations, the plaintiff may file a petition seeking the court's permission to collect the debt. This petition involves providing details of the debt, its age, and explaining why the plaintiff believes they should still be able to pursue collection. 5. Abilene Texas Petition for Credit Card Debt Collection — Counterclaim: In some cases, the debtor may file a counterclaim against the plaintiff, alleging unfair or illegal practices. This type of petition addresses both the original debt and the counterclaim and allows the court to consider both parties' arguments. Overall, Abilene Texas Plaintiffs Original Petition for Credit Card Debt Collection serves as the initial legal step taken by the creditor or collection agency to begin the process of collecting the outstanding credit card debt from the debtor.

Free preview

How to fill out Abilene Texas Plaintiffs Original Petition For Credit Care Debt Collection?

If you’ve already used our service before, log in to your account and download the Abilene Texas Plaintiffs Original Petition for Credit Care Debt Collection on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Ensure you’ve found an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Abilene Texas Plaintiffs Original Petition for Credit Care Debt Collection. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!