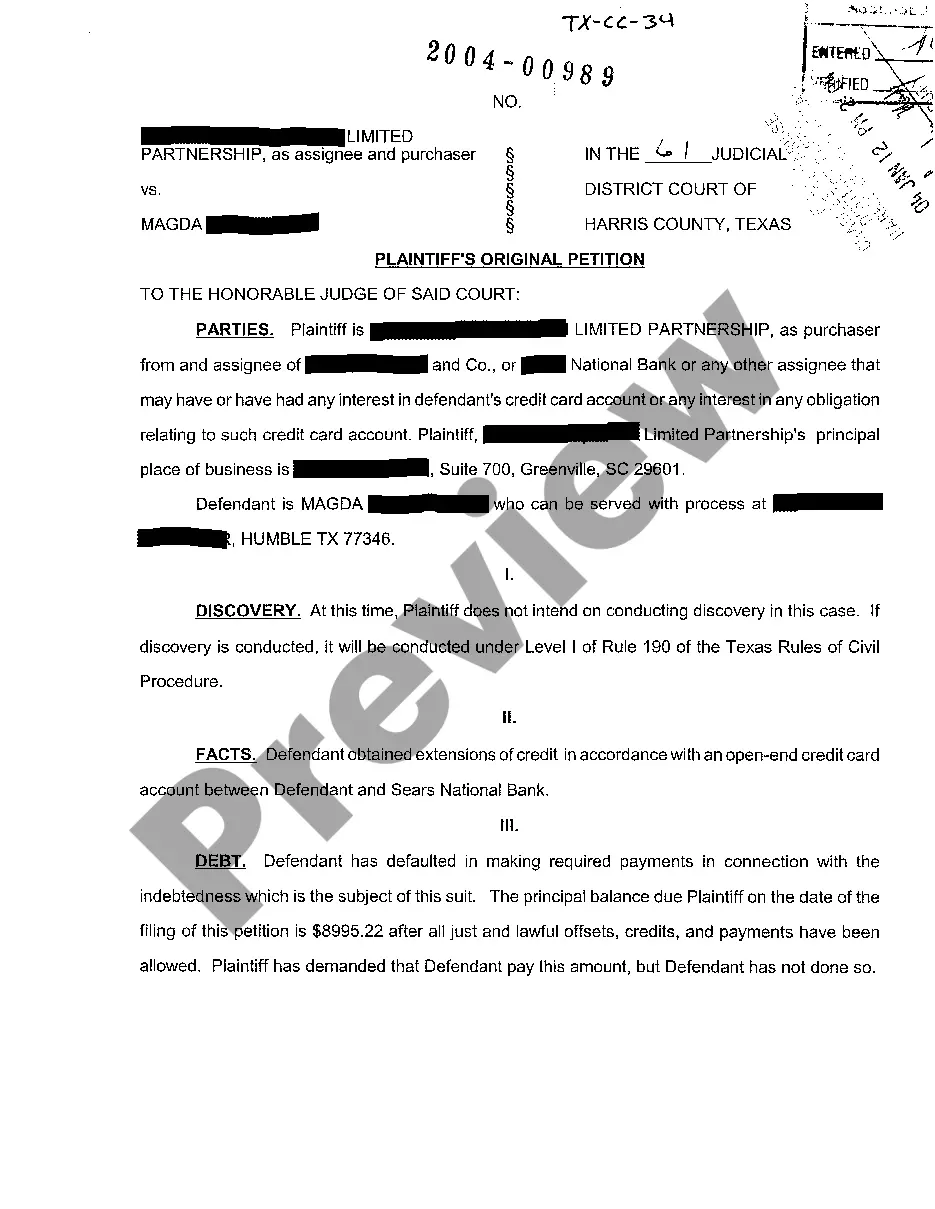

Dallas Texas Plaintiffs Original Petition for Credit Care Debt Collection is a legal document filed by the plaintiff seeking to recover outstanding debts on behalf of Credit Care. This petition initiates a civil lawsuit against the debtor in Dallas, Texas, focusing on credit card debt collection. The process begins with the plaintiff, often a law firm representing Credit Care, filing the original petition in the appropriate court. This document outlines the details of the credit card debt, including the outstanding balance, creditor's name (Credit Care), and the debtor's contact information. Keywords: Dallas, Texas, plaintiffs original petition, credit card debt collection, Credit Care, outstanding debts, civil lawsuit, law firm, court, debtor, credit card debt, outstanding balance, creditor, contact information. Different types of Dallas Texas Plaintiffs Original Petition for Credit Care Debt Collection may include: 1. Simplified Original Petition: This type of petition is used for small claims or cases involving smaller debt amounts. It may have fewer formal requirements and is usually used when the debtor owes a relatively small sum. 2. Fraudulent Debt Petition: If the plaintiff suspects the debtor of fraudulent activity related to the credit card debt, such as identity theft or unauthorized charges, they may file a fraudulent debt petition. This type of petition seeks to prove that the debtor is not responsible for the debt due to fraudulent circumstances. 3. Default Judgment Petition: When a debtor fails to respond or appear in court, the plaintiff may file a default judgment petition. This type of petition requests the court to grant a judgment in favor of the plaintiff due to the debtor's lack of response or appearance. 4. Counterclaim Petition: In some cases, the debtor may file a counterclaim against the plaintiff, alleging misconduct or violation of consumer protection laws. The counterclaim petition is a response to the original petition and seeks to address the debtor's grievances while maintaining the claim for debt collection. 5. Motion to Dismiss Petition: If the debtor believes that the plaintiff's original petition lacks legal validity or that they have valid defenses against the debt collection, they may file a motion to dismiss petition. This petition requests the court to dismiss the plaintiff's claim, citing legal grounds for doing so. Keywords: Dallas, Texas, plaintiffs original petition, credit card debt collection, Credit Care, simplified original petition, fraudulent debt petition, default judgment petition, counterclaim petition, motion to dismiss petition, small claims, debt amount, fraudulent activity, identity theft, unauthorized charges, response, appearance, misconduct, consumer protection laws, defenses.

Dallas Texas Plaintiffs Original Petition for Credit Care Debt Collection

Description

How to fill out Dallas Texas Plaintiffs Original Petition For Credit Care Debt Collection?

Take advantage of the US Legal Forms and obtain immediate access to any form sample you want. Our beneficial website with a large number of documents allows you to find and get virtually any document sample you need. You are able to save, fill, and certify the Dallas Texas Plaintiffs Original Petition for Credit Care Debt Collection in a couple of minutes instead of browsing the web for several hours looking for the right template.

Utilizing our library is an excellent way to increase the safety of your document submissions. Our professional attorneys on a regular basis check all the documents to ensure that the templates are appropriate for a particular state and compliant with new acts and regulations.

How can you obtain the Dallas Texas Plaintiffs Original Petition for Credit Care Debt Collection? If you have a profile, just log in to the account. The Download button will be enabled on all the documents you look at. In addition, you can get all the previously saved documents in the My Forms menu.

If you haven’t registered a profile yet, follow the tips listed below:

- Find the form you require. Ensure that it is the form you were hoping to find: check its name and description, and utilize the Preview function when it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the saving process. Click Buy Now and select the pricing plan you like. Then, create an account and pay for your order with a credit card or PayPal.

- Save the document. Pick the format to obtain the Dallas Texas Plaintiffs Original Petition for Credit Care Debt Collection and change and fill, or sign it according to your requirements.

US Legal Forms is probably the most significant and reliable form libraries on the web. Our company is always happy to assist you in virtually any legal case, even if it is just downloading the Dallas Texas Plaintiffs Original Petition for Credit Care Debt Collection.

Feel free to take advantage of our form catalog and make your document experience as straightforward as possible!