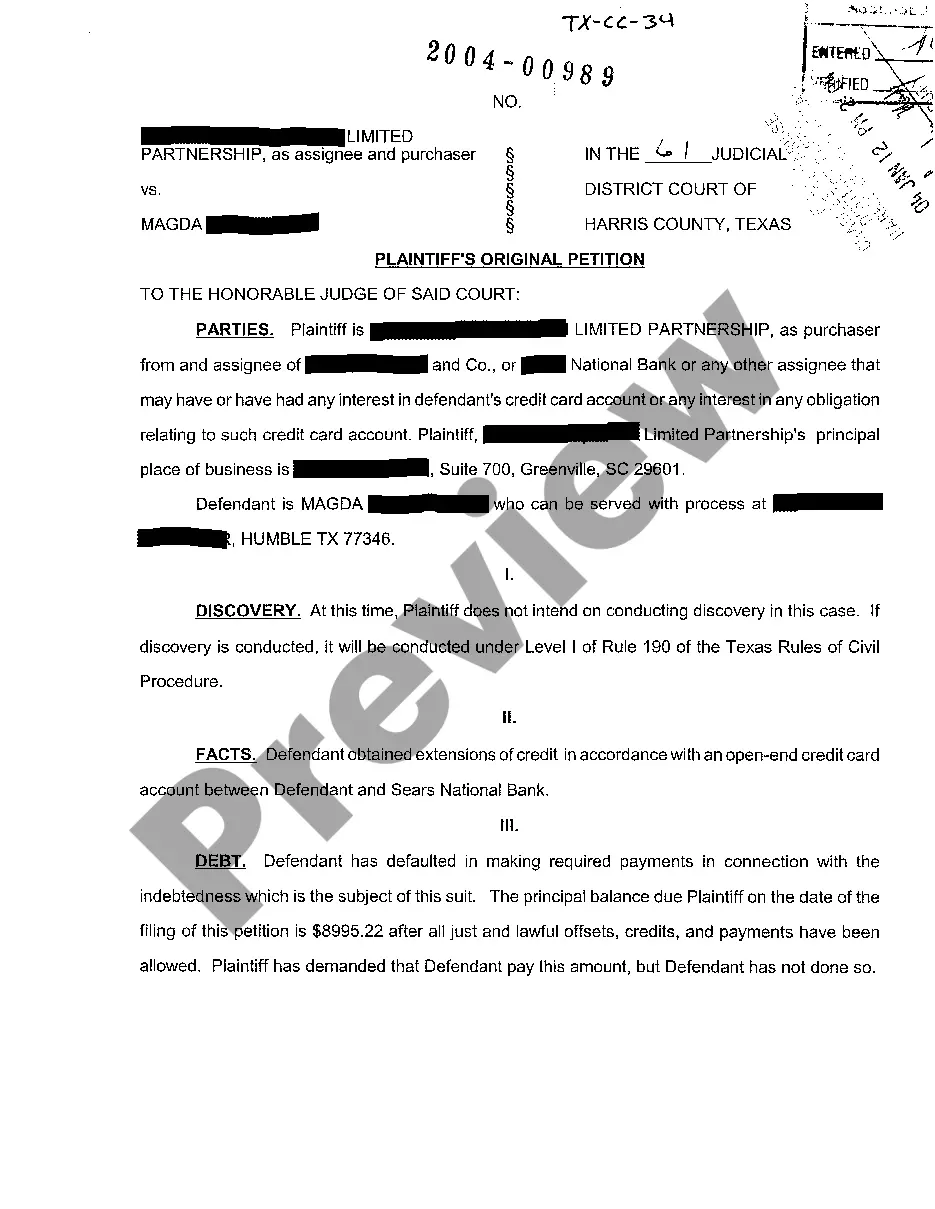

Harris Texas Plaintiffs Original Petition for Credit Card Debt Collection is a legal document filed by individuals or entities (plaintiffs) seeking to recover unpaid debts from individuals (defendants) in Harris County, Texas. This petition initiates a lawsuit and outlines important details related to the debt collection process. Here is a detailed description of the contents typically found in a Harris Texas Plaintiffs Original Petition for Credit Card Debt Collection: 1. Caption: The document starts with the court's name, cause number, the plaintiff's name (individual or company), their attorney's name, and the defendant's name. 2. Introduction: It contains introductory statements briefly summarizing the purpose of the petition. It may mention how the plaintiff and defendant are connected through a credit card agreement. 3. Parties: This section provides detailed information about the plaintiff and defendant involved in the debt collection case. It includes their legal names, addresses, contact information, and any additional identifying details that establish their relationship. 4. Jurisdiction: Here, the petition states the reason why the Harris County court has the authority to rule on this matter. It may cite applicable laws or provide reasons for why the lawsuit falls under the court's jurisdiction. 5. Facts: This section presents the specific details surrounding the debt. It discusses the nature of the credit card agreement, including the card issuer, account number, and related terms and conditions. It outlines the amount owed, itemizing the principal debt, interest, late fees, and any other charges associated with the account. 6. Breach of Agreement: This part establishes the defendant's violation of the credit card agreement. It explains how the defendant failed to fulfill their obligation to pay the debt as agreed upon, citing missed or late payments, defaulting on the account, or other breaches of the contractual terms. 7. Damages: The extent of damages incurred by the plaintiff is detailed here. It includes the total amount owed, broken down into individual components, such as the outstanding principal balance, accrued interest, fees, and any other costs directly related to the debt collection process. 8. Prayer for Relief: This section articulates the specific requests made by the plaintiff to the court. It typically includes demands for the total amount owed, prejudgment and post-judgment interest, attorney fees, and any additional relief deemed appropriate by the court. Types of Harris Texas Plaintiffs Original Petition for Credit Card Debt Collection: — Individual Plaintiff vs. Individual Defendant: This refers to a situation where a person is suing another person for unpaid credit card debt in Harris County, Texas. — Company Plaintiff vs. Individual Defendant: In this case, a company or credit card issuer files the petition against an individual debtor residing in Harris County. — Company Plaintiff vs. Company Defendant: This variation involves a corporate entity or financial institution pursuing legal action to collect unpaid credit card debt from another company or business in Harris County. By utilizing relevant keywords such as "Harris Texas Plaintiffs Original Petition for Credit Card Debt Collection," "lawsuit," "credit card agreement," "unpaid debt," "breach of agreement," and "Harris County Court," this description provides an informative overview of the content found in such a petition while also highlighting the various types that may exist.

Harris Texas Plaintiffs Original Petition for Credit Care Debt Collection

Description

How to fill out Harris Texas Plaintiffs Original Petition For Credit Care Debt Collection?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for a person with no legal education to draft such paperwork from scratch, mainly due to the convoluted jargon and legal nuances they entail. This is where US Legal Forms can save the day. Our platform offers a massive collection with more than 85,000 ready-to-use state-specific documents that work for almost any legal situation. US Legal Forms also serves as a great asset for associates or legal counsels who want to save time using our DYI forms.

No matter if you need the Harris Texas Plaintiffs Original Petition for Credit Care Debt Collection or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Harris Texas Plaintiffs Original Petition for Credit Care Debt Collection in minutes using our trusted platform. If you are presently an existing customer, you can go ahead and log in to your account to get the appropriate form.

Nevertheless, if you are unfamiliar with our platform, make sure to follow these steps before downloading the Harris Texas Plaintiffs Original Petition for Credit Care Debt Collection:

- Be sure the template you have chosen is good for your area since the rules of one state or county do not work for another state or county.

- Preview the form and go through a brief description (if available) of scenarios the paper can be used for.

- If the one you picked doesn’t suit your needs, you can start over and search for the suitable document.

- Click Buy now and pick the subscription plan that suits you the best.

- Access an account {using your credentials or register for one from scratch.

- Select the payment gateway and proceed to download the Harris Texas Plaintiffs Original Petition for Credit Care Debt Collection as soon as the payment is done.

You’re good to go! Now you can go ahead and print out the form or fill it out online. Should you have any issues locating your purchased documents, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.