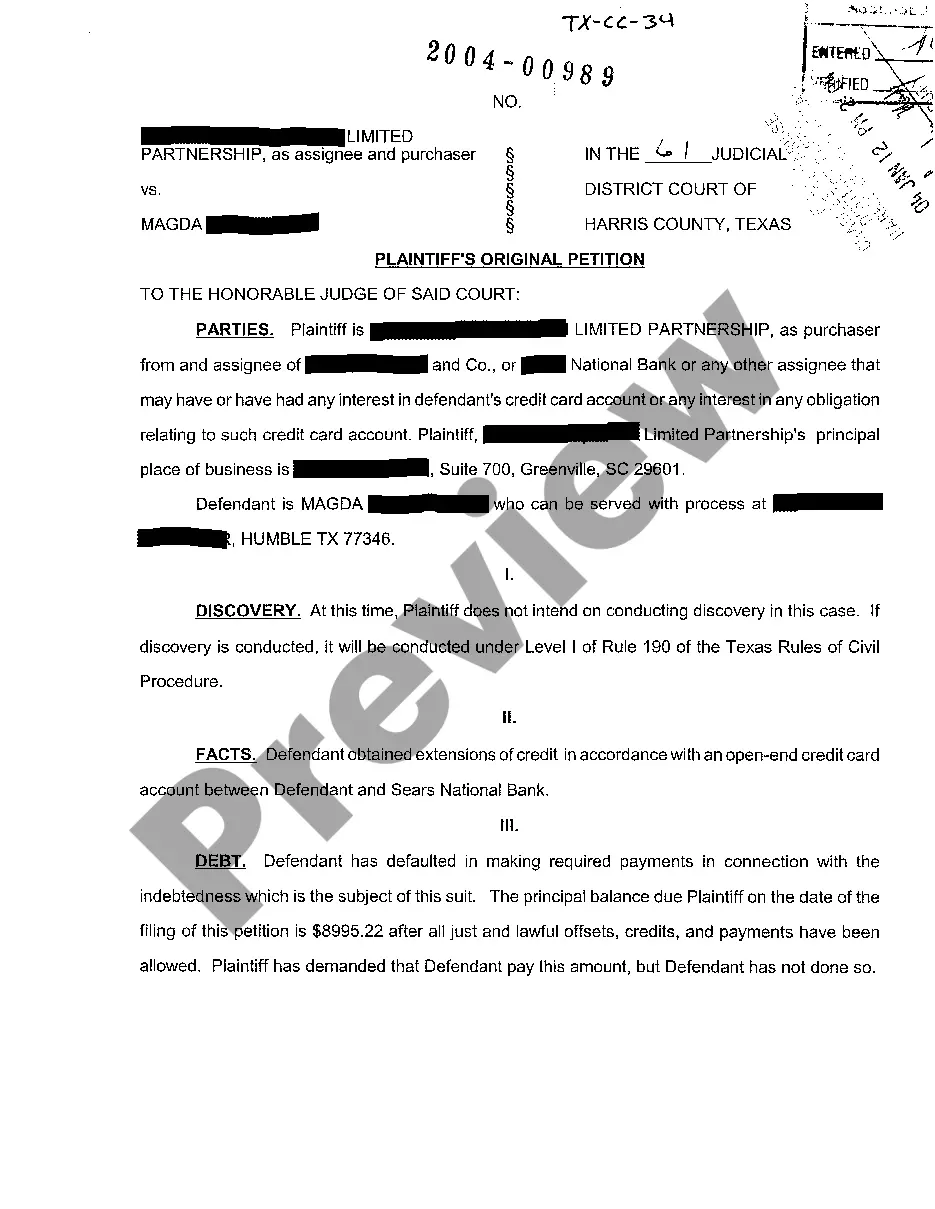

The Pearland Texas Plaintiffs Original Petition for Credit Care Debt Collection is a legal document filed by a plaintiff in Pearland, Texas, to initiate a lawsuit against an individual or entity for an outstanding debt owed to Credit Care. This petition serves as the initial step in the debt collection process and provides specific details regarding the case. Below is a detailed description of the various types and elements of Pearland Texas Plaintiffs Original Petition for Credit Care Debt Collection: 1. Overview: The Plaintiffs Original Petition outlines the purpose of the document, which is to seek legal action against the defendant for the non-payment of a debt owed to Credit Care. 2. Identification: The petition includes the full legal names of both the plaintiff (Credit Care) and the defendant (individual or entity in debt). It clearly states the addresses of both parties involved in the case. 3. Admissions: This section typically requests the defendant to admit owing a specific amount of debt to Credit Care. It may ask the defendant to verify the outstanding balance owed and any relevant account numbers. 4. Debt Details: The plaintiff's petition provides a comprehensive breakdown of the debt owed, including the original principal balance, any accrued interest or fees, and the current outstanding balance. This information is crucial in establishing the validity of the debt. 5. Payment History: The plaintiff may include a summary of the defendant's payment history, highlighting missed or late payments, as well as any attempts made by Credit Care to collect the debt. 6. Breach of Contract: If applicable, the petition may allege a breach of contract by the defendant. It provides details regarding the agreement or contract between the parties, emphasizing the terms and conditions related to the debt repayment. 7. Legal Basis: The petition states the specific legal grounds on which the plaintiff is seeking relief. It may cite relevant statutes, such as the Texas Debt Collection Act or the Fair Debt Collection Practices Act, to support the claim. 8. Prayer for Relief: This section outlines the specific relief the plaintiff is seeking from the court. It may include the full amount owed, interest, attorney's fees, court costs, and any additional damages. 9. Exhibits: The plaintiff's petition may attach supporting exhibits, such as account statements, loan agreements, correspondence, or other relevant documents that substantiate the debt and the plaintiff's right to collect it. Different types of Pearland Texas Plaintiffs Original Petition for Credit Care Debt Collection may involve variations in the underlying debt, such as credit card debt, personal loan debt, or medical debt. Each type of debt may require specific additional documentation or legal considerations in the petition. Keywords: Pearland Texas, Plaintiffs Original Petition, Credit Care Debt Collection, legal document, lawsuit, outstanding debt, debt owed, initiation of legal action, identification, admissions, debt details, payment history, breach of contract, legal basis, prayer for relief, exhibits, credit card debt, personal loan debt, medical debt.

Pearland Texas Plaintiffs Original Petition for Credit Care Debt Collection

Description

How to fill out Pearland Texas Plaintiffs Original Petition For Credit Care Debt Collection?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Pearland Texas Plaintiffs Original Petition for Credit Care Debt Collection becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Pearland Texas Plaintiffs Original Petition for Credit Care Debt Collection takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a few additional steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve chosen the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Pearland Texas Plaintiffs Original Petition for Credit Care Debt Collection. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!