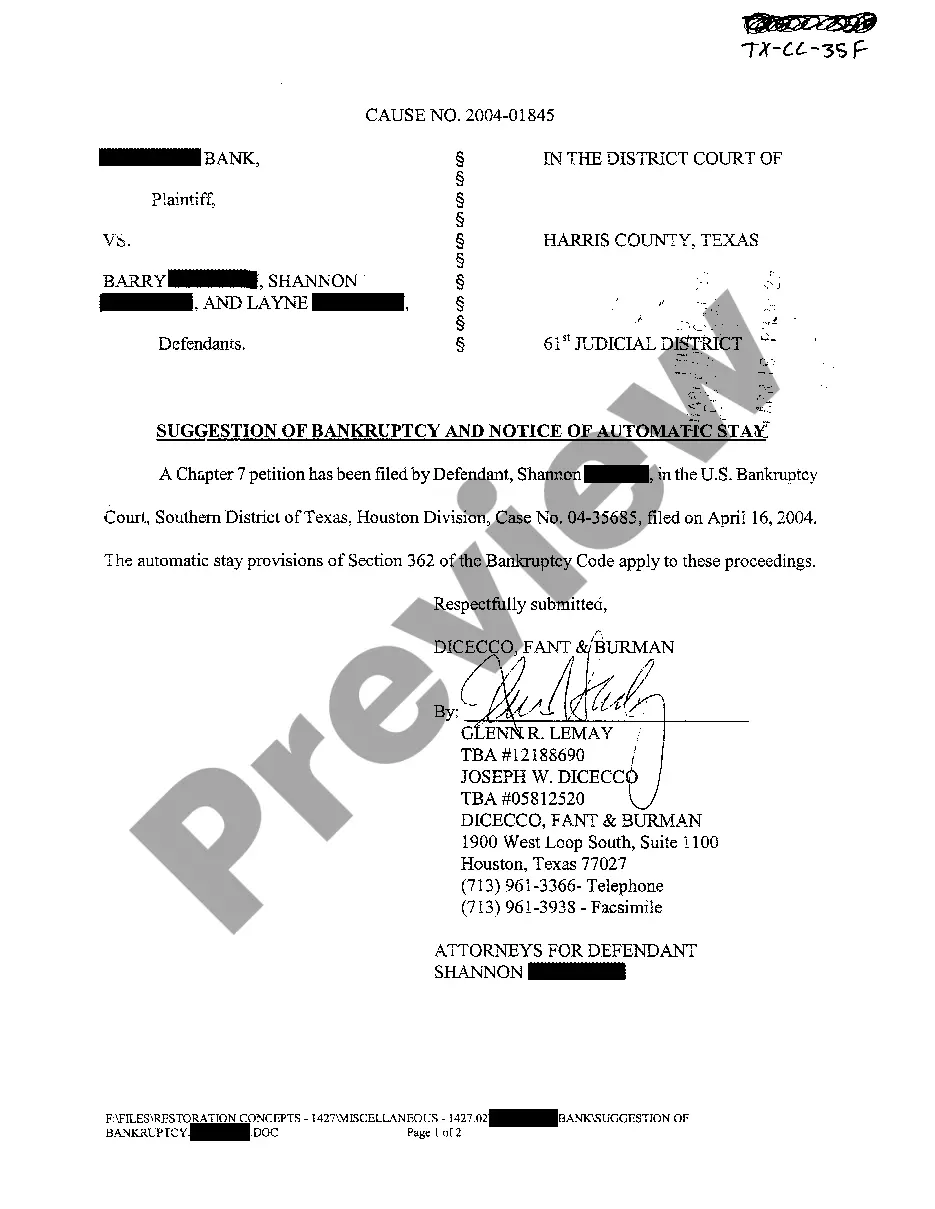

Title: McAllen, Texas Suggestion of Bankruptcy & Notice of Automatic Stay: A Comprehensive Overview Introduction: McAllen, Texas, serves as a vibrant city within Hidalgo County, known for its growing economy and diverse business landscape. However, individuals and businesses in McAllen may face financial difficulties, leading them to consider filing for bankruptcy. This article aims to provide in-depth information regarding the different types of McAllen, Texas Suggestion of Bankruptcy and Notice of Automatic Stay, shedding light on relevant keywords for improved understanding. 1. Chapter 7 Bankruptcy: Chapter 7 bankruptcy, often referred to as "liquidation bankruptcy," involves a debtor surrendering all non-exempt assets to a court-appointed trustee. The trustee then sells these assets to pay off creditors. The notice of automatic stay acts as a safeguard against creditor actions, halting collection proceedings and providing the debtor temporary relief from financial obligations. 2. Chapter 13 Bankruptcy: Chapter 13 bankruptcy, also known as "reorganization bankruptcy," allows individuals with a regular income to restructure their debts by creating a repayment plan, typically spanning three to five years. This option enables debtors to keep their property while making scheduled payments to creditors. The notice of automatic stay ensures that creditors cannot proceed with collection efforts during this period. 3. Chapter 11 Bankruptcy: Chapter 11 bankruptcy primarily applies to businesses seeking reorganization. It allows the debtor to propose a plan of reorganization, which may involve debt reduction or restructuring, to continue operations and repay creditors over time. The notice of automatic stay plays a crucial role in protecting the debtor's assets from aggressive creditor actions, allowing them to focus on their financial recovery. 4. Notice of Automatic Stay: Importance & Implications: The notice of automatic stay fundamentally serves to protect debtors from creditor harassment, wage garnishment, repossessions, utility disconnections, and other collection attempts while bankruptcy proceedings take place. It provides temporary respite, allowing debtors to regain control of their finances within the bounds of the law. Conclusion: Understanding the various types of McAllen, Texas Suggestion of Bankruptcy and Notice of Automatic Stay is crucial for individuals and businesses contemplating bankruptcy in McAllen. Whether it is Chapter 7, Chapter 13, or Chapter 11 bankruptcy, leveraging the automatic stay protects debtors from further financial distress, fostering an opportunity for recovery and a fresh start. (Note: The information provided here is purely informative and should not be considered as legal advice. It is recommended to consult with a bankruptcy attorney for personalized guidance based on specific circumstances.)

McAllen Texas Suggestion of Bankruptcy, Notice of Automatic Stay

Description

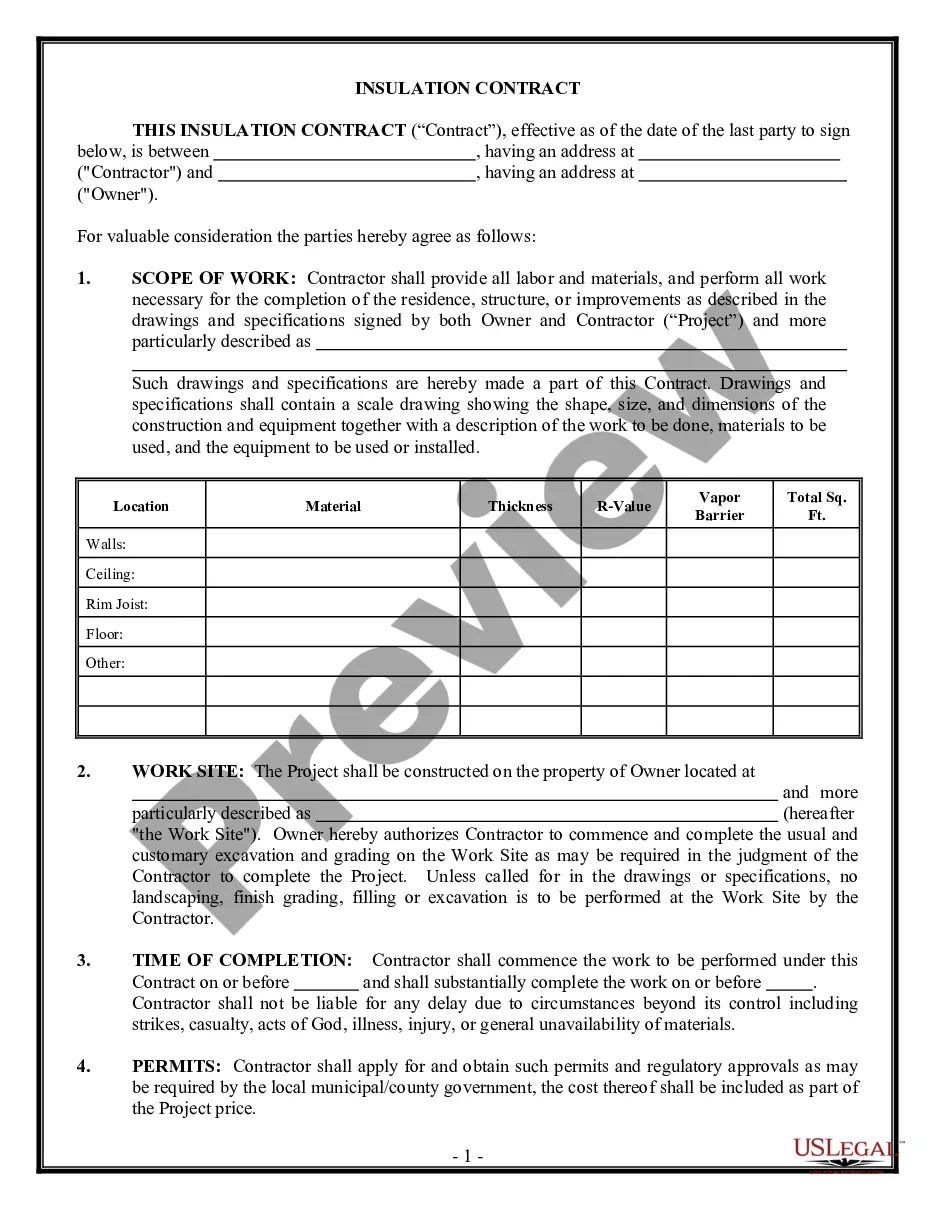

How to fill out McAllen Texas Suggestion Of Bankruptcy, Notice Of Automatic Stay?

If you are looking for a relevant form, it’s difficult to find a more convenient place than the US Legal Forms site – probably the most considerable libraries on the internet. With this library, you can get a huge number of document samples for company and personal purposes by types and states, or keywords. With the high-quality search option, getting the newest McAllen Texas Suggestion of Bankruptcy, Notice of Automatic Stay is as easy as 1-2-3. Moreover, the relevance of each and every document is confirmed by a team of skilled attorneys that regularly review the templates on our website and revise them according to the newest state and county demands.

If you already know about our platform and have an account, all you should do to get the McAllen Texas Suggestion of Bankruptcy, Notice of Automatic Stay is to log in to your account and click the Download button.

If you use US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have discovered the sample you require. Look at its description and use the Preview feature to check its content. If it doesn’t meet your requirements, utilize the Search option at the top of the screen to discover the proper record.

- Confirm your selection. Select the Buy now button. Following that, choose your preferred subscription plan and provide credentials to sign up for an account.

- Make the transaction. Use your credit card or PayPal account to finish the registration procedure.

- Obtain the form. Pick the format and download it to your system.

- Make adjustments. Fill out, revise, print, and sign the received McAllen Texas Suggestion of Bankruptcy, Notice of Automatic Stay.

Each form you save in your account has no expiry date and is yours forever. It is possible to access them using the My Forms menu, so if you need to get an extra duplicate for editing or creating a hard copy, you may return and export it once again whenever you want.

Make use of the US Legal Forms extensive library to gain access to the McAllen Texas Suggestion of Bankruptcy, Notice of Automatic Stay you were seeking and a huge number of other professional and state-specific templates on a single platform!