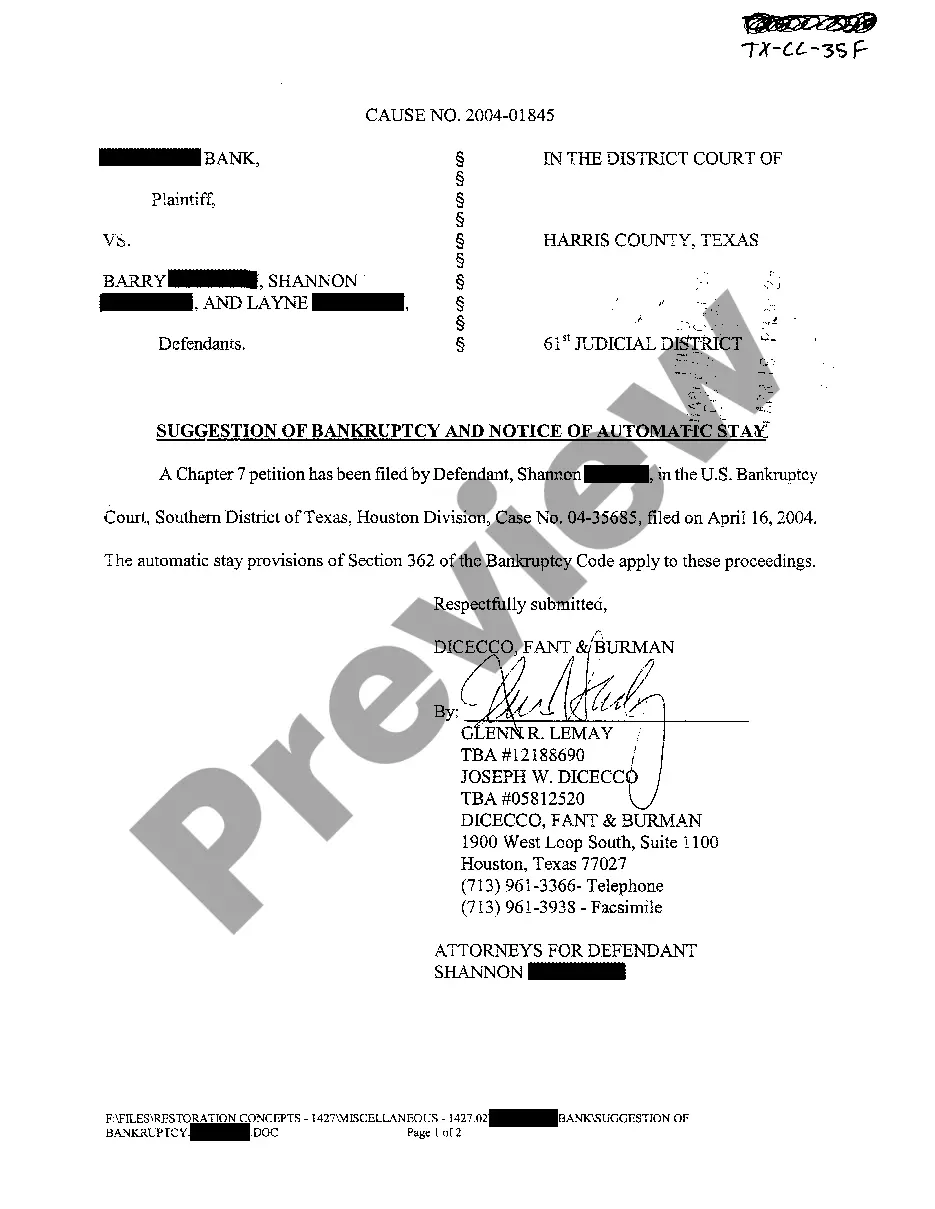

Pearland Texas is a city located in the greater Houston area of Texas. When an individual or business in Pearland faces overwhelming debt and is unable to repay their creditors, bankruptcy may be considered as an option. Bankruptcy provides a legal process to help debtors eliminate or restructure their debts while providing certain protections to both debtors and creditors. One type of Pearland Texas Suggestion of Bankruptcy is Chapter 7 bankruptcy. This type of bankruptcy is available to individuals and businesses and involves the liquidation of non-exempt assets to repay a portion of the debts owed. Chapter 7 bankruptcy allows individuals or businesses to obtain a fresh financial start by discharging certain debts. Another type of Pearland Texas Suggestion of Bankruptcy is Chapter 13 bankruptcy. This option is available to individuals only and involves creating a repayment plan to repay creditors over a period of three to five years. Chapter 13 bankruptcy allows debtors to keep their assets while establishing a reasonable payment plan based on their income and expenses. When a person or business files for bankruptcy in Pearland, they are usually issued a Notice of Automatic Stay. This notice informs creditors that an automatic stay has been implemented, meaning they must immediately stop all collection activities. The automatic stay prohibits creditors from pursuing lawsuits, making collection calls, repossessing property, or initiating foreclosure proceedings. By filing for bankruptcy and obtaining a Notice of Automatic Stay, debtors can experience the following benefits: — Protection from harassing collection calls: The automatic stay prevents creditors from contacting debtors to demand payment or engage in any collection activities. — Stopping foreclosure proceedings: If a debtor is facing a foreclosure on their home, filing for bankruptcy and obtaining an automatic stay can temporarily halt the process, giving them time to catch up on their missed payments or explore other options. — Halting wage garnishment: The automatic stay also puts a stop to wage garnishment, allowing individuals to keep their full paycheck and allocate their income towards necessary expenses. — Protection against utility disconnections: Bankruptcy and the automatic stay can prevent utility companies from disconnecting essential services, such as water or electricity. It is important to note that bankruptcy laws and regulations can vary, so it is advisable to seek legal counsel from a qualified bankruptcy attorney in the Pearland Texas area to understand the specific processes and options available for your situation.

Pearland Texas Suggestion of Bankruptcy, Notice of Automatic Stay

Description

How to fill out Pearland Texas Suggestion Of Bankruptcy, Notice Of Automatic Stay?

If you are searching for a valid form template, it’s difficult to find a more convenient service than the US Legal Forms website – one of the most extensive libraries on the internet. With this library, you can get a large number of templates for organization and individual purposes by categories and states, or key phrases. With the high-quality search option, getting the most up-to-date Pearland Texas Suggestion of Bankruptcy, Notice of Automatic Stay is as elementary as 1-2-3. In addition, the relevance of each document is confirmed by a group of skilled attorneys that regularly review the templates on our website and update them in accordance with the latest state and county laws.

If you already know about our platform and have an account, all you need to get the Pearland Texas Suggestion of Bankruptcy, Notice of Automatic Stay is to log in to your account and click the Download button.

If you use US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have found the form you need. Check its information and utilize the Preview feature (if available) to see its content. If it doesn’t suit your needs, use the Search field at the top of the screen to find the needed document.

- Confirm your decision. Select the Buy now button. After that, select the preferred pricing plan and provide credentials to sign up for an account.

- Make the financial transaction. Utilize your bank card or PayPal account to finish the registration procedure.

- Obtain the template. Select the file format and save it to your system.

- Make adjustments. Fill out, revise, print, and sign the acquired Pearland Texas Suggestion of Bankruptcy, Notice of Automatic Stay.

Every template you save in your account does not have an expiration date and is yours permanently. You can easily gain access to them via the My Forms menu, so if you want to receive an additional duplicate for enhancing or creating a hard copy, you may return and download it again at any time.

Take advantage of the US Legal Forms professional collection to gain access to the Pearland Texas Suggestion of Bankruptcy, Notice of Automatic Stay you were seeking and a large number of other professional and state-specific samples on one platform!