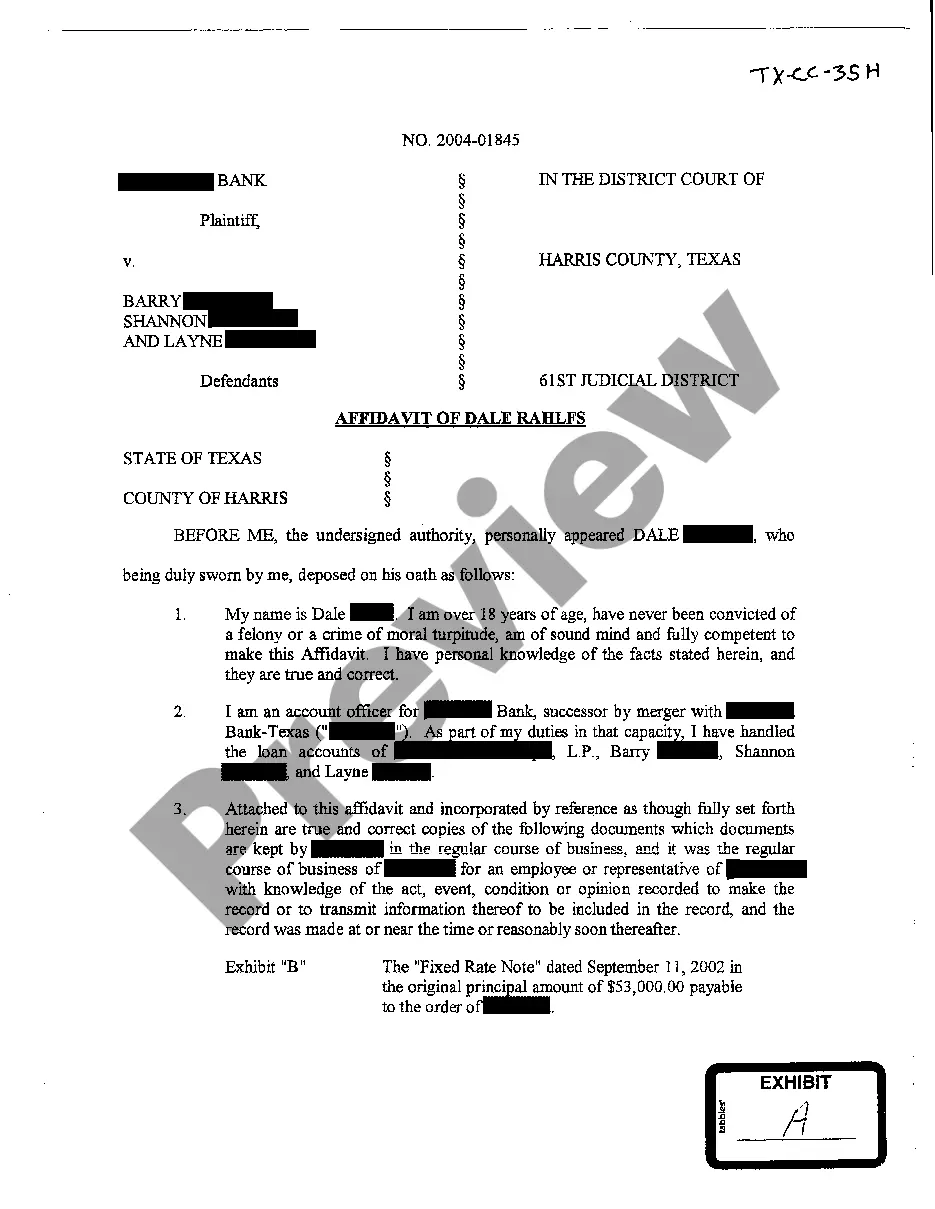

College Station, Texas Affidavit of Plaintiff is a legal document used to provide a detailed description of a debt owed in specific legal proceedings. This affidavit serves as evidence submitted by the plaintiff to support their claim of debt owed. It contains essential information related to the debt, including the amount owed, the parties involved, and the terms and conditions of the debt agreement. In College Station, Texas, there are various types of Affidavits of Plaintiff detailing debt owed, including: 1. College Station Texas Affidavit of Plaintiff — Credit Card Debt: This affidavit is used when a plaintiff seeks to recover unpaid credit card debts. It includes information about the credit card issuer, the outstanding balance, interest rates, and payment history. 2. College Station Texas Affidavit of Plaintiff — Student Loan Debt: This affidavit is utilized in cases where a plaintiff is attempting to collect on unpaid student loan debt. It outlines the loan details, such as the loan provider, loan amount, terms of repayment, and any relevant documents supporting the debt. 3. College Station Texas Affidavit of Plaintiff — Medical Debt: This type of affidavit is employed by a plaintiff seeking payment for outstanding medical bills. It includes details about medical services rendered, the healthcare provider, billing statements, and any insurance claims information. 4. College Station Texas Affidavit of Plaintiff — Loan Default: This affidavit is used when a plaintiff is pursuing repayment of a defaulted loan. It presents information about the loan agreement, default terms, payment history, and any relevant documents establishing the debt. 5. College Station Texas Affidavit of Plaintiff — Personal Loan Debt: When a plaintiff is attempting to recover money owed from a personal loan, this affidavit is utilized. It includes specifics about the loan amount, interest rates, repayment terms, and any supporting documents related to the loan. In all these types of affidavits, the information provided should be detailed, accurate, and supported by appropriate documentation. The affidavit acts as a crucial piece of evidence, and any false information or inaccuracies can weaken the plaintiff's case. Keywords: College Station Texas, Affidavit of Plaintiff, debt owed, legal proceedings, evidence, plaintiff, claim, credit card debt, student loan debt, medical debt, loan default, personal loan debt.

College Station Texas Affidavit of Plaintiff detailing debt owed

Description

How to fill out College Station Texas Affidavit Of Plaintiff Detailing Debt Owed?

If you’ve already utilized our service before, log in to your account and download the College Station Texas Affidavit of Plaintiff detailing debt owed on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make sure you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your College Station Texas Affidavit of Plaintiff detailing debt owed. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!

Form popularity

FAQ

To create an affidavit in Texas, you need to draft a written statement, include the necessary details, and have it signed before a notary. It should clearly outline the facts and assertions you want to verify, which is essential in a College Station Texas Affidavit of Plaintiff detailing debt owed. Using platforms like USLegalForms can help you access templates and guidelines that make drafting an affidavit straightforward.

A pauper's affidavit in Texas allows individuals who cannot afford legal costs to pursue their case without paying fees upfront. This affidavit states the individual's financial status and may waive court costs. If your College Station Texas Affidavit of Plaintiff detailing debt owed involves financial hardship, filing a pauper's affidavit can provide you access to the court system. It is a vital tool for those in need.

In Texas, the deadline to serve medical billing affidavits is typically set at 30 days before the trial date. This timing ensures that all parties have adequate notice and preparation time. When you are working on your College Station Texas Affidavit of Plaintiff detailing debt owed, adhering to this deadline is crucial for the success of your case. Always check with local rules or consult with a legal expert to be certain.

Yes, in Texas, an affidavit must be notarized to be valid. This notarization process verifies the identity of the person making the affidavit, which adds a layer of authenticity. When dealing with a College Station Texas Affidavit of Plaintiff detailing debt owed, having it notarized strengthens your legal standing. Without notarization, your affidavit may not hold up in court.

To answer a lawsuit for debt collection in Texas, you should first read the complaint carefully and note your defenses. You must file your answer with the court within the required timeframe to avoid default judgment. In your response, consider referencing a College Station Texas Affidavit of Plaintiff detailing debt owed to clarify any disputes regarding the debt. US Legal Forms can assist you in drafting a comprehensive answer that adheres to Texas legal standards.

To fill out a debt validation letter, start by including your personal details and the date at the top. Clearly state the request for validation of the debt, including all pertinent information about the debt, such as the creditor’s name and amount owed. Remember, the College Station Texas Affidavit of Plaintiff detailing debt owed can offer guidance on structuring your letter correctly. US Legal Forms provides templates to streamline this process.

Yes, sending a debt validation letter is generally a good idea, as it empowers you to verify the debt and protects your rights. This letter can help you identify whether the debt is valid and if the creditor has proper documentation. Additionally, using a College Station Texas Affidavit of Plaintiff detailing debt owed can provide legal backing for your claim. It’s an effective tool to ensure fairness in the debt collection process.

The best sample for a debt validation letter clearly outlines the necessary elements, such as your contact information, details of the debt, and a request for verification from the creditor. Look for templates that comply with Texas state laws to ensure you follow legal formats. Using a College Station Texas Affidavit of Plaintiff detailing debt owed can serve as an excellent reference for creating your letter. US Legal Forms offers reliable samples that you can customize to suit your needs.

Filling out a debt validation letter involves including key details such as your name, address, and the date. You should also provide specifics about the debt in question, such as the amount owed and the creditor's name. This ensures clarity and aids in requesting verification of the debt. For a detailed process, consider using a College Station Texas Affidavit of Plaintiff detailing debt owed template available on US Legal Forms.

An affidavit of debt is a legal document that serves as a sworn statement confirming the existence and amount of a debt owed. It is often used in court proceedings to provide evidence about the debt in question. By creating a College Station Texas Affidavit of Plaintiff detailing debt owed, you can effectively communicate your position to the court, helping to clarify the facts surrounding your financial obligation.