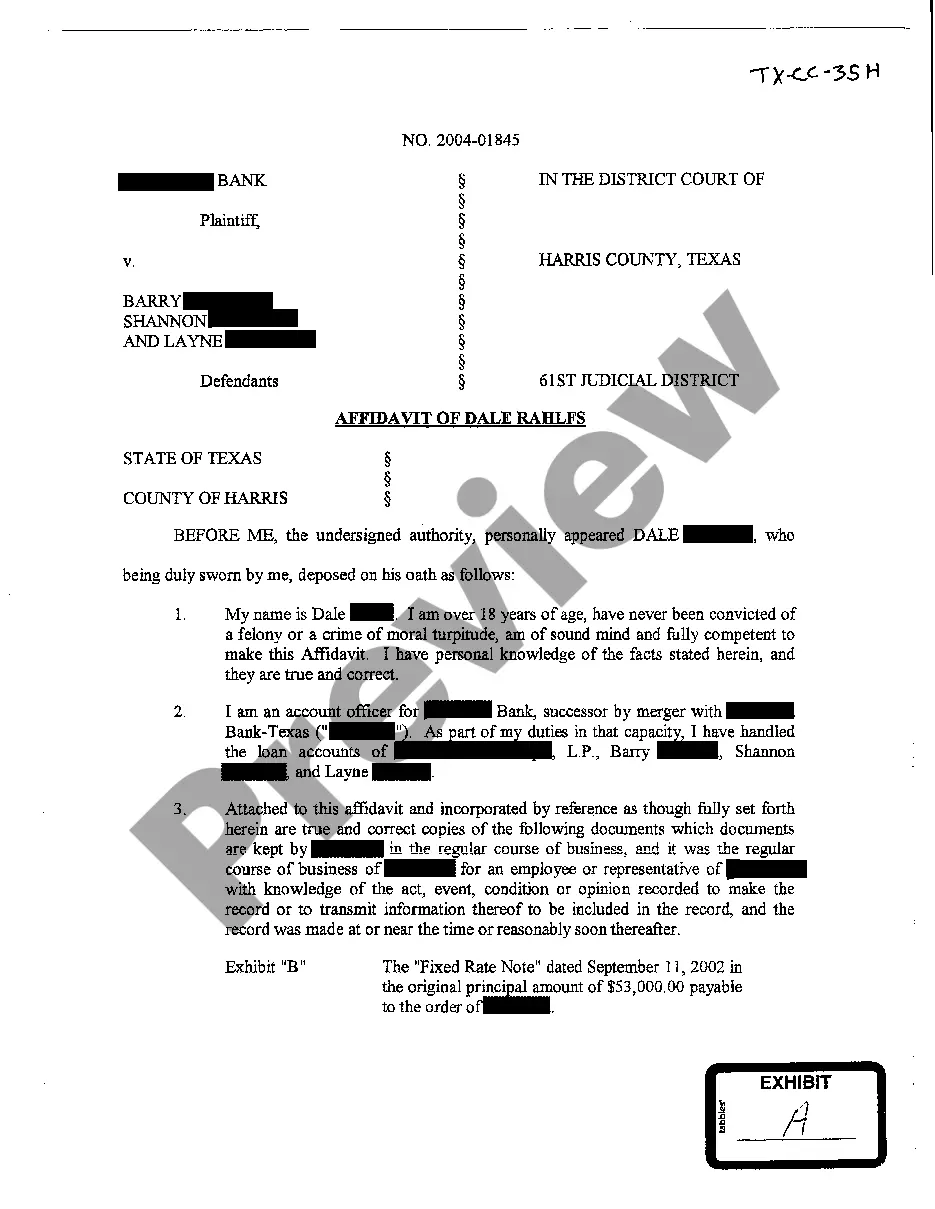

Grand Prairie Texas Affidavit of Plaintiff is a legal document used in debt collection cases to provide a detailed description of the debt owed by the defendant. It serves as evidence and is signed by the plaintiff, affirming the accuracy of the information contained within it. This affidavit plays a crucial role in court proceedings by helping establish the validity of the debt and the defendant's obligation to repay it. In Grand Prairie, Texas, there are a few different types of Affidavits of Plaintiff detailing debt owed that creditors may use: 1. Original Creditor's Affidavit: This type of affidavit is typically filed by the original creditor, such as a credit card company or a lender. It includes detailed information about the original debt, such as the amount owed, the account number, the date of default, and any pertinent account history. 2. Debt Buyer's Affidavit: Debt buyers are third-party entities that purchase debts from original creditors. When they file an Affidavit of Plaintiff detailing debt owed, they include information about the purchase transaction, the assignment of the debt, and any supporting documents proving the transfer of ownership. 3. Affidavit of Assignee: Sometimes, a creditor may assign the debt to another party for collection purposes. In such cases, the assignee files an Affidavit of Plaintiff to assert their right to collect the owed debt. This affidavit should provide details of the assignment, including the effective date and supporting documentation. For each type of Grand Prairie Texas Affidavit of Plaintiff, it is crucial to include key information such as the full name of the plaintiff, the defendant's full legal name, the nature of the debt, the amount owed, any interest or fees accumulated, and any supporting documentation that strengthens the claims made in the affidavit. In conclusion, the Grand Prairie Texas Affidavit of Plaintiff detailing debt owed is a vital legal document used in debt collection cases. It provides a comprehensive account of the debt, helping to establish the plaintiff's claim and the defendant's obligation to repay. By filing the appropriate type of affidavit based on the nature of the debt, creditors ensure they have a strong case in court.

Grand Prairie Texas Affidavit of Plaintiff detailing debt owed

Description

How to fill out Grand Prairie Texas Affidavit Of Plaintiff Detailing Debt Owed?

No matter one's societal or occupational position, completing legal documents is an unfortunate requirement in the current professional landscape.

Frequently, it is nearly impossible for an individual without legal experience to generate such documentation from the ground up, primarily because of the intricate terminology and legal nuances involved.

This is where US Legal Forms can provide assistance.

Ensure the form you have selected is appropriate for your region since the laws of one state or locality may not apply to another.

Preview the document and review a brief description (if available) of the situations for which the form can be utilized.

- Our service boasts an extensive library of over 85,000 state-specific documents that are suitable for nearly any legal circumstance.

- US Legal Forms is also an invaluable resource for associates or legal advisors aiming to save time with our DIY forms.

- Whether you need the Grand Prairie Texas Affidavit of Plaintiff addressing debt owed or any other paperwork applicable in your state or locality, US Legal Forms has you covered.

- Here’s how to quickly obtain the Grand Prairie Texas Affidavit of Plaintiff concerning debt owed using our reliable service.

- If you are already a customer, simply Log In to your account to download the form you need.

- However, if you are new to our platform, make sure to follow these steps before securing the Grand Prairie Texas Affidavit of Plaintiff regarding debt owed.

Form popularity

FAQ

In Dallas County, the small claims limit remains at $20,000, which is consistent with statewide rules. This amount includes claims for debts, damages, and other financial disputes. Filing a Grand Prairie Texas Affidavit of Plaintiff detailing debt owed can help simplify the process and clarify your claim within this limit. It is beneficial for individuals looking to ensure they remain within the legal boundaries while pursuing their rights.

The limit for small claims court in Dallas County is also $20,000, aligning with Texas state regulations. This cap allows individuals to settle disputes over debts and small financial claims effectively. When filing a claim, you may reference a Grand Prairie Texas Affidavit of Plaintiff detailing debt owed to substantiate your position. Understanding this limit can empower you to pursue debt recovery confidently.

In Texas, the maximum amount you can sue for in small claims court is $20,000. This limit applies to cases where you agree to handle disputes without a lawyer, including debt recovery through instruments like the Grand Prairie Texas Affidavit of Plaintiff detailing debt owed. It’s designed to help individuals collect small amounts owed without incurring significant legal fees. Careful attention to this limit can help you effectively pursue debt claims.

A debt claim is a legal demand for payment of a debt owed by one party to another. In the context of a Grand Prairie Texas Affidavit of Plaintiff detailing debt owed, it serves as an essential tool to outline the specifics of the obligation. This document formalizes the request for repayment and can be used in court proceedings to enforce the debt. Understanding how to file a debt claim can help you effectively recover what is owed.

Yes, Texas offers various debt relief programs aimed at helping residents manage their debts. These programs may include credit counseling and debt management plans. By exploring your options, you might find a solution that works best for your situation. A Grand Prairie Texas Affidavit of Plaintiff detailing debt owed could also support your case for seeking relief.

In Texas, the statute of limitations for most debts is four years. After this period, debt collectors can no longer sue you to collect the debt. It is essential to track the timeline to protect your financial reputation. Incorporating a Grand Prairie Texas Affidavit of Plaintiff detailing debt owed could provide clarity on your obligations.

Often, debt collectors may be willing to negotiate or settle for less than the full amount. You might also request validation of the debt to ensure its legitimacy. Additionally, consulting a Grand Prairie Texas Affidavit of Plaintiff detailing debt owed can be a strategic method to address discrepancies without immediate payment.

The 11-word phrase to stop debt collectors is, 'I request that you cease all communication with me.' This phrase clearly communicates your wishes and legal rights under the Fair Debt Collection Practices Act. Always keep a record of your communication when dealing with such matters. Referring to a Grand Prairie Texas Affidavit of Plaintiff detailing debt owed can also be beneficial.

To dispute a debt collection in Texas, you should send a written notice to the collector within 30 days of their initial contact. Include details stating why you dispute the debt, along with any supporting documentation. Utilizing a Grand Prairie Texas Affidavit of Plaintiff detailing debt owed can help you outline your position more formally.

To get a debt lawsuit dismissed in Texas, you may file a motion to dismiss for lack of evidence or improper service. Ensure that you present valid arguments and documentations to support your case. A well-prepared Grand Prairie Texas Affidavit of Plaintiff detailing debt owed can aid in substantiating your claims.