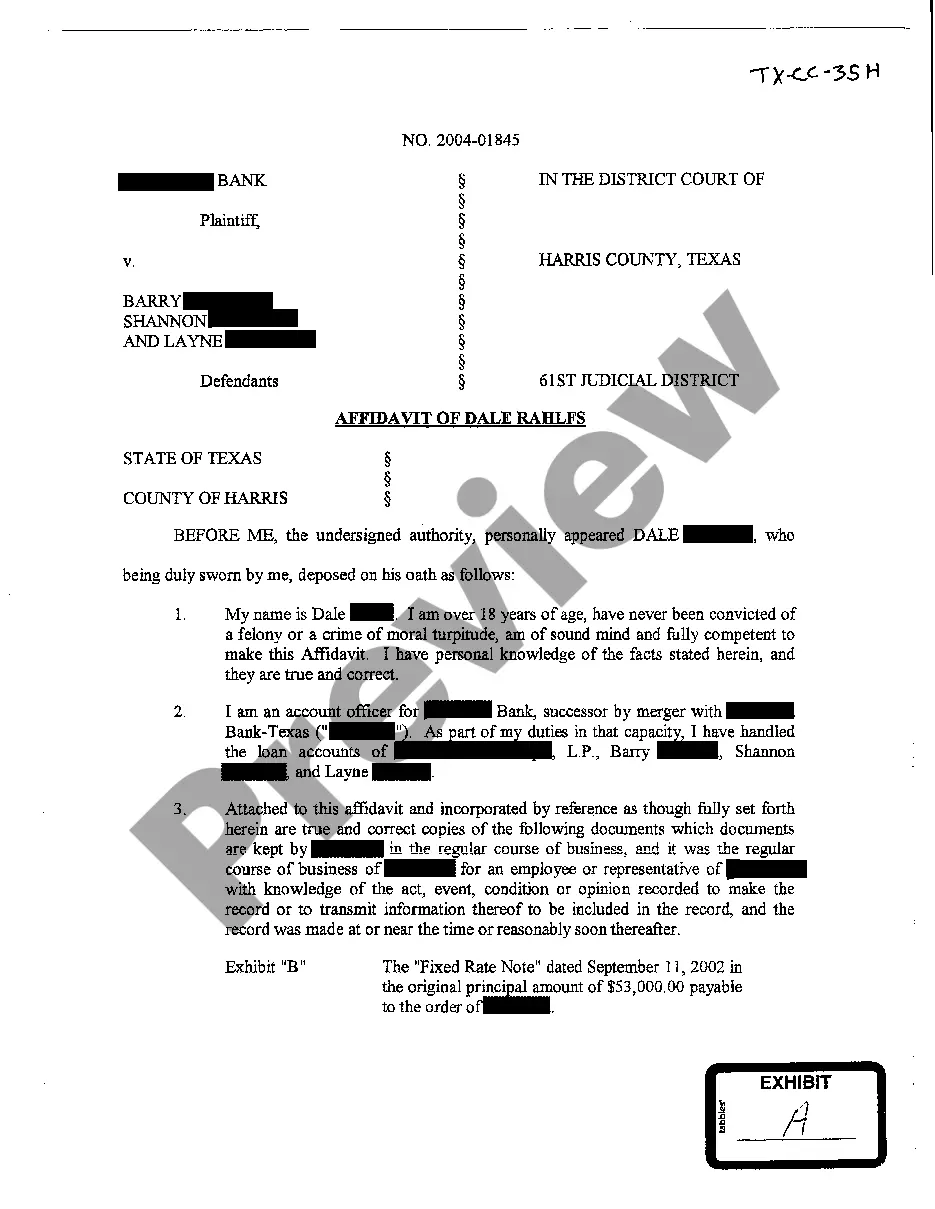

The Pasadena Texas Affidavit of Plaintiff detailing debt owed is a legal document used in civil lawsuits to provide a comprehensive description of the debt owed by the defendant to the plaintiff. This affidavit is necessary for initiating legal proceedings and serves as evidence of the debt owed. Key elements typically included in the Pasadena Texas Affidavit of Plaintiff detailing debt owed are: 1. Plaintiff Information: The affidavit begins by providing the plaintiff's details, such as name, address, and contact information. This information establishes the identity of the party filing the affidavit. 2. Defendant Information: The affidavit also includes the defendant's details, such as name, address, and any known contact information. This information helps identify the party against whom the debt is claimed. 3. Debt Description: The document elaborates on the nature and description of the debt owed. It includes crucial details such as the original amount owed, the date on which the debt was incurred or became due, and any applicable interest rates or additional charges. 4. Supporting Documentation: To substantiate the claim, the affidavit may include supporting documents such as invoices, contracts, account statements, or promissory notes. These documents provide tangible evidence of the debt and its legitimacy. 5. Payment History: The affidavit may outline the history of payments made by the defendant, if any, as this information showcases the attempts made to resolve the debt prior to legal action. 6. Calculation of Outstanding Amount: The affidavit details the calculations used to determine the total outstanding amount owed, including any interest, fees, penalties, or late charges applied. This provides transparency in the debt calculation process. 7. Affine Statement: The affidavit is typically signed and sworn before a notary public by an individual with personal knowledge of the debt and its details. This person, known as the affine, attests that the information provided in the affidavit is true and accurate to the best of their knowledge. Different types of Pasadena Texas Affidavits of Plaintiff detailing debt owed may not vary significantly in terms of content but rather in terms of the specific type of debt being claimed. Some examples of specific types may include: 1. Pasadena Texas Affidavit of Plaintiff detailing credit card debt owed. 2. Pasadena Texas Affidavit of Plaintiff detailing medical debt owed. 3. Pasadena Texas Affidavit of Plaintiff detailing personal loan debt owed. 4. Pasadena Texas Affidavit of Plaintiff detailing mortgage debt owed. 5. Pasadena Texas Affidavit of Plaintiff detailing auto loan debt owed. In conclusion, the Pasadena Texas Affidavit of Plaintiff detailing debt owed is a crucial document in civil lawsuits. It outlines essential information regarding the debt, substantiating the plaintiff's claim against the defendant. With supporting documentation and a sworn statement by an affine, this affidavit provides the necessary proof to initiate legal action and seek resolution for the debt owed.

Pasadena Texas Affidavit of Plaintiff detailing debt owed

Description

How to fill out Pasadena Texas Affidavit Of Plaintiff Detailing Debt Owed?

We always want to minimize or avoid legal issues when dealing with nuanced law-related or financial matters. To accomplish this, we apply for legal services that, as a rule, are very expensive. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of legal counsel. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Pasadena Texas Affidavit of Plaintiff detailing debt owed or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the Pasadena Texas Affidavit of Plaintiff detailing debt owed complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Pasadena Texas Affidavit of Plaintiff detailing debt owed is suitable for you, you can pick the subscription plan and make a payment.

- Then you can download the document in any suitable format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!