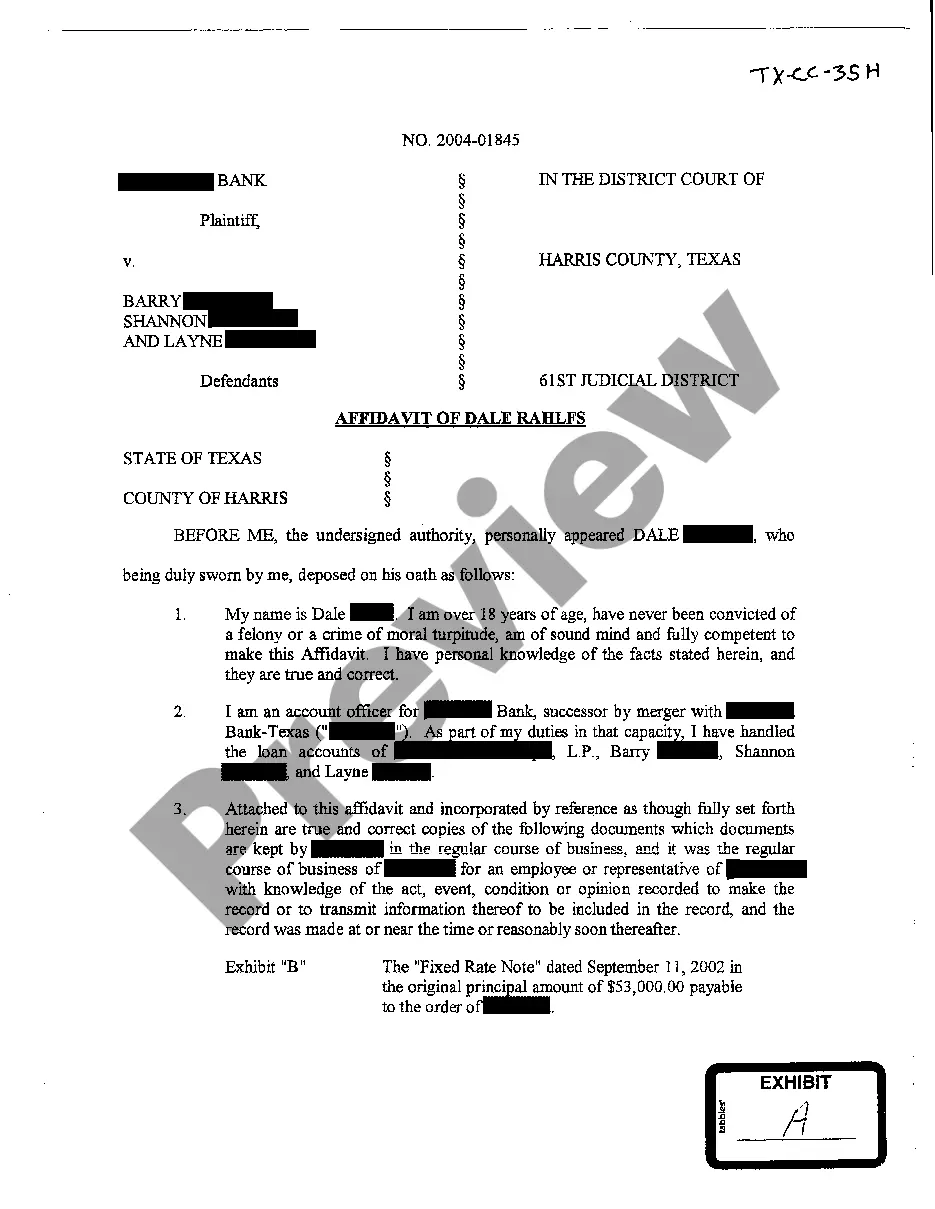

The Plano Texas Affidavit of Plaintiff is a legal document that serves as a detailed description of the debt owed by an individual or entity. It outlines pertinent information related to the debt, including the amount owed, parties involved, and any relevant supporting documents. The Affidavit of Plaintiff is crucial in debt collection cases as it provides a record of the debt and strengthens the plaintiff's case. In Plano, Texas, there are different types of Affidavits of Plaintiff that can be utilized in debt-related matters. Some of these variations may include: 1. Affidavit of Plaintiff — Unsecured Debt: This type of affidavit is used when the debt owed does not have any collateral or security attached to it. It could include credit card debts, medical bills, or personal loans, where the lender does not have a specific asset tied to the debt. 2. Affidavit of Plaintiff — Secured Debt: In cases where the debt is secured by collateral, such as a mortgage or a car loan, this type of affidavit is applicable. It outlines the specific asset or property attached to the debt, providing additional evidence for the plaintiff's claim. 3. Affidavit of Plaintiff — Business Debt: This variation is used when the debt owed is related to a business. It may involve outstanding payments for goods or services provided, unpaid invoices, or breach of contract related debts. 4. Affidavit of Plaintiff — Consumer Debt: This type of affidavit is specific to debts incurred by individuals for personal purposes. It encompasses credit card debts, student loans, and other similar consumer-related financial obligations. The Affidavit of Plaintiff in Plano, Texas, typically includes the following key information: 1. Plaintiff Information: The affidavit starts by identifying the plaintiff, including their name, address, and contact details. It establishes the legal standing of the party making the claim. 2. Defendant Information: The affidavit includes the defendant's details, such as name, address, and any other pertinent information. This helps clearly identify the party responsible for the debt. 3. Debt Details: The affidavit outlines the nature of the debt, including the amount owed, the date it was incurred, and any relevant terms and conditions agreed upon. It may reference any previous agreements or contracts related to the debt. 4. Supporting Documentation: The affidavit includes copies or references to supporting documents that validate the debt owed. This can include invoices, billing statements, contracts, or any other evidence that supports the plaintiff's claim. 5. Statement of Truth: The affidavit concludes with a statement of truth, confirming that the information provided is accurate to the best of the plaintiff's knowledge. It may also include a notarization or certification section, depending on the legal requirements. When filing a Plano Texas Affidavit of Plaintiff detailing debt owed, it is vital to consult with an attorney to ensure compliance with local laws and regulations. The content provided should be accurate, complete, and supported by relevant evidence to strengthen the plaintiff's case during debt collection proceedings.

Plano Texas Affidavit of Plaintiff detailing debt owed

Description

How to fill out Plano Texas Affidavit Of Plaintiff Detailing Debt Owed?

Regardless of social or professional status, filling out legal forms is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for a person without any legal education to create such papers from scratch, mostly because of the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes in handy. Our platform provides a huge catalog with over 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

Whether you require the Plano Texas Affidavit of Plaintiff detailing debt owed or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Plano Texas Affidavit of Plaintiff detailing debt owed quickly using our trustworthy platform. In case you are already a subscriber, you can go ahead and log in to your account to get the appropriate form.

However, if you are a novice to our library, make sure to follow these steps prior to obtaining the Plano Texas Affidavit of Plaintiff detailing debt owed:

- Be sure the form you have found is specific to your area considering that the rules of one state or county do not work for another state or county.

- Review the document and go through a brief description (if available) of cases the paper can be used for.

- If the one you picked doesn’t meet your needs, you can start over and search for the necessary document.

- Click Buy now and choose the subscription option you prefer the best.

- Log in to your account login information or create one from scratch.

- Choose the payment gateway and proceed to download the Plano Texas Affidavit of Plaintiff detailing debt owed as soon as the payment is done.

You’re good to go! Now you can go ahead and print the document or fill it out online. In case you have any issues getting your purchased forms, you can quickly access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.