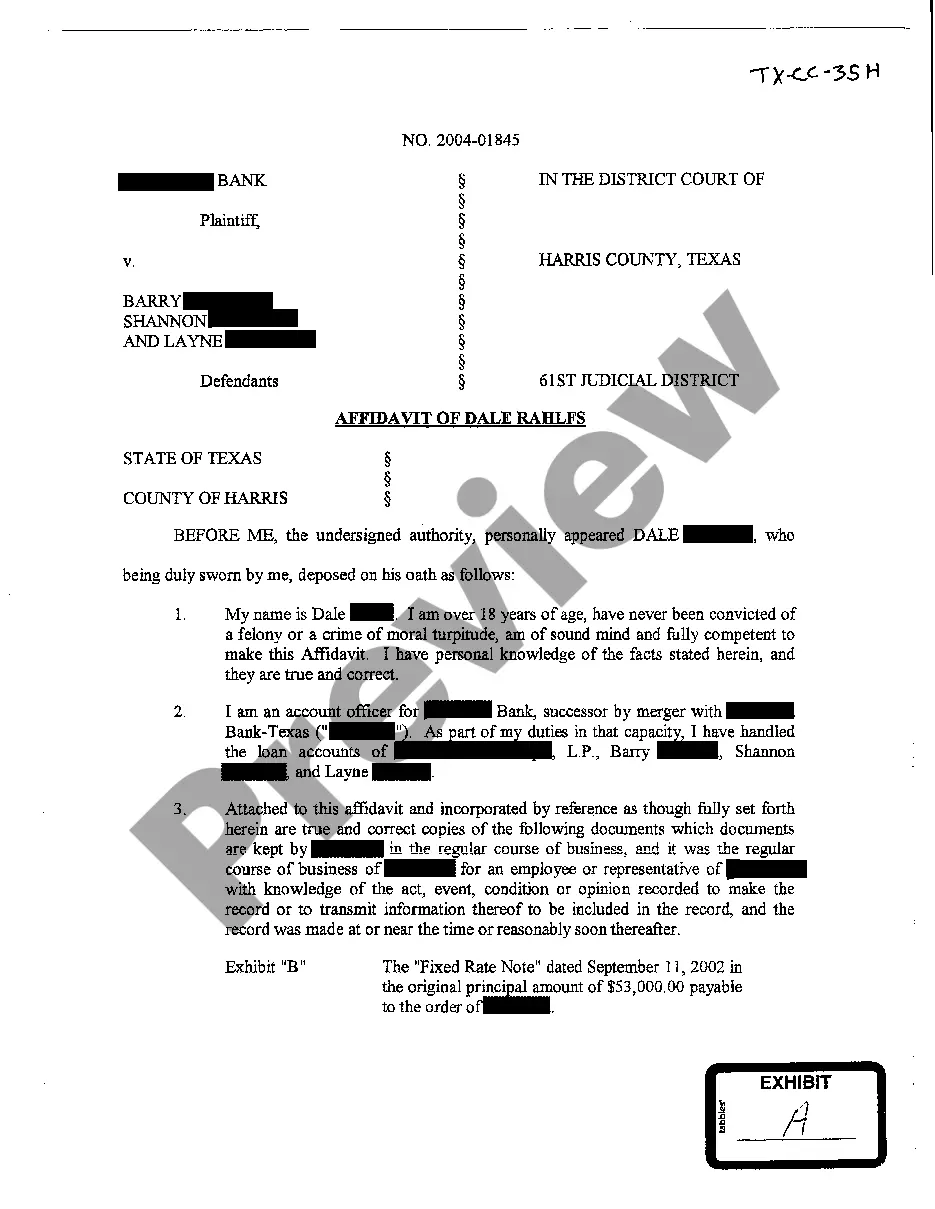

A San Angelo Texas Affidavit of Plaintiff detailing debt owed is a legal document used in the state of Texas, specifically in San Angelo, to assert and document a claim for outstanding debt. This affidavit serves as evidence submitted by the plaintiff (the individual or entity owed money) to support their claim in a legal proceeding. The San Angelo Texas Affidavit of Plaintiff detailing debt owed is a crucial document that outlines the specifics of the debt and provides pertinent information to the court. It helps establish the validity and amount of the debt owed, ensuring a fair and just resolution. Some relevant keywords associated with a San Angelo Texas Affidavit of Plaintiff detailing debt owed include: 1. Debt claim: The affidavit serves as a means for the plaintiff to assert and provide detailed information about the debt owed by the defendant (debtor). 2. Legal proceedings: The affidavit is typically filed as part of a lawsuit or legal action to initiate the process of seeking repayment for the outstanding debt. 3. Sworn statement: The affidavit is a sworn statement made under penalty of perjury, meaning the information provided must be true and accurate to the best of the plaintiff's knowledge. 4. Supporting documentation: The affidavit may be accompanied by various supporting documents, such as invoices, contracts, promissory notes, or communication records, which further substantiate the debt claim. 5. Loan default: The affidavit might detail the circumstances under which the debtor failed to repay a loan or fulfill their financial obligations as agreed upon in a contract. 6. Amount owed: The affidavit should clearly state the exact amount of debt owed, including any additional interest, late fees, or penalties that may have accrued. 7. Debtor identification: The affidavit should contain specific information about the debtor, such as their full name, residential address, contact details, and any other relevant identifying information. Different types of San Angelo Texas Affidavit of Plaintiff detailing debt owed could include: 1. Affidavit of Debt Owed — Credit Card: This type of affidavit would specifically address outstanding credit card debt owed by the defendant to the plaintiff or the credit card company. 2. Affidavit of Debt Owed — Mortgage: This affidavit type would be used when the debt owed involves a mortgage, outlining the specific terms of the loan and the default in payment. 3. Affidavit of Debt Owed — Personal Loan: This affidavit would pertain to a personal loan between the plaintiff and the defendant, documenting the failure to repay the loan and the resulting debt. 4. Affidavit of Debt Owed — Business Debt: In cases where the debt is owed by a business entity, this type of affidavit would be tailored to provide details specific to the nature and terms of the business debt. It's important to note that while these examples highlight different types of affidavits based on the nature of the debt owed, the underlying purpose and content of the affidavit remain similar — to establish a comprehensive claim concerning the debt.

San Angelo Texas Affidavit of Plaintiff detailing debt owed

Description

How to fill out San Angelo Texas Affidavit Of Plaintiff Detailing Debt Owed?

If you are searching for a valid form, it’s impossible to find a better service than the US Legal Forms site – probably the most considerable online libraries. Here you can find a large number of form samples for company and personal purposes by categories and regions, or keywords. Using our high-quality search feature, discovering the most up-to-date San Angelo Texas Affidavit of Plaintiff detailing debt owed is as elementary as 1-2-3. Furthermore, the relevance of each file is proved by a team of professional lawyers that on a regular basis review the templates on our website and update them based on the latest state and county regulations.

If you already know about our system and have a registered account, all you should do to receive the San Angelo Texas Affidavit of Plaintiff detailing debt owed is to log in to your profile and click the Download button.

If you use US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have found the form you require. Read its explanation and use the Preview function (if available) to check its content. If it doesn’t meet your requirements, use the Search option near the top of the screen to discover the needed file.

- Affirm your choice. Click the Buy now button. Next, select your preferred subscription plan and provide credentials to register an account.

- Make the purchase. Make use of your bank card or PayPal account to complete the registration procedure.

- Get the form. Choose the format and download it to your system.

- Make modifications. Fill out, revise, print, and sign the obtained San Angelo Texas Affidavit of Plaintiff detailing debt owed.

Every single form you add to your profile has no expiry date and is yours permanently. It is possible to access them using the My Forms menu, so if you need to have an extra copy for modifying or printing, you may return and save it again anytime.

Make use of the US Legal Forms extensive catalogue to gain access to the San Angelo Texas Affidavit of Plaintiff detailing debt owed you were seeking and a large number of other professional and state-specific samples in one place!