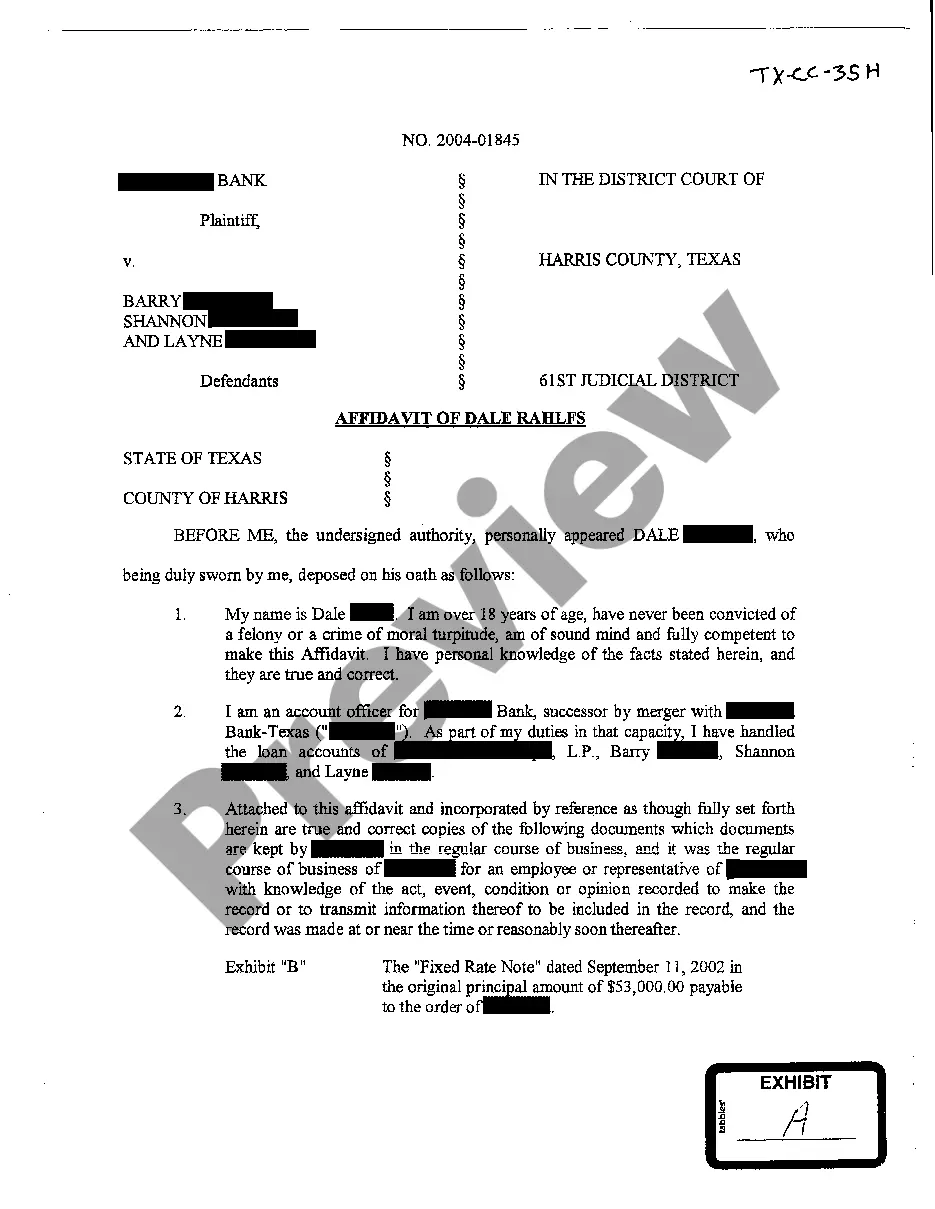

Title: Understanding the Sugar Land Texas Affidavit of Plaintiff Detailing Debt Owed Introduction: The Sugar Land Texas Affidavit of Plaintiff detailing debt owed is a legal document submitted by a plaintiff (creditor) in a civil lawsuit to support their claim against a defendant (debtor) who owes a financial debt. This affidavit serves as evidence that the creditor is owed a specific amount of money by the debtor. In Sugar Land, Texas, there are various types of affidavits utilized in debt-related cases, including: 1. Original Creditor Affidavit 2. Debt Purchaser Affidavit 3. Collection Agency Affidavit 1. Original Creditor Affidavit: An Original Creditor Affidavit is filed by the original company or institution that initially extended credit to the debtor. They are mainly used in cases where the debtor owes money directly to the original creditor. This type of affidavit outlines the details of the account, including the amount owed, payment history, and any relevant supporting documents (e.g., loan agreements, credit statements). 2. Debt Purchaser Affidavit: If the original creditor sells the debt to a third-party debt purchaser, a Debt Purchaser Affidavit is utilized. These affidavits are necessary to establish the chain of ownership and to prove that the purchasing entity has the legal right to collect the debt. This document usually includes information about the original creditor, the purchase agreement, the amount of debt transferred, and supporting documentation validating the sale of the debt. 3. Collection Agency Affidavit: In situations where a collection agency is attempting to collect the debt on behalf of the original creditor or debt purchaser, a Collection Agency Affidavit is filed. This affidavit includes information about the agency's relationship with the creditor or debt purchaser and verifies their authority to act as a representative in the debt collection process. It may also include details about the assignment of the debt to the collection agency. Content Keywords: Sugar Land Texas, Affidavit of Plaintiff, debt owed, Original Creditor Affidavit, Debt Purchaser Affidavit, Collection Agency Affidavit, civil lawsuit, creditor, debtor, legal document, evidence, financial debt, account, payment history, supporting documents, chain of ownership, third-party debt purchaser, collection agency, debt collection, authority, assignment. Conclusion: The Sugar Land Texas Affidavit of Plaintiff detailing debt owed plays a crucial role in legal proceedings pertaining to unpaid debts. Whether it is an Original Creditor Affidavit, Debt Purchaser Affidavit, or Collection Agency Affidavit, these documents provide essential information and supporting evidence regarding the debt owed. It is essential for both plaintiffs and defendants to thoroughly understand these affidavits and their implications when dealing with debt-related cases.

Sugar Land Texas Affidavit of Plaintiff detailing debt owed

Description

How to fill out Sugar Land Texas Affidavit Of Plaintiff Detailing Debt Owed?

Make use of the US Legal Forms and get instant access to any form sample you want. Our beneficial platform with thousands of templates makes it simple to find and obtain almost any document sample you want. You are able to export, fill, and certify the Sugar Land Texas Affidavit of Plaintiff detailing debt owed in just a matter of minutes instead of surfing the Net for several hours trying to find the right template.

Using our library is a great way to increase the safety of your document submissions. Our experienced lawyers regularly check all the records to make certain that the templates are relevant for a particular state and compliant with new acts and polices.

How do you obtain the Sugar Land Texas Affidavit of Plaintiff detailing debt owed? If you already have a profile, just log in to the account. The Download button will appear on all the samples you view. In addition, you can find all the earlier saved files in the My Forms menu.

If you don’t have a profile yet, stick to the tips below:

- Open the page with the form you require. Make sure that it is the form you were seeking: examine its headline and description, and utilize the Preview feature if it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the saving procedure. Select Buy Now and choose the pricing plan that suits you best. Then, create an account and pay for your order using a credit card or PayPal.

- Save the file. Pick the format to obtain the Sugar Land Texas Affidavit of Plaintiff detailing debt owed and change and fill, or sign it according to your requirements.

US Legal Forms is among the most significant and trustworthy document libraries on the internet. Our company is always ready to assist you in any legal process, even if it is just downloading the Sugar Land Texas Affidavit of Plaintiff detailing debt owed.

Feel free to take advantage of our service and make your document experience as convenient as possible!