Corpus Christi Texas Order for Withholding From Income for Child Support is a legal mechanism that enables the state of Texas to ensure the timely collection and enforcement of child support payments. This order is designed to protect the best interests of children by providing them with financial support from noncustodial parents. The Corpus Christi Texas Order for Withholding From Income for Child Support follows specific guidelines outlined in the state's child support enforcement laws. It requires employers to deduct a predetermined amount from the income of a noncustodial parent and directly transfer it to the custodial parent or the state's child support agency. There are different types of Corpus Christi Texas Order for Withholding From Income for Child Support, including: 1. Income Withholding Order: This is the most common type of order for child support withholding. It mandates the employer to deduct a specific portion of the employee's income and remit it to the appropriate recipient. 2. Lump-Sum Withholding Order: This order is applicable when a noncustodial parent receives a lump-sum payment, such as a tax refund or an inheritance. It allows the state or the custodial parent to intercept the payment and use it towards the owed child support. 3. Order for Priority Withholding: This type of order is issued when a noncustodial parent owes child support arrears along with current support. It ensures that the past-due payments receive priority when withholding income. The Corpus Christi Texas Order for Withholding From Income for Child Support has several benefits. It streamlines the payment process, reduces the risk of nonpayment or delinquency, and ensures consistent support for the child's welfare. It also provides an efficient and effective method of enforcing child support obligations, relieving the burden on custodial parents. In order for the Corpus Christi Texas Order for Withholding From Income for Child Support to be initiated, the custodial parent or child support agency must file a formal request with the court. A thorough examination of the noncustodial parent's income, financial statements, and employment records is conducted to determine the appropriate withholding amount. This amount is typically based on a percentage of the noncustodial parent's income and can be adjusted periodically to reflect changes in income or financial circumstances. Once the Corpus Christi Texas Order for Withholding From Income for Child Support is in effect, the employer is legally obligated to comply with the withholding requirements. Failure to do so may result in penalties and sanctions against the employer. Additionally, the order remains in effect until modified or terminated by the court. Overall, Corpus Christi Texas Order for Withholding From Income for Child Support is a crucial tool in ensuring that children in need receive the financial support they deserve. It provides a legal framework for the systematic collection of child support payments, contributing to the well-being and stability of families in Corpus Christi, Texas.

Corpus Christi Texas Order for Withholding From Income for Child Support

State:

Texas

City:

Corpus Christi

Control #:

TX-CC-37-06

Format:

PDF

Instant download

This form is available by subscription

Description

A06 Order for Withholding From Income for Child Support

Corpus Christi Texas Order for Withholding From Income for Child Support is a legal mechanism that enables the state of Texas to ensure the timely collection and enforcement of child support payments. This order is designed to protect the best interests of children by providing them with financial support from noncustodial parents. The Corpus Christi Texas Order for Withholding From Income for Child Support follows specific guidelines outlined in the state's child support enforcement laws. It requires employers to deduct a predetermined amount from the income of a noncustodial parent and directly transfer it to the custodial parent or the state's child support agency. There are different types of Corpus Christi Texas Order for Withholding From Income for Child Support, including: 1. Income Withholding Order: This is the most common type of order for child support withholding. It mandates the employer to deduct a specific portion of the employee's income and remit it to the appropriate recipient. 2. Lump-Sum Withholding Order: This order is applicable when a noncustodial parent receives a lump-sum payment, such as a tax refund or an inheritance. It allows the state or the custodial parent to intercept the payment and use it towards the owed child support. 3. Order for Priority Withholding: This type of order is issued when a noncustodial parent owes child support arrears along with current support. It ensures that the past-due payments receive priority when withholding income. The Corpus Christi Texas Order for Withholding From Income for Child Support has several benefits. It streamlines the payment process, reduces the risk of nonpayment or delinquency, and ensures consistent support for the child's welfare. It also provides an efficient and effective method of enforcing child support obligations, relieving the burden on custodial parents. In order for the Corpus Christi Texas Order for Withholding From Income for Child Support to be initiated, the custodial parent or child support agency must file a formal request with the court. A thorough examination of the noncustodial parent's income, financial statements, and employment records is conducted to determine the appropriate withholding amount. This amount is typically based on a percentage of the noncustodial parent's income and can be adjusted periodically to reflect changes in income or financial circumstances. Once the Corpus Christi Texas Order for Withholding From Income for Child Support is in effect, the employer is legally obligated to comply with the withholding requirements. Failure to do so may result in penalties and sanctions against the employer. Additionally, the order remains in effect until modified or terminated by the court. Overall, Corpus Christi Texas Order for Withholding From Income for Child Support is a crucial tool in ensuring that children in need receive the financial support they deserve. It provides a legal framework for the systematic collection of child support payments, contributing to the well-being and stability of families in Corpus Christi, Texas.

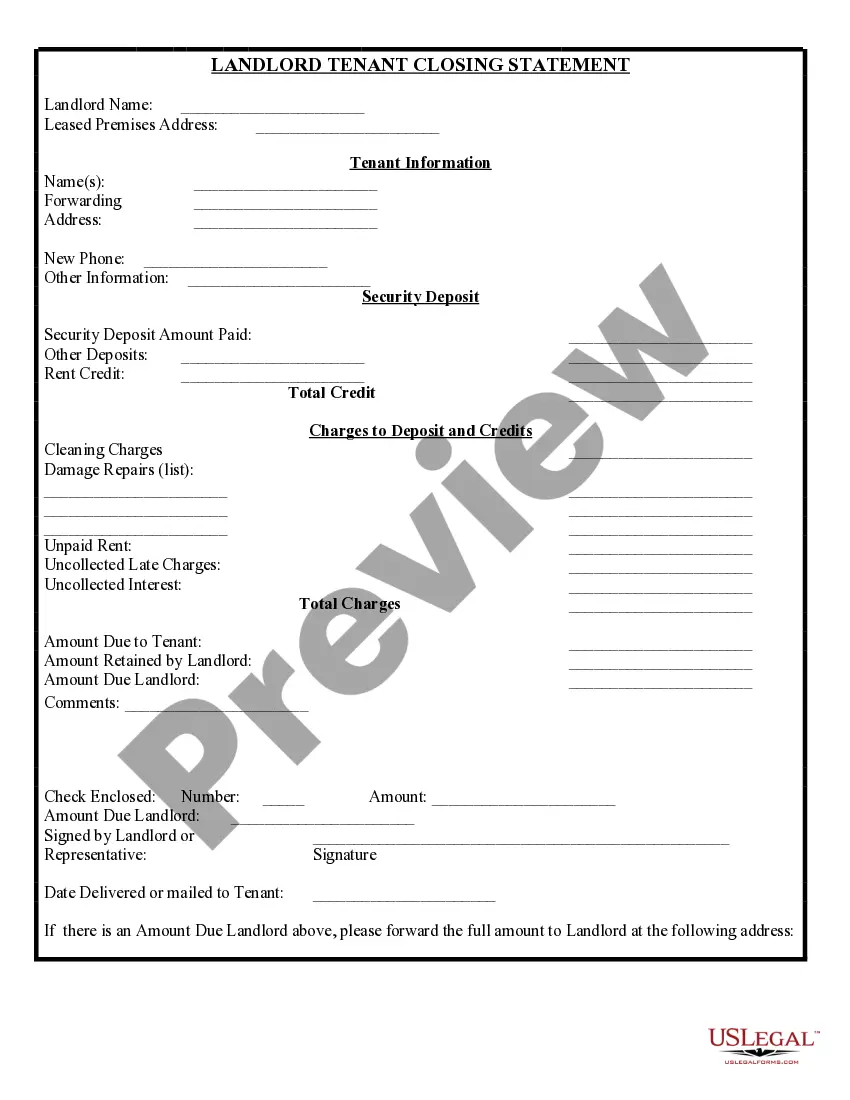

Free preview

How to fill out Corpus Christi Texas Order For Withholding From Income For Child Support?

If you’ve already used our service before, log in to your account and download the Corpus Christi Texas Order for Withholding From Income for Child Support on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Ensure you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Corpus Christi Texas Order for Withholding From Income for Child Support. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!