The Fort Worth Texas Order for Withholding From Income for Child Support is a legal document that ensures child support payments are deducted directly from an individual's income. It is designed to ensure that parents fulfill their financial obligations towards their children and guarantee that child support payments are consistently made. This order is applicable in Fort Worth, Texas, and is issued by the court to enforce child support obligations. It allows the child support payments to be automatically deducted from the non-custodial parent's wages or other sources of income, such as salaries, wages, commissions, bonuses, pensions, or retirement benefits. There are different variations of the Fort Worth Texas Order for Withholding From Income for Child Support, depending on the specific circumstances of the case. These may include: 1. Standard Order for Withholding From Income for Child Support: This is the most common type of order and is used when there is a regular, predictable income source from which child support payments can be deducted. 2. Modified Order for Withholding From Income for Child Support: This type of order is requested when the non-custodial parent's income or employment situation changes significantly. It could involve changes in the amount of child support due or modifications in the income withholding details. 3. Voluntary Order for Withholding From Income for Child Support: In some cases, parents may voluntarily agree to have child support payments automatically deducted from the non-custodial parent's income. This order is issued when both parties consent to the withholding arrangement. The Fort Worth Texas Order for Withholding From Income for Child Support is a crucial tool in ensuring the consistent and timely payment of child support. By having the payments deducted directly from the obliged's income, it reduces the chances of missed or late payments and provides stability and financial security for the children involved.

Fort Worth Texas Order for Withholding From Income for Child Support

Description

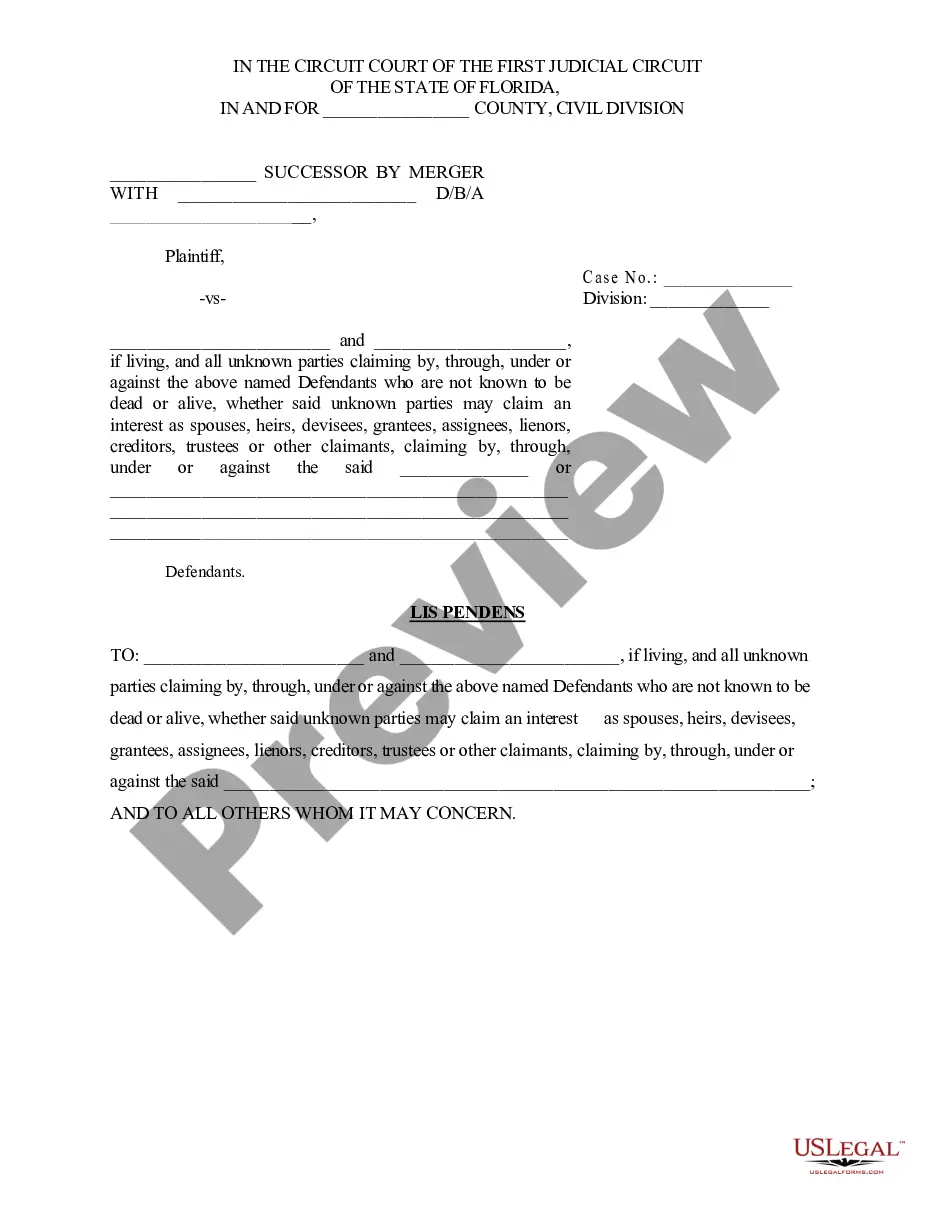

How to fill out Fort Worth Texas Order For Withholding From Income For Child Support?

If you are looking for a relevant form template, it’s impossible to choose a better place than the US Legal Forms website – one of the most extensive online libraries. With this library, you can find a huge number of form samples for company and personal purposes by categories and states, or key phrases. With our advanced search feature, finding the most recent Fort Worth Texas Order for Withholding From Income for Child Support is as easy as 1-2-3. Furthermore, the relevance of every document is proved by a team of skilled attorneys that regularly check the templates on our website and revise them based on the most recent state and county requirements.

If you already know about our system and have an account, all you should do to get the Fort Worth Texas Order for Withholding From Income for Child Support is to log in to your user profile and click the Download button.

If you make use of US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have chosen the form you require. Read its explanation and use the Preview feature to check its content. If it doesn’t suit your needs, use the Search field near the top of the screen to find the needed document.

- Confirm your selection. Select the Buy now button. Following that, choose the preferred pricing plan and provide credentials to sign up for an account.

- Make the transaction. Use your bank card or PayPal account to complete the registration procedure.

- Receive the template. Indicate the format and save it on your device.

- Make adjustments. Fill out, modify, print, and sign the acquired Fort Worth Texas Order for Withholding From Income for Child Support.

Every template you add to your user profile has no expiration date and is yours permanently. You always have the ability to access them using the My Forms menu, so if you want to get an additional duplicate for enhancing or creating a hard copy, feel free to return and save it again anytime.

Take advantage of the US Legal Forms extensive library to get access to the Fort Worth Texas Order for Withholding From Income for Child Support you were seeking and a huge number of other professional and state-specific templates on a single platform!