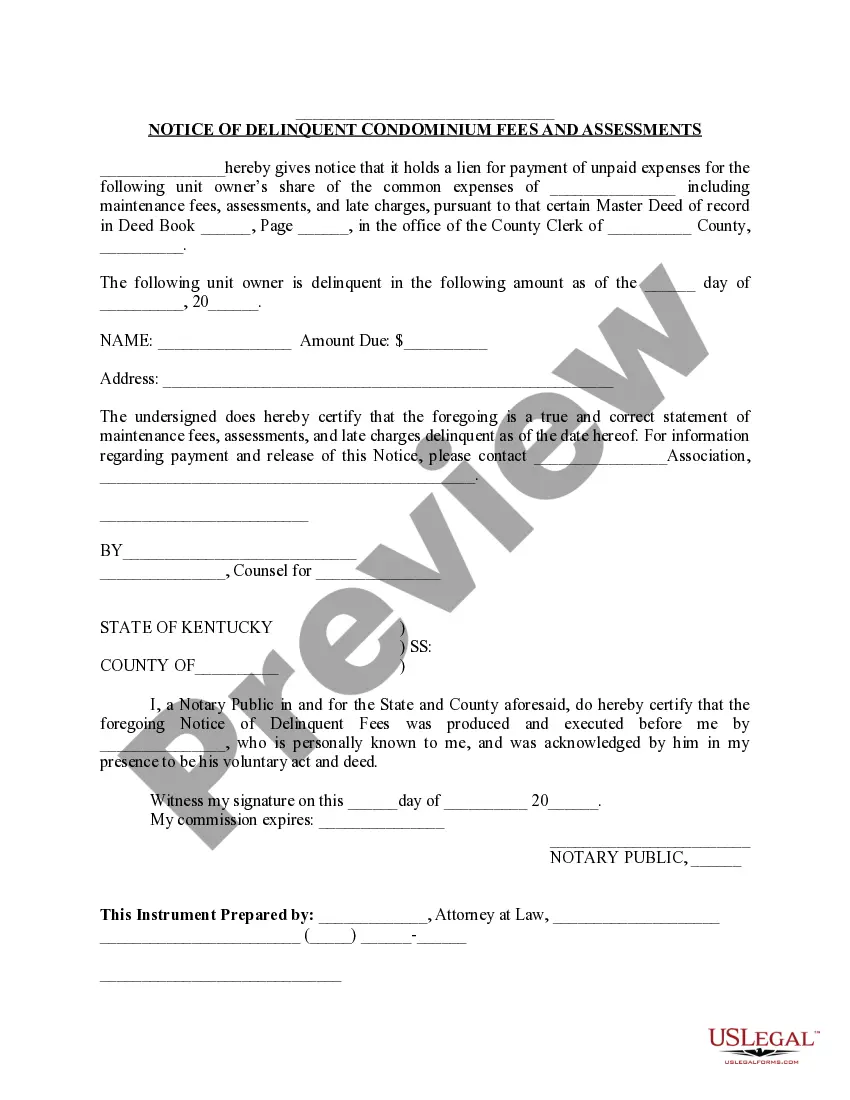

The Wichita Falls Texas Order for Withholding From Income for Child Support is a legal document that outlines the process of deducting child support payments directly from an individual's income. This order ensures consistent and timely payments towards supporting a child or children. The primary purpose of the Wichita Falls Texas Order for Withholding From Income for Child Support is to enforce child support obligations and guarantee that the custodial parent receives financial support for the child's well-being. The order specifies the responsibilities of the non-custodial parent in fulfilling their child support obligations and provides a mechanism for the consistent payment of these obligations. There are various types of Wichita Falls Texas Orders for Withholding From Income for Child Support, including: 1. Mandatory Income Withholding Order: This type of order is issued when child support has already been established, and the non-custodial parent is employed or receives income from other sources. The court or child support agency will direct the employer or mayor of income to withhold a specific amount from the non-custodial parent's earnings. 2. Voluntary Income Withholding Agreement: In cases where the non-custodial parent agrees to have child support payments deducted from their income voluntarily, a Voluntary Income Withholding Agreement is established. This type of agreement operates similarly to a Mandatory Income Withholding Order, but with the consent and cooperation of the non-custodial parent. 3. Administrative Income Withholding Order: This order is issued by the Texas Child Support Division (CSD) as part of the administrative process. It is used when child support payments are collected through income withholding, without the need for court involvement. The CSD may issue this order when there is an existing child support order and the non-custodial parent is employed. The Wichita Falls Texas Order for Withholding From Income for Child Support plays a crucial role in ensuring that child support obligations are met consistently. By deducting payments directly from the non-custodial parent's income, the order helps guarantee the financial support required for the child's welfare. It simplifies the payment process, promotes accountability, and helps sustain the child's well-being.

Wichita Falls Texas Order for Withholding From Income for Child Support

Description

How to fill out Wichita Falls Texas Order For Withholding From Income For Child Support?

Benefit from the US Legal Forms and have instant access to any form template you need. Our helpful website with a large number of documents simplifies the way to find and obtain almost any document sample you will need. You are able to save, complete, and sign the Wichita Falls Texas Order for Withholding From Income for Child Support in a matter of minutes instead of surfing the Net for several hours attempting to find an appropriate template.

Using our collection is a wonderful way to improve the safety of your document filing. Our experienced lawyers on a regular basis review all the documents to make sure that the templates are appropriate for a particular region and compliant with new acts and polices.

How can you obtain the Wichita Falls Texas Order for Withholding From Income for Child Support? If you have a profile, just log in to the account. The Download button will appear on all the documents you look at. In addition, you can find all the previously saved documents in the My Forms menu.

If you haven’t registered a profile yet, stick to the instruction listed below:

- Find the template you need. Ensure that it is the form you were hoping to find: check its title and description, and make use of the Preview feature when it is available. Otherwise, utilize the Search field to look for the needed one.

- Launch the downloading process. Click Buy Now and select the pricing plan that suits you best. Then, sign up for an account and process your order using a credit card or PayPal.

- Export the file. Pick the format to obtain the Wichita Falls Texas Order for Withholding From Income for Child Support and revise and complete, or sign it for your needs.

US Legal Forms is among the most considerable and reliable template libraries on the internet. Our company is always ready to assist you in virtually any legal process, even if it is just downloading the Wichita Falls Texas Order for Withholding From Income for Child Support.

Feel free to take full advantage of our platform and make your document experience as efficient as possible!