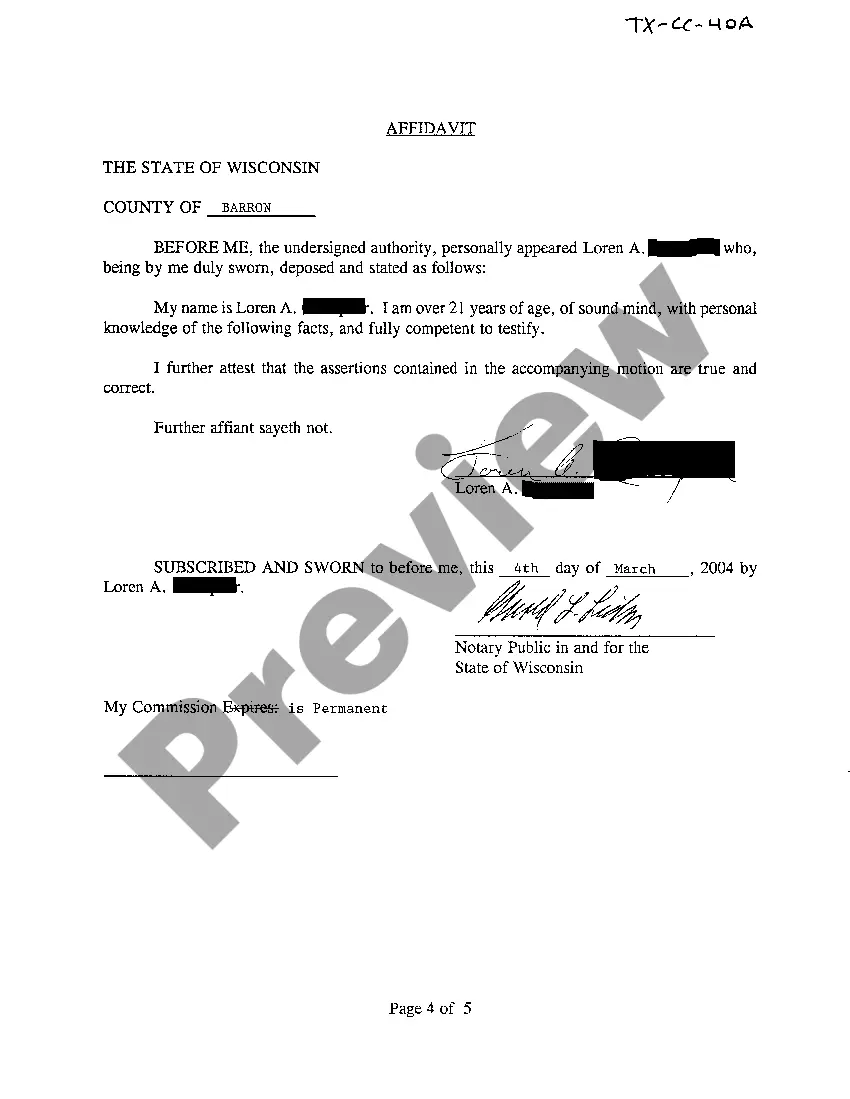

The Bexar Texas Affidavit of Property Owner as to facts stated in Motion for Review is a legal document that serves to provide a detailed description of the facts stated in a motion for review regarding property ownership in Bexar County, Texas. It is an important tool for property owners to assert their rights and ensure that the facts presented in their motion for review are accurate and supported by evidence. This affidavit is commonly used in cases where a property owner disagrees with a decision made by the Bexar County Appraisal District or another governing authority regarding the valuation or classification of their property. It allows the property owner to present additional facts and evidence that support their claims and challenge the previous decision. Keywords: Bexar Texas, Affidavit, Property Owner, Motion for Review, facts, detailed description, legal document, property ownership, Bexar County, Texas, rights, evidence, valuation, classification, Appraisal District, governing authority, claims, challenge. Different types of Bexar Texas Affidavit of Property Owner as to facts stated in Motion for Review could include variations based on specific property classifications such as residential properties, commercial properties, industrial properties, agricultural properties, and so on. Each type would focus on the specific facts and evidence relevant to the particular classification of the property in question. Keywords: Bexar Texas, Affidavit, Property Owner, Motion for Review, facts, detailed description, legal document, property ownership, Bexar County, Texas, rights, evidence, valuation, classification, residential properties, commercial properties, industrial properties, agricultural properties.

The Bexar Texas Affidavit of Property Owner as to facts stated in Motion for Review is a legal document that serves to provide a detailed description of the facts stated in a motion for review regarding property ownership in Bexar County, Texas. It is an important tool for property owners to assert their rights and ensure that the facts presented in their motion for review are accurate and supported by evidence. This affidavit is commonly used in cases where a property owner disagrees with a decision made by the Bexar County Appraisal District or another governing authority regarding the valuation or classification of their property. It allows the property owner to present additional facts and evidence that support their claims and challenge the previous decision. Keywords: Bexar Texas, Affidavit, Property Owner, Motion for Review, facts, detailed description, legal document, property ownership, Bexar County, Texas, rights, evidence, valuation, classification, Appraisal District, governing authority, claims, challenge. Different types of Bexar Texas Affidavit of Property Owner as to facts stated in Motion for Review could include variations based on specific property classifications such as residential properties, commercial properties, industrial properties, agricultural properties, and so on. Each type would focus on the specific facts and evidence relevant to the particular classification of the property in question. Keywords: Bexar Texas, Affidavit, Property Owner, Motion for Review, facts, detailed description, legal document, property ownership, Bexar County, Texas, rights, evidence, valuation, classification, residential properties, commercial properties, industrial properties, agricultural properties.