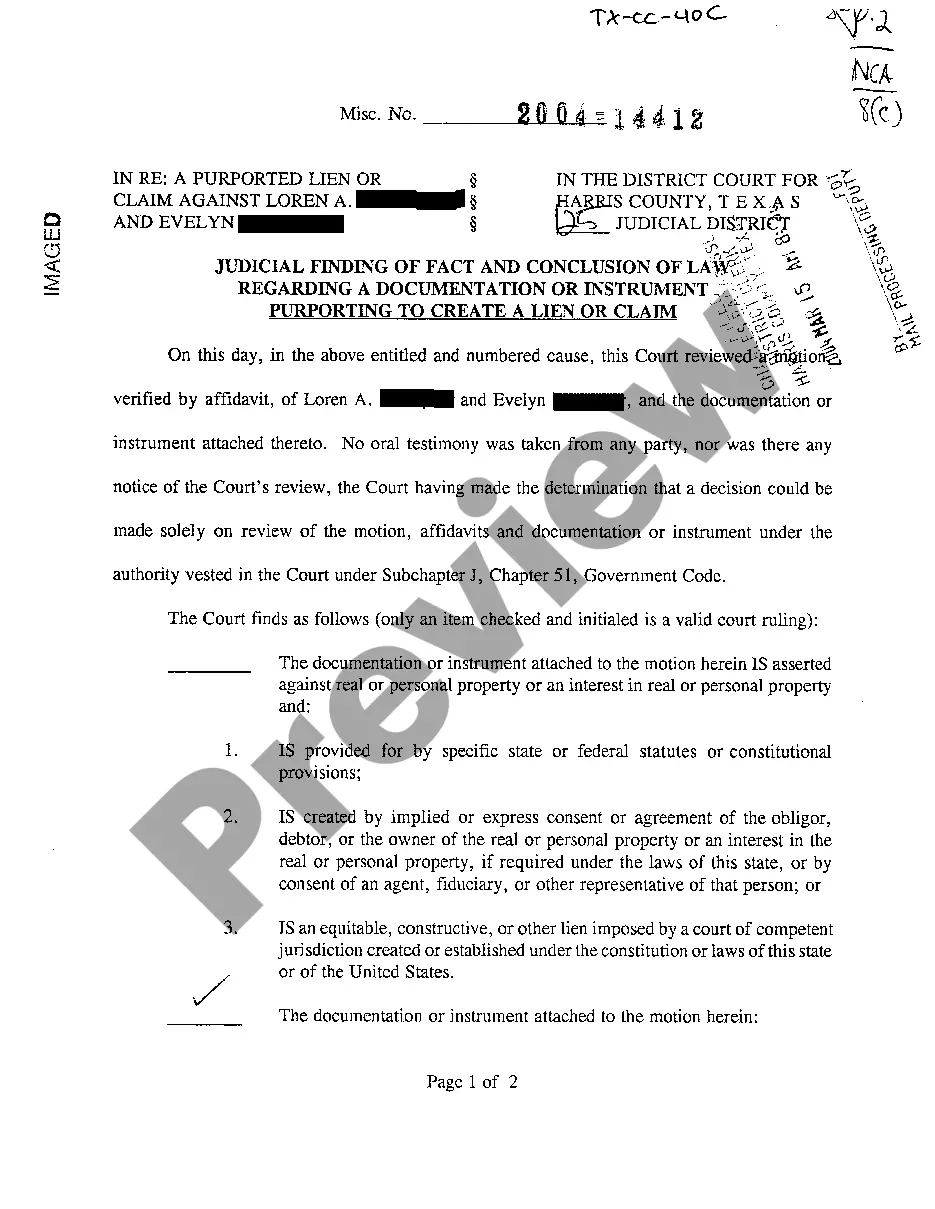

Dallas Texas Judicial Findings Regarding Instrument Purporting to Create a Lien of Claim In Dallas, Texas, there have been various judicial findings regarding instruments purporting to create a lien of claim. These findings help to determine the validity and enforceability of such liens in the legal system. Here are some relevant details and keywords associated with the judicial findings: 1. Definition of Instrument Purporting to Create a Lien of Claim: An "Instrument Purporting to Create a Lien of Claim" refers to any legal document or contract that asserts the existence of a lien on a specific property or asset, claiming a right to payment or satisfaction of a debt or claim. 2. Judicial Findings Establishing Fraudulent or Invalid Liens: — Fraudulent Lien Filings: Dallas courts have encountered cases where individuals or organizations have fraudulently filed instruments purporting to create a lien of claim on properties for personal gain. These findings establish that such false claims are invalid and unenforceable. — Lack of Legal Authority: Courts have also ruled that certain linens were invalid as they were filed by individuals or entities without proper legal authority or basis, thereby holding no legal standing. 3. Judicial Findings Confirming Validity of Liens: — Compliance with Statutory Requirements: Dallas courts also acknowledge that instruments purporting to create a lien of claim can be valid if they comply with the statutory requirements. For example, if the lien instrument follows proper filing procedures and meets all legal criteria, it may be recognized as valid. — Conducting Due Diligence: Courts emphasize the importance of conducting thorough due diligence to determine the validity of a lien. If the court finds that the instrument and the process of creating the lien are lawful and meet legal standards, the lien may be recognized as valid. 4. Challenges to Liens: Individuals or entities who believe a lien filed against them is fraudulent or invalid can challenge its enforceability in court. Such challenges may involve presenting evidence to support claims of fraud, lack of legal authority, or failure to meet statutory requirements. 5. Legal Consequences for Filing Fraudulent Liens: Filing fraudulent liens is illegal and may result in severe legal consequences. In Dallas, Texas, those found guilty of filing fraudulent liens may face civil penalties, criminal charges, fines, or imprisonment. 6. Seek Legal Advice: Given the complexity and potential consequences associated with instruments purporting to create a lien of claim, individuals or entities involved in such cases are strongly advised to seek professional legal advice. An experienced attorney can provide guidance and representation throughout the legal process, ensuring rights are protected and proper legal measures are taken. Keywords: Dallas Texas, judicial findings, instrument purporting to create a lien of claim, fraudulent lien filings, lack of legal authority, statutory requirements, due diligence, challenges to liens, legal consequences, seek legal advice.

Dallas Texas Judicial Findings regarding Instrument Purporting to Create a Lien of Claim

Description

How to fill out Dallas Texas Judicial Findings Regarding Instrument Purporting To Create A Lien Of Claim?

If you’ve already used our service before, log in to your account and download the Dallas Texas Judicial Findings regarding Instrument Purporting to Create a Lien of Claim on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make certain you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Dallas Texas Judicial Findings regarding Instrument Purporting to Create a Lien of Claim. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!

Form popularity

FAQ

In Texas, the lien period is described as ?on the 15th day of the month three months after the last month the claimant performs work?. (Three months for residential, four for non-residential) The deadline to file a lien is not extended if the 15th falls on a Saturday, Sunday, or legal holiday.

Three commons ways to fight a false lien are to: immediately dispute the lien through statutorily provided preliminary means, a demand to/against the claimant, or a full-blown lawsuit. force the claimant to file a lawsuit to enforce the lien in a shorter period if available where you live. just wait it out.

Filing a Judgment Lien A judgment lien lasts for ten years. According to Section 52.001 of the Texas Property Code, a judgment lien cannot attach to any real property that is exempt from seizure or forced sale under Chapter 41 of the Texas Property Code.

Texas Easy lien has created a fast, simple, and AFFORDABLE way to file a construction lien on a property with a few easy steps. All online?no lawyers needed!

The filing fee, on a notice of lien, is $30.00 at the Register of Deeds office. However, there are also notice requirements and costs to pay someone to prepare the form for you. Overall, not much.

Uniform Commercial Code - Fees Initial Filing Form ? Mail and Fax FilingsFiling FeeAgricultural Lien$15 for Two pages or less; $30 for Three pages or moreAircraft Maintenance LienContract Agricultural LienTransition Property Notice (TPN1) - PDF8 more rows

A judgment lien is one way to ensure that the person who won the judgment (the creditor) gets what he or she is owed. A judgment lien gives the creditor the right to be paid a certain amount of money from proceeds from the sale of the debtor's property.

A judgment lien lasts for ten years. According to Section 52.001 of the Texas Property Code, a judgment lien cannot attach to any real property that is exempt from seizure or forced sale under Chapter 41 of the Texas Property Code.

Remedial Bonds Under Section 53.171 of the Texas Property Code: Under Section 53.171(c) of the Texas Property Code, a mechanic's lien can be discharged with a bond even after the dispute has arisen and the lien has been filed. The bond must be substantially higher than the lien amounts.

To show that a lien has officially been removed on a property, you have to file a document called a ?lien release? in the real property records of the county where the property is located. A release of lien simply means removing the lien claim from a specific property.