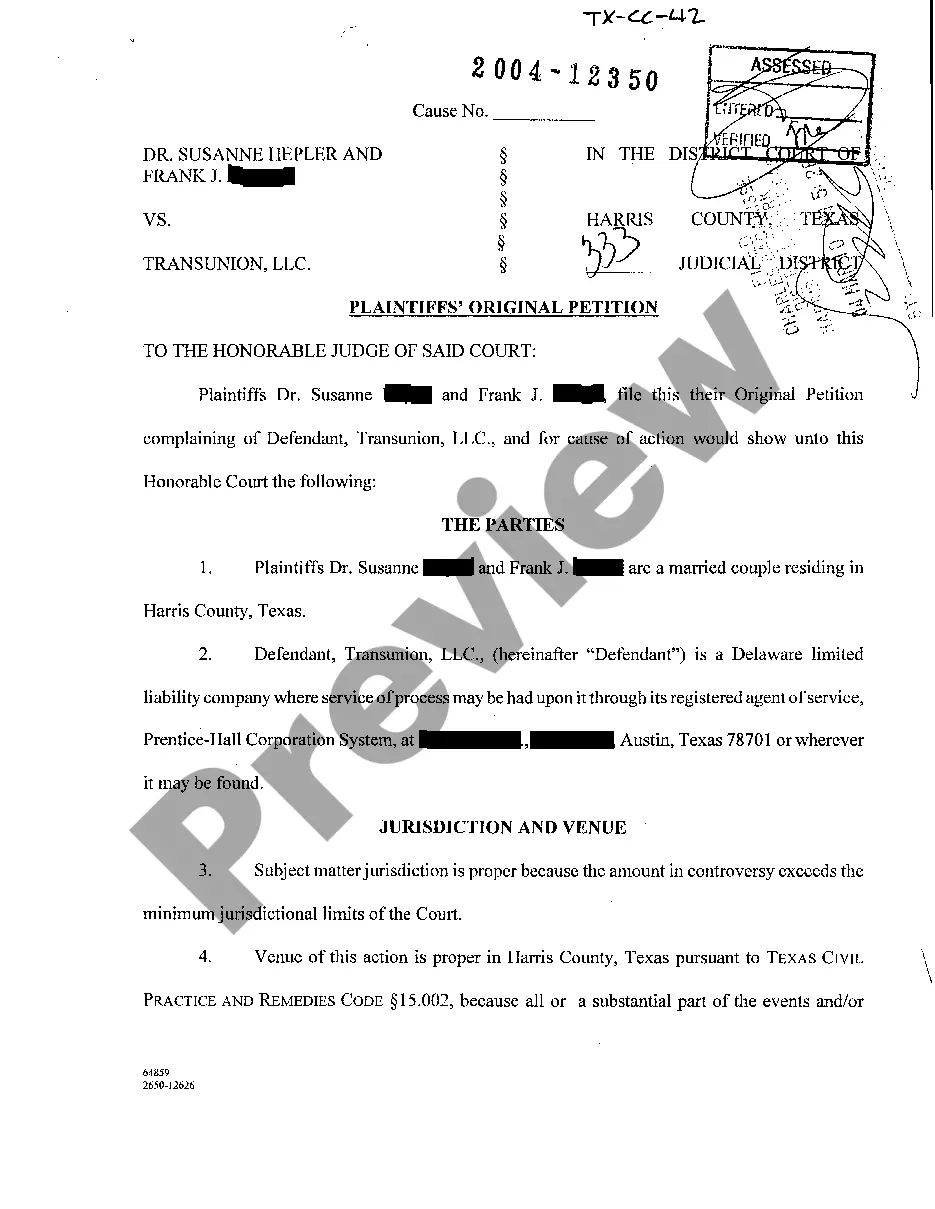

Carrollton Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act is a legal document filed by a plaintiff in Carrollton, Texas, to seek remedies for violations of the Fair Credit Reporting Act (FCRA). This petition is aimed at addressing issues related to inaccurate or misleading information in credit reports, unauthorized access to credit information, or failure to correct errors in credit reports by credit reporting agencies. The FCRA is a federal law enacted to ensure fair, accurate, and private credit reporting. It gives certain rights to consumers and imposes obligations on credit reporting agencies, creditors, and other entities that furnish information to credit reporting companies. Carrollton Texas Plaintiff's Original Petition regarding FCRA encompasses various types depending on the specific allegations made by the plaintiff. Some common types of petitions include: 1. Inaccurate Reporting: This type of petition is filed when the defendant credit reporting agency fails to maintain reasonable procedures to ensure the accuracy and completeness of the consumer's credit information. The plaintiff claims damages caused by false, incomplete, or outdated information reported on their credit report, affecting their creditworthiness, loan approvals, or job prospects. 2. Identity Theft: In cases of identity theft, the plaintiff alleges that the defendant credit reporting agency violated the FCRA by failing to block fraudulent accounts, conducting proper investigations, or accurately reflecting the identity theft-related information in the victim's credit report. The petitioner seeks damages for financial losses, emotional distress, and identity restoration costs. 3. Adverse Action: This type of petition arises when a creditor, employer, or insurer takes an adverse action against the plaintiff (such as denial of credit, employment, or insurance) based on information provided by a credit reporting agency. The plaintiff alleges that the adverse action was taken without providing the required notices or taking measures to ensure the accuracy and fairness of the provided information. 4. Reinvestigation: In certain instances, the plaintiff files a petition due to the credit reporting agency's failure to conduct a timely and reasonable reinvestigation of a disputed item on their credit report. The petitioner claims damages for the agency's non-compliance with the FCRA's reinvestigation procedures. 5. Violation of Disposal Rule: In this type of petition, the plaintiff alleges that the defendant credit reporting agency improperly disposed of consumer information, leading to the risk of identity theft or other forms of misuse. The petitioner may seek statutory damages and injunctive relief. When preparing Carrollton Texas Plaintiff's Original Petition, it is crucial to use relevant keywords such as Fair Credit Reporting Act, FCRA violations, credit reporting agency, inaccurate reporting, identity theft, adverse action, reinvestigation, disposal rule, damages, and statutory relief. These keywords will not only help in optimizing the document for search engines but also make it easier for legal professionals to identify the nature of the petition.

Carrollton Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act

Category:

State:

Texas

City:

Carrollton

Control #:

TX-CC-42-01

Format:

PDF

Instant download

This form is available by subscription

Description

A01 Plaintiff's Original Petition regarding Fair Credit Reporting Act

Carrollton Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act is a legal document filed by a plaintiff in Carrollton, Texas, to seek remedies for violations of the Fair Credit Reporting Act (FCRA). This petition is aimed at addressing issues related to inaccurate or misleading information in credit reports, unauthorized access to credit information, or failure to correct errors in credit reports by credit reporting agencies. The FCRA is a federal law enacted to ensure fair, accurate, and private credit reporting. It gives certain rights to consumers and imposes obligations on credit reporting agencies, creditors, and other entities that furnish information to credit reporting companies. Carrollton Texas Plaintiff's Original Petition regarding FCRA encompasses various types depending on the specific allegations made by the plaintiff. Some common types of petitions include: 1. Inaccurate Reporting: This type of petition is filed when the defendant credit reporting agency fails to maintain reasonable procedures to ensure the accuracy and completeness of the consumer's credit information. The plaintiff claims damages caused by false, incomplete, or outdated information reported on their credit report, affecting their creditworthiness, loan approvals, or job prospects. 2. Identity Theft: In cases of identity theft, the plaintiff alleges that the defendant credit reporting agency violated the FCRA by failing to block fraudulent accounts, conducting proper investigations, or accurately reflecting the identity theft-related information in the victim's credit report. The petitioner seeks damages for financial losses, emotional distress, and identity restoration costs. 3. Adverse Action: This type of petition arises when a creditor, employer, or insurer takes an adverse action against the plaintiff (such as denial of credit, employment, or insurance) based on information provided by a credit reporting agency. The plaintiff alleges that the adverse action was taken without providing the required notices or taking measures to ensure the accuracy and fairness of the provided information. 4. Reinvestigation: In certain instances, the plaintiff files a petition due to the credit reporting agency's failure to conduct a timely and reasonable reinvestigation of a disputed item on their credit report. The petitioner claims damages for the agency's non-compliance with the FCRA's reinvestigation procedures. 5. Violation of Disposal Rule: In this type of petition, the plaintiff alleges that the defendant credit reporting agency improperly disposed of consumer information, leading to the risk of identity theft or other forms of misuse. The petitioner may seek statutory damages and injunctive relief. When preparing Carrollton Texas Plaintiff's Original Petition, it is crucial to use relevant keywords such as Fair Credit Reporting Act, FCRA violations, credit reporting agency, inaccurate reporting, identity theft, adverse action, reinvestigation, disposal rule, damages, and statutory relief. These keywords will not only help in optimizing the document for search engines but also make it easier for legal professionals to identify the nature of the petition.

Free preview

How to fill out Carrollton Texas Plaintiff's Original Petition Regarding Fair Credit Reporting Act?

If you’ve already utilized our service before, log in to your account and download the Carrollton Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make sure you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Carrollton Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!