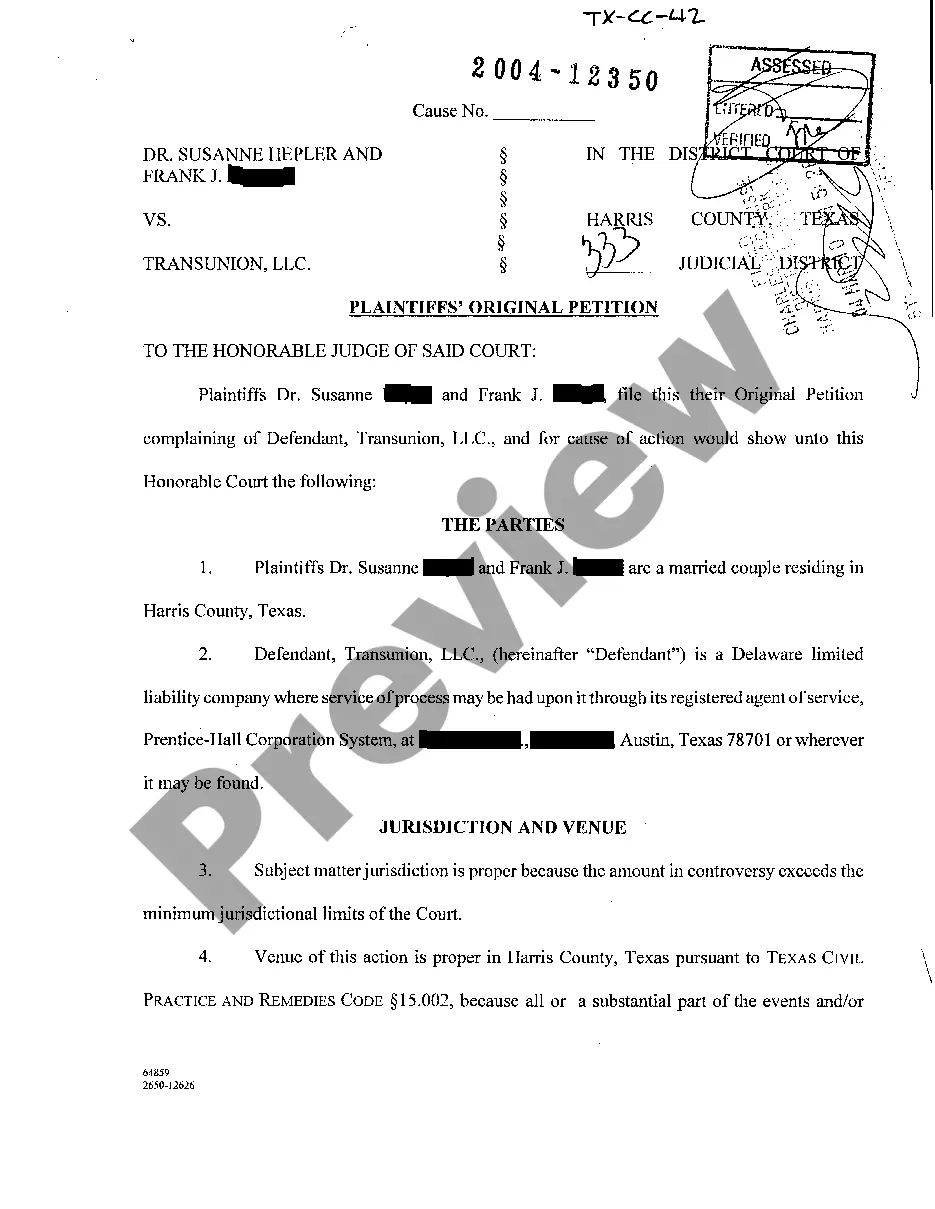

In Grand Prairie, Texas, a Plaintiff's Original Petition regarding the Fair Credit Reporting Act (FCRA) is a legal document filed by an aggrieved individual or entity (the plaintiff) who believes their rights under the FCRA have been violated by a defendant. This petition serves as the initial legal action, outlining the plaintiff's claims, seeking remedies, and initiating a lawsuit against the defendant. The FCRA is a federal law passed to regulate the collection, dissemination, and use of consumer credit information. It provides certain protections to consumers, ensuring accurate reporting, privacy, and fair treatment by credit reporting agencies, businesses, and lenders. When these protections are violated, the injured party can seek legal action through a Plaintiff's Original Petition. Key elements that may be included in a Grand Prairie Texas Plaintiff's Original Petition regarding the FCRA are as follows: 1. Parties Involved: The plaintiff identifies themselves and the defendant, typically a credit reporting agency, lender, or business that has allegedly violated the FCRA. 2. Nature of the Complaint: The plaintiff presents a detailed account of the alleged FCRA violations, ensuring that relevant keywords are included, such as "inaccurate credit reporting," "unauthorized access to credit information," "failure to investigate disputes," "willful noncompliance," or "negligent reporting." 3. FCRA Violations Alleged: The petition cites specific sections of the FCRA that the defendant is accused of violating, such as Section 1681e (Accuracy of Reporting), Section 1681b (Permissible Purposes of Consumer Reports), or Section 1681c (Information Furnishes). 4. Damages Sought: The plaintiff outlines the damages suffered due to the FCRA violations, including actual damages (such as financial losses), statutory damages, attorneys' fees, and other equitable or injunctive relief sought. 5. Jurisdiction and Venue: The petition states the court in which the lawsuit is filed, usually the appropriate District Court in Grand Prairie, Texas, and asserts the court's jurisdiction over the matter. It is important to note that within the scope of Grand Prairie Texas Plaintiff's Original Petition regarding the FCRA, there may be different types of claims, including: 1. Identity Theft/Fraudulent Accounts: Plaintiffs may file a petition if their identity was stolen or fraudulent accounts were opened in their name, seeking damages and actions against credit reporting agencies, lenders, or businesses that failed to prevent or correct such instances. 2. Employment Background Check Errors: Individuals may file a petition if inaccurate information on their credit reports negatively affects their employment prospects. This can occur when employers rely on faulty consumer reports or the reporting agencies fail to investigate disputes properly. 3. Inadequate Investigation of Disputes: Plaintiffs may claim that credit reporting agencies failed to conduct reasonable investigations into their disputes, resulting in continued reporting of inaccurate information, thus violating the FCRA. 4. Improper Access to Credit Information: A petition may be filed if a party accessed an individual's credit information without proper authorization, violating the FCRA's restrictions on the permissible purposes for obtaining consumer reports. By filing a Grand Prairie Texas Plaintiff's Original Petition regarding the FCRA, individuals and entities assert their rights and seek legal remedies for FCRA violations, with the ultimate goal of rectifying inaccuracies, protecting their privacy, and obtaining fair and just compensation for the damages incurred.

Grand Prairie Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act

Description

How to fill out Grand Prairie Texas Plaintiff's Original Petition Regarding Fair Credit Reporting Act?

We consistently aim to minimize or evade legal complications when engaging with intricate legal or financial matters.

To achieve this, we seek legal assistance that is often quite costly.

However, not all legal issues are that complicated.

Many can be addressed by ourselves.

Make the most of US Legal Forms whenever you need to obtain and download the Grand Prairie Texas Plaintiff's Original Petition related to the Fair Credit Reporting Act or any other form swiftly and securely.

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform empowers you to manage your affairs independently without the need for an attorney's services.

- We offer access to legal form templates that are not always readily available.

- Our templates are tailored to specific states and regions, significantly easing the search process.

Form popularity

FAQ

From the Clerk: The plaintiff should make a written request for the clerk to enter a default judgment, and provide the clerk with an affidavit of the amount owed by the defendant and a proposed clerk's default judgment. Internal Procedures: All documents are forwarded to the docket clerk for processing within 24 hours.

The Rules of Civil Procedure govern the proceedings in civil trials. The Code of Criminal Procedure governs criminal proceedings. When a case is appealed, the Rules of Appellate Procedure govern the appeals process.

Except as provided in (1), a plaintiff who seeks a default judgment against a defendant must request a hearing, orally or in writing. The plaintiff must appear at the hearing and provide evidence of its damages. If the plaintiff proves its damages, the judge must render judgment for the plaintiff in the amount proven.

Stages in Civil Litigation Filing of Plaint. The facts and summary of the case are recorded in the plaint, which is a legal document.Issuing of Summons.The appearance of the Parties to the Dispute.Interlocutory Proceedings.Written Statement.Examination.Framing of the Issues Involved.Documents Required.

Section 3. Default; declaration of. - If the defending party fails to answer within the time allowed therefor, the court shall, upon motion of the claiming party with notice to the defending party, and proof of such failure, declare the defending party in default.

Grounds for granting a motion for default judgment in Texas exist if a defendant fails to respond to the lawsuit and make an appearance in the matter. Plaintiffs must make a request before the court will grant a motion for default judgment in Texas. Most importantly, a default judgment is binding on both parties.

Steps in the Texas Civil Litigation Process. Research. File Suit. Give Legal Notice. Gather Information. Before Trial. Motions and Requests. Ending Your Case Before Trial.

Instances in which Default Judgment may be sought or granted: The Defendant failed to serve and file Notice of Intention to Defend. The Defendant delivered the Notice of Intention to Defend but failed to serve and file a Plea. The Defendant has entered into a defective entry of Notice of Intention to Defend.

The Process To begin a civil lawsuit in federal court, the plaintiff files a complaint with the court and ?serves? a copy of the complaint on the defendant.

What is a default judgment? A ?default judgment? is a court order made without the respondent because: the respondent was served and did not file an answer by the deadline, or. the respondent filed an answer and was given notice of a hearing but did not show up for the hearing.