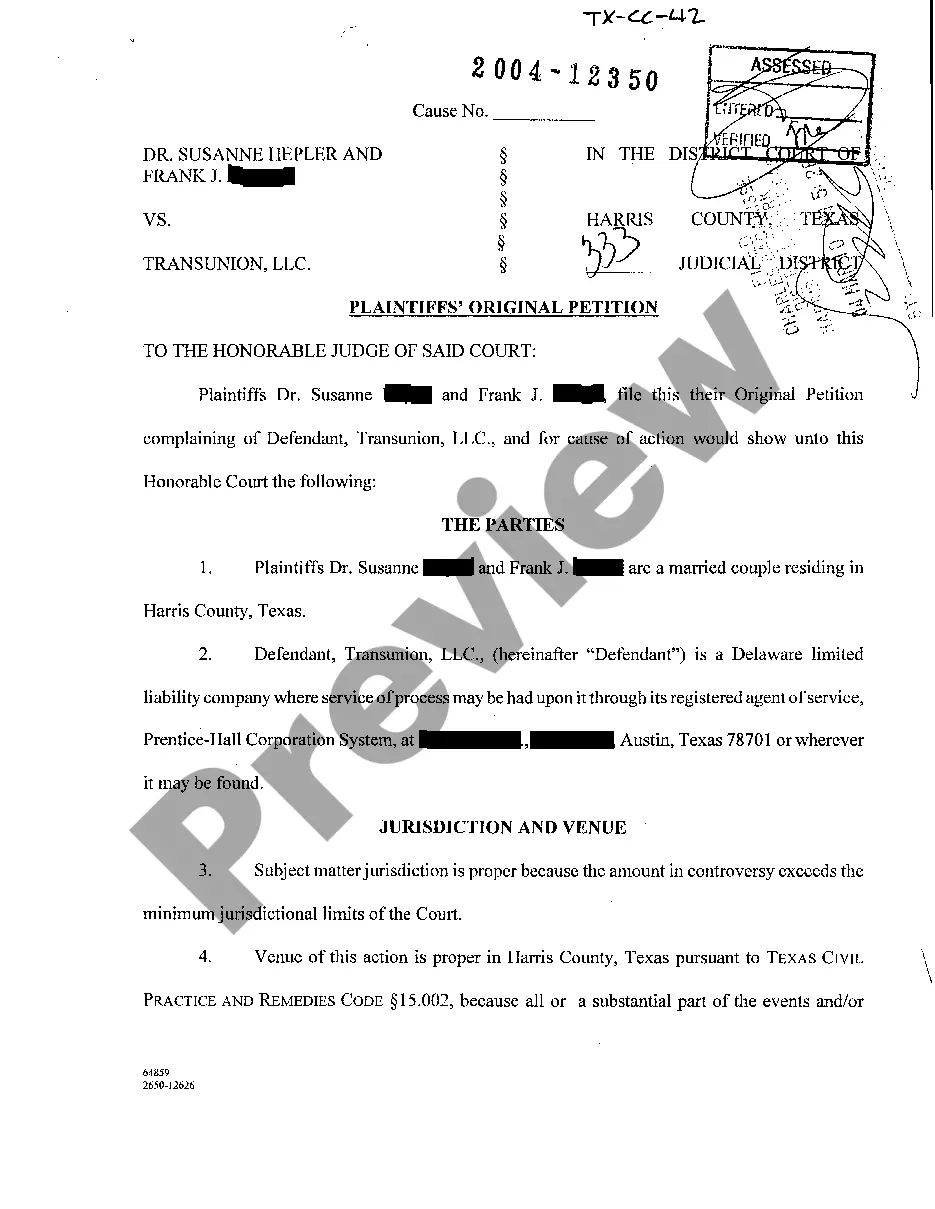

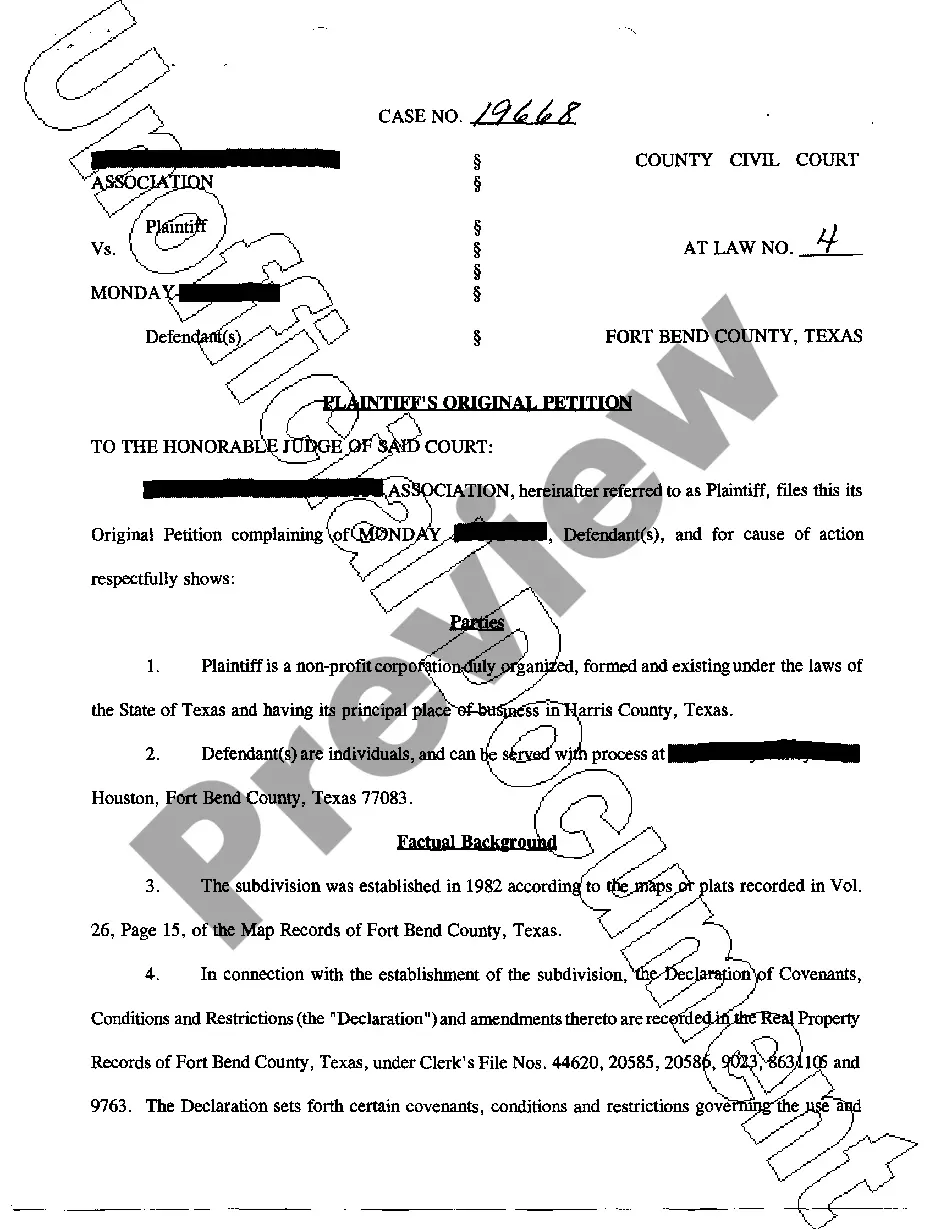

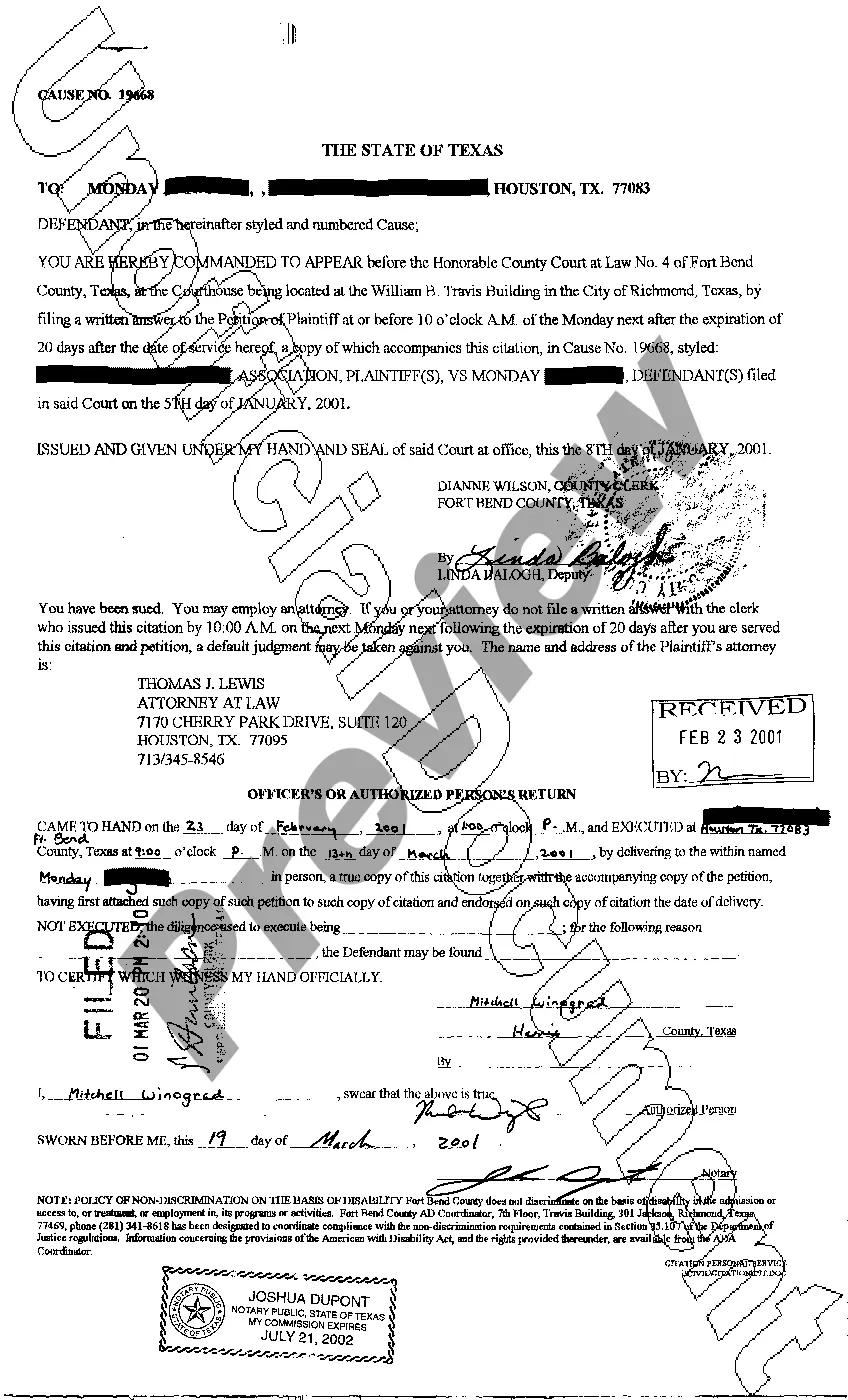

The Houston Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act is a legal document filed by a plaintiff in a civil lawsuit to initiate a legal action against a defendant for alleged violations of the Fair Credit Reporting Act (FCRA). The FCRA is a federal law that regulates how consumer credit information is collected, disseminated, and used by businesses and credit reporting agencies. It provides individuals with certain rights and imposes obligations on entities that obtain and report consumer credit information. In the plaintiff's original petition, the plaintiff outlines the facts and legal basis for their claim, presenting evidence of the defendant's alleged FCRA violations. The petition typically includes the following key details: 1. Parties: The plaintiff's original petition identifies the plaintiff, who is usually an individual or a class of individuals whose rights under the FCRA have been allegedly violated. The defendant is the party accused of violating the FCRA, and their identity is also disclosed. 2. Jurisdiction: The document establishes the court's jurisdiction over the matter, specifying the reasons why the court has the authority to hear the case. In this case, it would be within the jurisdiction of the district court in Houston, Texas. 3. FCRA Violations: The plaintiff outlines the specific violations of the FCRA that the defendant has allegedly committed. These violations can include but are not limited to: failure to provide accurate and up-to-date credit information, failure to investigate disputed information, failure to provide required disclosures to consumers, or improper use of consumer credit information. 4. Class Action Allegations: If the plaintiff is representing a class of individuals, the petition may seek certification as a class action lawsuit. In this case, the plaintiff will argue that there are numerous individuals who have suffered similar FCRA violations by the defendant, and it is appropriate to litigate the claims collectively as a class. Different types of Houston Texas Plaintiff's Original Petitions regarding FCRA may arise depending on the specific circumstances and FCRA violations alleged. For instance, a plaintiff may file a petition seeking damages for identity theft resulting from a defendant's failure to properly safeguard consumer credit information. Another type of petition could involve a plaintiff seeking remedies for a credit reporting agency's inaccurate reporting that has led to denied credit or employment opportunities for the plaintiff. In summary, the Houston Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act is a legal document that initiates a lawsuit against a defendant for alleged FCRA violations. It identifies the parties involved, outlines the alleged violations, and seeks appropriate remedies, including damages or injunctive relief, to rectify the harm caused by the defendant's actions.

Houston Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act

Category:

State:

Texas

City:

Houston

Control #:

TX-CC-42-01

Format:

PDF

Instant download

This form is available by subscription

Description

A01 Plaintiff's Original Petition regarding Fair Credit Reporting Act

The Houston Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act is a legal document filed by a plaintiff in a civil lawsuit to initiate a legal action against a defendant for alleged violations of the Fair Credit Reporting Act (FCRA). The FCRA is a federal law that regulates how consumer credit information is collected, disseminated, and used by businesses and credit reporting agencies. It provides individuals with certain rights and imposes obligations on entities that obtain and report consumer credit information. In the plaintiff's original petition, the plaintiff outlines the facts and legal basis for their claim, presenting evidence of the defendant's alleged FCRA violations. The petition typically includes the following key details: 1. Parties: The plaintiff's original petition identifies the plaintiff, who is usually an individual or a class of individuals whose rights under the FCRA have been allegedly violated. The defendant is the party accused of violating the FCRA, and their identity is also disclosed. 2. Jurisdiction: The document establishes the court's jurisdiction over the matter, specifying the reasons why the court has the authority to hear the case. In this case, it would be within the jurisdiction of the district court in Houston, Texas. 3. FCRA Violations: The plaintiff outlines the specific violations of the FCRA that the defendant has allegedly committed. These violations can include but are not limited to: failure to provide accurate and up-to-date credit information, failure to investigate disputed information, failure to provide required disclosures to consumers, or improper use of consumer credit information. 4. Class Action Allegations: If the plaintiff is representing a class of individuals, the petition may seek certification as a class action lawsuit. In this case, the plaintiff will argue that there are numerous individuals who have suffered similar FCRA violations by the defendant, and it is appropriate to litigate the claims collectively as a class. Different types of Houston Texas Plaintiff's Original Petitions regarding FCRA may arise depending on the specific circumstances and FCRA violations alleged. For instance, a plaintiff may file a petition seeking damages for identity theft resulting from a defendant's failure to properly safeguard consumer credit information. Another type of petition could involve a plaintiff seeking remedies for a credit reporting agency's inaccurate reporting that has led to denied credit or employment opportunities for the plaintiff. In summary, the Houston Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act is a legal document that initiates a lawsuit against a defendant for alleged FCRA violations. It identifies the parties involved, outlines the alleged violations, and seeks appropriate remedies, including damages or injunctive relief, to rectify the harm caused by the defendant's actions.

Free preview

How to fill out Houston Texas Plaintiff's Original Petition Regarding Fair Credit Reporting Act?

If you have previously used our service, Log In to your account and download the Houston Texas Plaintiff's Original Petition concerning the Fair Credit Reporting Act to your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it based on your payment plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You have uninterrupted access to all documents you have purchased: they can be located in your profile within the My documents section whenever you need to use them again. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or business needs!

- Make sure you’ve found an appropriate document. Review the description and use the Preview feature, if available, to see if it satisfies your requirements. If it doesn’t fit your needs, employ the Search tab above to find the correct one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Create an account and process your payment. Enter your credit card information or use the PayPal option to finalize the transaction.

- Obtain your Houston Texas Plaintiff's Original Petition regarding the Fair Credit Reporting Act. Select the file format for your document and save it to your device.

- Complete your document. Print it out or use professional online editors to fill it out and sign it digitally.