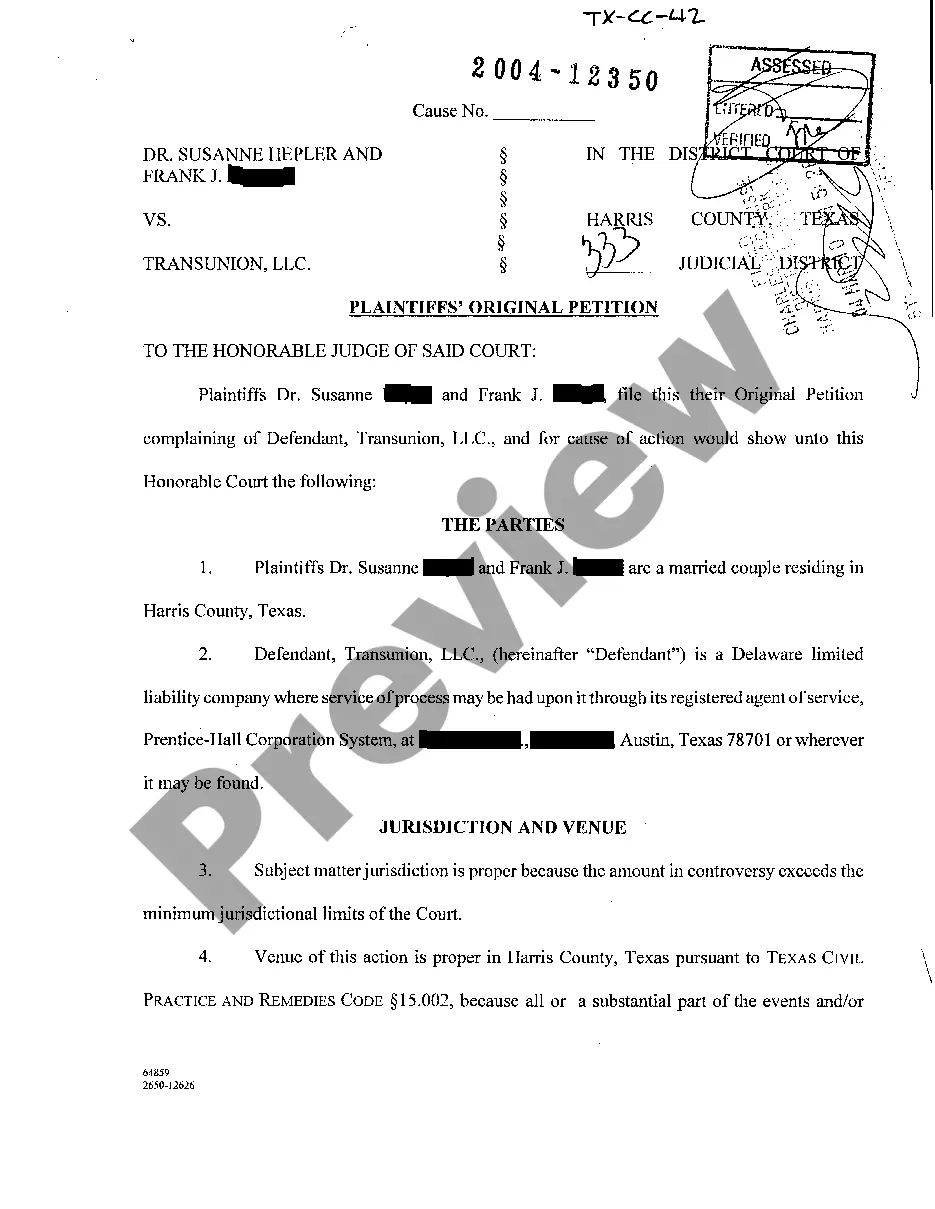

Title: Understanding Killeen Texas Plaintiff's Original Petition Regarding Fair Credit Reporting Act Introduction: In Killeen, Texas, plaintiffs can file an Original Petition regarding violations of the Fair Credit Reporting Act (FCRA). The FCRA is a federal law that regulates how consumer credit information is collected, shared, and used by credit reporting agencies. This detailed description will provide an overview of Killeen Texas Plaintiff's Original Petition related to the Fair Credit Reporting Act, highlighting its purpose, types, and key elements. 1. Overview of Killeen Texas Plaintiff's Original Petition: The Killeen Texas Plaintiff's Original Petition is a formal legal document filed by a plaintiff in a lawsuit alleging the violation of their rights under the Fair Credit Reporting Act. It serves as the initial step in initiating a legal claim against the defendant, typically a credit reporting agency or lender. 2. Types of Killeen Texas Plaintiff's Original Petition regarding the Fair Credit Reporting Act: a) FCRA Violation by Credit Reporting Agency: This type of original petition focuses on credit reporting agencies that fail to comply with FCRA regulations, such as improper or inaccurate reporting, failure to correct errors, or unauthorized disclosures of consumer credit information. b) FCRA Violation by Lender or Creditor: This petition addresses lenders or creditors who violate the FCRA by making false or misleading statements, engaging in unfair practices, or negligently handling consumer credit information. c) FCRA Violation by Debt Collectors: This type pertains to debt collectors who violate FCRA provisions by engaging in unjust debt collection practices, including false reporting, harassment, or unauthorized disclosure of consumer data. 3. Key Elements of Killeen Texas Plaintiff's Original Petition: a) Parties Involved: The original petition identifies the plaintiff (victim of the FCRA violation) and defendant(s) (alleged violator(s)), including their full names, addresses, and contact information. b) Jurisdiction and Venue: It specifies the court in which the lawsuit is filed and the reasons why that court has the authority to hear the case. c) FCRA Violations Alleged: The petition outlines the specific provisions of the Fair Credit Reporting Act that the defendant(s) allegedly violated. This includes details of the unlawful actions or omissions committed and the resulting harm suffered by the plaintiff. d) Damages Sought: The plaintiff explains the compensation or remedies they are seeking, such as actual damages, statutory damages, punitive damages, attorney fees, and injunctive relief to stop ongoing violations. e) Legal Arguments and Evidence: The original petition presents a legal argument, supported by relevant facts and evidence, demonstrating how the defendant(s) violated FCRA regulations and how it has affected the plaintiff's rights. f) Prayer for Relief: At the end of the petition, the plaintiff requests specific relief, such as monetary compensation, a cease and desist order, and any other appropriate remedies to rectify the harm caused. Conclusion: Killeen, Texas Plaintiff's Original Petition regarding the Fair Credit Reporting Act allows individuals to seek legal recourse when their rights under the FCRA have been violated. By filing such a petition, plaintiffs aim to hold credit reporting agencies, lenders, creditors, or debt collectors accountable for their actions and seek appropriate remedies for the harm suffered. These petitions play a vital role in safeguarding consumer credit information and upholding the principles of the FCRA.

Killeen Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act

Description

How to fill out Killeen Texas Plaintiff's Original Petition Regarding Fair Credit Reporting Act?

If you are searching for a valid form template, it’s impossible to find a more convenient service than the US Legal Forms website – one of the most comprehensive libraries on the web. With this library, you can get a large number of document samples for organization and individual purposes by types and regions, or key phrases. With the high-quality search feature, discovering the most recent Killeen Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act is as easy as 1-2-3. In addition, the relevance of each file is confirmed by a group of skilled attorneys that regularly review the templates on our platform and revise them based on the most recent state and county requirements.

If you already know about our platform and have an account, all you need to get the Killeen Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act is to log in to your account and click the Download button.

If you make use of US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have chosen the sample you need. Read its information and make use of the Preview feature (if available) to see its content. If it doesn’t meet your needs, utilize the Search field near the top of the screen to discover the appropriate record.

- Affirm your selection. Choose the Buy now button. Next, pick your preferred subscription plan and provide credentials to register an account.

- Process the purchase. Make use of your bank card or PayPal account to complete the registration procedure.

- Get the template. Indicate the format and save it on your device.

- Make changes. Fill out, edit, print, and sign the acquired Killeen Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act.

Each and every template you save in your account does not have an expiry date and is yours forever. You can easily access them via the My Forms menu, so if you want to have an extra version for editing or printing, feel free to return and save it once more anytime.

Take advantage of the US Legal Forms extensive library to get access to the Killeen Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act you were seeking and a large number of other professional and state-specific templates on one website!