McAllen Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act is a legal document filed by an individual or entity (referred to as the plaintiff) in McAllen, Texas, initiating a lawsuit against a defendant for violations related to the Fair Credit Reporting Act (FCRA). The FCRA is a federal law that regulates the gathering, dissemination, and use of consumer credit information by consumer reporting agencies. The Plaintiff's Original Petition outlines the specific allegations and claims against the defendant, seeking legal remedies for the defendant's non-compliance with the FCRA. The plaintiff may allege various violations of the FCRA, including but not limited to: 1. Inaccurate or incomplete reporting: The plaintiff may argue that the defendant provided false, outdated, or incorrect information to consumer reporting agencies, resulting in damage to the plaintiff's creditworthiness or reputation. 2. Failure to investigate disputes or respond to consumer complaints: The plaintiff may claim that the defendant neglected to investigate the accuracy of disputed information or failed to respond adequately to consumer complaints, as required by the FCRA. 3. Unauthorized access or disclosure of credit reports: The plaintiff may argue that the defendant accessed or disclosed their credit reports without proper authorization, violating the privacy protections afforded under the FCRA. 4. Failure to provide required notices or disclosures: The plaintiff may assert that the defendant did not furnish mandated disclosures or failed to provide proper notices required by the FCRA, such as adverse action notices or pre-screened offers. It is important to note that different types or variations of McAllen Texas Plaintiff's Original Petitions may exist depending on the specific circumstances of the FCRA violations alleged. These could include cases involving identity theft, credit report errors, employment background check disputes, or cases involving consumer reporting agencies or furnishes of credit information. The primary purpose of filing a McAllen Texas Plaintiff's Original Petition regarding FCRA violations is to seek legal remedies through the court system. Relief sought by the plaintiff may include compensatory damages, statutory damages, injunctive relief, attorney fees, and any other appropriate relief as determined by the court. Navigating FCRA violations and filing a McAllen Texas Plaintiff's Original Petition can be complex. It is essential for plaintiffs to consult with experienced attorneys specializing in consumer protection or FCRA law to assess the specific circumstances of their case and ensure adherence to legal procedures.

McAllen Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act

Description

How to fill out McAllen Texas Plaintiff's Original Petition Regarding Fair Credit Reporting Act?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the McAllen Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the McAllen Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a couple of more actions to make for new users.

Follow the guidelines below to get started with the most extensive online form library:

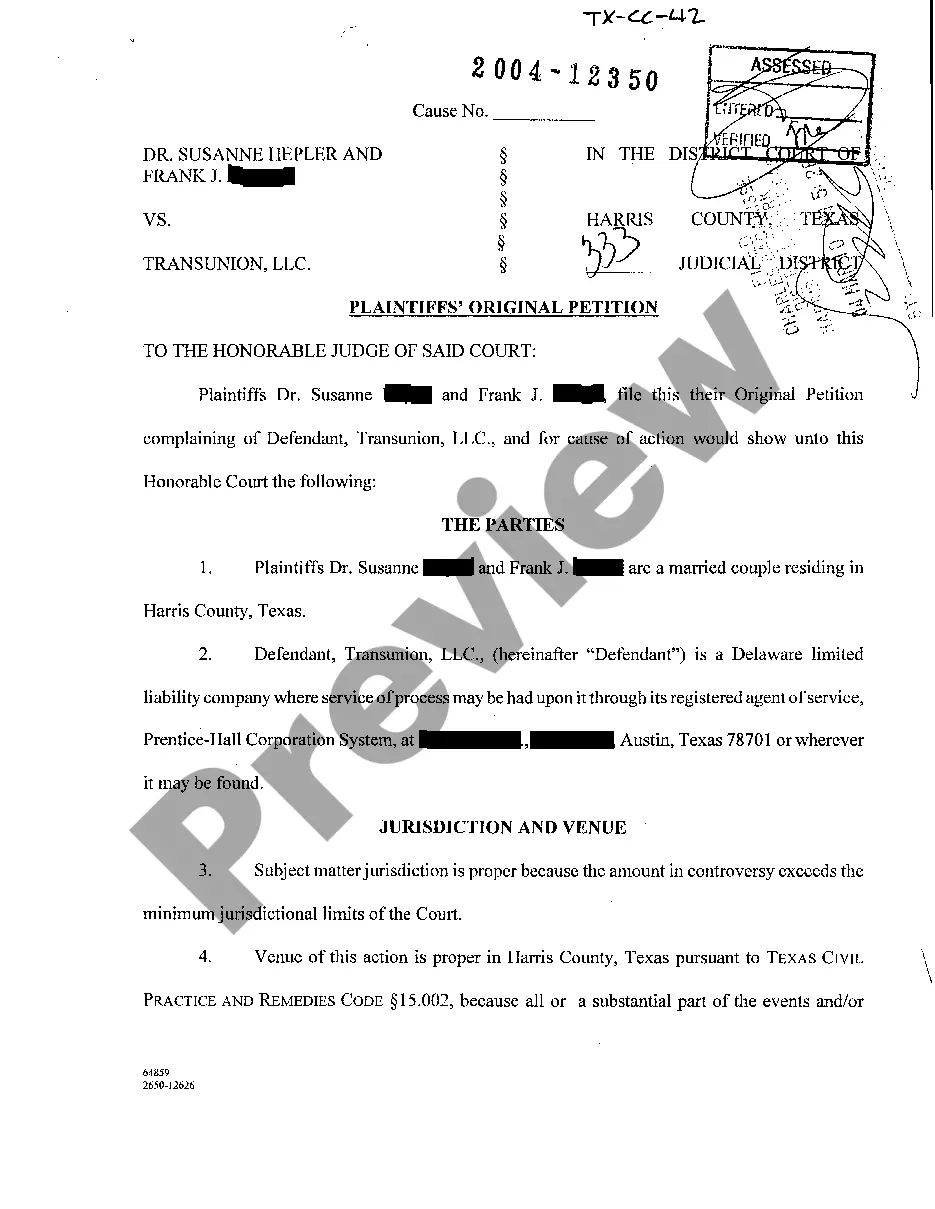

- Look at the Preview mode and form description. Make sure you’ve chosen the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the McAllen Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!