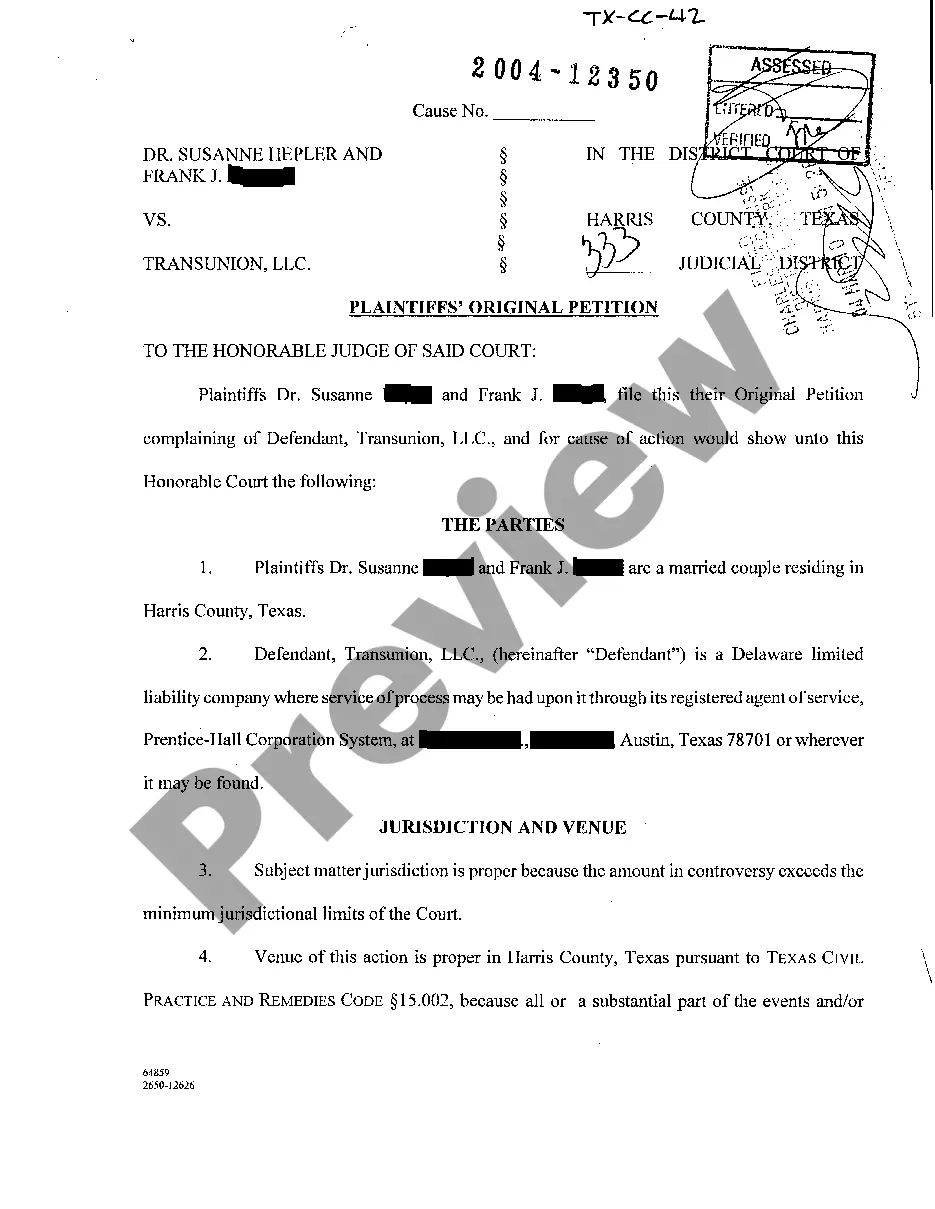

The San Antonio Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act is a legal document that outlines a complaint filed by a plaintiff in San Antonio, Texas, related to violations of the Fair Credit Reporting Act (FCRA). The FCRA is a federal law that regulates how consumer credit information is collected, shared, and used by consumer reporting agencies and creditors. The plaintiff's original petition is typically filed in a civil court and serves as the initial document that sets forth the details of the plaintiff's claims against the defendant or defendants. It provides a factual background of the case, describes the relevant events and parties involved, and outlines the alleged violations of the FCRA. Keywords that may be present in a San Antonio Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act include: 1. Fair Credit Reporting Act (FCRA): This federal law is the primary statute governing the collection, sharing, and use of consumer credit information. 2. Plaintiff: The individual or entity bringing the legal action against the defendant. 3. Defendant: The person or entity being sued for the alleged FCRA violations. 4. Civil court: The court system that handles non-criminal cases, including FCRA-related disputes. 5. Consumer reporting agencies: These are entities that collect and maintain consumer credit information and generate credit reports, such as Equifax, Experian, and TransUnion. 6. Creditors: Organizations or individuals who extend credit to consumers, such as banks, credit card companies, or loan providers. 7. Violations: Alleged instances of non-compliance or improper actions related to the FCRA, such as inaccurately reporting credit information, failing to investigate disputes, or sharing credit reports without proper authorization. Different types of San Antonio Texas Plaintiff's Original Petitions regarding the FCRA could exist based on the specific claim made by the plaintiff. For example, a plaintiff may file a petition alleging that a consumer reporting agency negligently reported inaccurate credit information, causing financial harm. Another type of petition may involve a creditor unlawfully accessing and using a consumer's credit report without proper authorization. The specific allegations made by the plaintiff will determine the unique characteristics of each petition.

San Antonio Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act

Description

How to fill out San Antonio Texas Plaintiff's Original Petition Regarding Fair Credit Reporting Act?

We always strive to minimize or avoid legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we sign up for attorney services that, usually, are very costly. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of turning to a lawyer. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the San Antonio Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the website! You can create your account within minutes.

- Make sure to check if the San Antonio Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the San Antonio Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act would work for you, you can pick the subscription option and make a payment.

- Then you can download the form in any suitable file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!