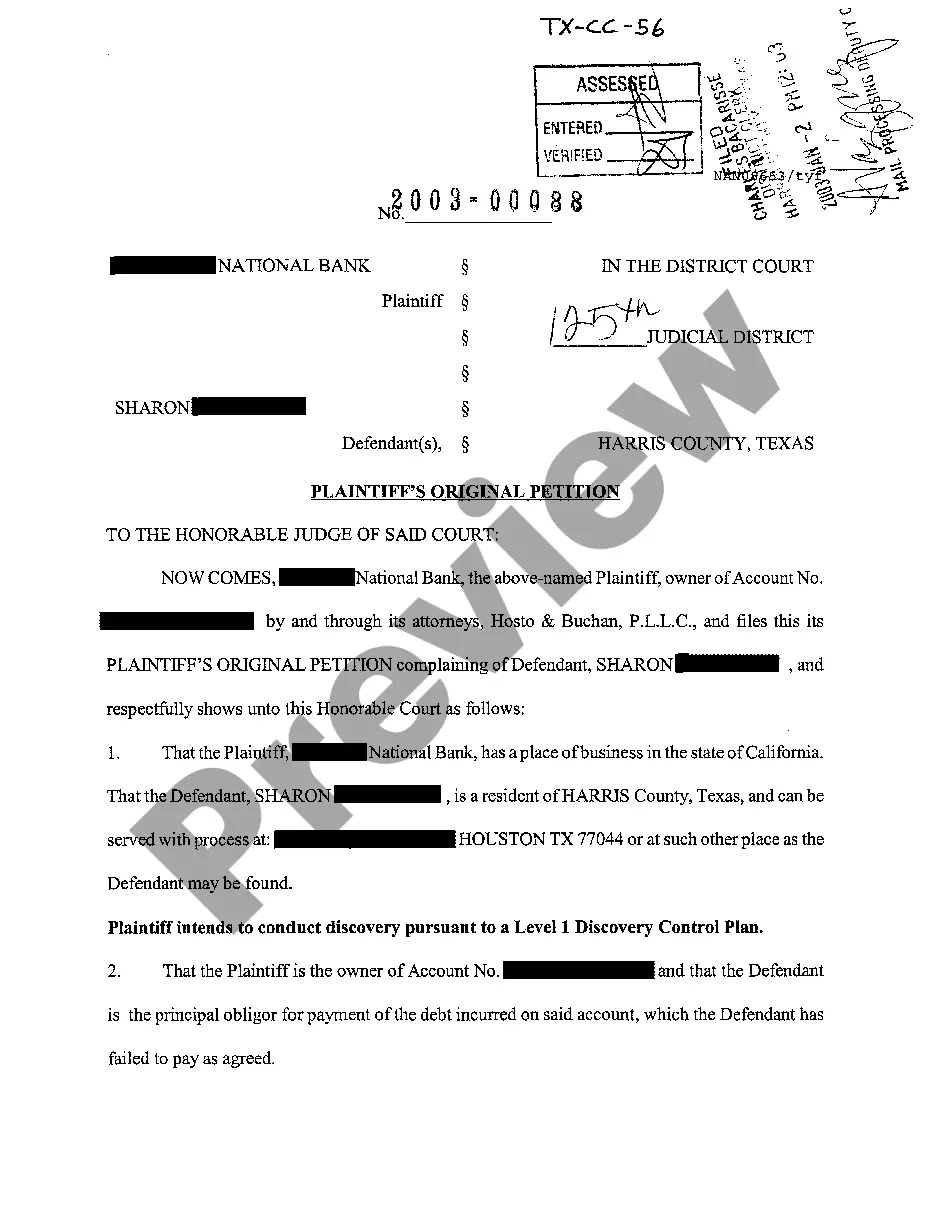

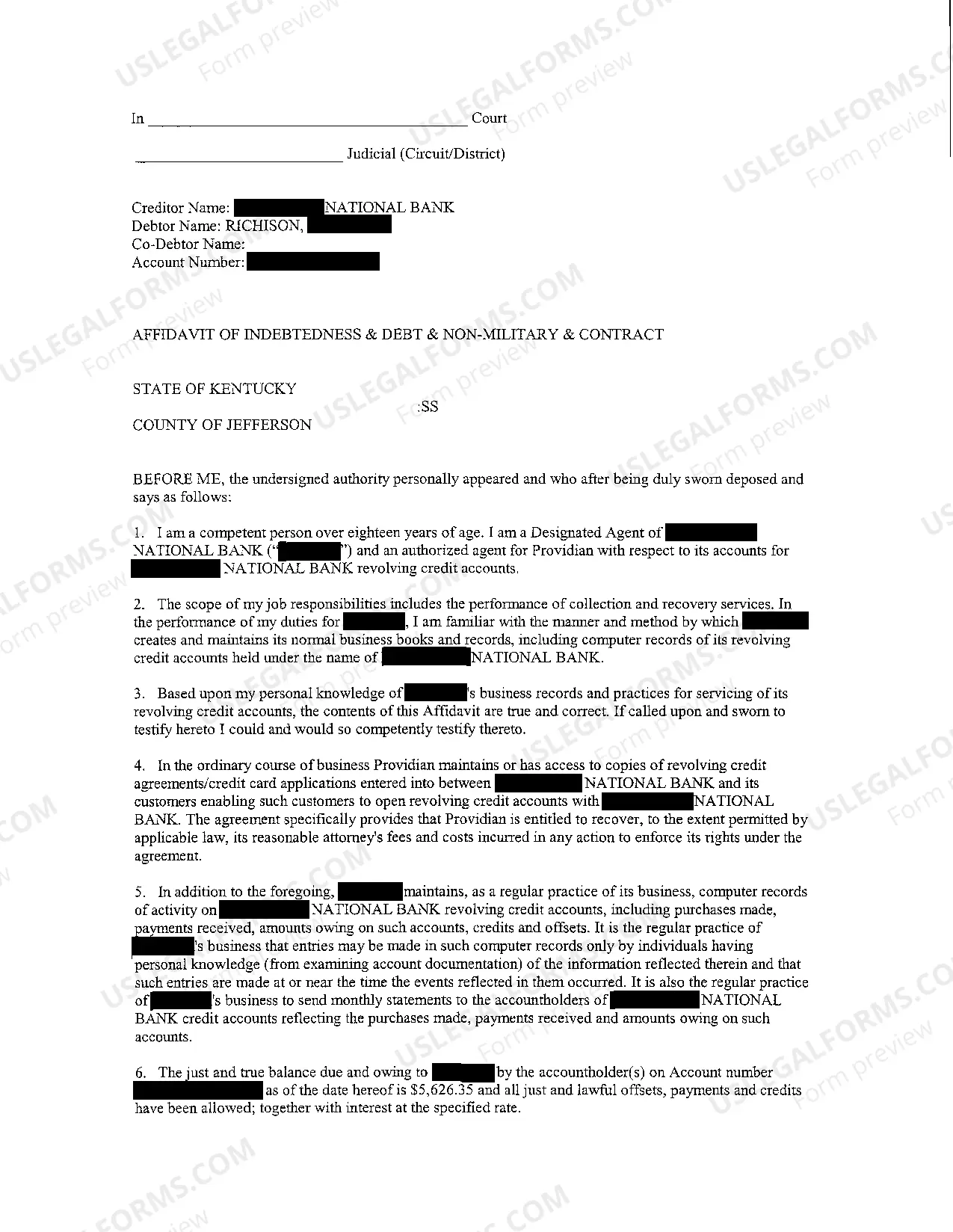

In Beaumont, Texas, a Plaintiff's Original Petition for Debt Collection is a legal document filed by a creditor or debt collection agency to initiate a lawsuit against a debtor in an effort to collect an outstanding debt. This petition serves as the initial step in the debt collection process and outlines the creditor's claims, supporting evidence, and the relief they seek from the court. Keywords: Beaumont Texas, Plaintiff's Original Petition, Debt Collection, lawsuit, creditor, debtor, outstanding debt, claims, supporting evidence, relief, court. Types of Beaumont Texas Plaintiff's Original Petition for Debt Collection: 1. Unsecured Debt Collection Petition: This type of petition is filed when the debt owed by the debtor does not have any collateral or security attached to it. Examples include credit card debt, medical bills, personal loans, or unpaid utilities. 2. Secured Debt Collection Petition: In cases where the debtor has secured the debt with collateral, such as a car, home, or any other valuable asset, the creditor may file a secured debt collection petition. The petition highlights the collateral involved and seeks to recover the outstanding debt by potentially repossessing or foreclosing on the secured property. 3. Business Debt Collection Petition: If the debt collection pertains to a business, the plaintiff, who may be another business or an individual, can file a business debt collection petition against the debtor. This type of petition differs from personal debt collection, as it often involves larger amounts owed and complexities related to commercial transactions or contracts. 4. Consumer Debt Collection Petition: Consumer debt collection petitions are filed when the debt is owed by an individual consumer. This could include debts arising from credit card accounts, personal loans, retail financing, or other forms of consumer credit. 5. Medical Debt Collection Petition: In cases where a debtor fails to pay their medical bills, healthcare providers or medical facilities may file a medical debt collection petition. This type of petition specifically targets outstanding medical expenses, including treatments, surgeries, hospital stays, or any other medical services not covered by insurance. 6. Judgment Debt Collection Petition: Following a successful lawsuit resulting in a judgment in favor of the plaintiff, a judgment debt collection petition can be filed. This petition aims to enforce the court's judgment and recover the amount owed by the debtor as determined by the court. It's important to note that the specific requirements and procedures for filing a Plaintiff's Original Petition for Debt Collection may vary depending on the jurisdiction and the nature of the debt involved. It is advised to consult with a local attorney or legal professional to ensure compliance with the applicable laws and regulations.

Beaumont Texas Plaintiff's Original Petition for Debt Collection

Description

How to fill out Beaumont Texas Plaintiff's Original Petition For Debt Collection?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Beaumont Texas Plaintiff's Original Petition for Debt Collection gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Beaumont Texas Plaintiff's Original Petition for Debt Collection takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a couple of additional actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve picked the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Beaumont Texas Plaintiff's Original Petition for Debt Collection. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!