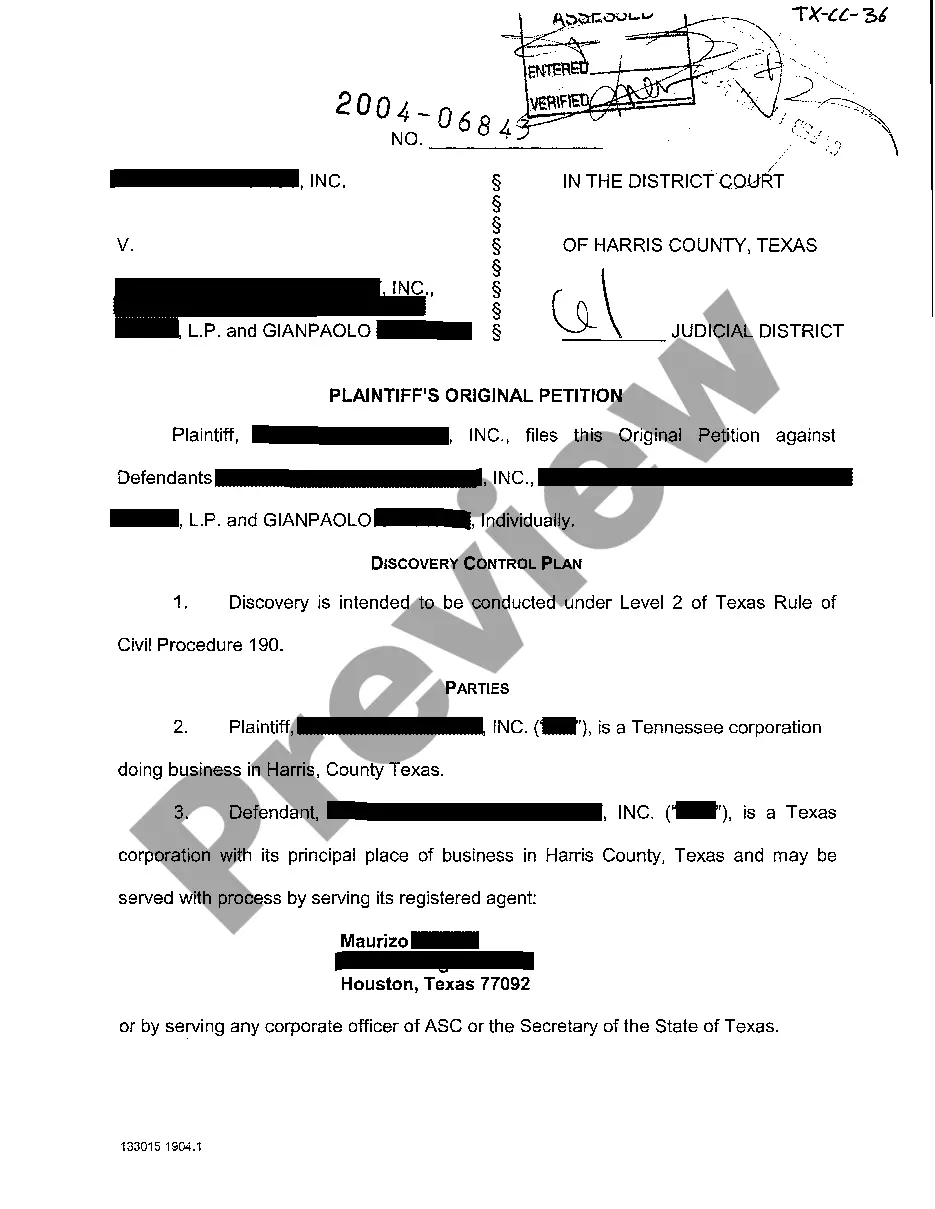

Fort Worth Texas Plaintiff's Original Petition for Debt Collection

Description

How to fill out Texas Plaintiff's Original Petition For Debt Collection?

Regardless of social or occupational rank, filling out legal documents is an unfortunate requirement in the modern world.

Frequently, it’s nearly impossible for someone lacking legal education to create such documentation from the ground up, primarily due to the complex language and legal intricacies involved.

This is where US Legal Forms can come to the rescue.

Confirm that the form you have selected is appropriate for your area since the regulations of one state or region may not apply to another.

Examine the document and read a brief summary (if available) of situations for which the document can be utilized.

- Our platform offers a vast assortment of over 85,000 ready-to-use state-specific documents suitable for nearly any legal situation.

- US Legal Forms is also a significant resource for associates or legal advisors who wish to enhance their time efficiency by using our DIY papers.

- Whether you require the Fort Worth Texas Plaintiff's Original Petition for Debt Collection or another document beneficial in your jurisdiction, with US Legal Forms, everything is readily available.

- Here’s how you can swiftly obtain the Fort Worth Texas Plaintiff's Original Petition for Debt Collection using our reliable platform.

- If you are an existing client, you can proceed to Log In to your account to access the required document.

- However, if you are new to our collection, make sure to follow these steps before acquiring the Fort Worth Texas Plaintiff's Original Petition for Debt Collection.

Form popularity

FAQ

This is done by putting your request in writing and sending it to the court and to the plaintiff. Once you have been served with the citation, you have 14 days to file an answer, which is your response to your lawsuit. You must give your answer to the court and also send it to the plaintiff.

Texas and Federal Law The statute of limitations on debt in Texas is four years. This section of the law, introduced in 2019, states that a payment on the debt (or any other activity) does not restart the clock on the statute of limitations.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

5 Steps to Beat LVNV Funding in Court Do not call them up.Get a current copy of your credit report.Get a consult with a consumer attorney.Hire a consumer attorney.Force them to prove a case.

The 3 Steps to respond to a debt lawsuit Respond to every paragraph in the Complaint. The Complaint includes several numbered paragraphs that lay out the lawsuit against you.Assert your Affirmative Defenses.File the Answer with the court and the plaintiff.

Takeaways on How to Effectively Defend Yourself in a Debt Collection Lawsuit Make sure you respond to the Complaint and your response is timely filed. Review potential affirmative defenses that could apply to your case. Make the debt collector prove that they have the legal right to sue you.

Resurgent Capital Services is not a scam. It is a real debt collection agency. LVNV Funding buys debts from credit card companies and banks. They also buy debt from many industries, including telecommunications, utilities, health, cable companies, and financial service providers.

TrueAccord is a legitimate company. They are not a fake company, or a scam.

Your answer can be a handwritten letter to the court that says you do not agree with the lawsuit. Include your case (cause) number and mailing address and any defenses you may have to the lawsuit; for example, the amount they claim you owe is incorrect, the account isn't yours, or the debt is older than 4 years.