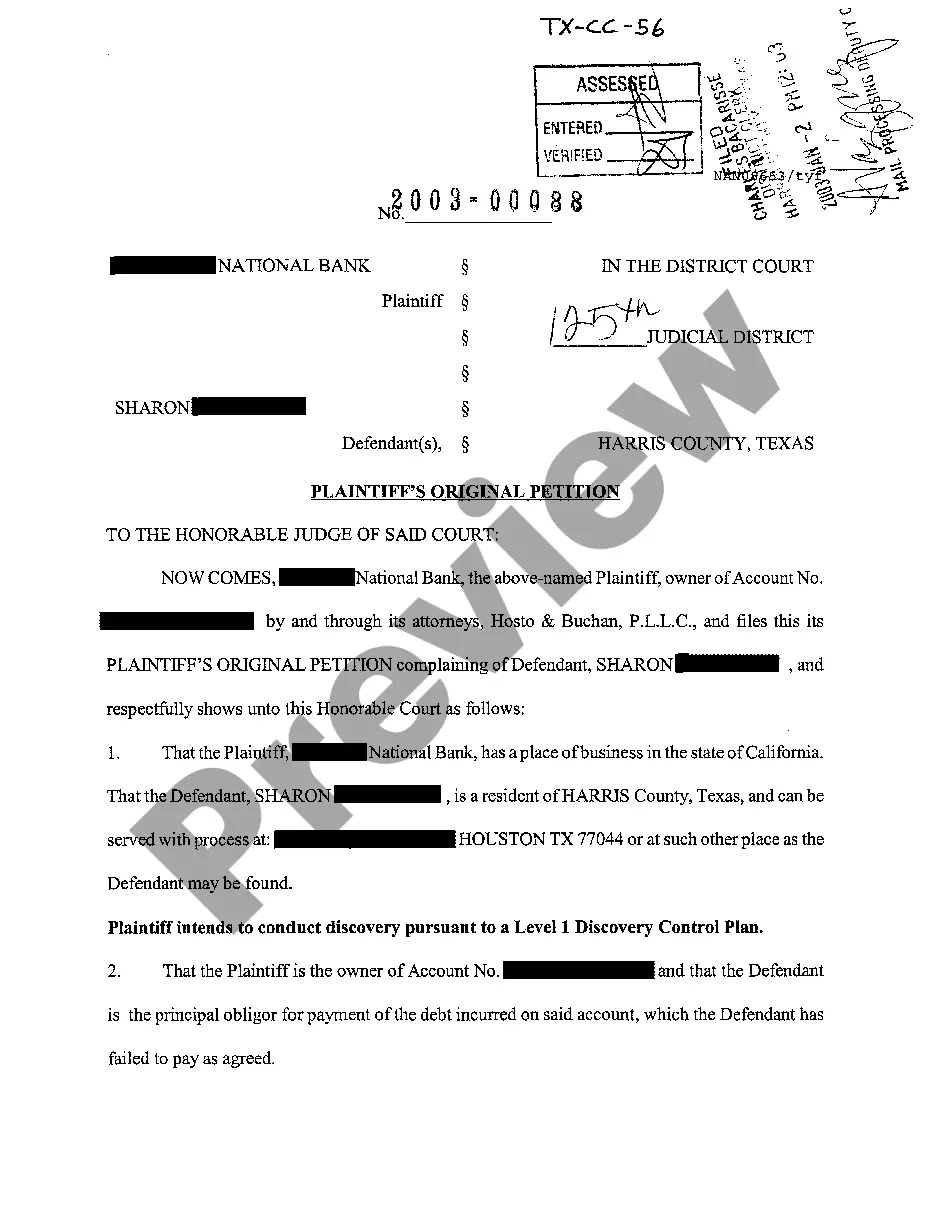

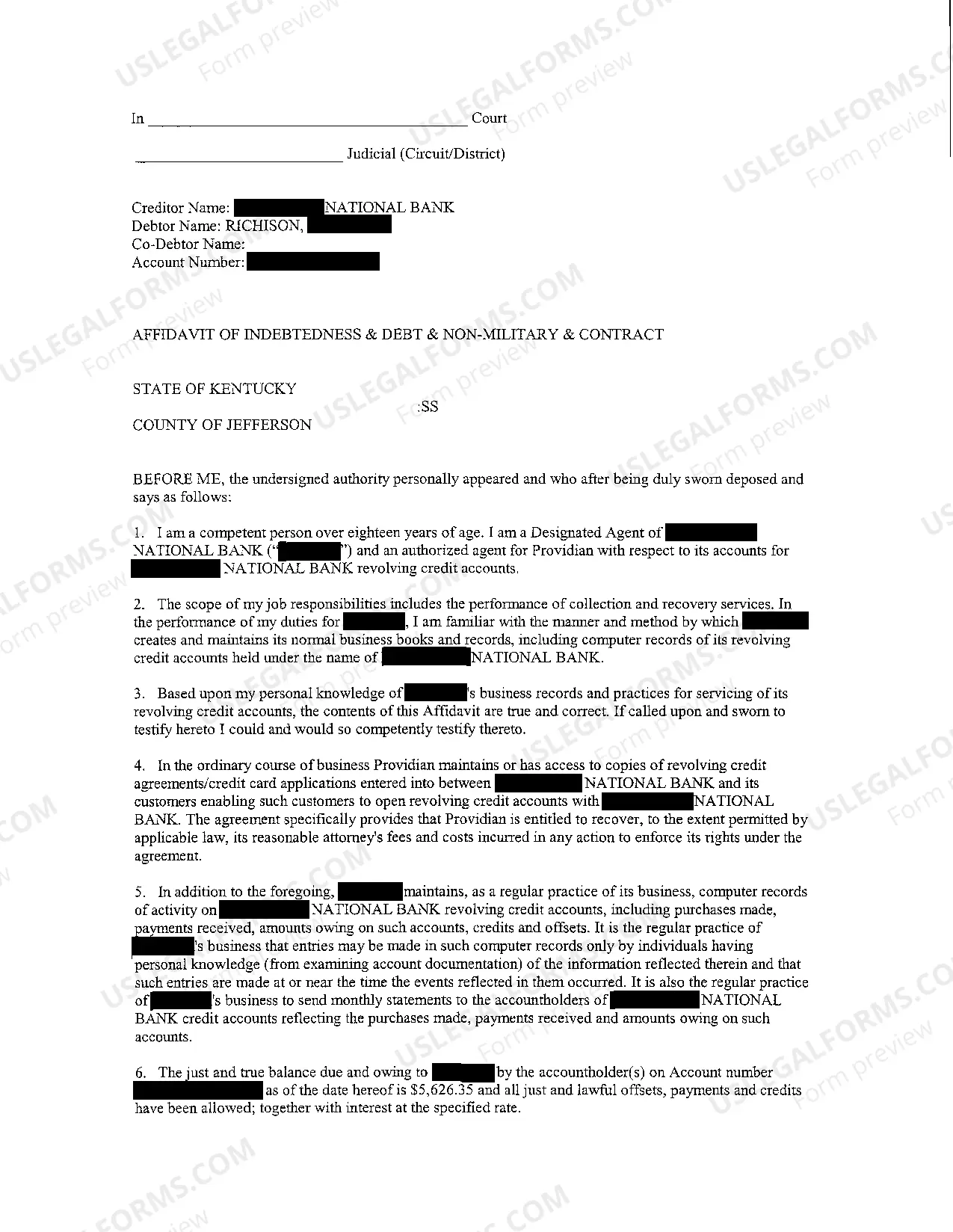

Harris Texas Plaintiff's Original Petition for Debt Collection is a legal document filed by an individual or entity (the plaintiff) in Harris County, Texas. This petition serves as the initial step in a debt collection lawsuit and outlines the specific details surrounding an unpaid debt. It includes relevant keywords such as debt collection, plaintiff, defendant, Harris County, Texas, and petition. There are different types of Harris Texas Plaintiff's Original Petition for Debt Collection, depending on the nature and circumstances of the debt. Some of these types may include: 1. Unsecured Debt Collection: This type of petition is filed when the debt is not backed by collateral, such as credit card debts, medical bills, personal loans, or unpaid utility bills. The plaintiff seeks to recover the outstanding debt amount from the defendant. 2. Secured Debt Collection: If the debt is secured by collateral, such as a mortgage loan or an auto loan, the plaintiff may file a petition to collect the debt along with the right to claim and sell the collateral if the debt remains unpaid. This type of petition typically includes details about the collateral and its estimated value. 3. Small Claims Debt Collection: In cases where the debt amount is relatively low, often below a certain threshold (such as $10,000), the plaintiff may choose to file a petition in small claims court. This simplified process is designed for swift debt resolution without the need for extensive legal proceedings. 4. Commercial Debt Collection: When the debt is owed by a business entity rather than an individual, a plaintiff may file a commercial debt collection petition. This type of petition typically includes additional details about the debtor's business structure, financial records, and any applicable contracts or agreements. Regardless of the type, a Harris Texas Plaintiff's Original Petition for Debt Collection is a crucial legal document that initiates the debt collection process. The petition should contain comprehensive information about the debt, parties involved, the amount owed, any applicable interest or fees, and a request for the court to intervene and resolve the dispute.

Harris Texas Plaintiff's Original Petition for Debt Collection

Description

How to fill out Harris Texas Plaintiff's Original Petition For Debt Collection?

No matter the social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for a person without any law background to create this sort of paperwork cfrom the ground up, mainly because of the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes in handy. Our service offers a huge collection with more than 85,000 ready-to-use state-specific forms that work for almost any legal situation. US Legal Forms also is a great asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you require the Harris Texas Plaintiff's Original Petition for Debt Collection or any other document that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Harris Texas Plaintiff's Original Petition for Debt Collection in minutes employing our trustworthy service. If you are presently an existing customer, you can proceed to log in to your account to get the needed form.

Nevertheless, in case you are new to our library, make sure to follow these steps prior to downloading the Harris Texas Plaintiff's Original Petition for Debt Collection:

- Ensure the form you have found is specific to your location since the regulations of one state or area do not work for another state or area.

- Preview the document and go through a brief outline (if provided) of cases the paper can be used for.

- If the one you chosen doesn’t suit your needs, you can start over and look for the suitable form.

- Click Buy now and choose the subscription plan that suits you the best.

- Access an account {using your login information or register for one from scratch.

- Select the payment gateway and proceed to download the Harris Texas Plaintiff's Original Petition for Debt Collection once the payment is done.

You’re all set! Now you can proceed to print out the document or complete it online. In case you have any issues locating your purchased forms, you can quickly find them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.

Form popularity

FAQ

On July 20, 2022, the Court preliminarily approved the Settlement.

In California, the statute of limitations for consumer debt is four years. This means a creditor can't prevail in court after four years have passed, making the debt essentially uncollectable.

LVNV Funding LLC is a company that buys charged-off accounts from companies like credit card issuers and personal loan lenders. A charge-off is a debt that the original creditor has given up trying to collect on after you've missed a number of payments.

If you've already been given a court order for a debt There's no time limit for the creditor to enforce the order. If the court order was made more than 6 years ago, the creditor has to get court permission before they can use bailiffs.

Your answer can be a handwritten letter to the court that says you do not agree with the lawsuit. Include your case (cause) number and mailing address and any defenses you may have to the lawsuit; for example, the amount they claim you owe is incorrect, the account isn't yours, or the debt is older than 4 years.

The statute of limitations on debt in Texas is four years. This section of the law, introduced in 2019, states that a payment on the debt (or any other activity) does not restart the clock on the statute of limitations.

What is LVNV Funding? LVNV Funding LLC is a debt collection company. Debt collection companies generally buy accounts in default. For example, LVNV Funding would connect with companies like Capital One, Chase, Citibank, Synchrony Bank, and Wells Fargo.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Whether you choose to pay an old debt is up to you. It will fall off your credit after seven years, but collection agencies can still call. If you want to stop the calls, you can offer to settle.

5 Steps to Beat LVNV Funding in Court Do not call them up.Get a current copy of your credit report.Get a consult with a consumer attorney.Hire a consumer attorney.Force them to prove a case.

Interesting Questions

More info

Must file and serve and have served a written, sworn document setting forth that defendant has done so. You may not file on behalf of a third party.×4) If the time period for a defendant to file an answer or counterclaim has expired, the case must be dismissed.×5) If the case is filed for collection, you may only file for the defense of the claim in the court's jurisdiction.×6) It must be the filing of an answer that prevents your having to pay a fee for a filing fee.×7) If one or both of your claims are denied by a court of law, the court shall grant an order directing a person to send to the clerk on or before the date specified therein.×8) The clerk shall file in the clerk's office one copy of the notice and its supporting papers for the purposes of this provision (the Notice, Notice of Claim, Complaint, and a copy of the Notice and supporting papers filed with the clerk×.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.