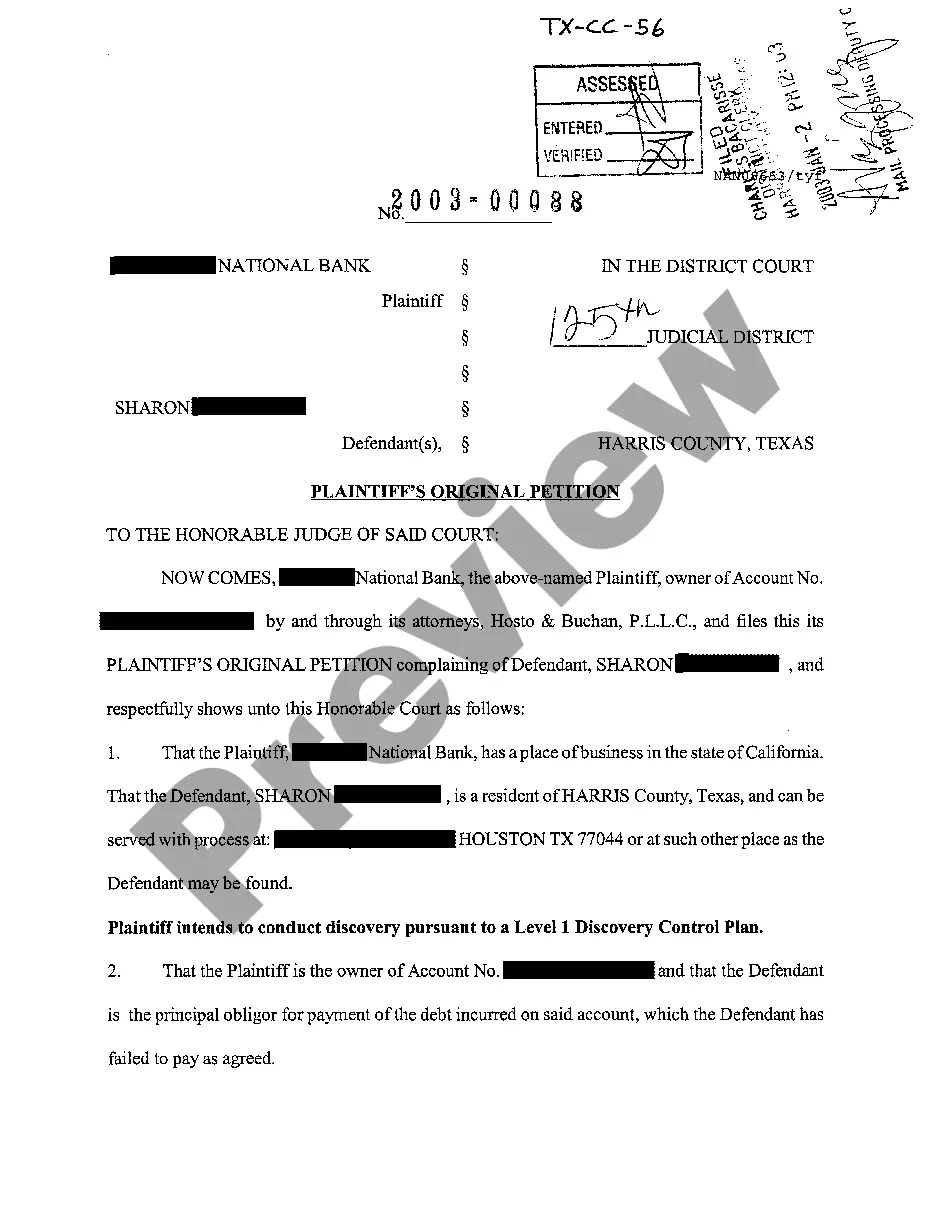

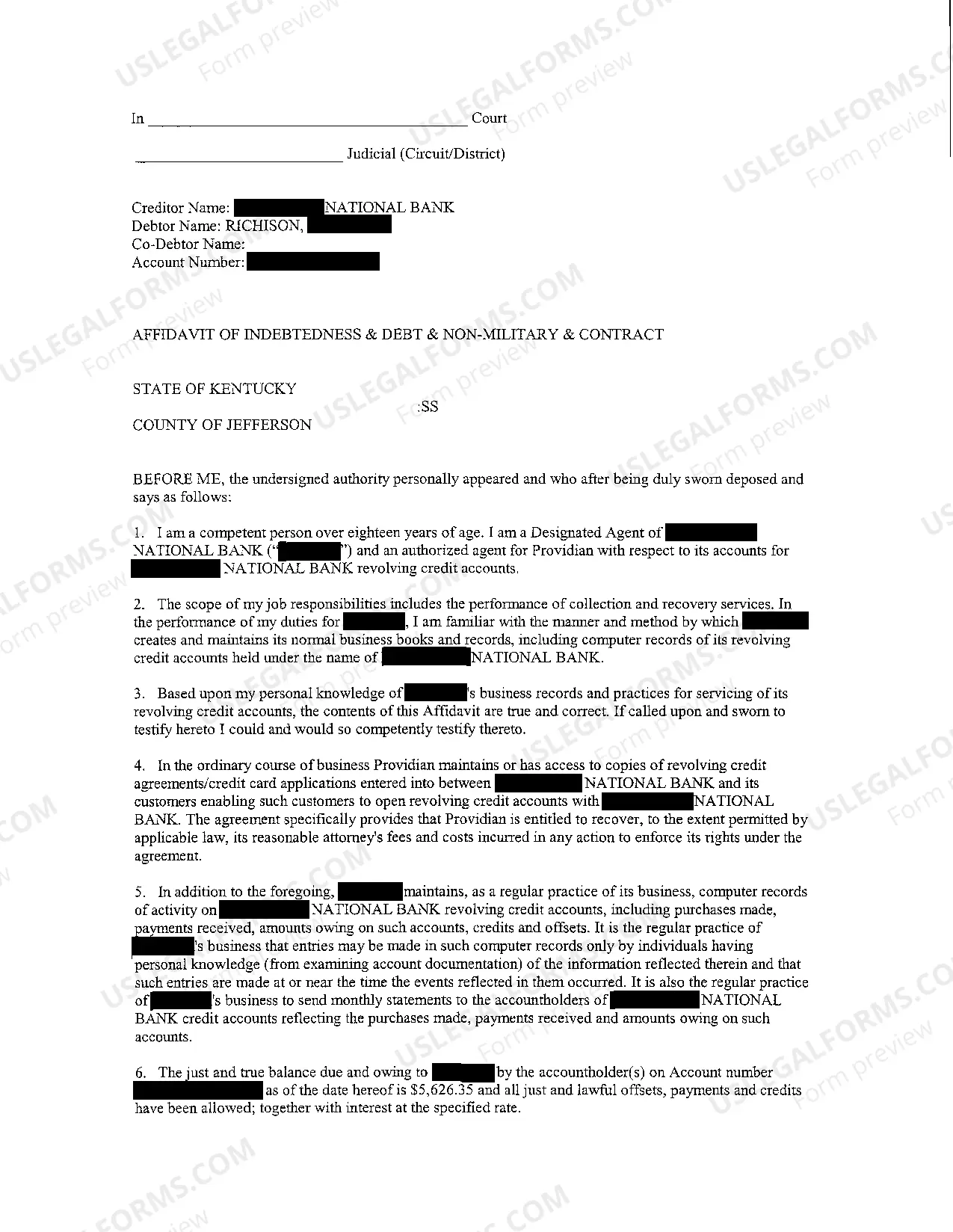

Lewisville Texas Plaintiff's Original Petition for Debt Collection refers to a legal document filed by a plaintiff to initiate a lawsuit against a debtor in Lewisville, Texas. This petition is specifically focused on debt collection and aims to seek a judgment in favor of the plaintiff to recover the owed amount from the debtor. Here is a detailed description of what this petition entails: 1. Party Information: The petition includes detailed information about the plaintiff, known as the creditor, such as their full legal name, address, and contact information. Similarly, the debtor's information, including their name, address, and contact details, is also stated accurately. 2. Case Details: The petition includes necessary case details, such as the case number assigned by the court, the court's name and address, and the date the lawsuit is being initiated. 3. Statement of Claim: The plaintiff's initial statement in the petition describes the nature of the debt owed by the debtor. It includes the debt amount, the original creditor's name (if applicable), the date the debt was incurred, and any supporting documentation, such as invoices, promissory notes, or contracts. 4. Legal Basis: The petition outlines the legal basis for the debt collection claim. It typically includes reference to relevant state laws and statutes and may include information on any breached agreements or defaults by the debtor that justify the collection action. 5. Detailed Facts: This section provides a detailed account of the events leading up to the debt collection action. It may highlight any payment reminders, demand letters sent to the debtor, or previous attempts made to resolve the matter amicably. These facts aim to demonstrate that the plaintiff has made reasonable efforts to settle the debt before resorting to legal action. 6. Request for Relief: This section outlines the specific relief sought by the plaintiff. It usually includes a request for the full amount owed, additional costs incurred due to the collection process, legal fees, court costs, and any other applicable damages that the plaintiff believes should be awarded. Types of Lewisville Texas Plaintiff's Original Petition for Debt Collection can vary based on the specifics of the case and the nature of the debt involved. Some possible variations or related scenarios could include: — Plaintiff's Original Petition for Debt Collection — Credit Card Debt: This type may focus specifically on the collection of credit card debts, outlining the relevant credit card account details, payment history, and any specific terms associated with the debt. — Plaintiff's Original Petition for Debt Collection — Medical Debt: If the debt pertains to medical expenses, this variation might emphasize the medical services provided, the debtor's responsibility for payment, and any insurance claims or coverage information relevant to the case. — Plaintiff's Original Petition for Debt Collection — Loan or Mortgage Debt: This type could focus on loans or mortgages, highlighting the loan agreement or mortgage terms, terms of default, any collateral involved, and any specific issues related to lawful collection under Texas mortgage and loan laws. It is important to consult with a legal professional to understand the specific requirements and variations that may apply to a Lewisville Texas Plaintiff's Original Petition for Debt Collection based on the circumstances of your particular case.

Lewisville Texas Plaintiff's Original Petition for Debt Collection

Description

How to fill out Lewisville Texas Plaintiff's Original Petition For Debt Collection?

Do you need a reliable and affordable legal forms provider to buy the Lewisville Texas Plaintiff's Original Petition for Debt Collection? US Legal Forms is your go-to solution.

Whether you need a simple agreement to set rules for cohabitating with your partner or a set of documents to advance your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of separate state and area.

To download the document, you need to log in account, find the needed form, and click the Download button next to it. Please take into account that you can download your previously purchased form templates anytime in the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Lewisville Texas Plaintiff's Original Petition for Debt Collection conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to learn who and what the document is intended for.

- Restart the search in case the form isn’t suitable for your legal scenario.

Now you can register your account. Then choose the subscription plan and proceed to payment. As soon as the payment is done, download the Lewisville Texas Plaintiff's Original Petition for Debt Collection in any provided file format. You can return to the website when you need and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about wasting hours learning about legal paperwork online for good.

Form popularity

FAQ

Even though they are old, they will never become ?statute barred? (that is the legal term for a debt that is too old for a creditor to enforce) because you are making payments to them..

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

To file online, go to E-File Texas and follow the instructions. To file in person, take your answer (and copies) to the district clerk's office in the county where the plaintiff filed the case.

Writing Your Response For each point that you admit or deny, include a brief reason why. An example would be if the plaintiff alleged you never paid back a loan you've already repaid. You can include any affirmative defense at the end of these responses, such as the statute of limitations nullifying the complaint.

Yes, but again the debt collector will be allowed to continue debt collection activities and will not have to verify the debt. If you want to assert your right to verify the debt, you must send your dispute letter within 30 days of receiving notice of the debt from the debt collector.

If a debt is sold to another company, do I have to pay? Once your debt has been sold to a debt purchaser you owe them the money, not the original creditor. The debt purchaser must follow the same rules as your original creditor when they collect the debt, and you keep all the same legal rights.

Use these 6 tips to make your Answer and beat debt collectors in court! Keep your Answer brief. Deny as many claims as possible. Add your affirmative defenses. Use standard formatting and style. Include a certificate of service. Sign the Answer document.

Your answer can be a handwritten letter to the court that says you do not agree with the lawsuit. Include your case (cause) number and mailing address and any defenses you may have to the lawsuit; for example, the amount they claim you owe is incorrect, the account isn't yours, or the debt is older than 4 years.

There are 3 ways you can remove collections from your credit report without paying. 1) sending a Goodwill letter asking for forgiveness 2) disputing the collections yourself 3) working with a credit repair company like Credit Glory that can dispute it for you.

Texas and Federal Law The statute of limitations on debt in Texas is four years. This section of the law, introduced in 2019, states that a payment on the debt (or any other activity) does not restart the clock on the statute of limitations.