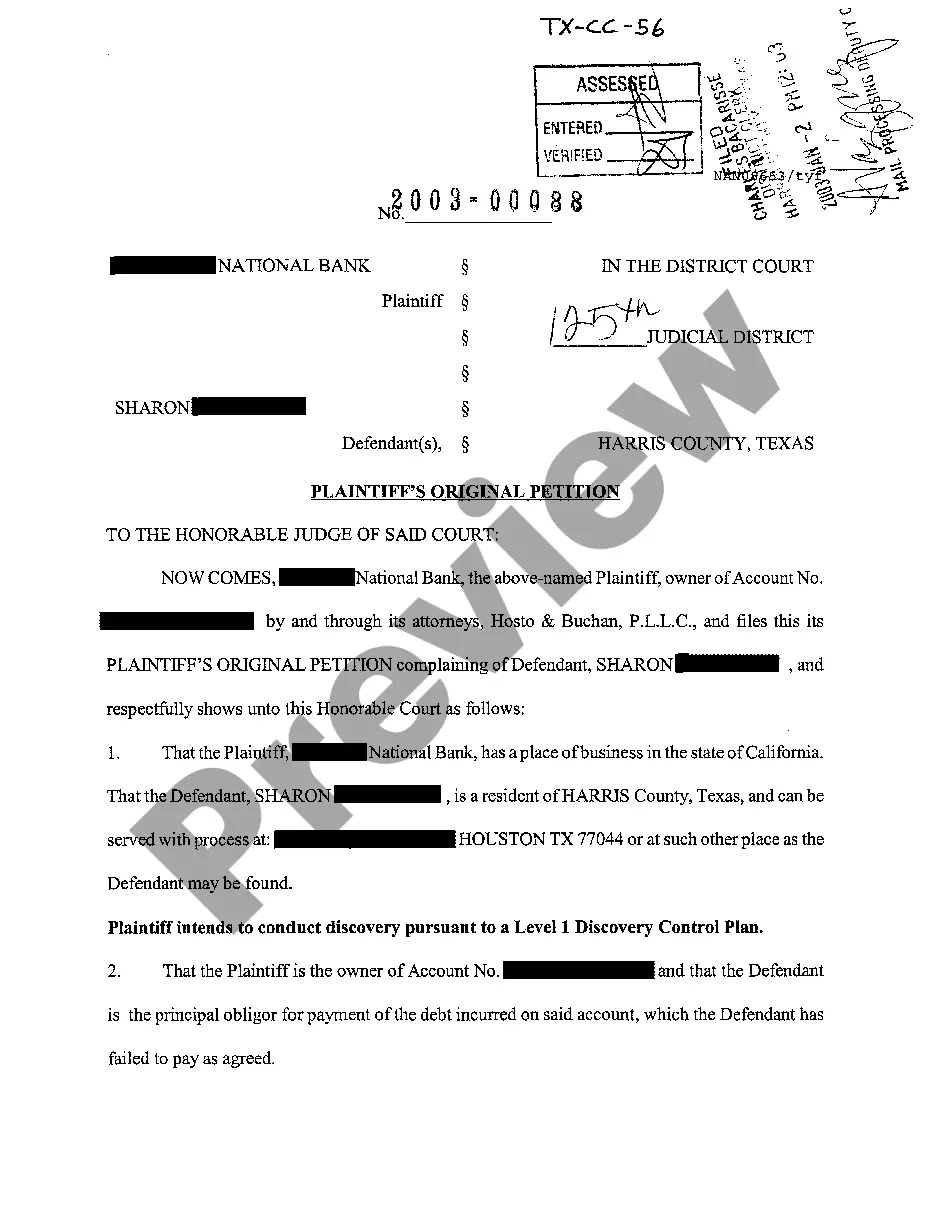

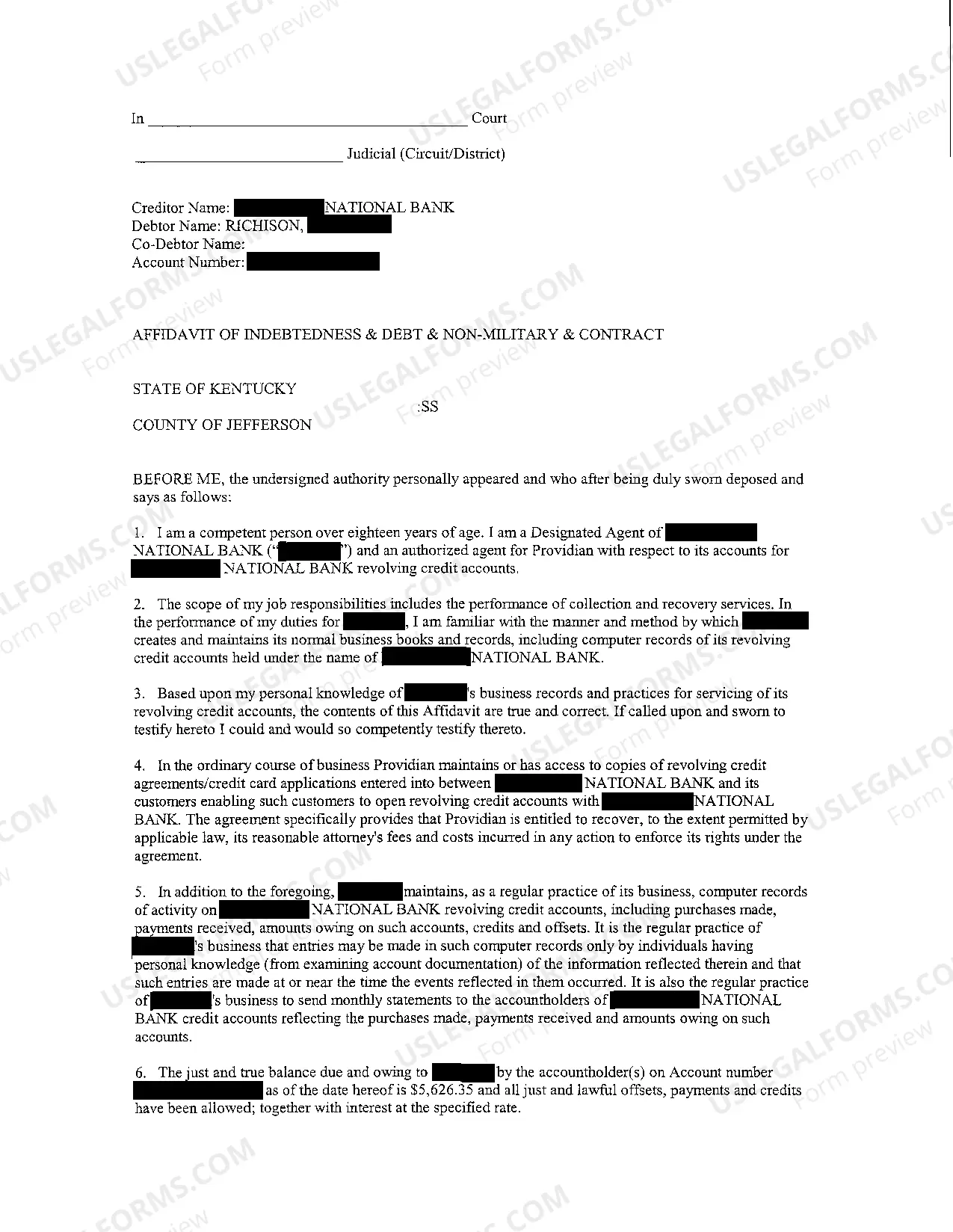

In San Antonio, Texas, a Plaintiff's Original Petition for Debt Collection is a legal document filed by a creditor or plaintiff seeking to recover a debt owed to them by a debtor. This petition initiates a lawsuit in the court system and outlines the details of the debt, the parties involved, and the legal basis for the collection. Key components included in a Plaintiff's Original Petition for Debt Collection may vary depending on the type of debt involved and the specific circumstances of the case. However, there are general elements typically present in such a petition: 1. Caption: This section contains information about the court where the petition is filed, such as the name of the court, the case number, and the names of the plaintiff and the defendant. It provides an identifying header for the document. 2. Parties: The petition identifies the creditor or plaintiff (the party filing the lawsuit) and the debtor or defendant (the party who owes the debt). This section includes their names, addresses, and any other relevant identifying information. 3. Jurisdiction and Venue: This section explains why the case falls under the jurisdiction of the specific court where the petition is filed. It establishes that the court has the authority to hear the case, and it determines the proper geographical location for the case's resolution. 4. Facts: In this section, the plaintiff presents a summary of the relevant facts surrounding the debt. This includes details such as the nature of the debt (credit card debt, personal loan, etc.), the date the debt was incurred, the amount owed, and any pertinent contractual agreements between the parties. The plaintiff may also include evidence supporting their claim, such as account statements, invoices, or payment records. 5. Legal Claims: The petition outlines the legal basis on which the plaintiff is seeking to collect the debt. This section may reference specific laws, statutes, or contractual provisions that authorize the plaintiff to take legal action to recover the debt. 6. Prayer for Relief: Towards the end of the petition, the plaintiff requests specific remedies or relief from the court. This can include seeking a judgment for the outstanding debt, requesting the defendant's assets to be seized or frozen, or asking for legal costs and attorney fees. Regarding different types of Plaintiff's Original Petitions for Debt Collection in San Antonio, Texas, they may vary based on the specific type of debt or the legal framework under which the debt arises. For example, there might be separate petitions for credit card debt, medical debt, or defaulted loans. Additionally, the procedural requirements for filing a petition could differ depending on whether it is a personal or corporate debt. It is essential to consult with a legal professional or review Texas's specific laws and regulations to better understand the nuances and variations in San Antonio's Plaintiff's Original Petition for Debt Collection for different scenarios.

San Antonio Texas Plaintiff's Original Petition for Debt Collection

Description

How to fill out San Antonio Texas Plaintiff's Original Petition For Debt Collection?

Are you searching for a dependable and cost-effective supplier of legal forms to purchase the San Antonio Texas Plaintiff's Original Petition for Debt Collection? US Legal Forms is your ideal option.

Whether you need a simple agreement to establish guidelines for living together with your partner or a set of documents to facilitate your divorce process through the court, we have you covered. Our platform features over 85,000 current legal document templates for individual and business purposes. All templates we provide are not generic and are structured in accordance with the specific state and county regulations.

To obtain the document, you must Log In to your account, find the desired template, and click the Download button adjacent to it. Please keep in mind that you can retrieve your previously acquired document templates whenever you want in the My documents section.

Is this your first time exploring our website? No need to worry. You can create an account in a matter of minutes, but before that, be sure to do the following.

Now you can establish your account. Afterward, select the subscription option and proceed to make a payment. Once the payment process is finalized, download the San Antonio Texas Plaintiff's Original Petition for Debt Collection in any given format. You can revisit the website anytime and re-download the document at no additional charge.

Locating current legal documents has never been simpler. Experience US Legal Forms today, and put an end to spending countless hours searching for legal paperwork online forever.

- Verify if the San Antonio Texas Plaintiff's Original Petition for Debt Collection complies with the laws of your state and locality.

- Review the form’s specifics (if available) to understand who and what the document is meant for.

- Restart your search if the template does not suit your particular needs.

Form popularity

FAQ

Your answer can be a handwritten letter to the court that says you do not agree with the lawsuit. Include your case (cause) number and mailing address and any defenses you may have to the lawsuit; for example, the amount they claim you owe is incorrect, the account isn't yours, or the debt is older than 4 years.

Takeaways on How to Effectively Defend Yourself in a Debt Collection Lawsuit Make sure you respond to the Complaint and your response is timely filed. Review potential affirmative defenses that could apply to your case. Make the debt collector prove that they have the legal right to sue you.

TrueAccord is a legitimate company. They are not a fake company, or a scam.

The 3 Steps to respond to a debt lawsuit Respond to every paragraph in the Complaint. The Complaint includes several numbered paragraphs that lay out the lawsuit against you.Assert your Affirmative Defenses.File the Answer with the court and the plaintiff.

Resurgent Capital Services is not a scam. It is a real debt collection agency. LVNV Funding buys debts from credit card companies and banks. They also buy debt from many industries, including telecommunications, utilities, health, cable companies, and financial service providers.

The statute of limitations on debt in Texas is four years. This section of the law, introduced in 2019, states that a payment on the debt (or any other activity) does not restart the clock on the statute of limitations.

This is done by putting your request in writing and sending it to the court and to the plaintiff. Once you have been served with the citation, you have 14 days to file an answer, which is your response to your lawsuit. You must give your answer to the court and also send it to the plaintiff.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

In Texas, debt collectors only have four years to bring a lawsuit on debt?the statute of limitations on debt in Texas. Most of the time, the debt collection statute of limitations in Texas is counted from the last payment, or first default, on the debt.

5 Steps to Beat LVNV Funding in Court Do not call them up.Get a current copy of your credit report.Get a consult with a consumer attorney.Hire a consumer attorney.Force them to prove a case.